4 types of insurance plans to boost your retirement income

![]()

If you've only got a minute:

- A Traditional Annuity plan like CPF LIFE will require you to pay a one-time single premium or a series of payments over an agreed period. You will then get regular payouts for life.

- A Retirement Income Insurance plan can also cover you for life, and it offers a wider range of components like payout periods and additional cover for long-term care.

- A Whole Life Insurance plan is a life insurance policy that incorporates a savings element that can be drawn upon surrendering the policy. Endowment Policies combine protection, savings and investment.

![]()

Many Singaporeans are waking up to the harsh reality that retiring is “expensive”. With the likely escalating cost of funding your golden years - no thanks to inflation and higher living standards - the need for adequate income during retirement is a concern and priority.

To better enjoy the years when we are still healthy and physically mobile, we are likely to want to travel more when retired. This is typical in the first 10 to 20 years after stopping work. And with more free time, it is natural to look for activities to occupy us, which could add to expenses.

Retirement survey findings indicate that the top three bucket list retirement activities to be travel, spending quality time with friends and family, and pursuing hobbies. Not a lot of that comes cheap.

Here are four types of insurance that can contribute to cash flows to fund your retirement.

Traditional Annuity

An annuity provides monthly or yearly payouts for as long as you live. It involves paying an insurer a one-time single premium or a series of payments over an agreed period. The premiums are invested to provide you with the regular income which is usually guaranteed.

As most retirees worry about outliving their financial resources, the annuity’s regular payouts – especially if they are guaranteed and for life – offer them a peace of mind. Such a policy is often part of a retirement plan’s building block to generate retirement income flows. Should the insured pass away prematurely, the balance cash value, if any, will be distributed to his/her beneficiaries.

The Central Provident Fund (CPF) LIFE (which stands for Lifelong Income for The Elderly) is a national annuity scheme that offers Singaporeans a monthly payout for as long as they live. The earliest that you can commence your CPF LIFE payouts is at age 65. You can also opt to defer them till age 70. The monthly payouts depend on how much you set aside in your CPF Retirement Account.

You can boost your retirement income by purchasing an annuity from an insurer. Furthermore, remember that CPF LIFE payouts start at 65. So, if you desire an earlier income flow, you may consider an immediate annuity that is designed to pay an income soon after it is bought.

Retirement Income Insurance

With retirement insurance cover, you can decide on the income amount and desired retirement age to commence payments over a chosen period. The premium will vary, depending on your age and the selected options.

Besides the option of lifetime income, some of these plans allow the customer to select other income payout periods, such as five, 10, 15 and 20 years starting from age 55.

The main advantage of a retirement income insurance like RetireSavvy is its flexibility. Since everyone’s retirement expectations is different (age, lifestyle, health…etc), a flexible plan is crucial for catering to different needs.

RetireSavvy will allow you to defer your retirement age, adjust your income payout period, gives flexibility to do premium top-ups and adjust your retirement income rate (apportion part of income to be disbursed as lump sum upon retirement).

Regular payouts from a retirement insurance plan comprise guaranteed and non-guaranteed components. The flow of guaranteed monthly income provides a form of assurance for your golden years. The non-guaranteed portion offers a potential upside for a higher payout, depending on the performance of the fund in which the premium is invested.

Some retirement insurance plans offer additional cover for long-term care. For instance, it may offer an additional income payout if you lose the ability to perform two out of six “Activities of Daily Living” (ADLs) such as washing, feeding, dressing, toileting, mobility and transferring independently.

Here are some questions to ask when shopping for a retirement insurance plan:

- How much payout do you need?

- What are the guaranteed and non-guaranteed income components? Note that the higher the guaranteed amount, the more sustainable the income payout.

- When do you want to start the payout?

- Do you want payouts over a limited number of years or a lifetime?

- Do you want fixed or variable payouts?

- Is there an additional payout (bonus) during and/or at the end of the policy term?

- Is the premium payment over a limited period or is it a single payment?

- Do you have the flexibility of changing the income payout period if there is a change in your retirement needs? Being able to make changes after you have bought the plan is useful as you can reduce or extend the payout period according to your health or living conditions.

- Is there protection cover and an additional payout in the event of a disability?

- What is the payout upon death?

Whole Life Insurance

Whole life insurance typically remains in force for the insured's entire lifetime. This is provided the insured’s required premiums are paid, or to a specified maturity date of say age 100.

Whole life insurance plans have a savings element in addition to the protection element of a payout to your beneficiaries in the event of death, and total and permanent disability. The savings element (surrender value) can be drawn upon by surrendering the policy, if needed in your old age. Some offer a rider to cover major illnesses.

One such plan is the Manulife IncomeSecure, a whole life insurance income plan that provides annual payouts, starting from end of policy year 3, year 5, or year 10 up to age 120. The coverage includes death and terminal illness, and you can even get a premium waiver upon total and permanent disability, while your coverage continues.

Generally, whole life insurance costs more than term insurance as part of the premium is invested to build up cash value. Be prepared to commit for the long - term as early termination may result in losses.

Whole life insurance is available in different forms, such as participating and non-participating policies.

Participating whole life policies share in the profits of the insurer’s participating fund. Your share of the profit is paid in the form of bonuses or dividends to your policy. However, these bonuses or dividends are not guaranteed as they depend mainly on the investment performance of the participating fund. When you make a claim, bonuses or dividends which have been declared will be paid in addition to the sum assured.

Endowment Policy

An endowment policy combines protection, savings and investment. Endowment and whole life plans share the similarity of having both protection and savings elements. However, endowment policies have shorter and defined periods of cover. They pay benefits in either of these situations:

- Death or total permanent disability, or

- When the policy reaches its maturity date

Your premiums are deployed into buying a protection plan—one that pays benefits in the event of death or, total and permanent disability—and investing in financial markets.

The two most common uses of endowment policies are:

- Providing for children’s education expenses

- Retirement

You can tailor the policy depending on your needs. If the objective is a child’s education, the plan can be shorter-term, say, 10 to 20 years. And the benefits are usually taken as a lump sum payment on maturity. For instance, SavvySpring (II) is a 12-year endowment plan that is capital-guaranteed upon maturity, and helps you grow your savings with both guaranteed and non-guaranteed bonuses. This could be a good plan that you can use to save for your child’s future tertiary education, and even allows you to change the life - insured to your child.

Endowment plans are popular for saving up for retirement as well. Depending on your preference, you may choose a longer-term policy to coincide the payout with your retirement years.

In recent years, shorter term endowment plans are becoming popular as well, as they allow more flexibility in managing your money. Say you have suddenly inherited a lump sum or have made some money from the sale of your property, you can seek out a shorter term endowment plan like the SavvyEndowment to help you grow your funds instead of leaving it in a bank account.

As insurance companies invest your premiums in a mix of low-risk and higher risk assets, an endowment plan offers a guaranteed and a non-guaranteed component, in the form of bonuses, if their investments do well.

Ready to start?

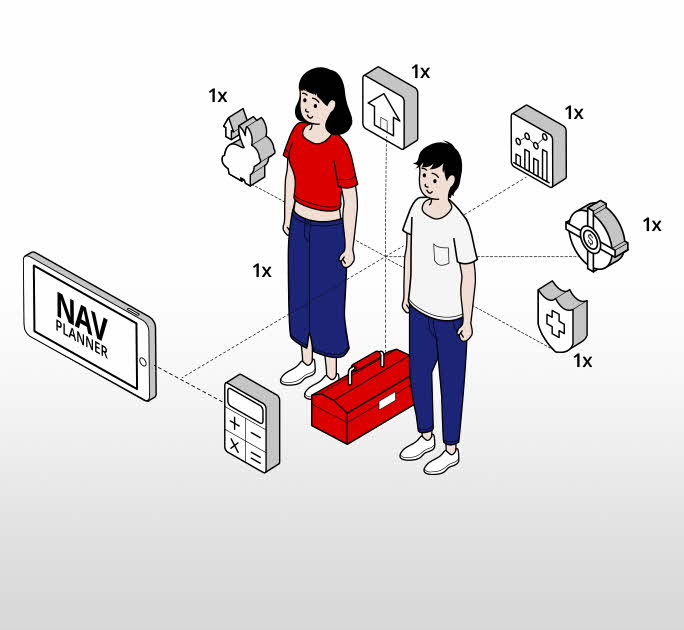

Start planning for retirement by viewing your cashflow projection on Plan tab in digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)