![]()

If you've only got a minute:

- Understanding investing costs is crucial as they will impact your gains.

- Unlike ETFs, unit trusts are more often actively managed, which typically results in higher administrative fees.

- Costs of investing in unit trusts include sales charges, platform fees and management fees.

![]()

Whether you are shopping for a new bag or purchasing a new car, there are costs involved in the pricing of your item. Examples of these include the costs of raw materials, labour costs, overheads, among others.

Let’s think about your daily cup of coffee. The price you pay for your cuppa joe includes not just the cost of the raw materials like the coffee beans and milk, but other elements too.

In this case, how much you value these elements will determine how much you are willing to pay for the product.

The same applies to a variety of investment products like unit trusts.

Understanding what contributes to the costs of investing in them is crucial, as these costs will take away from your eventual returns. Some examples of these include costs of processing, manpower, product development and creating distribution channels.

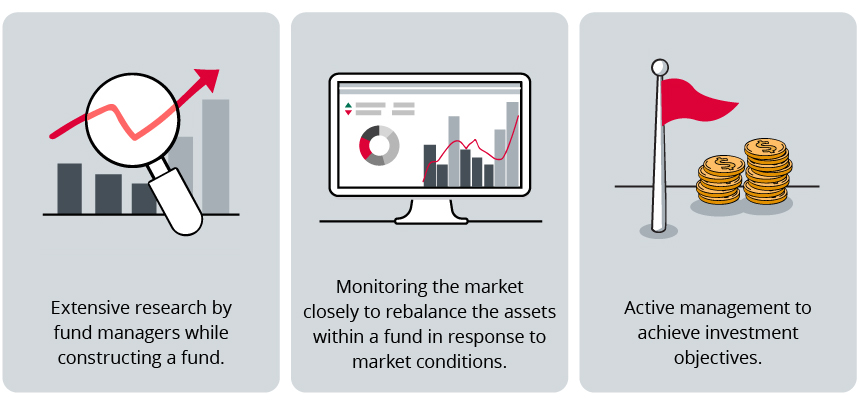

In the case of unit trusts, which are pooled investment instruments that provide investors with diversified exposure to investment markets, fund managers actively look at rebalancing the fund’s portfolio by buying and selling securities based on the overall market outlook.

The aim of this is to maximise the returns of the fund. Unlike ETFs and equities which are traded on the stock exchange, unit trusts are usually traded on private markets and sold through distributors like banks.

As such, common costs involved with investing in unit trusts include platform fees, management fees, switching fees, and distribution fees. These can be broadly categorised into one-time and/or recurring fees.

Read more: Costs of investing in equities

Costs of investing in ETFs

One-time fees

Examples of these include the sales charge, redemption fee, switching fee, and upfront charges for wrap accounts.

Sales charge

This front-end fee is charged by distributors and ranges from 0% to 5% of the total investment.

Redemption fee

The back-end load equivalent of a sales charge is called a redemption fee. It is charged when you sell or redeem your investment. This can range from 1% to 5% of an investment. Where front-end loads are charged, back-end loads usually aren’t.

Switching fee

A switching fee is a one-time fee charged when investors switch between different funds managed by the same fund manager. These fees are paid to the distributor.

Upfront charges (wrap accounts)

Wrap accounts are investment portfolios managed by a financial firm for a recurring fee. They also provide advisory, brokerage and administrative services for investors. Those using a wrap account to invest in unit trusts also face specific one-time fees in the range of 2% to 3% of any new funds invested with the distributor.

Recurring fees

Besides one-time fees, there are recurring charges when investing in a unit trust. These include platform, management, trustee, custodian, and administration fees.

Platform fees

As unit trusts are not publicly traded on a stock exchange, investors usually subscribe to them via a platform. This platform would typically charge a fee that ranges between 0% and 3% of the total fund holdings. That said, platform fees have been falling in recent years and it is becoming more common to see platforms charging no such fees.

Investors using wrap accounts will incur fees of roughly 0.5% to 1% per annum of the total value of the investment. These can be charged quarterly or yearly.

Management fees

The most commonly known recurring fee would be the management fee. These are charged for the administration and management of a pooled investment.

Management fees are required to cover the costs of:

These are not charged directly to the investor, but instead deducted from the net asset value of the respective fund at the end of each year. While this can reduce the value of the investment over time, it does not mean that you are getting negative returns on your investments.

Actively managed funds like unit trusts generally incur higher management fees than passively managed ones like ETFs. This is due to the higher time and expertise required in rebalancing the portfolios regularly.

Given the differences in fee structures between various pooled investment instruments, it can be challenging to do a dollar-to-dollar comparison of the total costs involved.

The total expense ratio (TER) comes in handy here as it reflects the total expenses incurred by the fund as a percentage of the total assets of the fund. These expenses are deducted from a unit trust’s yearly returns and typically vary from 1% to 2.5%.

According to Morningstar Manager Research in 2022, the asset-weighted average expense ratio for active funds was 0.37%. This is lower than the 0.60% recorded in 2021.

One of the main reasons why investors pay attention to TER is so that they can determine if a fund is an appropriate investment for them after fees are considered.

Read more: A beginner’s guide to unit trusts

Investing in unit trusts using CPF funds

You can invest in CPF Investment Scheme (CPFIS)-approved unit trusts using your CPF Ordinary Account (OA) and Special Account savings.

Switching fees are still charged according to the rate the fund manager charges, should an investor decide to switch between funds managed under the same fund manager. However, if you have purchased unit trusts through a wrap account of a CPFIS Investment Administrator, these fees do not apply.

Further upfront costs include agents charging up to $2.50 per 1,000 units, with a maximum charge of $25 per transaction.

CPFIS-approved unit trusts have a cap on their TER, as shown below:

For unit trusts held in a wrap account with a CPFIS Investment Administrator, an annual fee is charged at a rate of 0.4% per year on the total market value of the investment.

Before you invest in a unit trust, it is important to be aware of all the costs that are involved and what they are for. You can look out for details of these costs, which are usually disclosed in a unit trust’s prospectus or factsheet.

Read more: Is my CPF enough to beat inflation?

Find out more about: CPF Investment Account