How to get started on financial planning

![]()

If you’ve only got a minute:

- Pull your financial data together using SGFinDex to have a holistic view of your finances.

- Budgeting and savings are the foundation of good financial planning.

- Take charge of your financial future by managing any outstanding debts, getting the right insurance and growing your money through investing.

![]()

Think about your current life situation. What are some changes you’re likely to expect within the next 2 years? Perhaps acquiring a new laptop or a bedroom makeover? What about in 5 years’ time? Can you envision achieving more significant milestones, such as buying your dream home or having a wedding complete with a honeymoon at your desired destination?

Years from now, you could be supporting your child through university and/or building your retirement nest. All the above are examples of your potential financial goals for the short, medium and long term.

Financial planning is a personal journey since individuals have different financial goals and varying needs. That said, it doesn’t have to be complicated. With proper planning, everything will fall into place.

Here are 7 tips to get you started on your financial planning journey!

1. Map out your financial journey

When was the last time you had a good look at your finances? If you haven’t, it’s never too late to start.

Supercharged by SGFinDex, DBS digibank takes in all your financial information from CPF, CDP, HDB, IRAS and other banks to give you a holistic view of your financial health. It also empowers you with personalised insights and tips, allowing you to make better, informed financial decisions. Hit the Plan & Invest tab in the app to get started.

Read more: Plan on digibank - Supercharged by SGFinDex

If you need help or want a second opinion, you may reach out to our team of Wealth Planning Managers (WPMs). They’ll be able to offer you advice aligned with your financial goals and circumstances.

2. Saving is the foundation

After setting your financial goals, focus on building savings as a discipline.

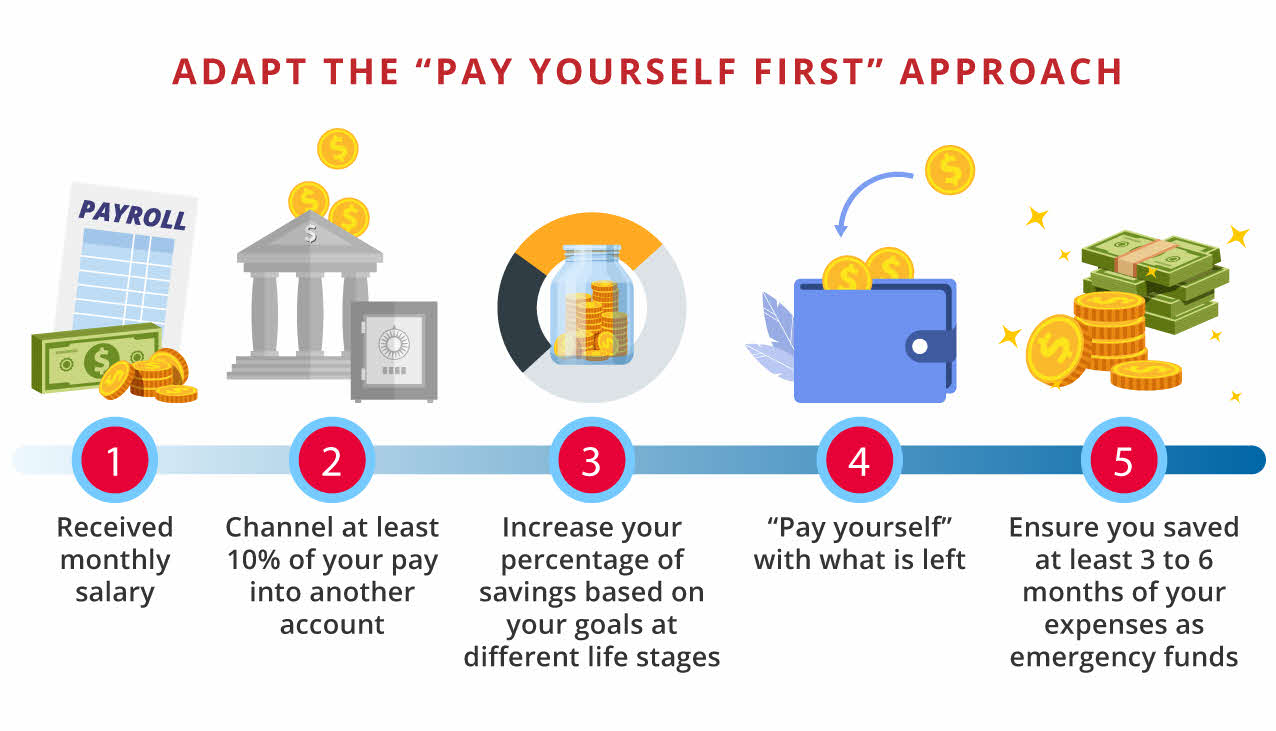

As Warren Buffet once said, “spend what is left after savings”. It is prudent to adopt the “pay yourself first” approach to automatically channel a portion of your pay to a separate account once you receive your pay cheque, before you start spending. Depending on your goals and lifestyle needs, you should try to save at least 10% of your income and this savings ratio should be one that you are comfortable with.

More importantly, it is essential is to set aside savings for a rainy day. In the event of an emergency, you should have access to ready cash. It is recommended to have an emergency fund to cover at least 3 to 6 months of expenses or more if you have dependents. If you are self-employed, you may want to increase this emergency fund to cover at least 12 months of expenses.

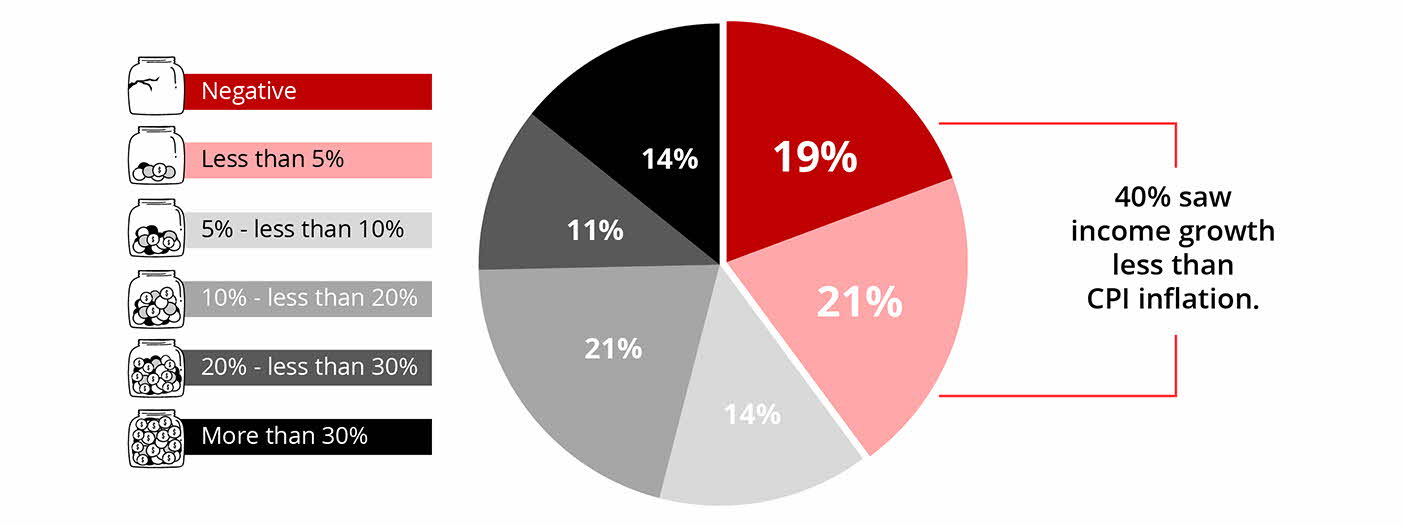

Your emergency fund does not need to stay idle. DBS’s latest report “Are you losing the race against inflation?” showed that inflation is at an all-time high and that income growth is lagging for 40% of our 1.2 million retail customers. It is important to save smarter.

Customers categorised by income growth over the past year

You can grow your savings with the DBS Multiplier and enjoy an interest rate of up to 4.1% p.a. You can also stash your funds in other liquid assets including saving deposits, fixed deposits, Singapore Savings Bonds that can be readily liquidated without incurring penalties or a loss in value.

Read more: Financial tips for 2023

3. Keep tabs on where your money is going

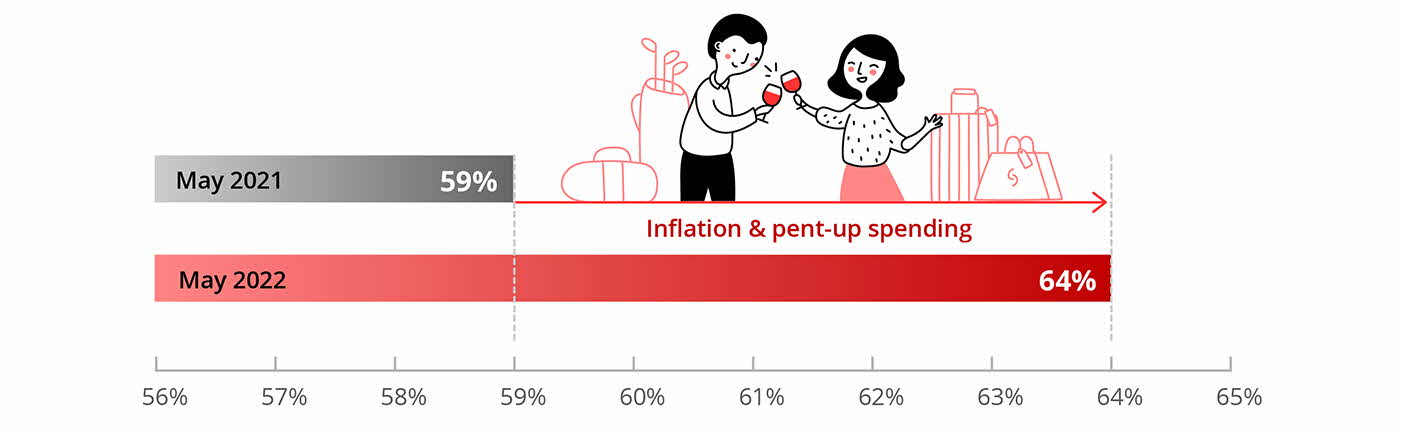

Budgeting involves tracking your cashflows and making plans on ways to spend your money. While it may appear daunting for some, a simple way to start is by dissecting your expenses to gain clearer distinctions between your essential needs and discretionary wants. Our 2022 report indicated that customers are now generally spending more relative to their income. Specifically, expenses grew 2 times faster than income on aggregate.

Expenses to income (%) of an average customer in May 2021 vs May 2022

Tracking your expenses makes it easier for you to re-prioritise your spending and cut down on “wants” such as fine dining and recurring expenses incurred by telco bills, gym membership, beauty and spa packages.

Read more: Track your savings and spending with digibank

4. Protect your future

While it is common to safeguard ourselves and loved ones from unforeseen circumstances, many postpone or avoid addressing insurance matters due to the uncomfortable nature of discussing topics dealing with injury, illness, accidents, disasters, and death. However, a comprehensive financial plan should address protection needs because insurance serves as a safety net for you and your loved ones and it provides a sense of security should something unexpected happen.

With the abundance of insurance plans available, it can be overwhelming to narrow down your options. This article can help you get started on your insurance planning and decide which policy is suitable for you.

Should you require further assistance, our dedicated team of WPMs are ready to assist you in identifying and bridging any gaps between your current and desired level of coverage.

5. Manage your debt

From personal to housing loans, most of us will come face-to-face with debt at some point. As such, managing debt is the cornerstone of prudent financial planning. When taking up a home loan, it is essential to explore options that align with your needs and requirement. If you have an existing home loan, you may be able to reduce it through refinancing. Home loan options include fixed-rate, floating-rate or a combination of both. By carefully selecting the most suitable package, you can make significant savings in the long run.

If you are struggling with debts, there are solutions to help you work your way out of the endless bills cycle. Rather than having debts with multiple banks, the DBS Debt Consolidation Plan can help you consolidate all your debts under one bank, providing a more steamlined approach to repay your debts and help you regain control of your financial situation. Furthermore, you can potentially save on interest payments too.

Read more: Debt repayment programmes in Singapore

6. Make your money work hard for you

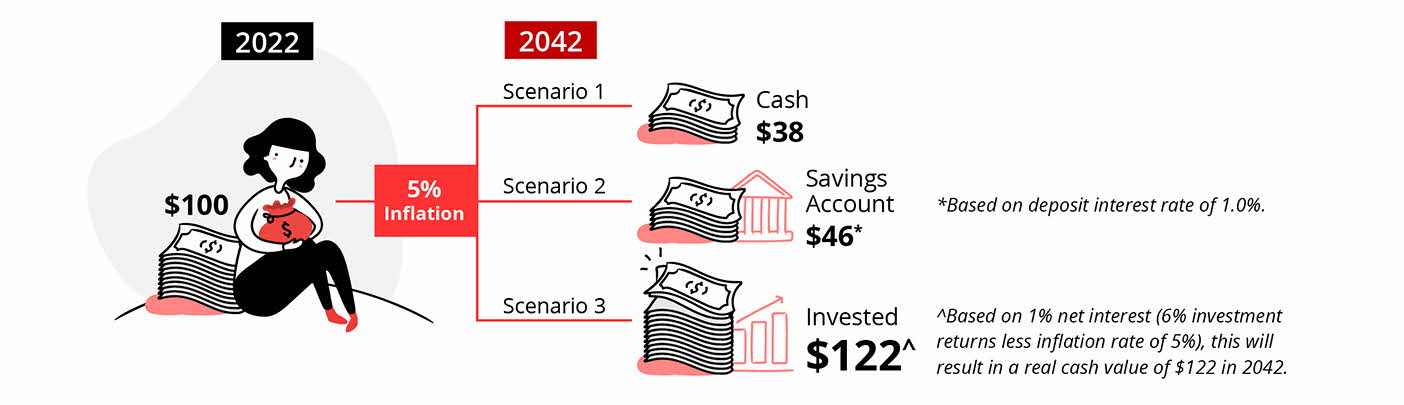

If you want to succeed in this financial planning journey, you can’t be working hard alone. Your money should also work diligently for you through investments. Furthermore, investing serves as a defence against inflation. It is advisable to allocate any surplus funds towards investments for higher potential gains after having addressed your savings and insurance requirements. Starting your investment journey early holds greater potential for wealth accumulation due to the effects of compounding and the capacity to ride out market volatility over time.

Investing is especially important during periods of high inflation due to the accelerated decline in the value of money. Relying solely on cash deposits in bank accounts that generate a modest deposit interest rate of 1-2% is insufficient as inflation rate tends to outpace the returns earned on bank deposits, leading to negative real returns on your cash. Any surplus cash left uninvested faces the risk of a more rapid decline in its value.

Real value of money under 3 scenarios

You don’t need a large capital to start investing. For beginners, kickstart your investment journey with Invest-Saver, a regular saving plan with as little as $100 a month. Alternatively, you can leave it to the DBS Investment Team of experts by investing in managed portfolios via our robo-advisory platform - digiPortfolio. Start with just $1,000 for the Asian portfolio or US$1,000 for the global portfolio.

If you’re a seasoned investor and prefer to manage and build your stocks portfolio on your own, consider opening a DBS Vickers account. It provides access to 7 key global markets.

Fight inertia and start checking off some items right now to be on your way towards building a robust financial plan.

Read more: I’m ready to invest, how can I start?

7. Stress test your finances

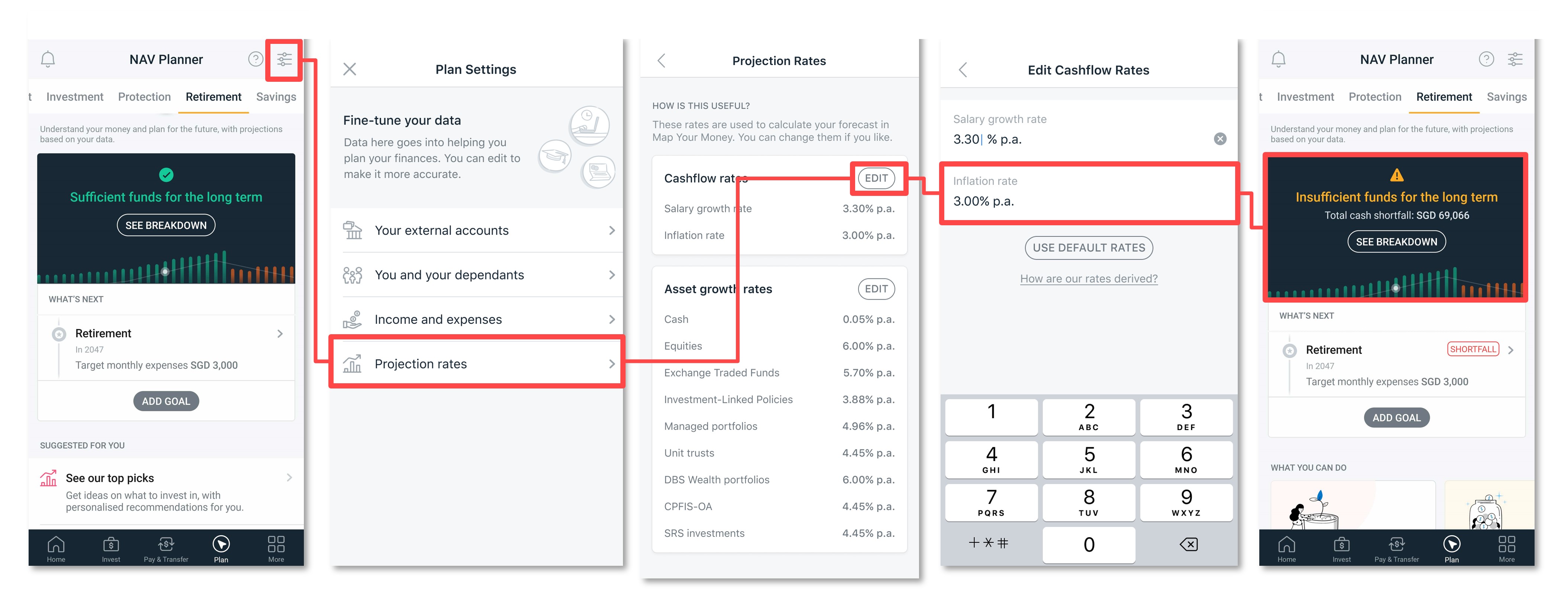

Most financial plans assume an inflation rate of 3% when projecting future income flows to determine retirement adequacy. Plan for higher costs of living by assuming different inflation scenarios of 3%, 4% or 5 % and work out how these different rates may impact your future cash flows and retirement planning, via the Map Your Money feature under the Plan & Invest tab in digibank app.

Read more: Let's get better at money

All in all

Financial planning can help you achieve your life goals and protect your loved ones in times of need. It may seem daunting at first but by taking baby steps, you can build financial resilience and enhance your financial wellness.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)