Preparing for retirement - A Home Perspective

By Lynette Tan

![]()

If you’ve only got a minute:

- Your home is an important retirement asset - what you intend to do with your residential property when you retire can affect your retirement income stream your quality of life during those golden years.

- It would be wise to be free of home loan liabilities before retirement. One way is to do lump-sum payments when you have spare cash to reduce the mortgage payments.

- You may consider monetising your home using government schemes such as Lease buyback or Silver Housing Bonus to boost your retirement income.

When it comes to retirement planning, many Singaporeans tend to focus on their investments and savings, Central Provident Fund (CPF) and Supplementary Retirement Scheme accounts.

However, the property you own can form a significant part of your retirement assets as well.

Other than providing a roof over your head, what you intend to do with your residential property when you retire can affect your retirement income stream, and ultimately, your quality of life during those golden years.

Here are 5 things to consider when retiring with a property on hand.

1. Be free from home loan liabilities

Home loans are long-term financial commitments that typically last between 20 and 35 years. With Singaporeans marrying later, some could still be servicing their home loans into their 60s. If you decide to retire early, it could get challenging to service a home loan without any income. Thus, there’s a need to strategise how to manage your property in preparation for retirement.

You could try to plan early to reduce your loan tenure such that you finish financing your property before retirement. One way is to do partial payments when you have lump sum idle cash such as when you receive your annual bonuses.

In addition, you may wish to consider using idle cash rather than your CPF savings to pay off your housing loan as the interest rate from the CPF Ordinary Account is higher than the bank’s interest rate. Doing so will enable you to accumulate more retirement savings faster due to the power of compounding interest.

2. Renting out your property for income

One advantage of owning a property is the possibility of renting it out for income. You can consider renting out a room, or the entire unit if you are able to find alternative accommodation. Of course, rental income is not fool proof as there are always these risks: tenants who may not always pay on time, fluctuating rental markets, as well as shelling out extra cash for property maintenance.

If you intend to rent out the entire unit and stay with relatives, it would be prudent to consider the non-financial aspects of the move. With more people living under one roof, there will be shifts and changes in dynamics of the relationships and would require some effort to develop new norms and mutual understanding. If the disagreements and common ground cannot be found, you might find yourself in search for a new home.

3. Downsizing

You can also consider downsizing your current home. This is especially applicable if your children have flown the coop and you can make do with a smaller property which also means it takes less time and costs to upkeep it.

4. Government schemes – Lease Buyback and Silver Housing Bonus

There are government schemes available that can help you unlock your property value in preparation for retirement. For instance, under the Lease Buyback Scheme (LBS), you can sell part of your flat's lease to HDB and choose to retain the length of lease based on the age of the youngest owner. Part of the sales proceeds will be used to top up your CPF Full Retirement Sum ($205,800 in year 2024) if your balance falls short. Doing so will enable you to receive higher monthly pay outs from the national annuity scheme CPF LIFE, for as long as you live.

The Silver Housing Bonus (SHB) is a scheme that can help to supplement your retirement income. It allows you to sell your current property (either HDB or private) and receive a bonus if you choose to buy a 3-bedroom or smaller flat.

To qualify for the Silver Housing Bonus, you will be required to top-up $60,000 of your proceeds into your CPF Retirement Account (RA) and join CPF LIFE. By topping up $60,000 in your CPF RA, you will receive the maximum cash bonus of $30,000. If the top-up is less than $60,000, you will receive a pro-rated cash bonus of $1 cash bonus for every $2 top-up made.

Both the Lease Buyback Scheme and the Silver Housing Bonus come with several eligibility criteria so do ensure that you satisfy those conditions.

5. DBS Home Equity Income Loan

If you own a private home and are aged 65 to 79, you can consider the DBS Home Equity Income Loan as an avenue to unlock some cash while remaining in your home.

If you are a Singapore citizen or PR, the DBS Home Equity Income Loan allows you to borrow against your fully paid private residential property to top up your CPF Retirement Sums which will be used for the CPF LIFE scheme.

This will result in higher monthly payouts for life to supplement your retirement funds.

Here are some key features:

- No monthly loan repayments, with the loan amount and accrued interest payable only at loan maturity

- Fixed interest rate of 3.88% p.a. throughout the loan tenure

- Loan tenure of up to 30 years – till you (or the youngest borrower in the case of a joint loan) reaches age 95

- Flexibility to sell the property anytime, and repay the loan with no penalty

- The minimum loan amount would be the amount needed for you to top-up your CPF savings to meet the Full Retirement Sum for your cohort

- The maximum amount that can be borrowed is the amount required to top-up to the prevailing CPF Enhanced Retirement Sum (S$308,700 in 2024)

For most of us, having a roof over our heads when we retire offers great comfort. A property is an asset that can bring value to our retirement – as a safety net, the possibility of supplementing our retirement income via the various government schemes, as well as being used as a passive income source through rental and the DBS Home Equity Income Loan.

As such, it is important to include your property as part of your retirement assets and see it as part of the bigger retirement plan. If you are unsure of how best to make use of an existing property to increase your retirement income, do consider meeting with a Wealth Planning Manager for a free consultation.

Ready to start?

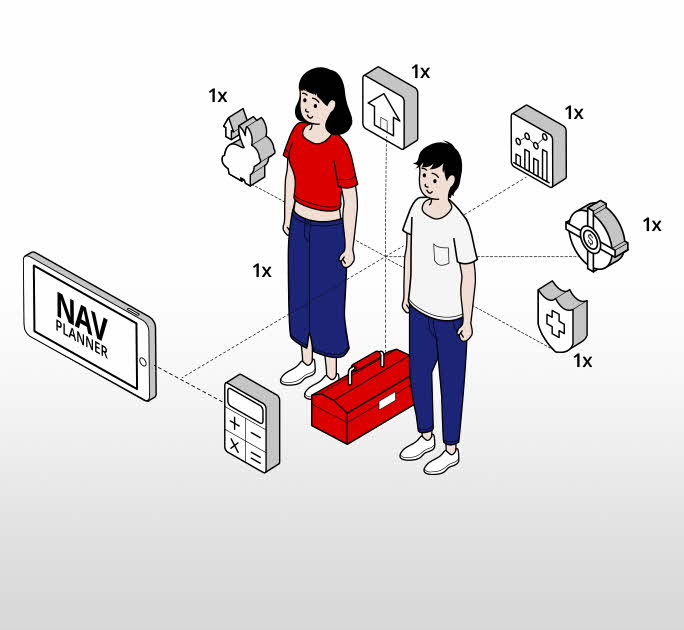

Start planning for retirement by viewing your cashflow projection on DBS Plan & Invest tab in digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Alternatively, speak to a Wealth Planning Manager today for a financial health check and how you can better plan your finances.

You may also wish to learn more about how you can unlock the equity value of your home to supplement your retirement income.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)