Foreign Account Tax Compliance Act (FATCA)

Foreign Account Tax Compliance Act (FATCA) is a regulatory requirement for tax authorities to obtain financial account information of US Persons.

Why am I requested to submit FATCA?

Under FATCA, financial institutions in Singapore are required to:

- Conduct due diligence procedures.

- Disclose financial account information of account holders who are US Persons, regardless of age or employment status, to the Inland Revenue Authority of Singapore (IRAS).

The primary objective of FATCA is to address perceived tax evasion by US persons using offshore accounts. It aims to gather information about accounts held by:

- US citizens and tax residents

- US entities

- Passive investment holding entities that are non-US but substantially owned by US persons

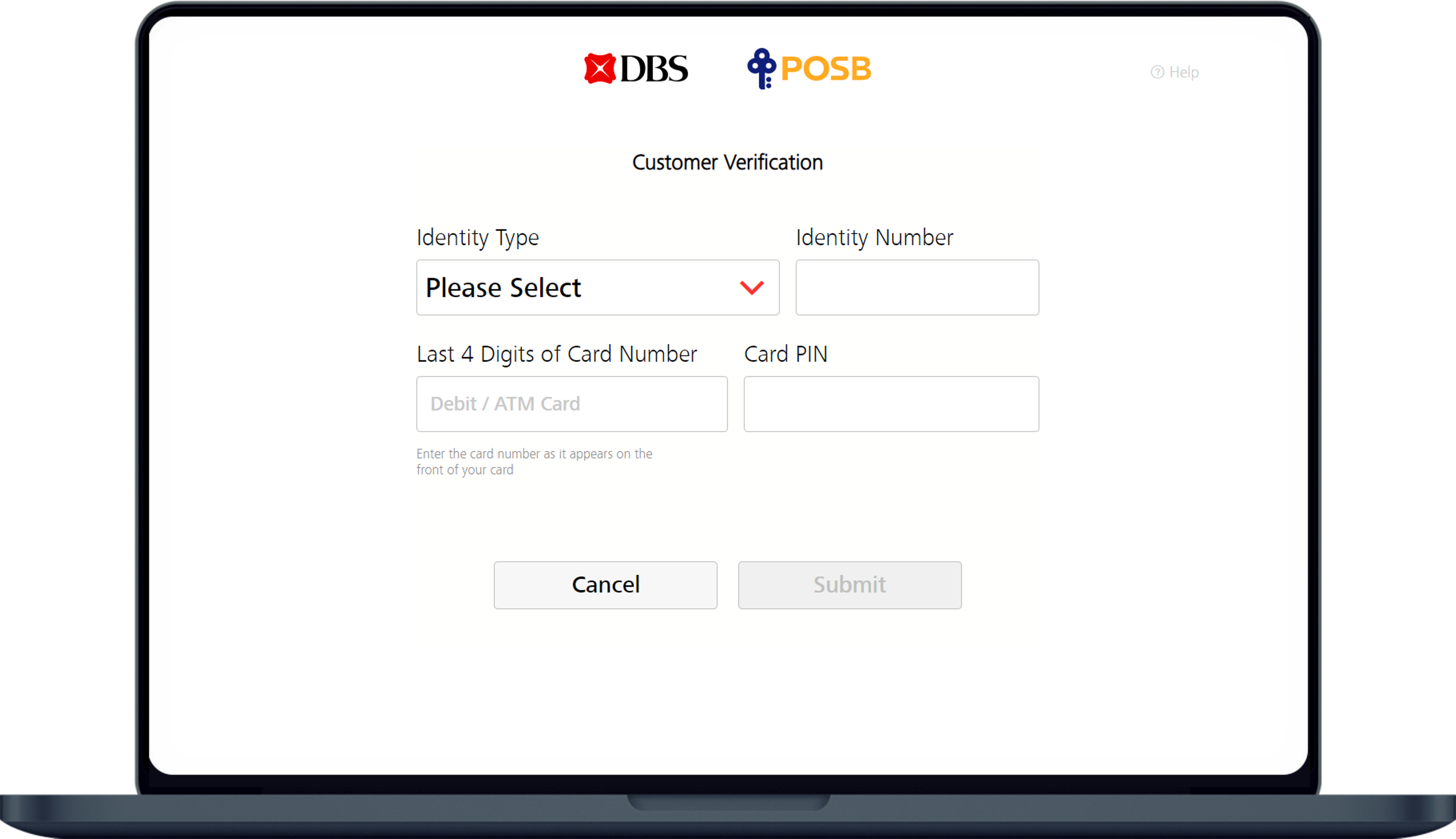

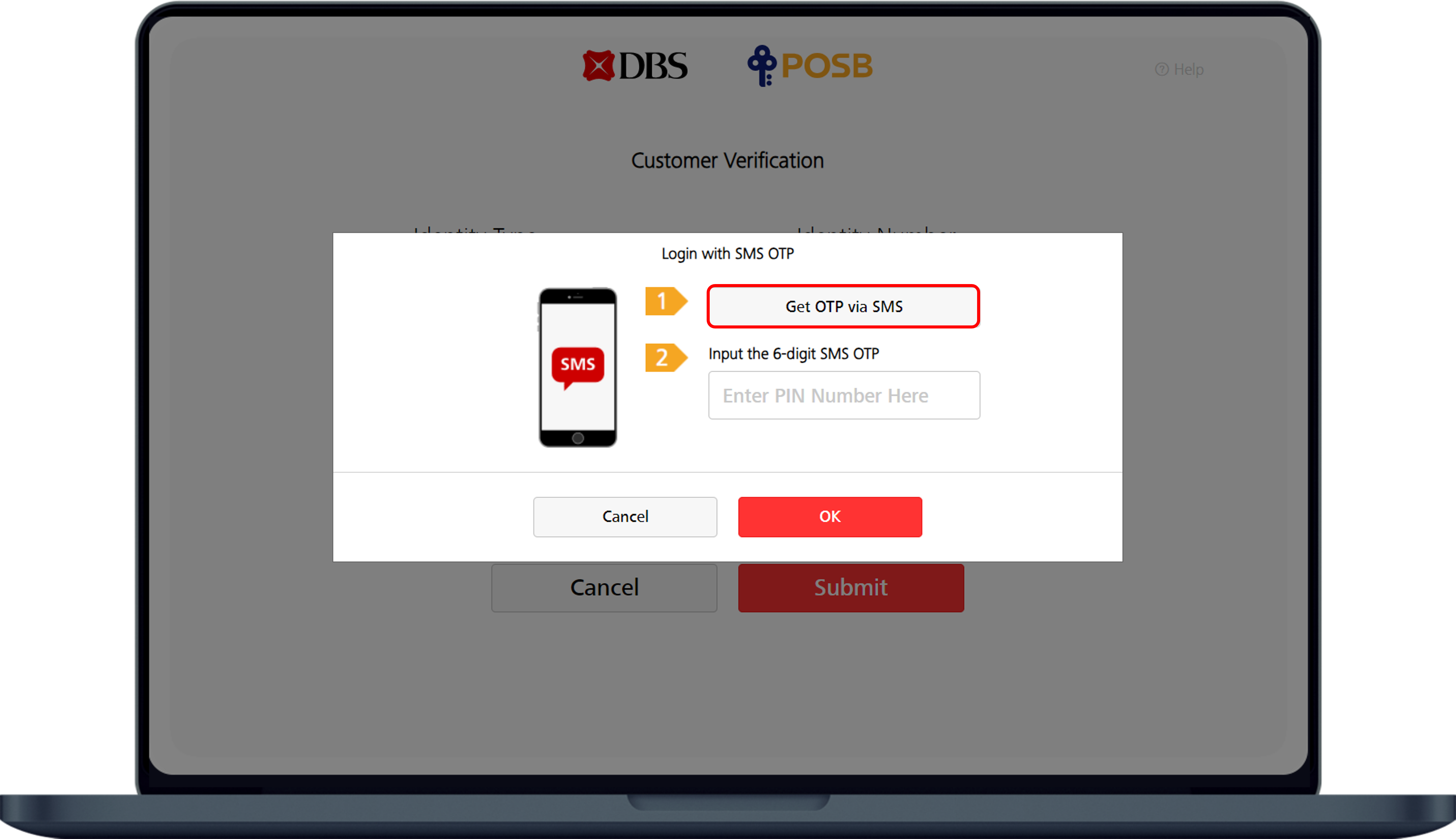

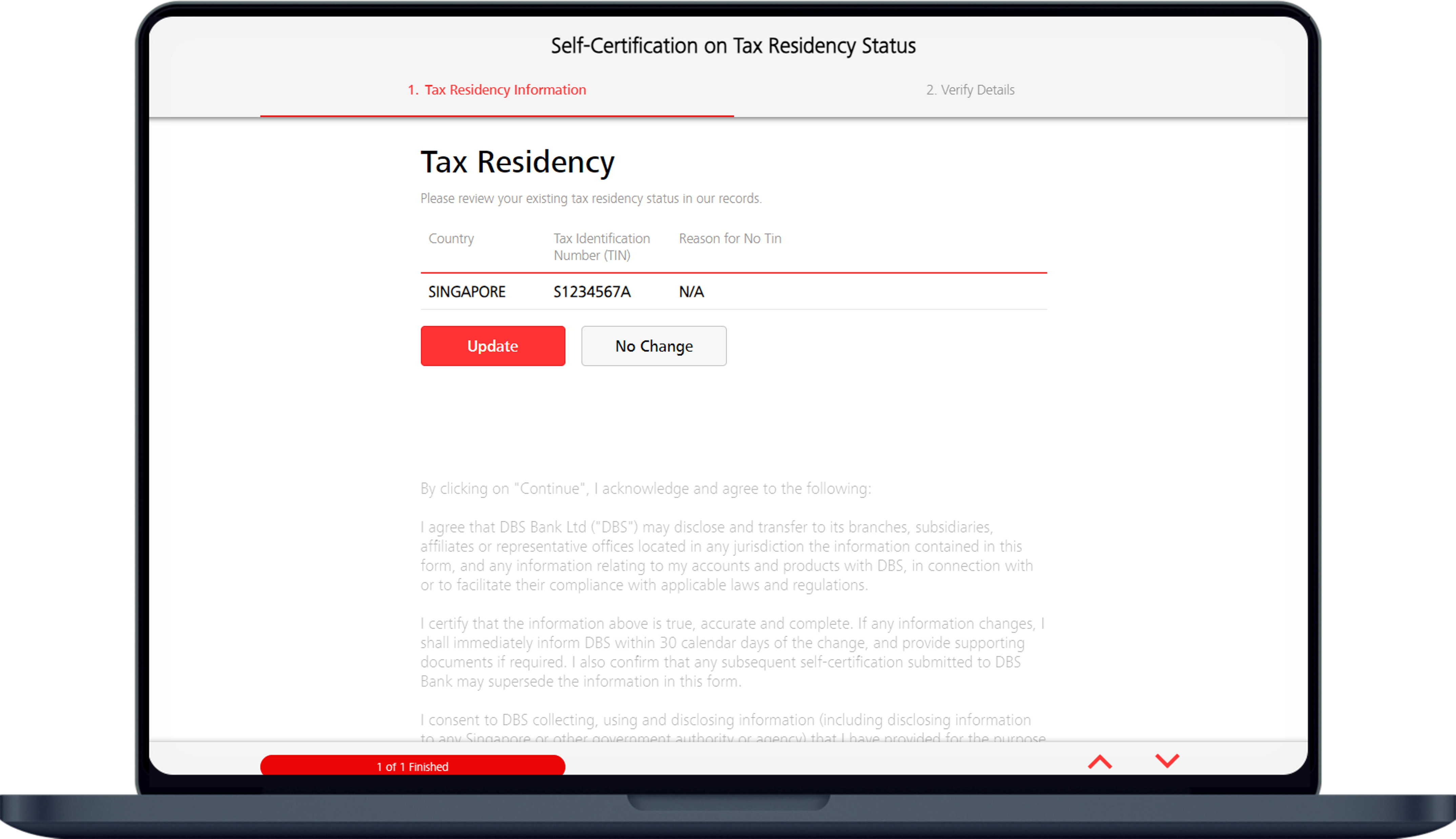

How to submit FATCA online

Online Form

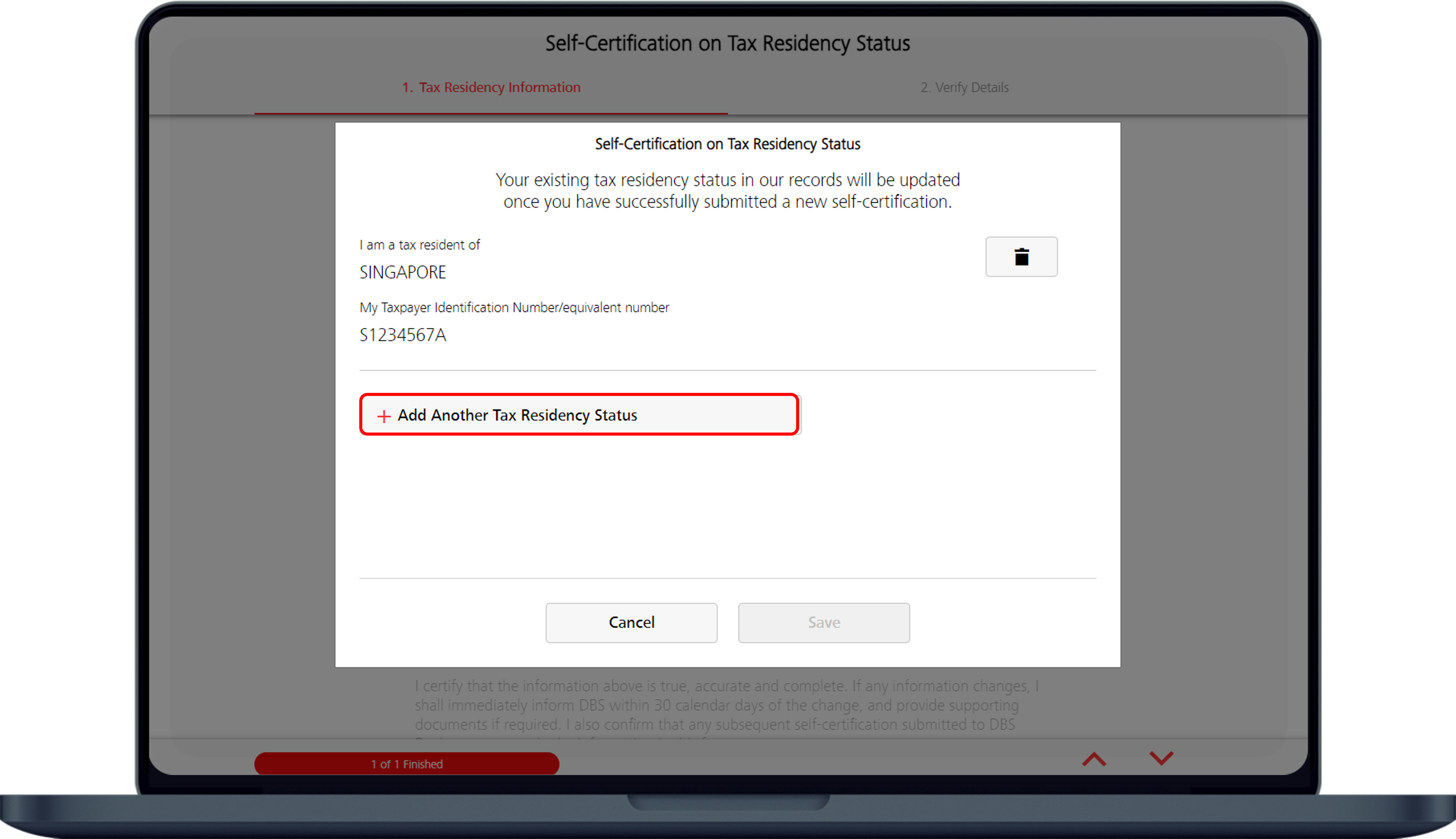

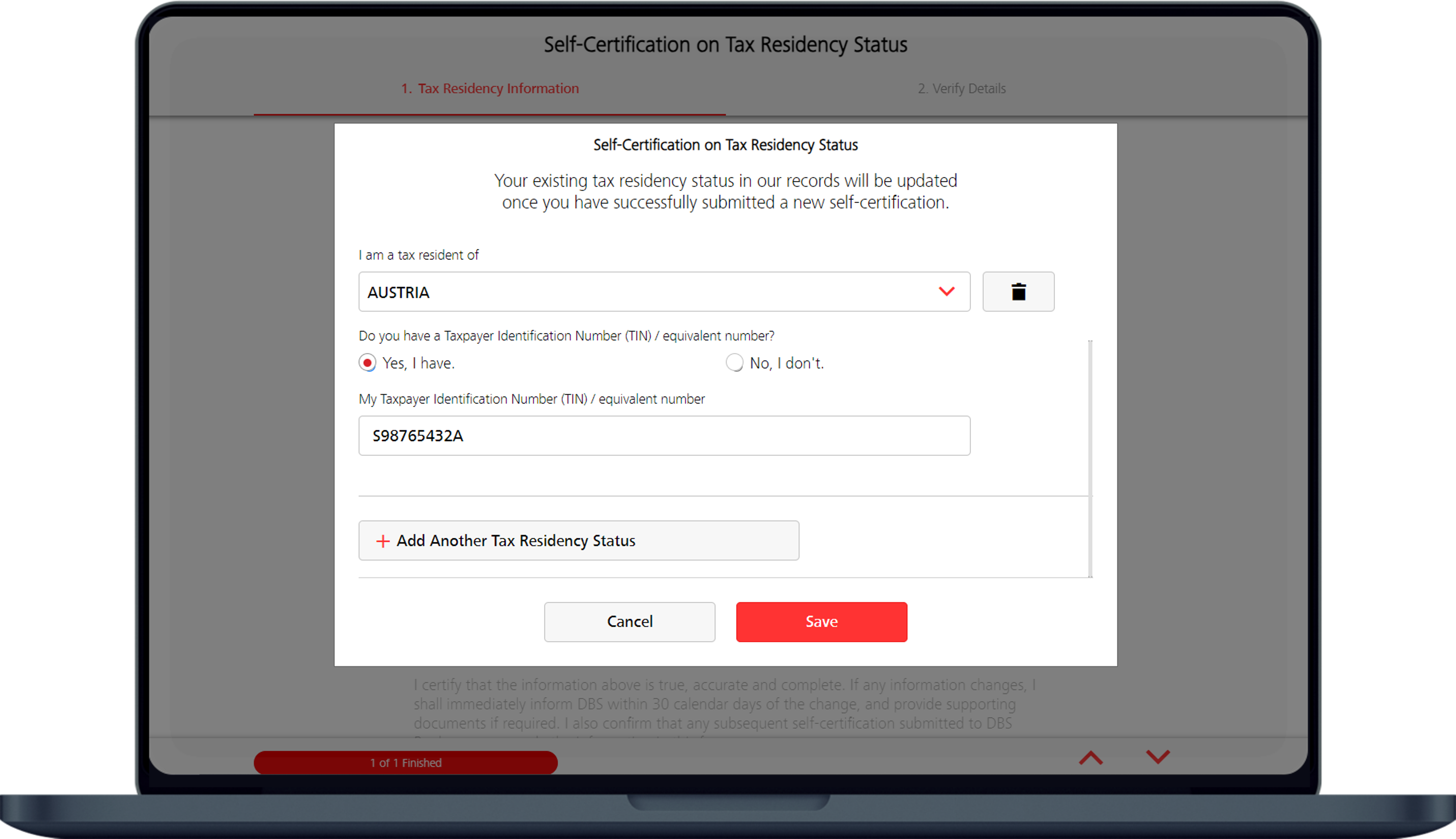

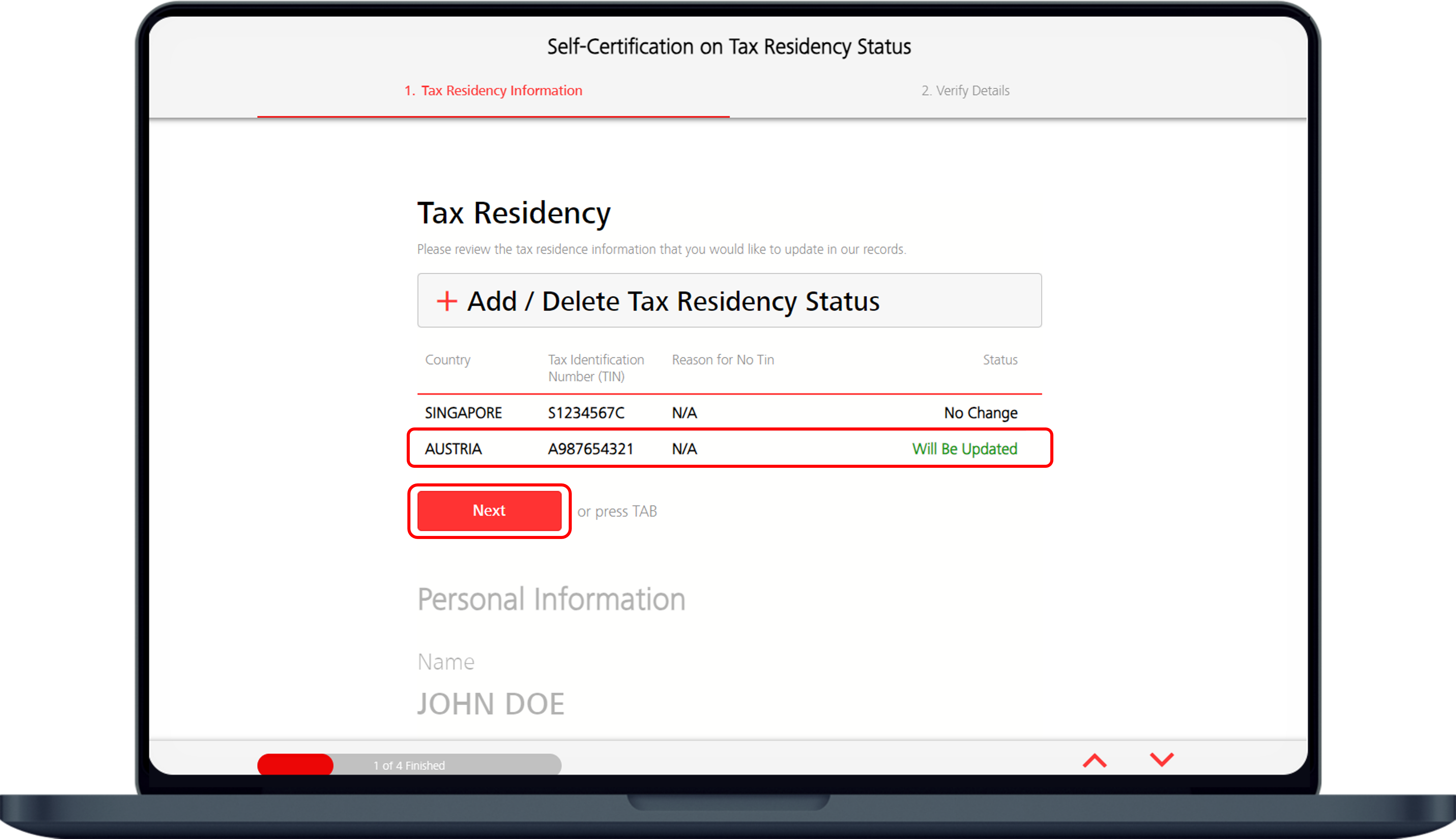

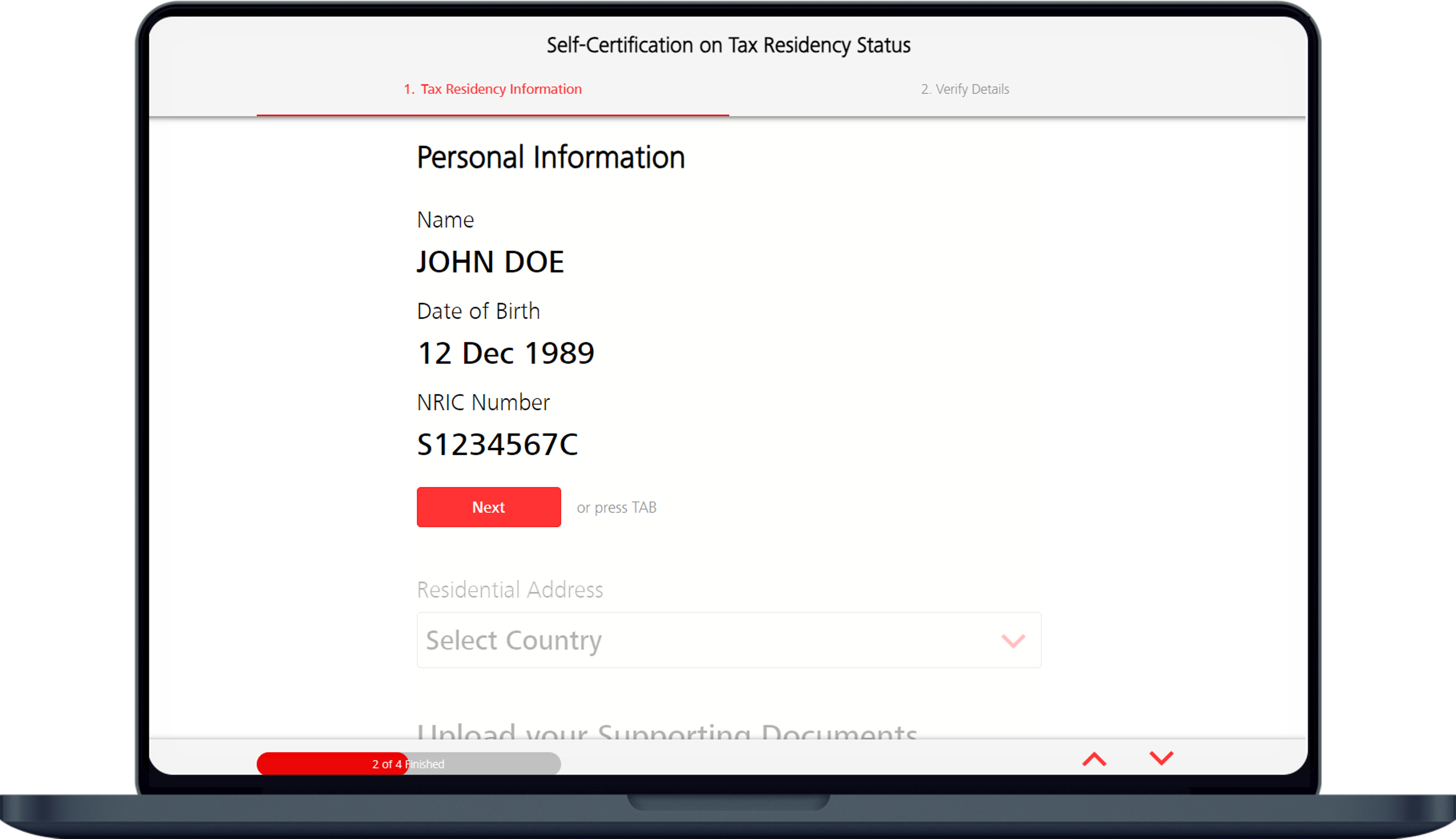

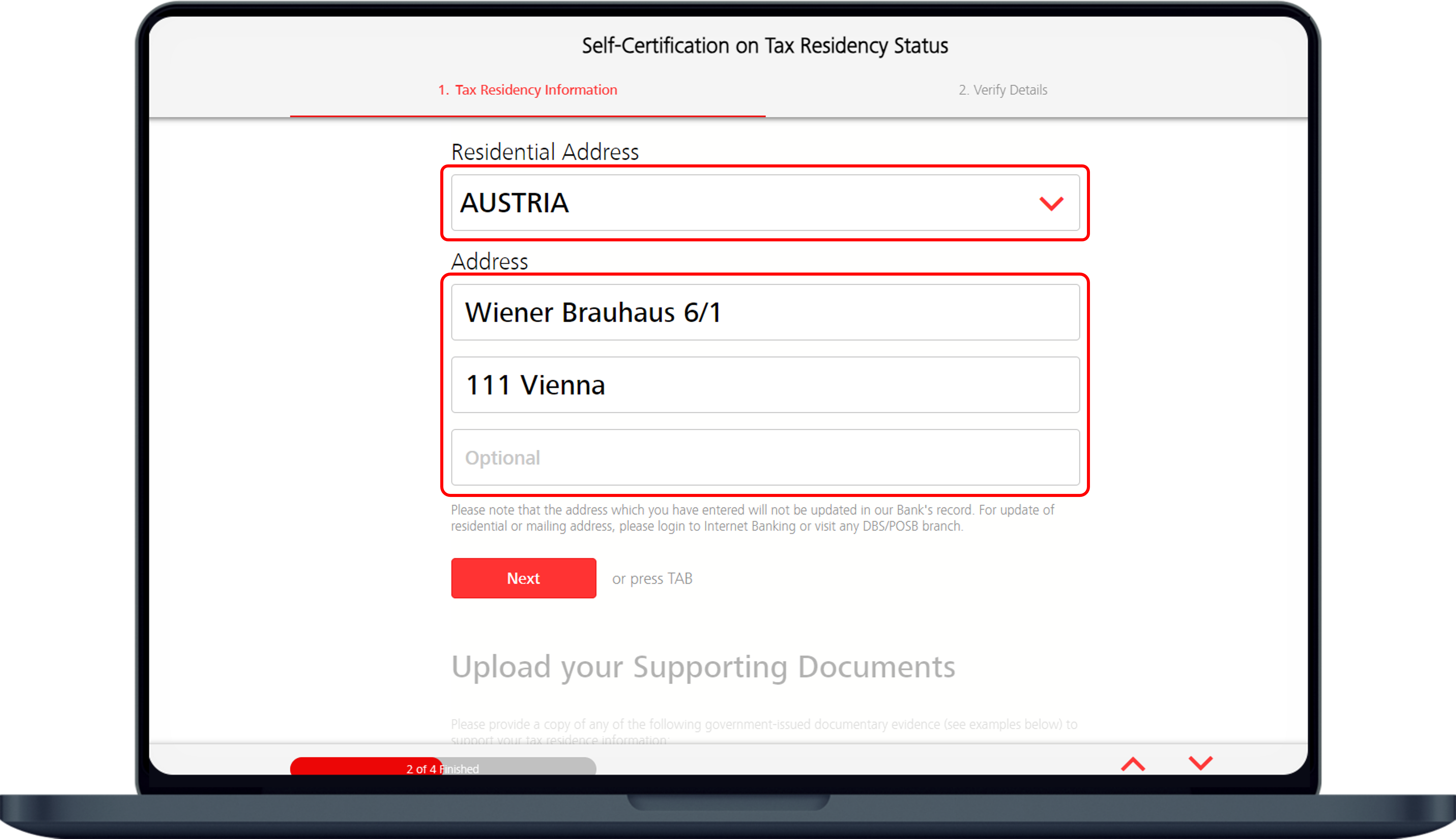

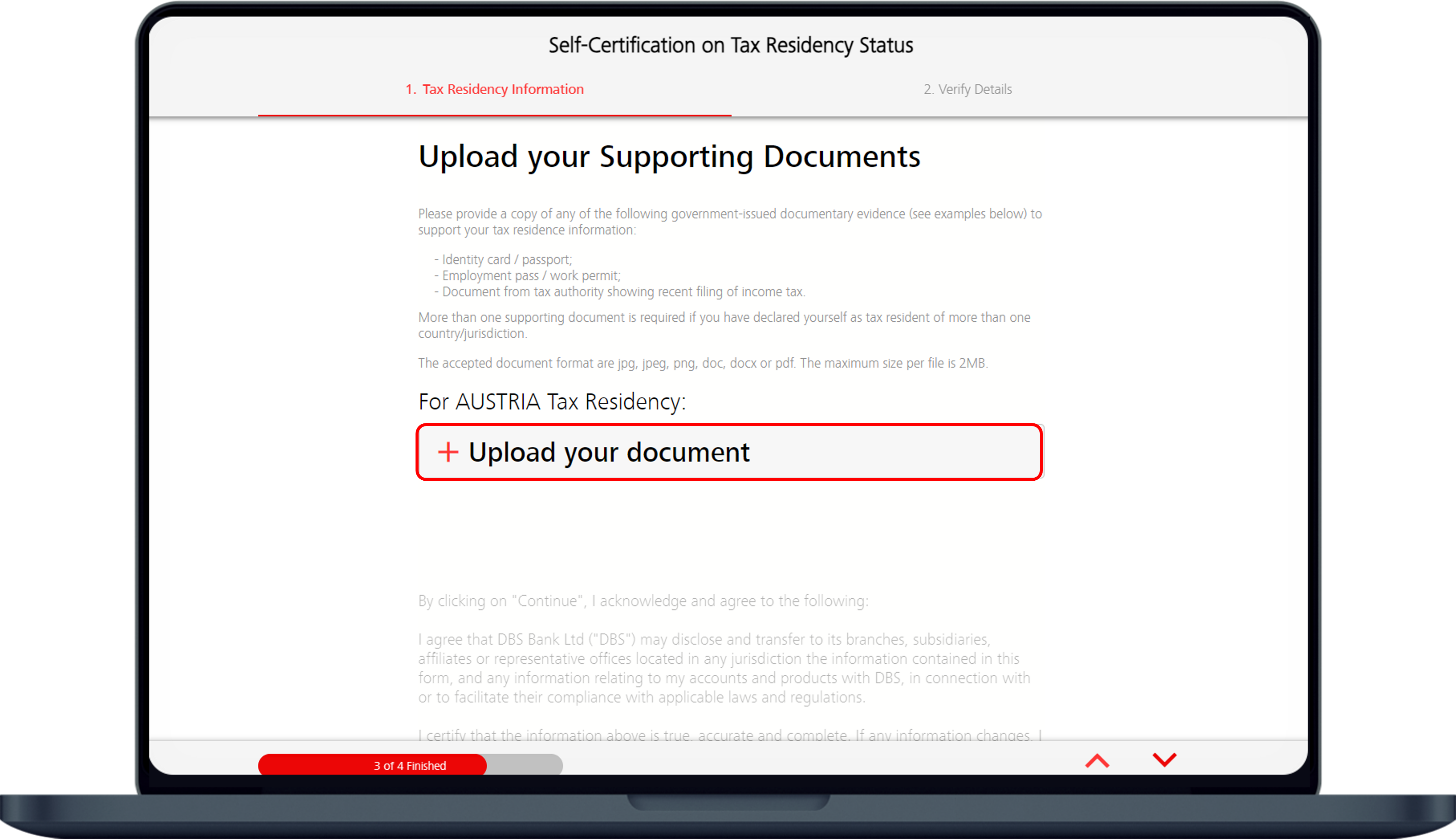

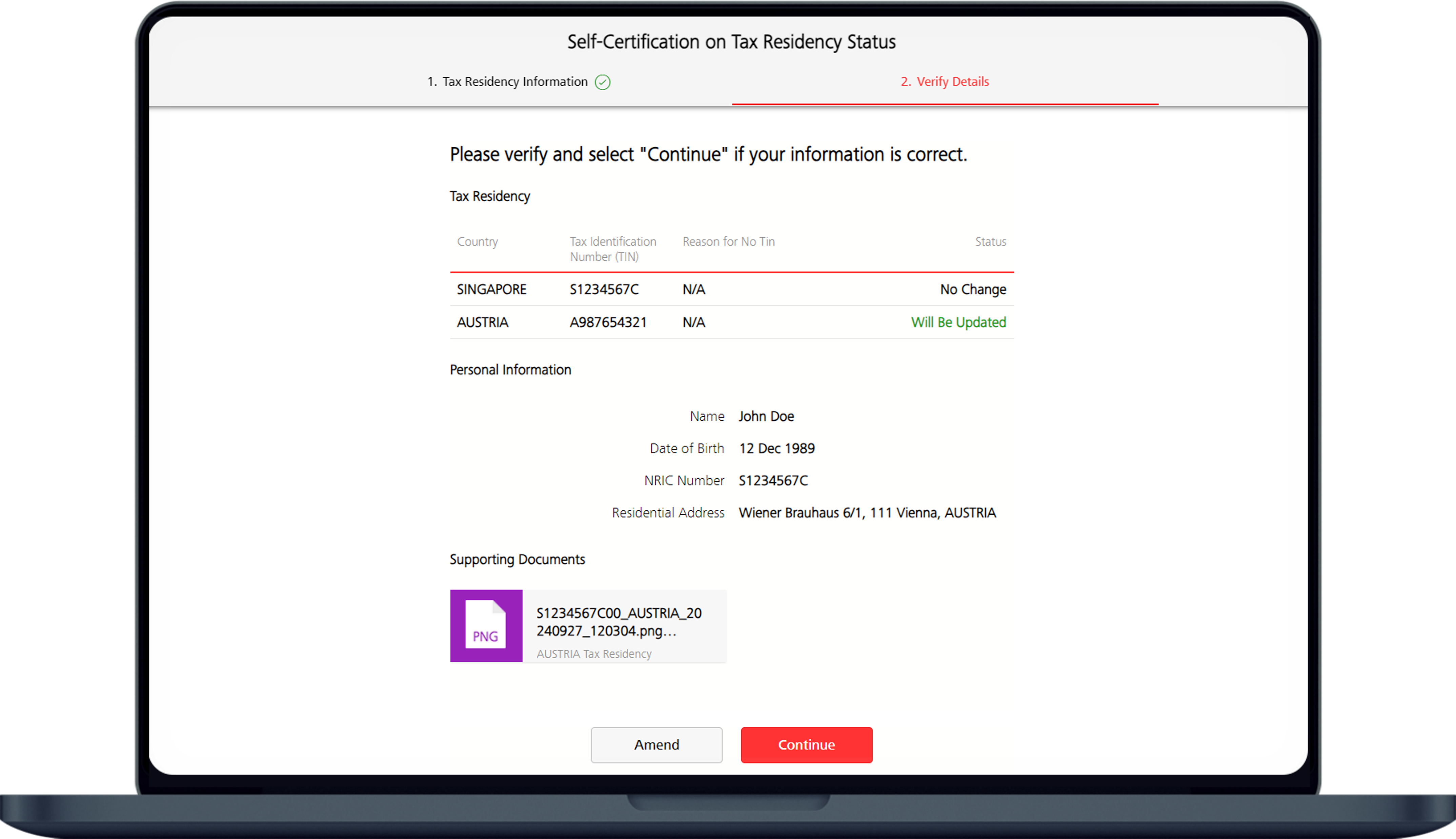

Prepare the following before proceeding to certify your tax residency information online:

- Ensure your mobile number is updated in our system. An OTP will be sent to your mobile number for confirmation. If your mobile number is not updated, learn more on how to Update Mobile Number.

- Taxpayer Identification Number (TIN)

Frequently Asked Question

What if my contact information/residential address/passport/FIN is not updated in the bank records?

You can update your personal details online. You can refer to the following step-by-step guides to:

How do I update my tax residency status if I am below 18 years of age or do not have a valid DBS/POSB ATM or Debit Card?

In the event you are below 18 years of age or do not have a valid DBS/POSB ATM or Debit Card, you can download the Self-Certification Form and;

-

Mail to:

DBS Bank Ltd - Deposits & Unsecured Lending Operations

Privy Box No. 920905

Singapore 929292 (AH0011) OR - Visit any POSB/DBS Branch with the completed form and your NRIC/Passport for verification.

For more information on FATCA, refer to IRS or FATCA Fact Sheet issued by the Association of Banks in Singapore (ABS).

Was this information useful?