Your Security Is Our Priority

In the light of today’s ever-evolving scam landscape, DBS/POSB has been bolstering our multi-layered defence against scams and fraud, so you can bank safely with peace of mind.

Here’s a suite of security measures we’ve implemented to help protect you:

Block access to funds in case of suspected scam with Safety Switch

If you think you've provided personal details to scammers by mistake, Safety Switch lets you to block access to your funds immediately. This can be activated 24/7 via the DBS Hotline at 1800 339 6963 from Singapore or (65) 6339 6963 (from Overseas).

Lock away funds in a digital safety deposit box with digiVault

You can transfer funds from your accounts into your personal digiVault. These funds cannot be transferred out digitally, but can only be accessed after verifying your identity, such as in person at a DBS/POSB branch. This helps protect the funds from scammers performing fraudulent digital transfers.

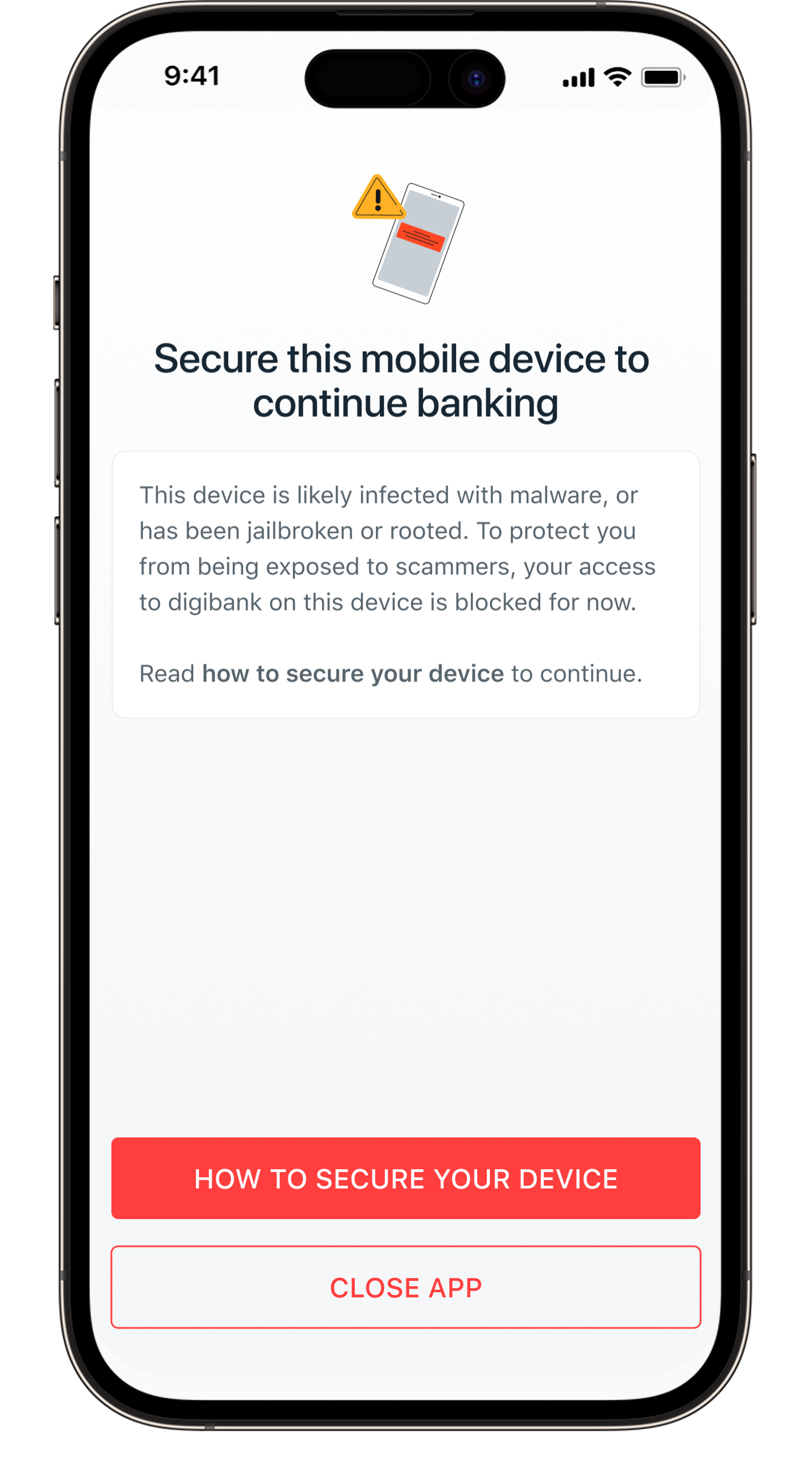

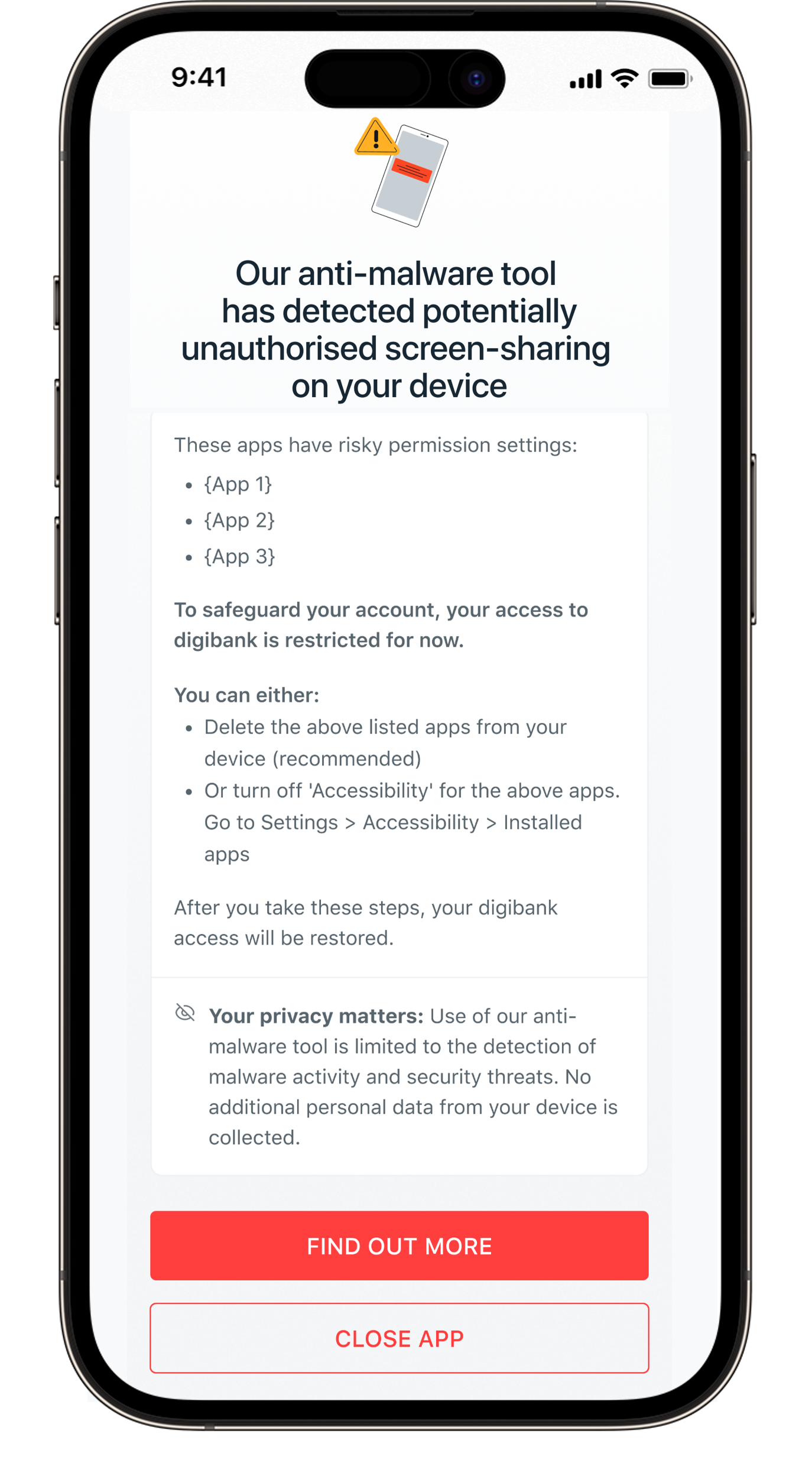

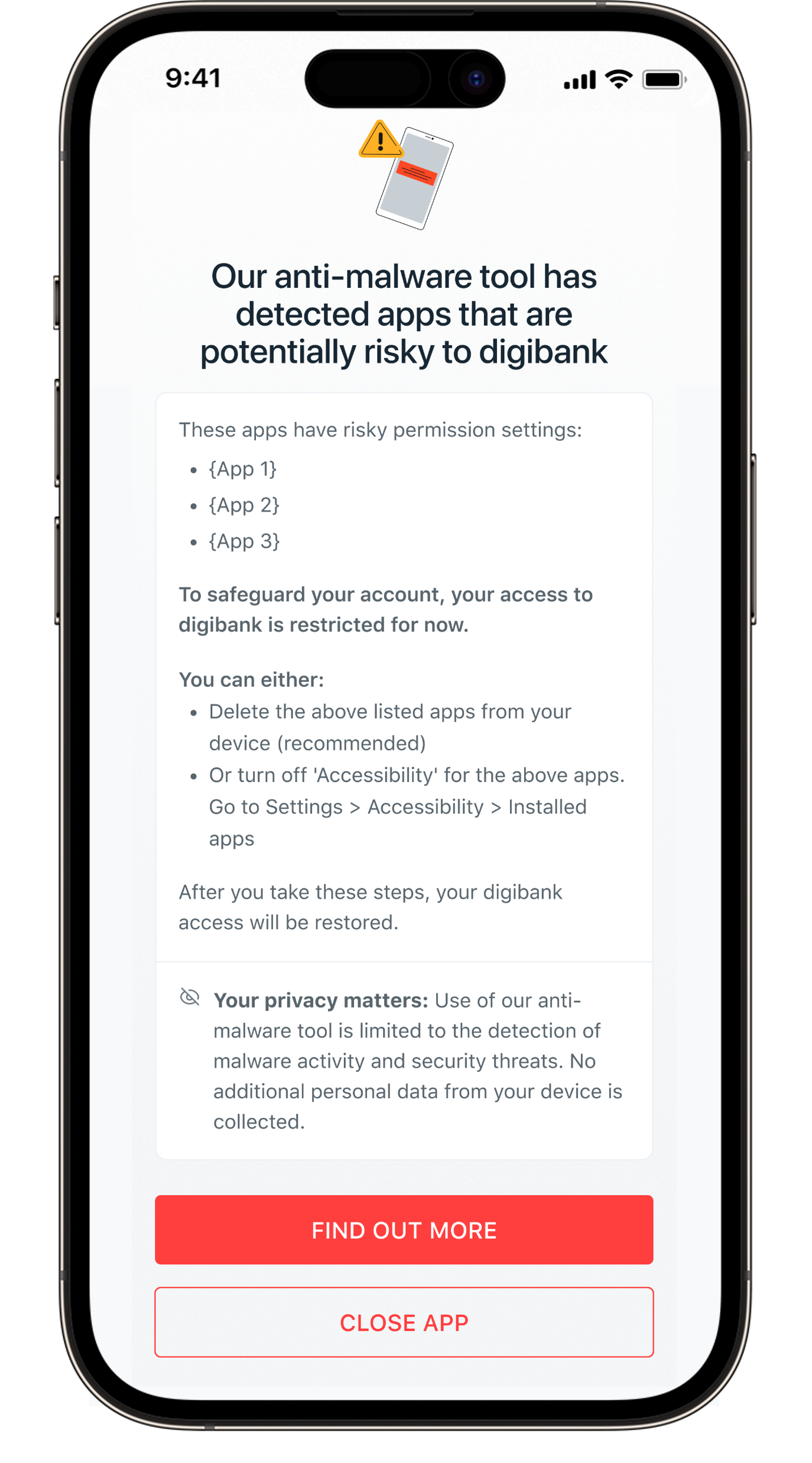

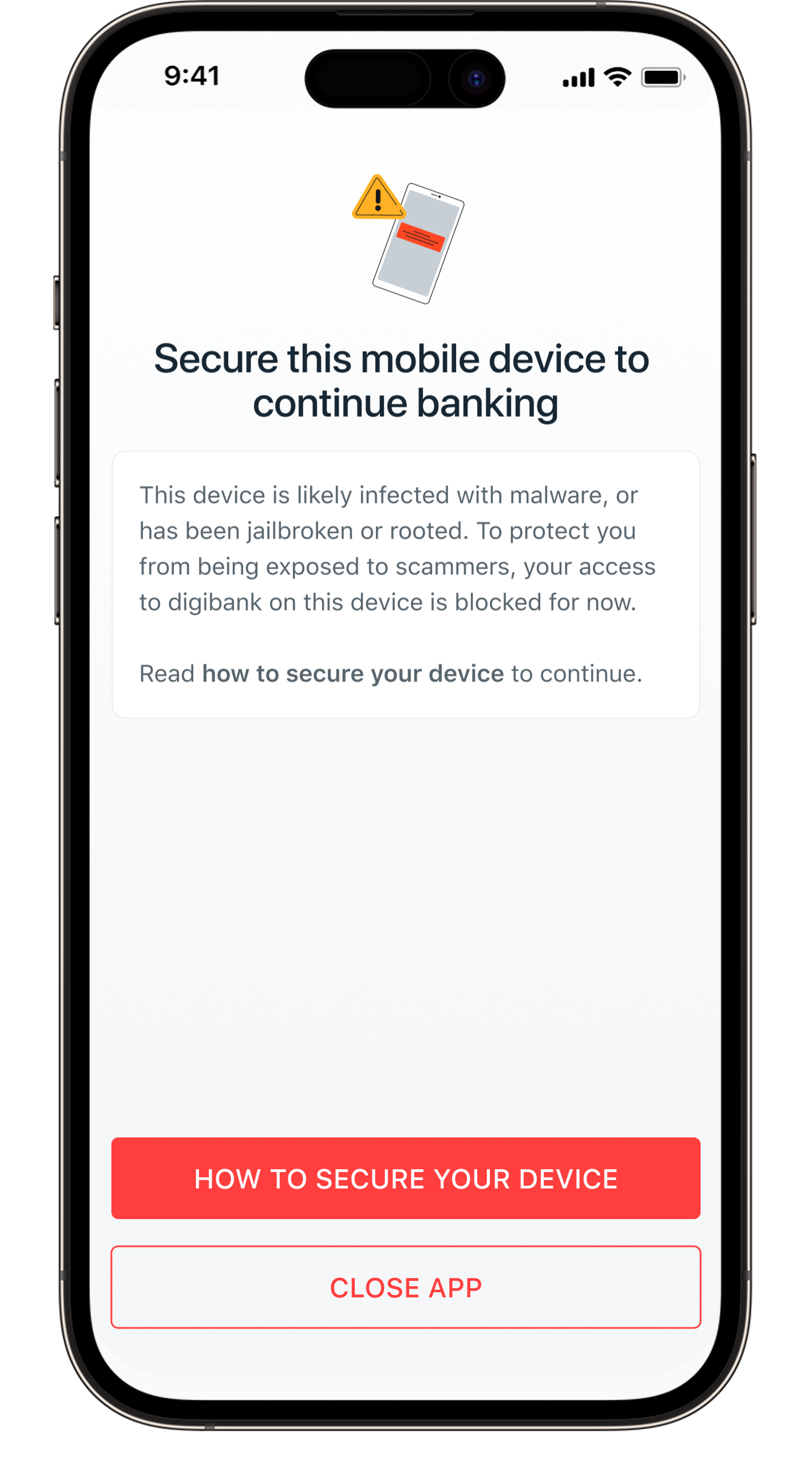

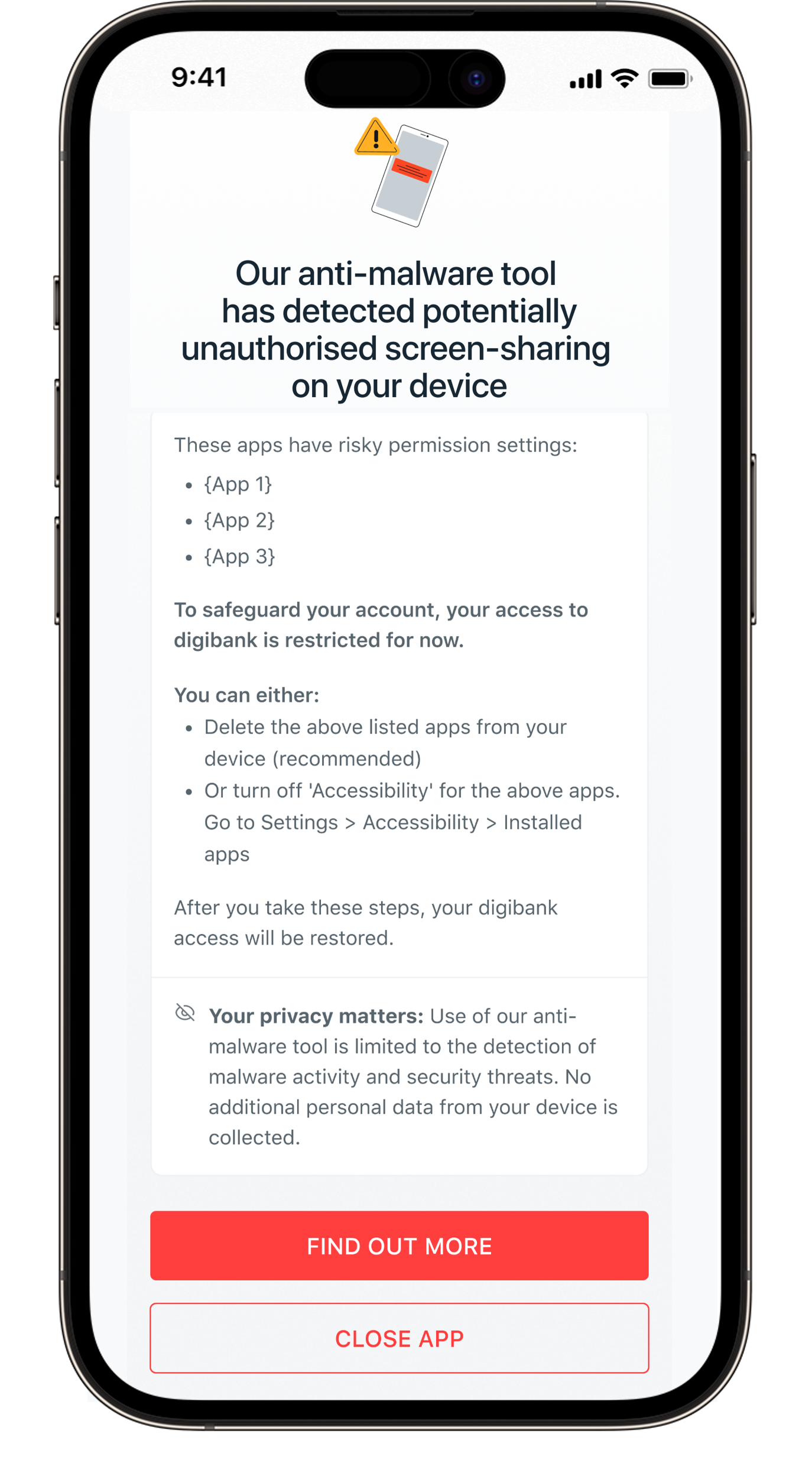

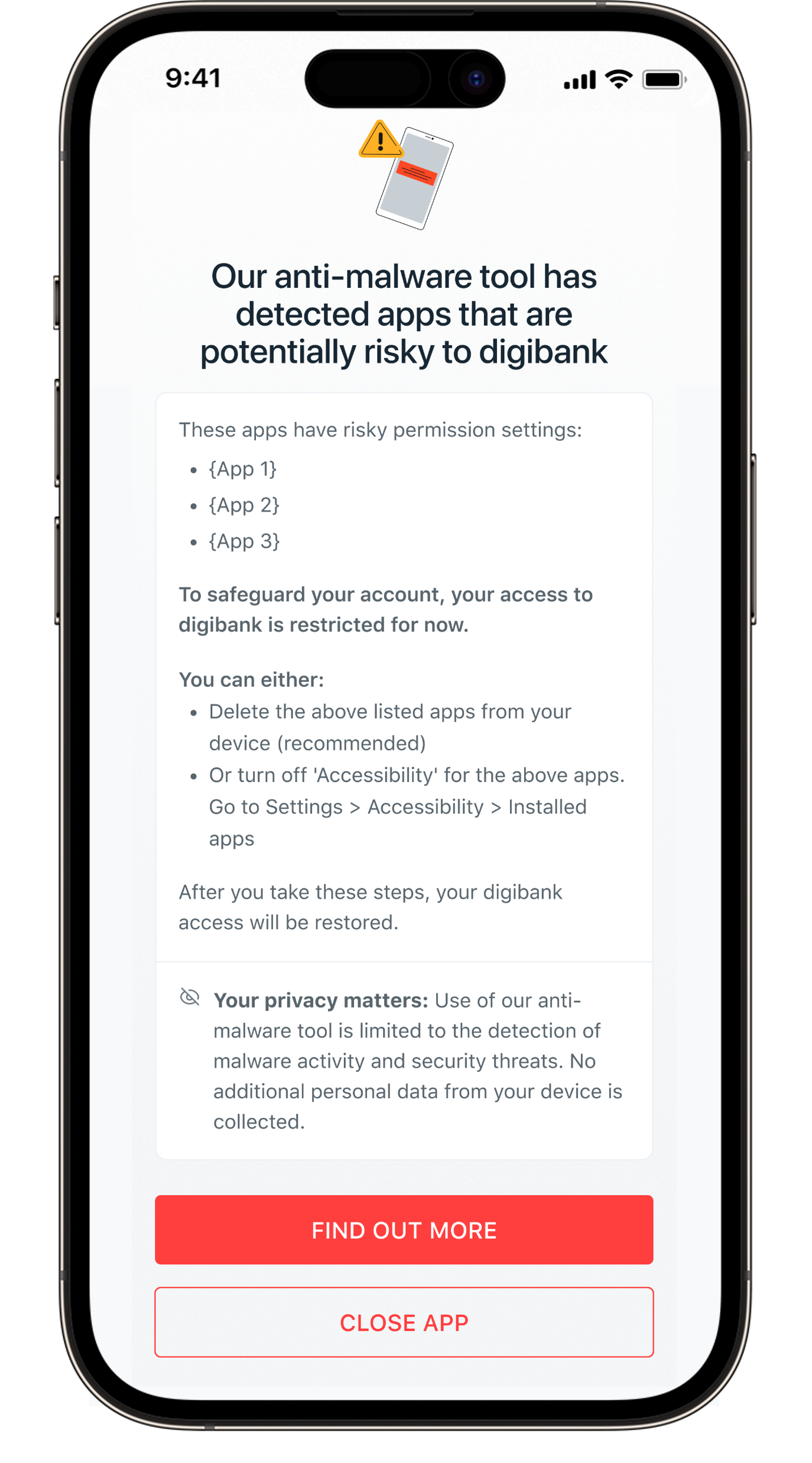

Enhanced capabilities to detect and block malware

To counter rising malware scams, DBS/POSB has enhanced its anti-malware tool that restricts access to digibank mobile when it detects malicious activity. Your access to digibank will be blocked if it detects a) the presence of malware or malicious applications, b) apps downloaded from unverified app stores (sideloaded apps) with accessibility permission enabled that can attempt unauthorised access to the DBS/POSB digibank app on a customer’s device or c) ongoing screen-sharing / mirroring on the device.

Your access will be restored once these risks are removed. A good practice is to only download apps from official app stores.

Rest assured that your personal privacy will always be protected. Our security measures will not monitor your phone activity, nor collect or store your personal data.

Learn more about the anti-malware tool and how you can protect yourself from malware attacks as we progressively roll it out from September 2023.

Your access will be restored once these risks are removed. A good practice is to only download apps from official app stores.

Rest assured that your personal privacy will always be protected. Our security measures will not monitor your phone activity, nor collect or store your personal data.

Learn more about the anti-malware tool and how you can protect yourself from malware attacks as we progressively roll it out from September 2023.

Access security actions in one place with Security Checkup

DBS/POSB has been rolling out features to empower our customers to proactively manage their online security. Security Checkup is the latest addition to our suite of self-managed security controls. With it, you can easily review your security settings in a single easy-to-use dashboard, and take action to strengthen your account security.

Learn more about Security Checkup, and how you can make full use of it to stay secure.

Learn more about Security Checkup, and how you can make full use of it to stay secure.

Safeguarding transactions with Payment Controls

Another self-managed security feature we have rolled out is Payment Controls, that lets you manage the security on your card accounts easily on your digibank app. Among other things, you can:

- Set or limit your card spending amounts.

- Instantly enable/disable cash advances, e-commerce and overseas transactions.

- Place a temporary lock on your card, instantly.

Was this information useful?