DBS/POSB Anti-Malware Security Features

What we are doing to better protect you from malware threats and scams.

Important information

- For the security of your accounts, we may restrict your digibank and/or PayLah! access. Please follow our detailed guides below to restore your digibank and/or PayLah! access.

- If you suspect that you are a victim of scam, call our 24-hour fraud hotline at 1800 339 6963 or (65) 6339 6963 from overseas.

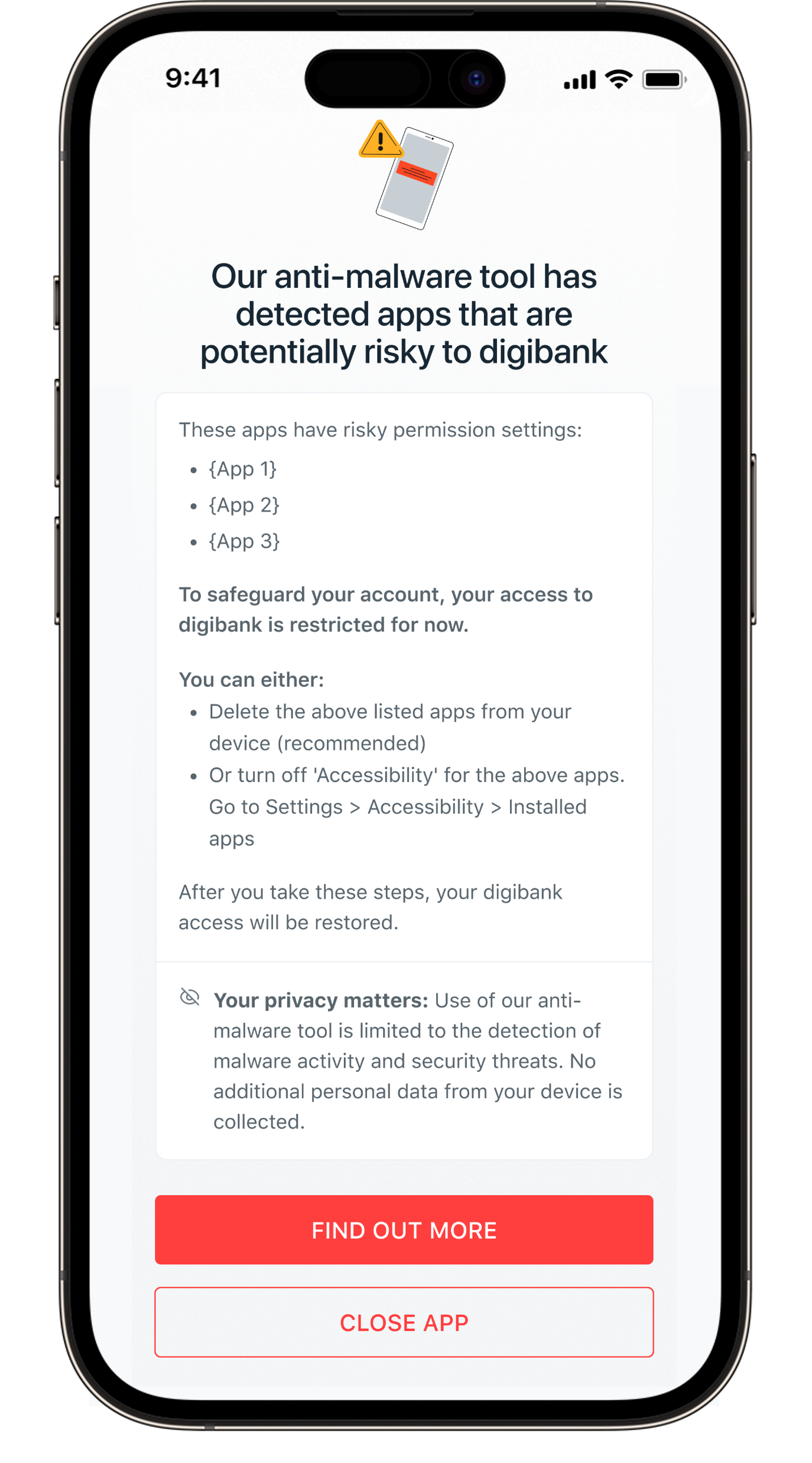

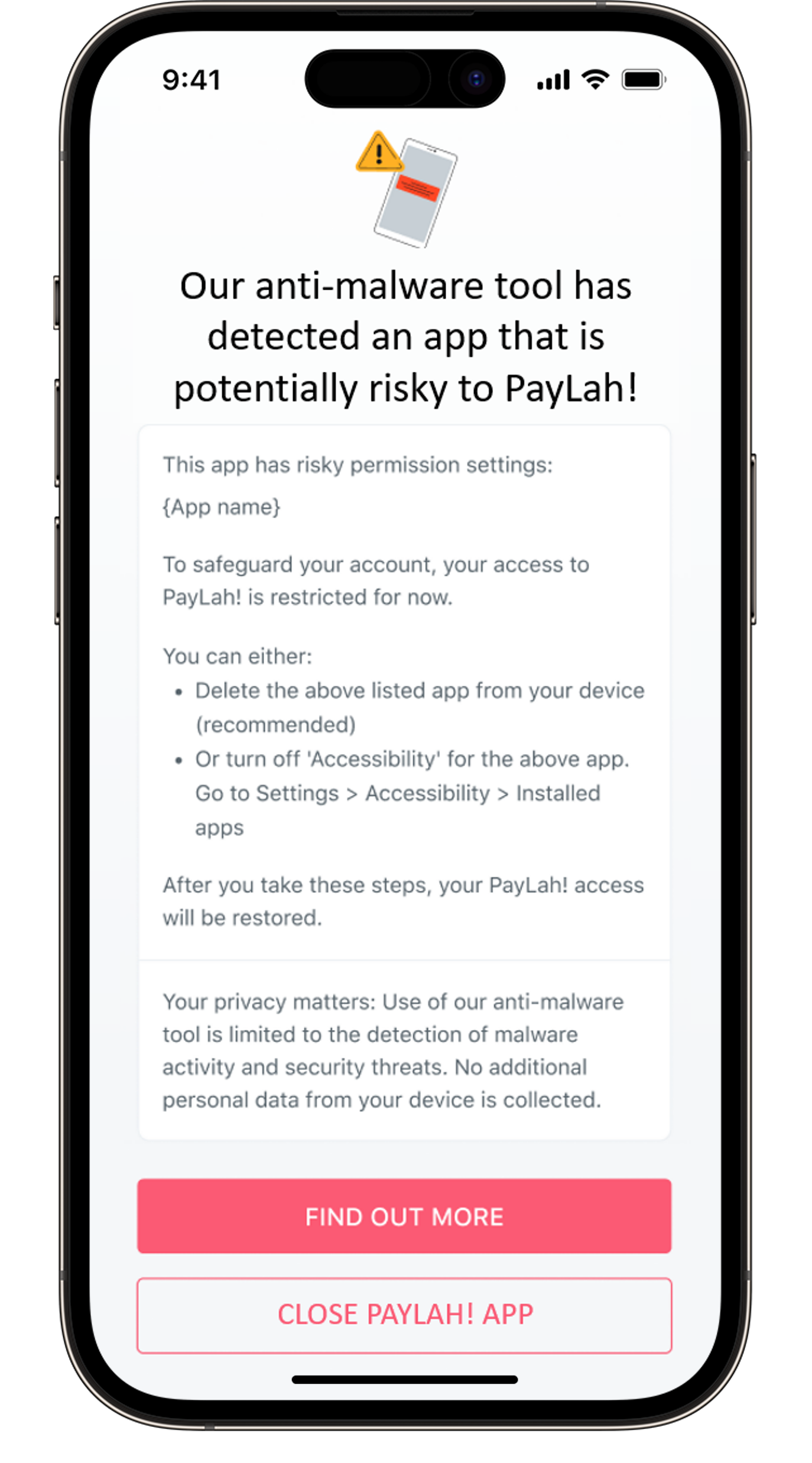

Seeing a restricted access message on digibank and/or PayLah! app?

This is our precautionary measure to safeguard you against potential malware threats. If you see this, it means that your mobile device is likely exposed to malware-related threats.

Select the message you see on your mobile device and we’ll guide you on how to restore your digibank and/or PayLah! access.

Why are you seeing this?

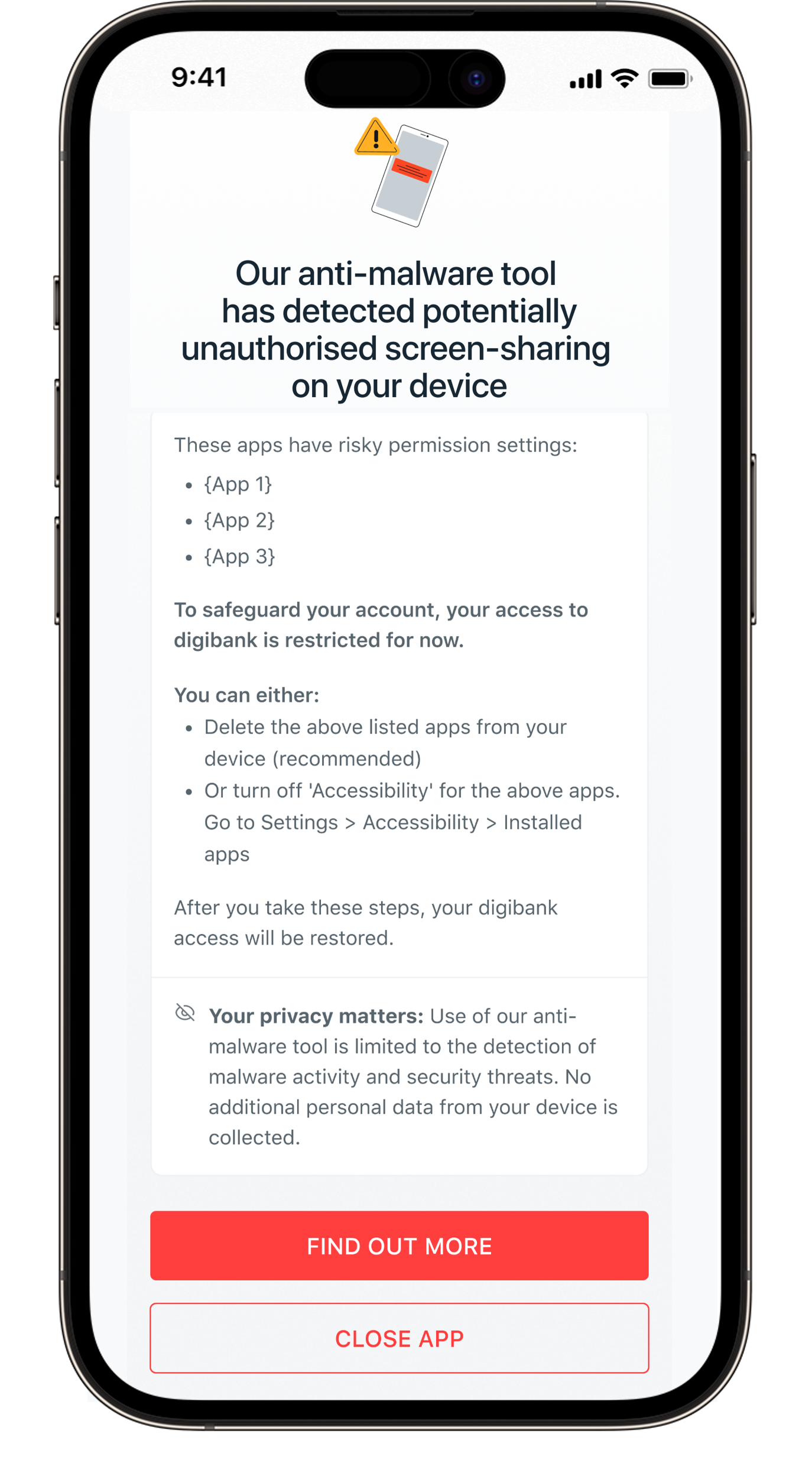

If you see this message, it means that your mobile device contains apps that are not downloaded from official app stores and has accessibility settings switched on. This may give scammers control of your device.

To safeguard your banking account, access to digibank and PayLah! have been restricted.

What you can do?

- Uninstall the apps shown in the message that pops up on your screen when you open your digibank mobile or PayLah! app. (Recommended)

- Or, if you trust that the app is safe, you can turn off ‘Accessibility’ for the listed apps via the ‘Settings’ menu on your device

Note: The steps to turn off an app’s ‘Accessibility’ may differ by phone model. Please check with your device manufacturer for details.

Does DBS/POSB scan your mobile device or collect personal information?

Is it possible to continue using the digibank or PayLah! app alongside the apps identified in the message?

What are ‘Accessibility’ settings and how do cyber criminals exploit them?

How do I change the Accessibility settings for apps that were not downloaded from the official app stores?

Here are steps to change accessibility settings for some popular phone models:

- Samsung Galaxy A53 5G / Flip 4 / Fold4 / A73 5G / S21 Ultra / A23 5G: Settings > Accessibility > Installed Apps

- Samsung Galaxy S21 5G / Galaxy S10: Settings > Accessibility > Installed Services

- Oppo A78 5G / Reno8 5G: Settings > Additional Settings > Accessibility

- Oppo Find X2 Pro / A17: Settings > System Settings > Accessibility

- Huawei P50 Pro: Settings > Accessibility features > Accessibility > Installed Services

- Huawei Nova 3i / Nova 5T: Settings > Smart Assistance > Accessibility

- Huawei Mate30 & Huawei Y9a: Settings > Accessibility features > Accessibility (Scroll down to Downloaded Services)

- Google Pixel 5 / Pixel 3 XL: Settings > Accessibility

- Redmi Note 10 5G: Settings > Additional Settings > Accessibility > Downloaded Apps

- Poco X5 5G: Settings > Additional Settings > Accessibility > Downloaded Apps

Why are some well-known apps being flagged as risky apps?

What are the official app stores?

- Google Play Store

- Samsung Galaxy Store

- Huawei AppGallery

- Xiaomi MI App Store

- Amazon appstore

- Vivo V-Appstore

- Oppo App Market

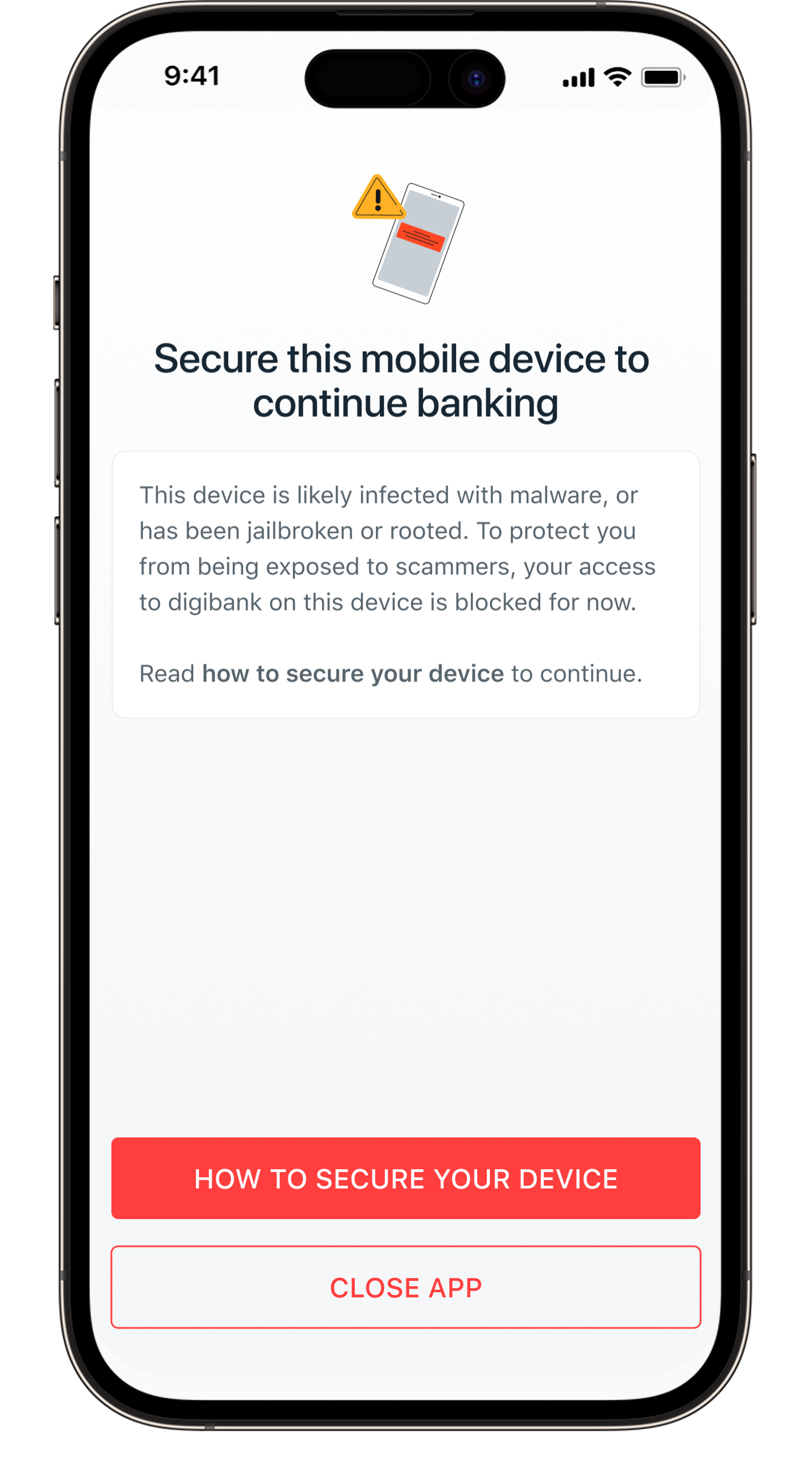

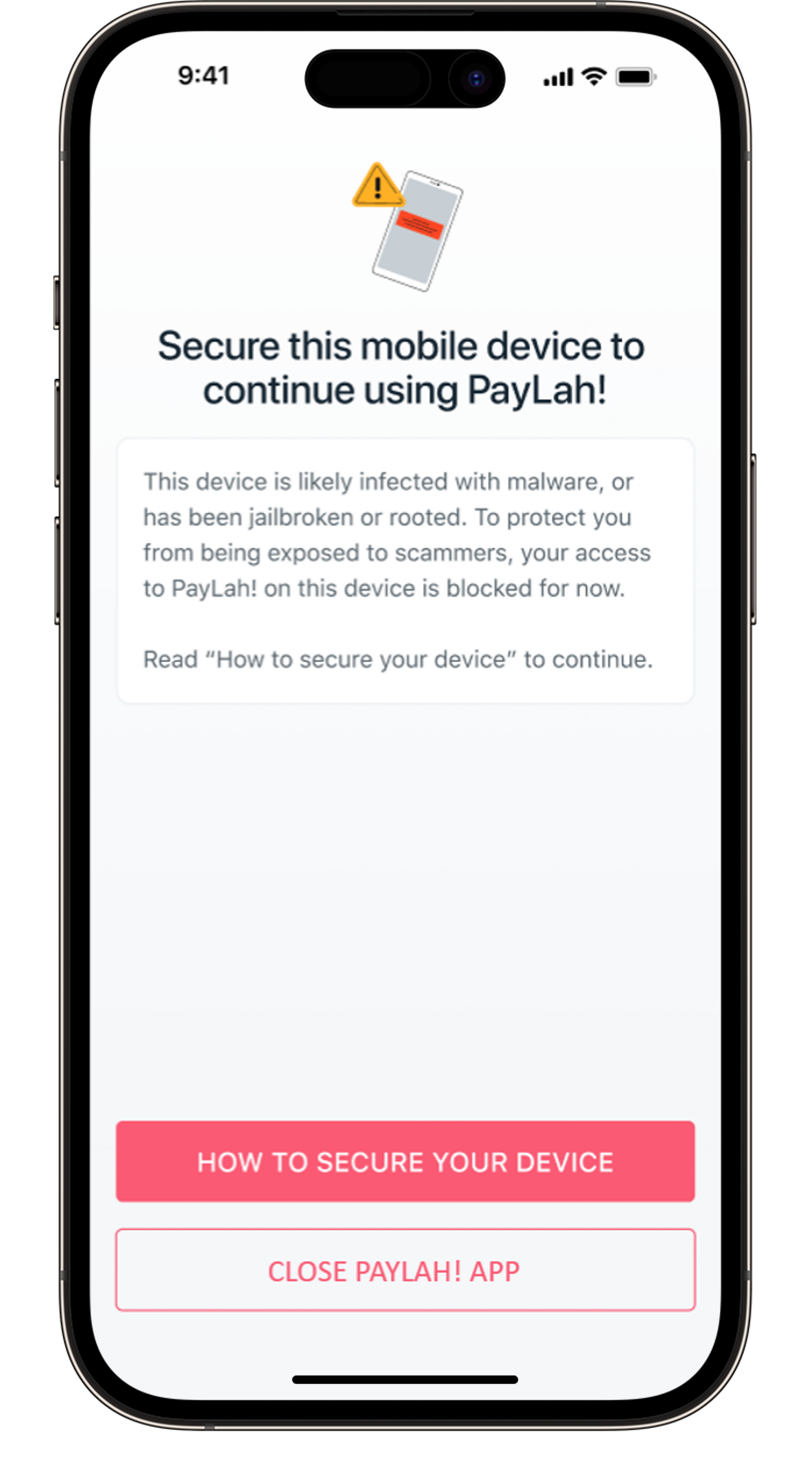

Why are you seeing this?

If you see this message, it means that your device is likely infected with known malware applications, or is jailbroken or rooted. You may have downloaded malicious apps via links in text messages, social media or third-party websites instead of official sources like the Google Play or Apple App Store.

What you can do?

If your mobile device is not jailbroken or rooted, follow the steps below to remove the malware.

How to remove malware on your mobile device?

- Disconnect your mobile device from the internet. Turn off WiFi and mobile data, or turn on Airplane Mode, so scammers cannot access your phone through the malicious app.

- Go through your list of installed apps. Look for anything suspicious:

- Apps not downloaded from the official app store

- Apps you do not recognise or do not recall downloading

- Suspicious apps with generic names, wrong spellings, or unauthorised app store icons.

- Delete such apps from your mobile device.

What if your digibank mobile and/or PayLah! access is still blocked after taking these steps?

If you spot suspicious activity on your digibank account such as unauthorised transactions, call our 24-hour DBS fraud hotline at 1800 339 6963 from Singapore or (65) 6339 6963 from overseas to report it immediately.

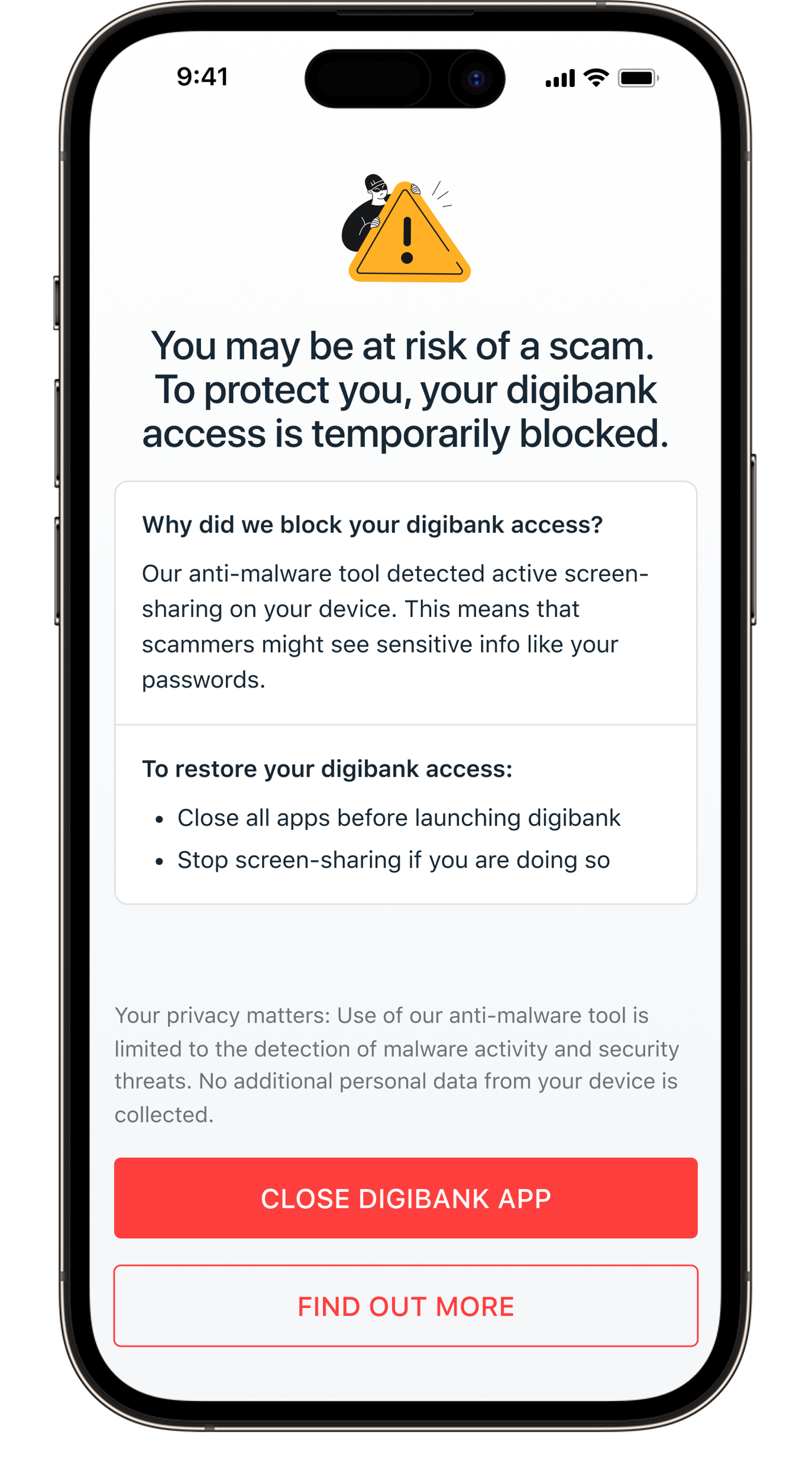

Why are you seeing this?

If you see this message, it means that screen-sharing or mirroring is taking place on your device. This may be a sign of a malware attack. To safeguard your banking account, access to digibank or PayLah! will be restricted while screen-sharing or mirroring is going on.

What you can do?

- Close all apps and relaunch digibank mobile.

- Stop screen sharing or recording activities.

- Restart your device and relaunch digibank mobile

- For digibank mobile Android users, review and delete apps listed in the message

Why are you seeing this?

|

If you see this message, it means that an app on your mobile device is accessing digibank remotely. This may potentially give scammers an opportunity to control your device to monitor and steal sensitive information like your passwords. |

What you can do?

- Delete any apps that allow your mobile device to be controlled remotely.

- Close all open apps or restart your mobile device before accessing digibank.

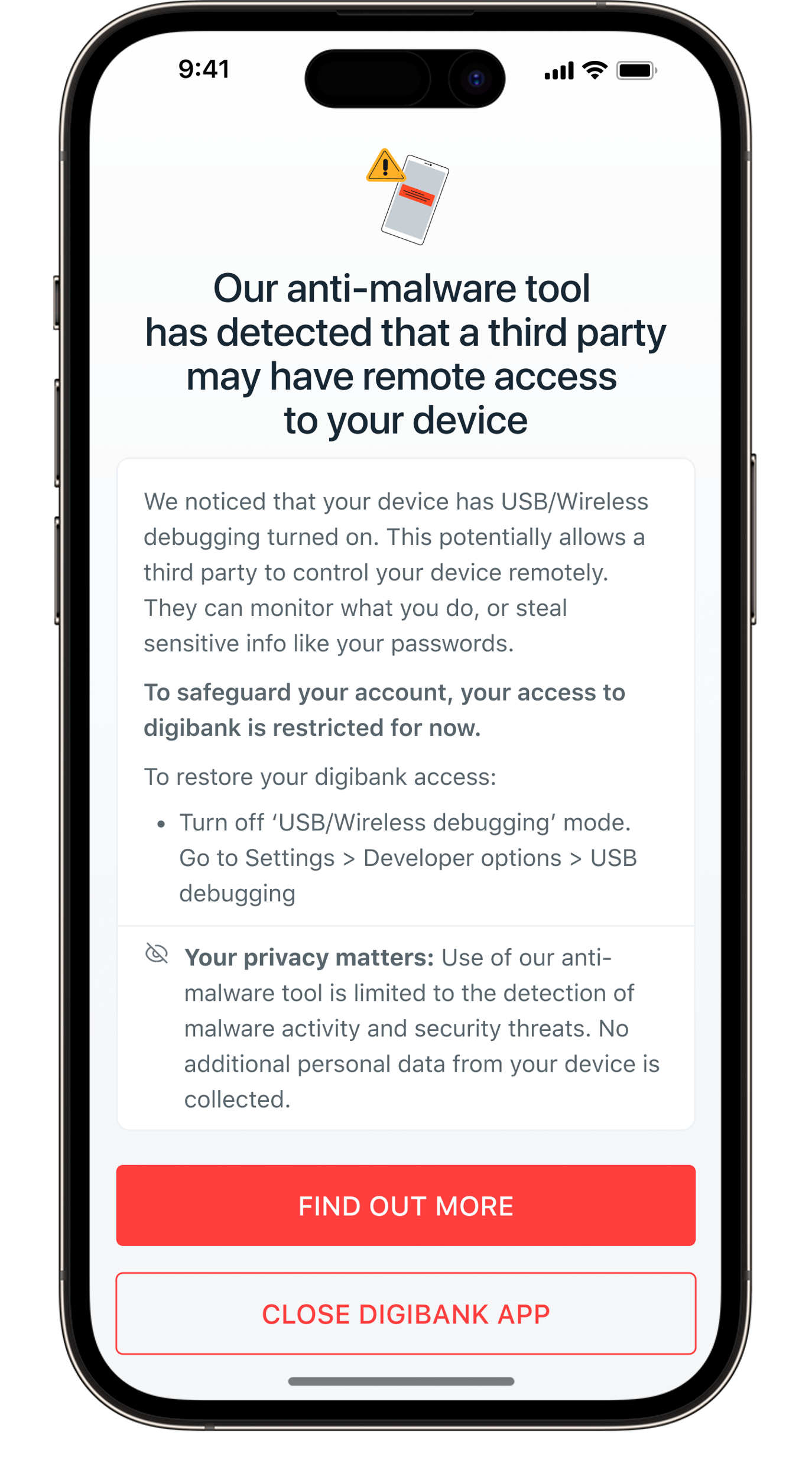

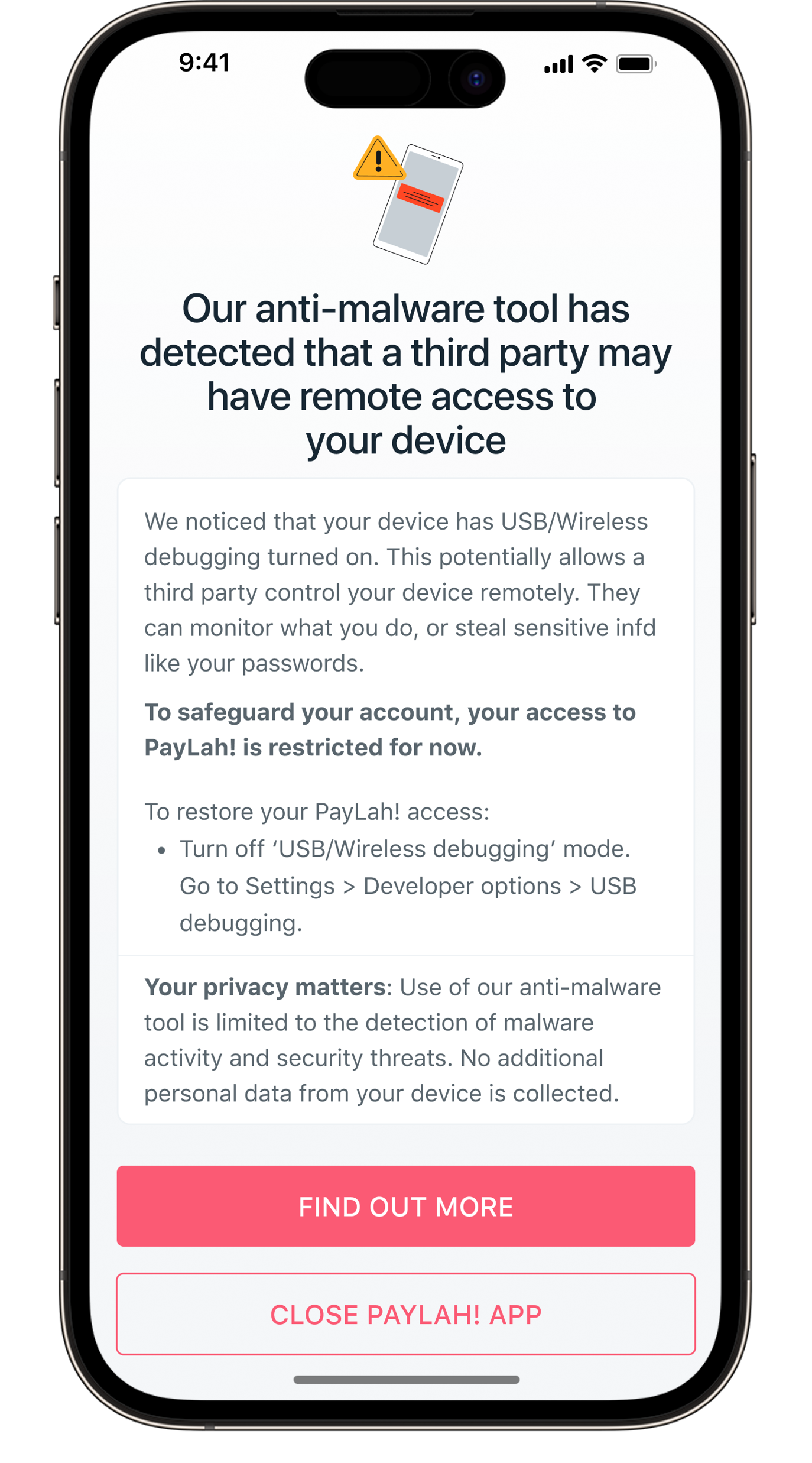

Why are you seeing this?

If you see this message, it means that your mobile device has the USB/Wireless debugging setting enabled. This potentially allows another person to control your device remotely to monitor and steal sensitive information like your passwords.

What you can do?

- Go to Developer options in your device settings and turn off ‘USB/Wireless debugging’ mode

- To access Developer options, go to Settings > Developer options > USB/Wireless debugging

What if you are not able to locate Developer options in your device settings?

Your Developer options is likely disabled. To enable Developer options and turn off ‘USB/Wireless debugging’ you will need to:

- Enable developer option by going to your device Settings > About device > Version > Tap on ‘Build number’ 7 times > Key in device PIN/password > Developer option is now enabled

- Access Developer options to disable USB/Wireless debugging by going to device Settings > Additional settings > Developer options > Turn off ‘USB/Wireless’ debugging > Disable Developer Options

The rise of malware threats

Malware threats are on the rise, with scammers using carefully planned and sophisticated methods to trick customers into downloading malware through malicious apps. Once your phone is infected by malware, scammers can steal sensitive information like your banking login credentials and SMS OTPs. They can remotely control your mobile device to perform fraudulent monetary transactions without your knowledge or consent.

What we are doing to protect you

We have recently enhanced our anti-malware capabilities to prevent scammers from logging into customers’ digibank and PayLah!.

Our enhanced anti-malware tool restricts digibank and/or PayLah! access when it detects log-in attempts from mobile devices that are likely infected with malware or have settings that make it prone to security vulnerabilities. This includes:- Known malware applications and jailbroken or rooted mobile devices

- Mobile devices with risky apps or permission settings

- Mobile devices with potentially unauthorised ongoing screen-sharing

- Mobile devices remotely controlled by another device to access digibank

- Mobile devices with USB/Wireless debugging mode enabled

To safeguard your banking accounts and monies, you will need to remove the malicious or risky apps, turn off accessibility permission settings or stop screen-sharing before you can access digibank and/or PayLah! again.

As with all our security features, customers can be assured that the use of the anti-malware tool is limited to the detection of malware activity and security threats. No additional personal data from their device is collected.

Is your device jailbroken or rooted?

What is jailbreak or rooting?

Why is jailbreaking or rooting unsafe?

- gives malicious apps and their creators, possibly scammers, a back door into your phone and private data

- voids the warranty of your device

- can damage your device and make it faulty or unstable

- weakens your device security

- may be illegal if you download software that infringes on copyright laws

What should you do to access digibank?

What should you do to access PayLah!?

Frequently Asked Questions

What if you need to make an urgent transaction?

You may also use digibank online on your laptop or desktop. However, only limited services will be available as you will not be able to perform some transactions that require additional authentication. For instance, the adding of new recipients or increasing of your transaction limits.

You are strongly encouraged to secure your mobile device before you continue to perform any banking activity.

Does DBS/POSB scan your device or collect personal information?

Can customers opt out of this security feature?

If you do not see the message, does it mean that your device is 100% secure from malware?

To remain vigilant, be careful of the types of apps you install and the permissions you enable on your phone. Check out our Security Alerts webpage to be aware of the latest security threats.

Knowledge and Tips

Understanding Malware and Malware Scams

What is malware?

More info from the Cyber Security Agency of Singapore can be found here.

How do malware scams happen?

How do scammers trick victims into downloading malware?

Victims are then tricked into clicking on a web link to download an app that is not from the official Google Play or Apple App Store.

What happens when your device is infected with malware?

What are some tell-tale signs that your device may be infected with malware?

- Device is operating slower than usual

- Apps are taking longer to load

- Battery drains faster than expected

- Seeing a lot of pop-up ads

- Device has unfamiliar apps that you do not recognise

- Unexplained increase in data usage

- Higher than expected phone bills

Tips to protect yourself from malware attacks

Be wary of a deal that seems too good to be true

- Because it probably is! Scammers have been offering fake, attractive deals like extremely cheap iPhones or durians, and very low prices for services like cleaning or pet grooming. Such scams are often found in website ads, emails, text messages, or on WhatsApp.

- Once you click on the ad or contact the seller, you may be asked to download unfamiliar, harmful apps to make payment. That’s how your device gets infected with malware.

Stick to official sources like Google Play and Apple App Store

- When downloading mobile apps, only use trusted sources like the Google Play Store or Apple App Store. These app stores have measures in place to reduce your risk of installing harmful apps.

- Even on official stores, always check the descriptions, reviews and ratings of apps to make sure they're trustworthy. Avoid downloading apps from third-party websites, emails, text messages, or social media!

Pay attention to app permissions and use mobile security software

- Whenever an app you install asks for permissions, take a moment. If it asks for accessibility permissions, full control over your device, or access to sensitive information like your text messages and emails that it does not need, it could be a warning sign of a malicious threat.

- For example, a shopping app should not be asking for access to your contact list, camera or photos. Such permissions can allow a scammer to get full control of your device.

- Consider using reputable mobile security software to protect your device. Such software can help detect and block any harmful apps and alert you to potential risks.

Make use of your security features today!

To strengthen your digibank security, knowing what tools you have to protect yourself is crucial.

Take precautions

- Personal Particulars Update: Keep your contact details updated to get timely alerts and detect fraudulent transactions early.

- Transaction Alerts: Set alerts on your bank accounts and debit or credit cards to be notified of transactions.

- Transfer Limits: Set lower daily transfer limits in digibank to limit your exposure to fraudulent transactions.

In case of fraud, act fast!

- Payment Controls (for your card): Review your card transactions regularly. If you notice anything unauthorised, use Payment Controls to block your debit or credit card immediately and call us.

- Safety Switch (for your account): Suspect a scam attack on your account? Activate our Safety Switch to suspend access to your funds and self-service banking facilities quickly.

- DBS Fraud Reporting Hotline: Call the DBS fraud hotline at 1800 339 6963 from Singapore or (65) 6339 6963 from Overseas to report any fraudulent transactions.

If the guide did not work for you, you can Get in Touch with Us.