Why choose DBS Regional Interest Optimisation?

- Preserve full autonomy of the participating accounts without balance sheet implications since funds are not co-mingled.

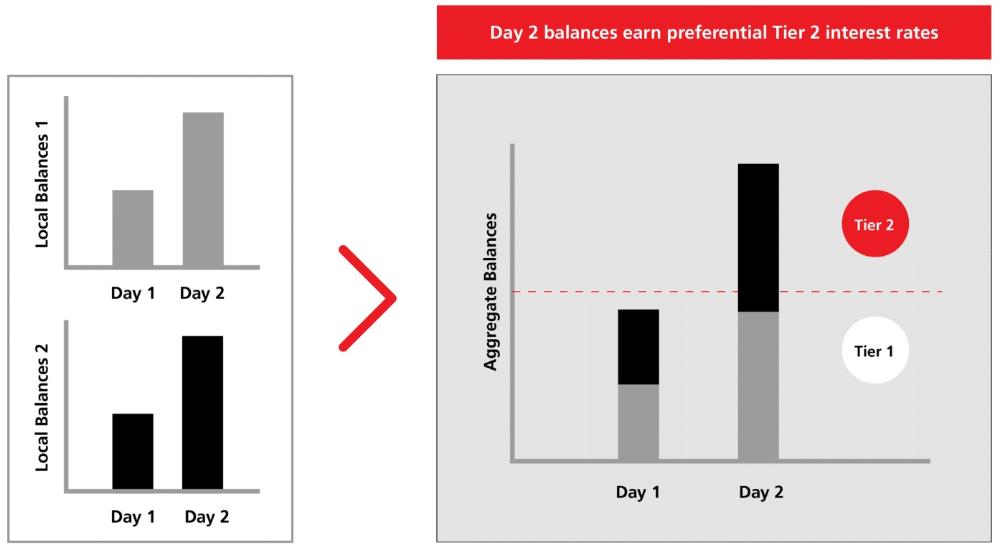

- Local entities enjoy higher yield from idle funds and cost savings from lower interest on borrowings as preferential interest rates are dynamically applied on a daily basis based on total portfolio value.

- Easy to implement and administer as it requires less product documentation compared to other types of liquidity management.

- Reports can be accessed through DBS IDEAL, our online banking platform, for greater convenience.

Comparison Table

| Criteria | Cross-border Cash Concentration | Regional Interest Optimisation |

| Physical transfer of Funds | Yes | No |

| Inter-company lending | Yes, if cross-entity | No |

| Non-convertible currency | No | Yes* |

| Multi-currency inclusion | No | Yes |

| Cash Management approach | Centralised | Decentralised |

* Certain currencies are unable to receive interest benefit due to local regulations. Please see the FAQ for more details.

FAQs

| Can DBS Regional Interest Optimisation be performed across different currencies? | |

| Yes. Balances will be notionally aggregated in a common base currency. |

How To Apply?

Simply call us at 1800 222 2200, or +65 6222 2200 if you are calling from overseas to apply. Alternatively, please speak with your relationship manager.