Bridge your business ambitions with smart cashflow management when you tap on DBS’s trade financing solutions.

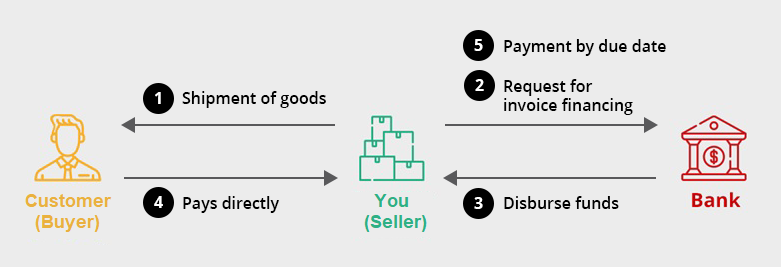

With Sales Invoice Financing (SIF), DBS can help to unlock cash from your receivables by providing you with an advance on unpaid invoices before your buyer pays you. This helps to free up cashflow for your other business requirements.

*You must have a DBS IDEAL Login and access to submit trade transactions

Please refer to the Trade Pricing Guide.

Submit your loan application along with a copy of your supplier invoices and supporting trade documents through one of the following channels:

A credit facility with DBS will be required for Sales Invoice Financing. Please get in touch with us to assist you with the setup.

| Can I apply for Sales Invoice Financing if I do not have a credit facility with DBS? | |

| A credit facility with DBS will be required. Please get in touch with us to assist you with the setup. |

| How do I check the status of financing? | |

| You can check your payment status through DBS IDEAL or contact us. You will receive a reminder from IDEAL upon maturity. |

| Can I ask for an extension on the due date? | |

| This is subject to approval. The loan period must not exceed the maximum period granted in the letter of offer. |

| Can I repay the loan before the due date? | |

| Yes, however, you will be subject to a fee. Please get in touch with us to find out more. |

| What will be the foreign exchange rates used for the settlement? | |

| We will use our prevailing foreign exchange rates for the settlement of your Trade Financing. For amounts less than S$200,000 or the equivalent on the due date, please refer to Rates Online for our prevailing rates. If you have an FX contract, please inform us by 2pm on the due date. Should you required an FX contract, you may book via FX Online. |

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?