Harness the power of compound interest

By Lynette Tan

![]()

If you’ve only got a minute:

- Compound interest is a wealth-generating machine in the long run.

- How early you start compounding, the compounding frequency and adding regular top-ups to the principal base are ways to increase the rate of compounding.

- When investing, reinvest your bonuses and returns to make compounding work for you.

![]()

One of the most famous quotes on compounding came from Einstein – “Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn't, pays it.”

Indeed, whether you are a saver or an investor, you might have seen compound interest in action and benefitted from it. On the other hand, if you had forgotten to pay your monthly credit card bill, the compounded interest might have shocked you.

Here’s an interesting example – consider your daily coffee. Let’s say you are spending S$5 on your daily latte and are able to reduce your coffee expense to just S$1 a day. This savings of S$4 will translate into S$120 a month, and S$1,440 a year. If you put your savings into an investment that yields 4% per annum (p.a.), this sum of money will accumulate/compound to S$80,732 in 30 years!

This “Latte effect”, coined by author David Bach, serves as an example of how compound interest is a wealth-generating machine in the long run.

Read more: Discipline, time, and patience in investing

Compound interest vs simple interest

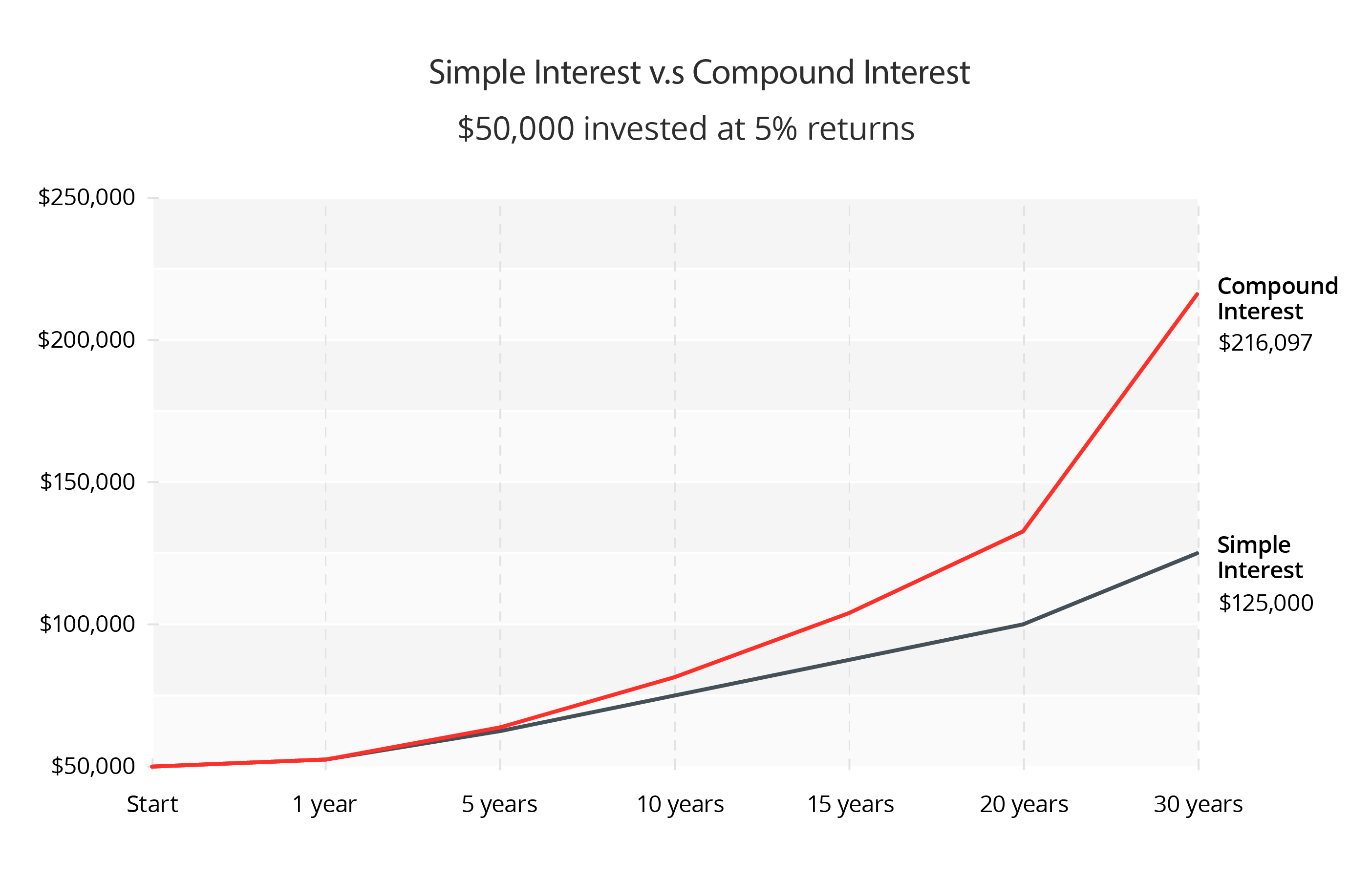

Compounding is the process where interest is credited to an existing principal amount as well as to interest already paid. It can thus be construed as interest on interest—the effect of which is to magnify returns to interest over time.

This growth occurs because the investment will generate earnings from both its initial principal, as well as the accumulated earnings/interest earned from preceding periods.

In contrast, simple interest is where the interest earned is only added on to the principal.

Compound interest vs Simple interest

|

$10,000 invested at 5% returns p.a. |

Compound interest |

Simple interest |

|---|---|---|

| Start | S$10,000 | S$10,000 |

| After 1 year | S$10,500 | S$10,500 |

| After 2 years | S$11,025 | S$11,000 |

| After 3 years | S$11,576.25 | S$11,500 |

| After 4 years | S$12,155 | S$12,000 |

| After 5 years | S$12,762.75 | S$12,500 |

| After 10 years | S$16,288.95 | S$15,000 |

| Growth | 62.9% | 50% |

| Annualised rate | 6.28% | 5% |

Giving your savings or investments time to compound the interests definitely gives you more bang for your buck. If you have a larger principal sum or a long time period for compounding, the results will be even more astounding.

Starting with a principal of S$50,000, you will double your returns in about 15 years, based on a compounded return of 5% p.a.. Comparatively, earning simple interest will take you a total of 20 years to double your principal of S$50,000.

Factors affecting compound interest

Are you amazed at the potential of compounding interest in your savings account or investments? Other than simply allowing it to work its magic on growing your wealth, there are 3 other factors that can impact how interests compound.

1. Compounding frequency

Most of the time when we look at investment returns, we think of the returns on a “per annum” basis. But compound interests work harder when it is compounded more frequently. The following table illustrates the effect of simple interest vs compound interest with different compounding periods. The original example of S$1,000 earning 5% return p.a. for 10 years is used.

Compounding Frequency

|

Year |

Simple Interest |

Annual Compounding |

Monthly Compounding |

Weekly Compounding |

Daily Compounding |

|---|---|---|---|---|---|

| 0 | S$1,000 | S$1,000 | S$1,000 | S$1,000 | S$1,000 |

| 1 | S$1,050 | S$1,050 | S$1,051.16 | S$1,051.24 | S$1,051.27 |

| 2 | S$1,100 | S$1,102.50 | S$1,104.94 | S$1,105.11 | S$1,105.16 |

| 3 | S$1,150 | S$1,157.63 | S$1,161.47 | S$1,161.74 | S$1,161.82 |

| 4 | S$1,200 | S$1,215.51 | S$1,220.90 | S$1,221.28 | S$1,221.39 |

| 5 | S$1,250 | S$1,276.28 | S$1,283.36 | S$1,283.86 | S$1,284.00 |

| 6 | S$1,300 | S$1,340.10 | S$1,349.02 | S$1,349.65 | S$1,349.83 |

| 7 | S$1,350 | S$1,407.10 | S$1,418.04 | S$1,418.81 | S$1,419.03 |

| 8 | S$1,400 | S$1,477.46 | S$1,490.59 | S$1,491.51 | S$1,491.78 |

| 9 | S$1,450 | S$1,551.33 | S$1,566.85 | S$1,567.94 | S$1,568.26 |

| 10 | S$1,500 | S$1,628.89 | S$1,647.01 | S$1,648.29 | S$1,648.66 |

| Effective Interest rate | 5% | 6.28% | 6.47% | 6.48% | 6.48% |

Calculator used here

Certain investments such as bonds and dividend paying stocks may offer interest payments to stockholders more than once a year. You may choose to reinvest these payments/dividends so that you enjoy a higher compound rate.

Read more: I’m ready to invest, how can I start?

2. Compounding earlier is key

Many of us know that the Central Provident Fund (CPF) provides a relatively attractive risk-free interest of 2.5% for our Ordinary Account (OA) and 4.01% (in Q3 2023) for our Special Account (SA) balances. However, some may resist the idea of topping up their CPF accounts because it is irreversible. However, the compounding effect becomes significant the earlier you start.

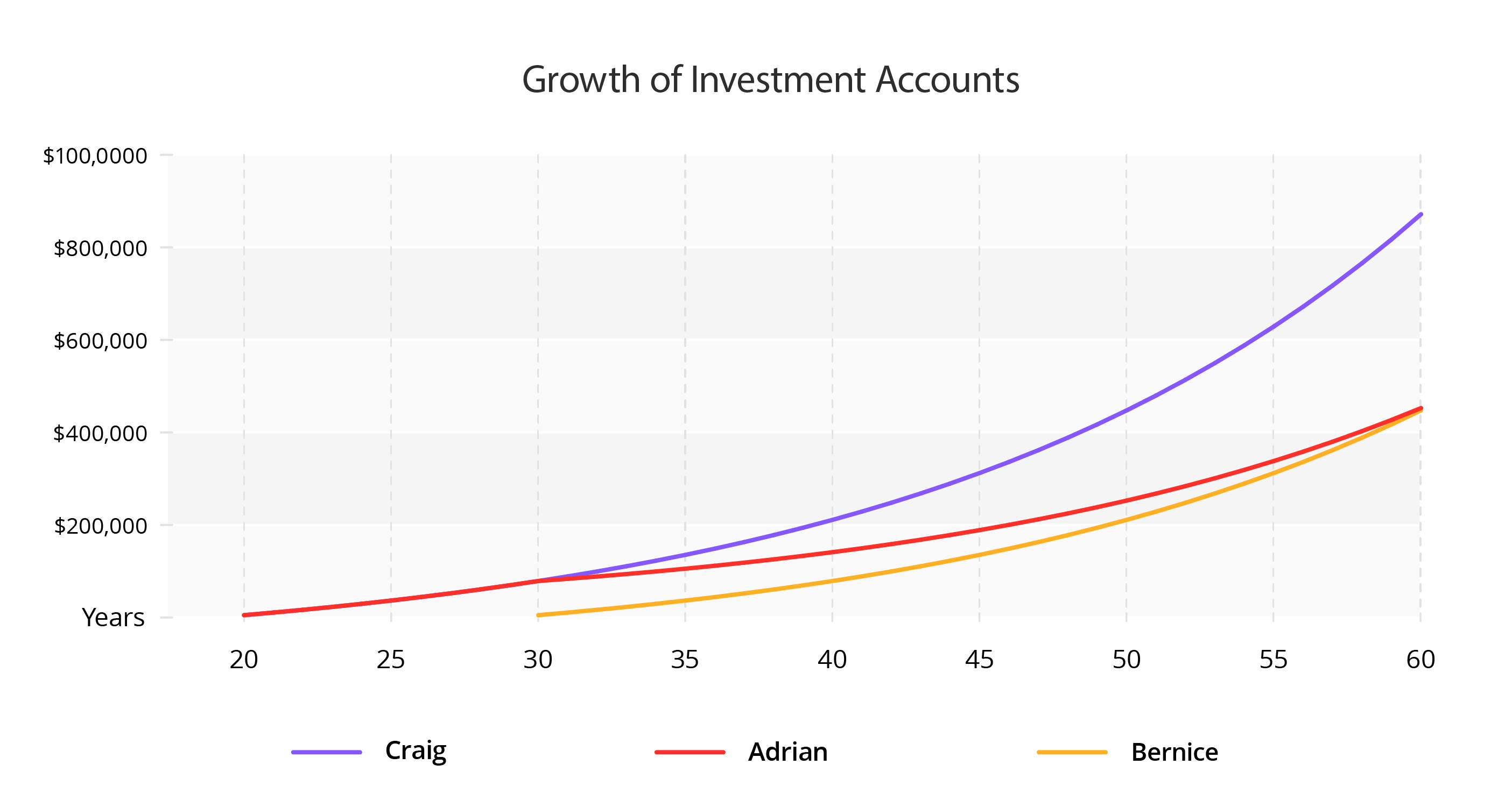

In this example, we look at how Adrian, Bernice and Craig experience the same 6% p.a. investment return on their savings. The only difference is when and how often they save:

- Adrian invests S$5,000 per year beginning at age 20. At age 30, he stopped. He has invested for 10 years and S$50,000 in total.

- Bernice invests the same S$5,000 but begins where Adrian left off. She begins investing at age 30 and continues the annual S$5,000 investment until she retires at age 60. Bernice invested for 30 years which translated to a total principal sum of S$150,000.

- Craig is our most consistent investor. He invests S$5,000 per year beginning at age 20 and continues investing until his retirement at age 60. He has invested for 40 years resulting in a principal sum of S$200,000.

With the power of compounding, you can see that Adrian ended up with slightly more funds than Bernice despite stopping his investments after 10 years. The compound interests continued to snowball and eventually grew his funds by about 8 times his initial capital.

At the end of 40 years, the most disciplined investor Craig enjoyed a total return of S$871,667, with a capital of S$200,000.

The lesson? Start saving or investing early and let compounding work its magic.

One of the most noticeable ways compound interest works can be seen in our CPF savings. This is especially so for those who contribute monthly, thus adding to the principal.

There are several ways you can make use of compound interest to grow your CPF savings:

- Perform annual top-ups under the Retirement Sum Topping-up Scheme (RSTU) to earn risk-free interest of up to 5% p.a. for SA savings and up to 6% for Retirement Account savings. For those who do not intend to use their CPF-OA funds, they may transfer the money from CPF-OA (currently at 2.5% p.a.) to their CPF-SA to earn higher interest

- Make a voluntary housing refund – refund the CPF-OA money you have used for your home payment so that more funds can be used to earn the risk-free interest of 2.5%.

Read more: Is my CPF enough to beat inflation?

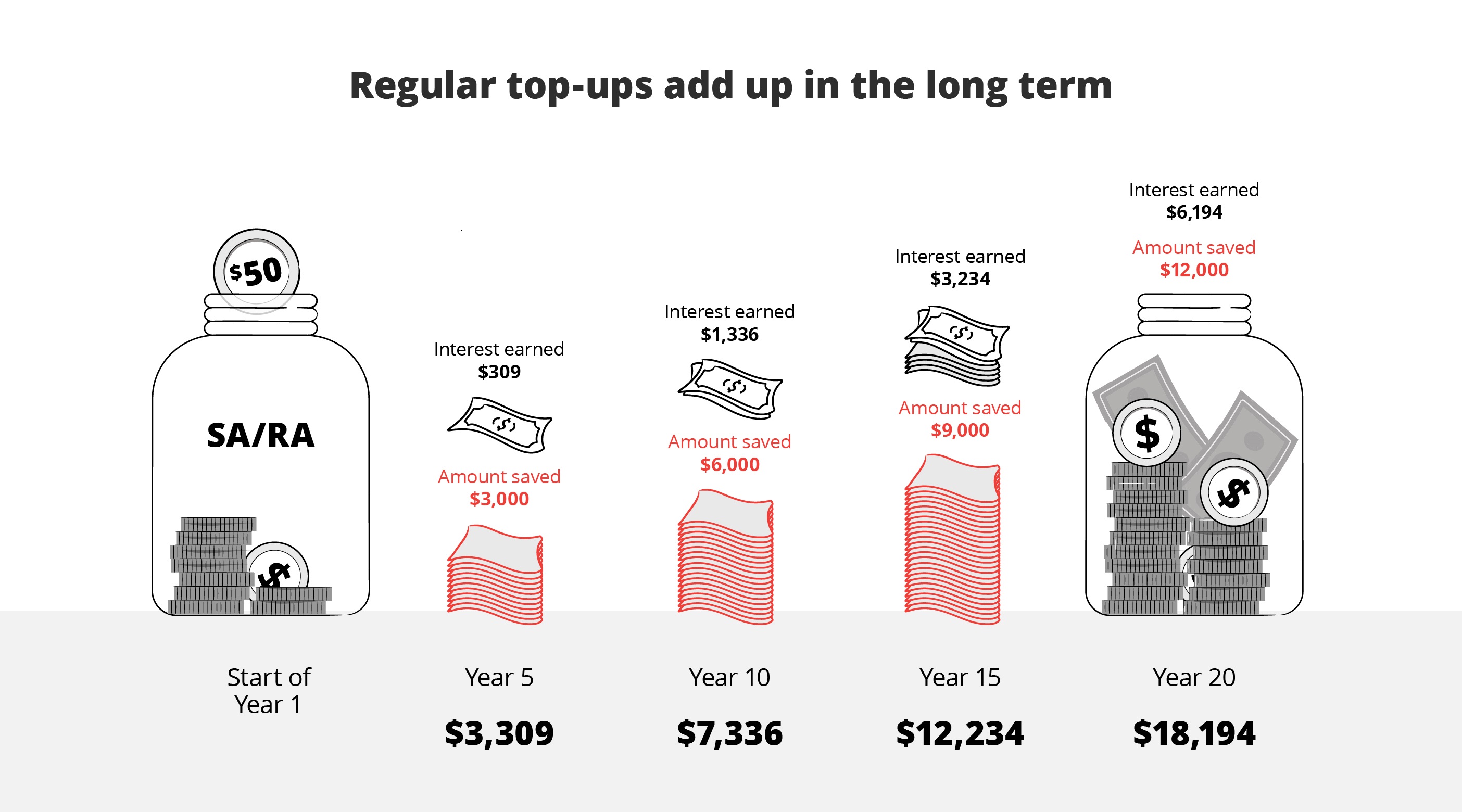

3. Contributing to the principal regularly

When investing or saving to earn higher interest, you can choose to add to your existing principal on a regular basis in order to earn more interest in the long term. The sum does not need to be a huge amount and your principal will grow over time and in turn, your interest as well.

Here’s a look at how depositing S$50 a month into your CPF can grow your money:

Simply by depositing S$50 per month, you’d end up earning S$6,194 more in interest over a 20-year period.

Compounding in Investments

The magic of compounding is not limited to savings. It works for investments as well. Some ways to take advantage of compounding in investments include:

- Reinvesting your dividends from stocks and bonds

- On top of reinvesting your dividends, consider the dollar-cost averaging approach by setting aside a fixed amount each month to investing via a Regular Savings Plan like the DBS Invest Saver

- Reinvesting your bonuses from investment-linked policies and endowment plans

Some of us may be tempted to take our dividends out of our portfolio and spend them every year as a “reward”. But reinvesting our dividends will give us a greater reward in the long run. The dividends can be used to buy more shares and grow our investment base as well. As your total investment amount grows, your compounded returns would be higher too.

Read more: Is DCA or lump-sum investing better for you?

Find out more about: DBS Invest-Saver

Time is your best friend when it comes to making the best of compounding. Saving and investing now will pay dividends in your future and help you accumulate a sizeable nest egg or multiple income flows.

Ready to start?

Need help selecting an investment? Try 'Make Your Money Work Harder' on digibank to receive specific investment picks based on your objectives, risk profile and preferences.

Invest with DBS Invest with POSB

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Let's Meet

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)