Going cashless without overspending!

By Lorna Tan

Head, Financial Planning Literacy

![]()

If you’ve only got a minute:

- The reality is that those embroiled in financial trouble mostly chalk up common expenses such as eating out, transport and holidays.

- By making an item more “affordable” in the short term, it may encourage impulsive buying and overspending.

- Affordability is key - Do ensure that the purchase is within your budget and that you will be able to repay it.

![]()

A common myth is that people who overspend usually buy many luxurious items. The reality is that those embroiled in financial trouble mostly chalk up common expenses such as eating out, transport and holidays. Like a frog in a pot of water that is slowly boiling, they do not realise they are in the soup till it’s too late.

It doesn’t help that with the rise of e-commerce, there are more avenues for cashless payments. This includes a combination of mobile payments, e-wallets, debit and credit cards. Coupled with safe distancing measures and people staying home due to the Covid-19 pandemic, it is inevitable that there is a surge in the use of cashless payments.

This includes the “Buy Now, Pay Later” (BNPL) scheme which is quickly becoming a popular payment method. They typically do not charge any fees and provide an interest-free instalment period. Unlike the traditional “Instalment Payment Plan” which was popular among credit card holders, BNPL schemes do not require you to have a credit card.

The ease of using cashless payment modes have made it easier for customers, especially among the younger segment, to spend. For some, instalment plans can be a good option. This can be useful on months where you need to buy an expensive item, such as a TV set, immediately but want to reduce the amount of expenditure or credit for that month.

Read more: Should you Buy Now Pay Later?

The lowdown on overspending

However, for those who do not have a tight rein on their cashflow and budget, they may fall into the danger of overspending.

Let’s assume you chose to pay for your purchases by instalments. By making an item more “affordable” in the short term, it may encourage impulsive buying and overspending. As you are breaking down your purchases into smaller payments, it's harder for you to track your exact spending, which can result in mismanaging your budget and finances.

In addition, late payments will incur additional charges, which add on to the outstanding debt. Do bear in mind that delaying a debt is still chalking up debt.

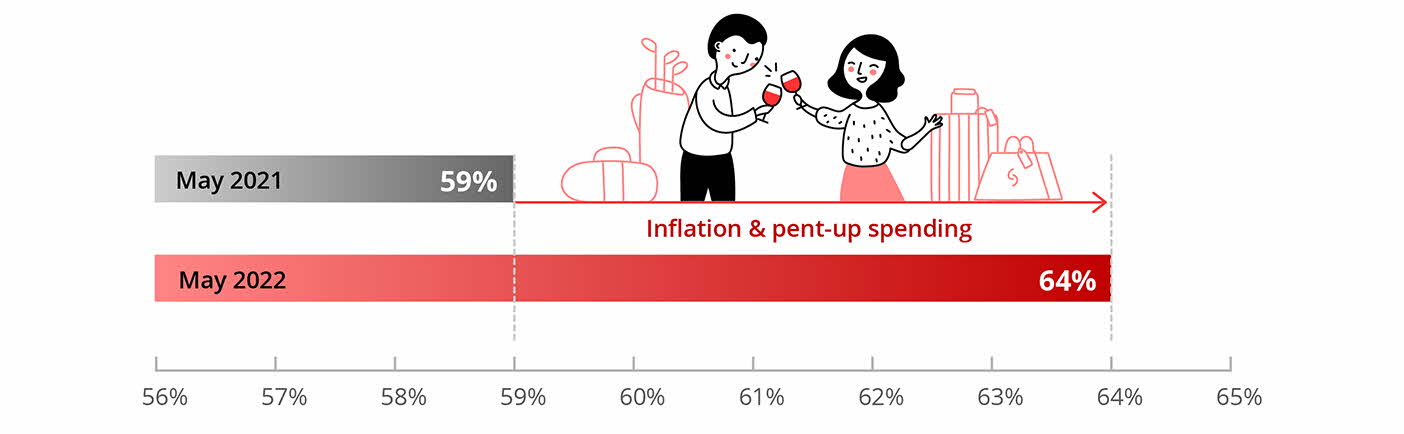

Expense growth rates (by categories) for an average customer

The recent DBS research report “Are you losing the race to inflation” identified transportation, shopping and food as 3 key expense categories that saw the steepest increase. Apart from transportation (+60.2%), spending on shopping, entertainment, and travel, which are discretionary in nature, witnessed the steepest increase (+56.7%).

As the recent inflationary pressures coincide with post-Covid pent-up demand, customers might want to be mindful of the long-term consequences on their finances.

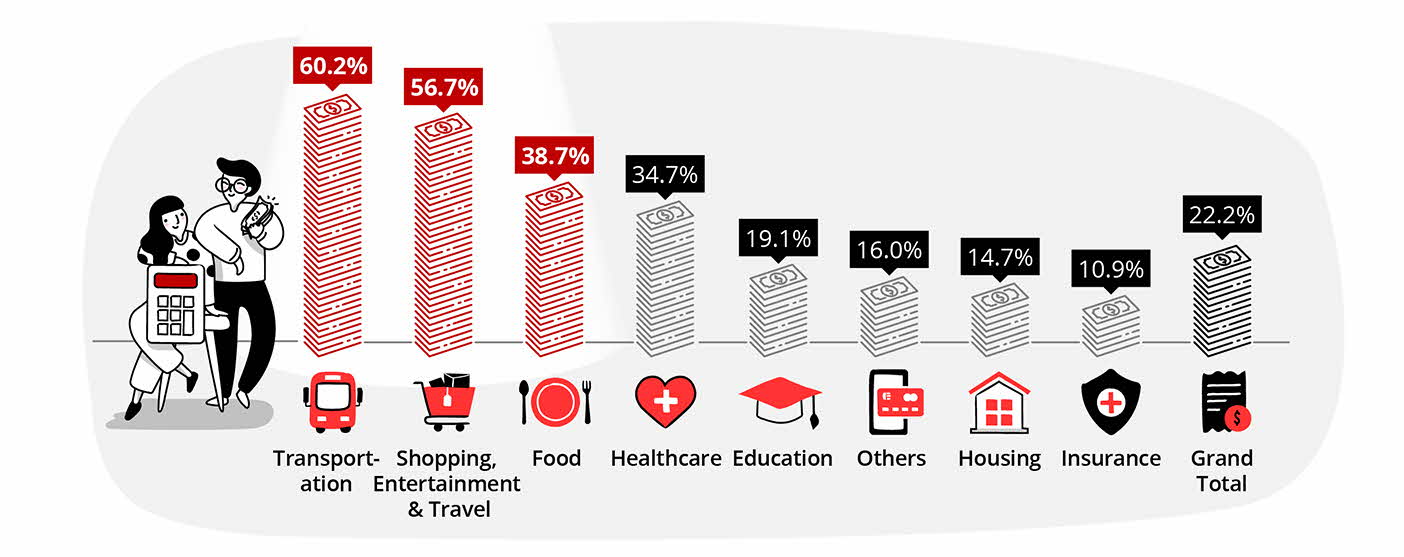

Customers are also spending more relative to their income - expenditure has outpaced income growth by 2 times. While customers have, in general, continued to spend within their means, the ratio of expenses to income has increased to 64% in May 2022, compared to 59% in the same period last year.

Expenses-to-income (%) of an average customer in May 2021 vs May 2022

Another key finding of the DBS research report indicated that income is not keeping up with inflation for 40% of DBS customers. Among the sampled customers, 40% saw their income grow by less than 5% over the past year, which is lower than Singapore’s average CPI inflation of 5.2% in first half of 2022, and DBS’ 2022 CPI forecast of 5.1%.

The lowest income group witnessed the greatest lag in income growth. Customers within the income group earning below S$2,500 registered just a 2.5% increase in income between May 2021 and May 2022. Simply put, vulnerable segments of the society are struggling most with high inflation.

The top cause for people falling into financial ruin in Singapore is not gambling or bad investments but overspending. Those who overspend usually do not realise they are in trouble until they are weighed down by a mountain of debt. By then, it will usually be too late except to seek help from banks and Credit Counselling Singapore (CCS) or file for bankruptcy.

Having a bad credit history may adversely affect their job prospects and their access to housing loans in the future. Debt also leads to a myriad of other problems which are non-financial in nature, such as stress, depression, and other health issues, all of which can have serious impact.

For some, overspending is a form of addictive behaviour due to psychological dependence. They spend to relieve other problems in their lives such anxiety or stress. Others may overspend to impress their colleagues and friends, for example by picking up the bill for a meal.

With rising inflation and costs of essential items, it is imperative to moderate discretionary spending, maintain prudent spending habits and practise monthly budgeting to rise above the ugly head of inflation.

7 tips to go cashless without overspending

1. Set up a realistic budget and savings/spend targets

Start your financial plan by setting up a realistic budget as well as savings and spend targets to curb discretionary spend and instil a savings habit.

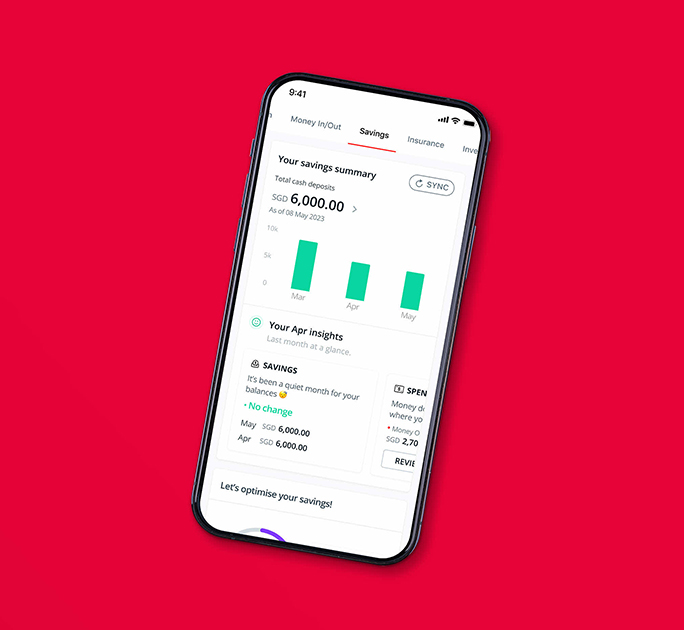

Use DBS digibank for budgeting, saving, insurance, investing, home and retirement planning. Under the Plan & Invest tab, you will find an overview of your spending habits that include:

- Your budgets which help you stay on track with your financial spending

- 3 month comparison which provides an overview of your cashflows

- Top spending categories which provides a view to track your top expenditures (by categories) for the month

Knowing how your money is spent can help you to trim your annual expenses by hundreds, if not thousands of dollars. If you are not conscientious with your tracking, an expensive dinner or a new branded bag can easily cause your monthly expenses to spike up.

The clarity in understanding your financial situation will help you make informed and smarter money decisions to help you achieve your short- and long-term financial goals.

2. Save before you spend and build an emergency fund

Cultivate a habit of automatically paying yourself first once your pay cheque comes in. Try setting aside at least 10% of your monthly take-home income. Keep your savings in a separate account like a higher yielding DBS Multiplier Account, away from your spending account.

In addition, you should aim to build up an emergency fund equivalent to at least 3 to 6 months of your expenses (12 months if you are a freelancer). This will give you a buffer in the event you have to make unforeseen payments. It also avoids the undesirable situation where you may be forced to liquate your investments prematurely, just to raise cash.

Read more: Habits to embrace in your financial journey

Find out more about: Plan with digibank

3. Do not fund a purchase with future income if you are often low on cash

Paying for your purchases in smaller amounts over time does not work for everyone. Some of you will be better off saving and buying later.

Instalment plans are probably not a good idea for those who are often low on cash. By paying a little bit of your purchases each month, you might lose track of your monthly expenditures and accumulate debt unknowingly. It could also tempt you into buying things out of impulse.

If you belong to this group, it would be best to wait until you can pay for what you want upfront to avoid the risk of getting into debt.

4. Affordability is key

Cashless payments and instalment schemes can be useful for consumers who are financially responsible and are able to pay off the instalments within the stipulated periods. This can help in managing their personal cash flow.

For the younger generation who may not have substantial savings, using such avenues can empower them to make necessary purchases such as laptops and computers without the need of a credit card.

Affordability is key. Do ensure that the purchase is within your budget and that you will be able to repay them.

Read more: How much emergency cash is enough?

5. Avoid temptations from online sales

Be cautious of seemingly attractive promotions during 7.7/9.9/1.1 online sales, as it is easy to rationalise your next buy when you are constantly bombarded by the latest trends and promotional messages online.

Unless you are on the lookout for certain items that you need, start by scrubbing your social media clean of these enticing images. Doing so will help you avoid making impulsive and unnecessary purchases.

6. Make your credit cards work smarter for you

Credit cards do not have to be a gateway to debt. They also allow you to utilise offerings such as substantial discounts, reward points and cash rebates. Choose credit cards that best suit your lifestyle needs so that you can enjoy better mileage for every dollar spent.

What’s more, if you consolidate your spending on 1 or 2 cards, you can accumulate your points and rebates faster.

Another tip is to lower the limit on your credit card to curb spending. If controlling your spending is an issue, ask your credit card issuer to restrict your credit limit to, say, 1 month of your salary.

Do remember to pay your credit balances on time and in full, to prevent racking up on late payment charges and massive interest over time.

Read more: Use your credit card to your advantage

Rolling over credit card debt is no game

7. Do not let your debt spiral out of control

For better control, reduce your payment modes and streamline the due payment dates.

To avoid being late on card payments, set up alerts of calendar reminders or go for services such as automatic GIRO payments. Such alerts will also help you to end a subscription on an online service before the auto-renewal sets in.

If you find yourself using multiple forms of credit (that is, credit cards, BNPL, personal loans) to fund your monthly spending and are struggling to repay your bills every month, it’s time to take a hard look at your finances.

Seek help if you need to re-structure your debt. You may want to consider a Debt Consolidation Plan offered by the banks or a Debt Management Programme from CCS.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)