By Lynette Tan![]()

If you’ve only got a minute:

- Women have a longer average lifespan, so it is important to start financial planning early to take the uncertainty out of living longer.

- As our lives evolve, we need to review our financial goals and needs and align our financial plan to support these changing goals.

- “A man is not a financial plan” – women need to take charge of their own financial planning so that they and their loved ones are financially-secure.

![]()

It is of paramount importance that women understand why they need to plan. Given that females have an average lifespan of 86 years (about 5 years longer than males), they’re likely to live longer. This underlines the need to plan for the long-term. Having a comprehensive financial plan takes a lot of the uncertainty out of ageing.

For this year’s International Women’s day, why not practise some self-care and review your finances to see how you can improve on your financial well-being?

A man is not a financial plan

Women should recognise that they have a personal responsibility to start planning early. By doing so, they’ll be better equipped to upgrade their financial know how and manage their money matters well.

As their life evolve, their financial goals and needs will change over time. So should their financial plan. Here are three major life stages and the likely financial planning priorities:

1. Entering the workforce

Women should aim to adopt a disciplined savings strategy and set aside an emergency fund that can sustain three to six months of expenses. You can start by saving at least 10% of your income every month. This will help protect you from financial uncertainties arising from a job loss or medical crisis.

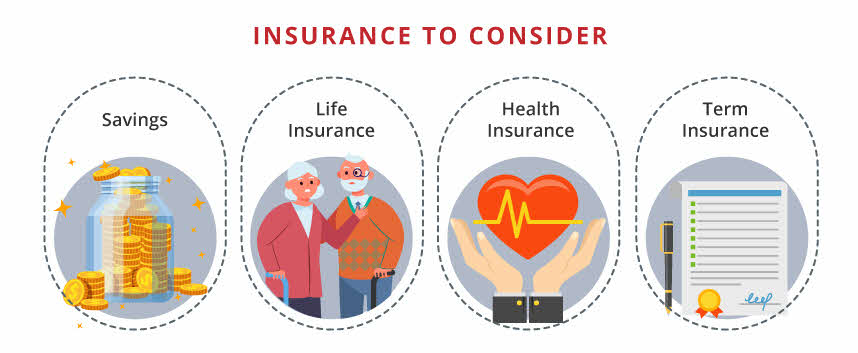

Get basic life and health insurance and be adequately insured while the premiums are low, and you are still insurable and healthy. Review your family’s medical history and consider buying appropriate health insurance (for example, female-related critical illnesses) to mitigate the risk of being diagnosed with similar illnesses. If you have dependants, consider getting term insurance to protect them in the event of premature death or if you become totally and permanently disabled.

Consider investing some of your savings on a regular basis to benefit from the power of compounding and make time your best friend to ride out market volatility. If you are unsure of what to invest and prefer to DIY, use the services of a robo-advisory platform (such as DBS digiPortfolio) for easy access to professionally managed portfolios that are aligned to your risk profile.

2. Mid-career

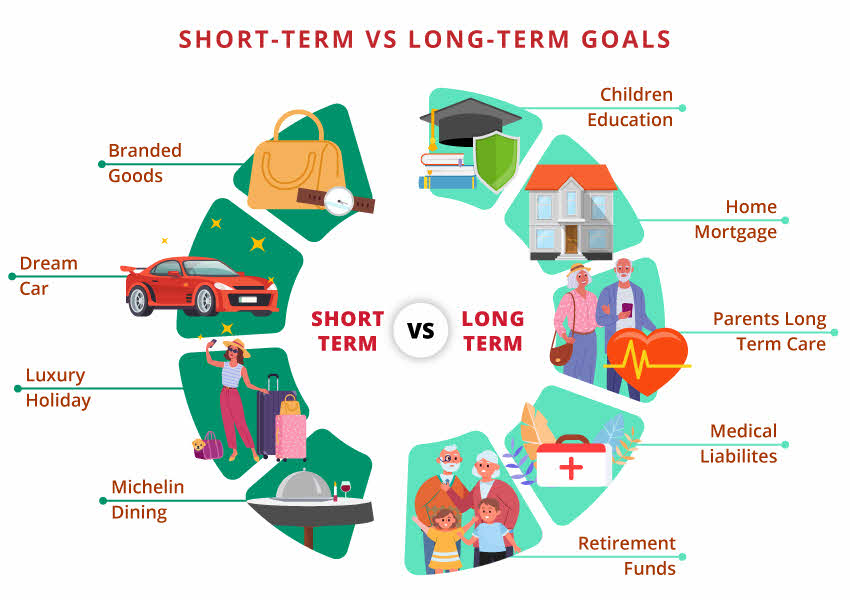

A home is a big-ticket item so buy one that you can afford and leave more to invest based on your risk profile, to build passive income flows to fund your golden years. Understand that there are trade-offs between short- and long-term goals. For example, buying branded goods or taking up a car loan may impact your future financial wellness. You may be married now and have become a mother. With increased commitments, ensure that you and your loved ones have adequate insurance coverage. If you have children and are also responsible for your parents, ensure you have planned for the kids’ tertiary education as well as your parents’ long-term care. If you are single, you may desire to help fund the educational needs of your siblings and help plan for the retirement needs of your parents.

If you have children and are also responsible for your parents, ensure you have planned for the kids’ tertiary education as well as your parents’ long-term care. If you are single, you may desire to help fund the educational needs of your siblings and help plan for the retirement needs of your parents.

3. Preparing for retirement

Having a comprehensive financial plan is necessary to mitigate the risks of inflation, longevity and healthcare costs. As you journey through life, continually review the income flows that will fund your desired retirement lifestyle and duration and close the gaps with a digital financial tool like the DBS Plan & Invest tab in digibank.

Do consider topping up your own CPF as well as your loved one’s CPF accounts to enjoy the risk-free interest on your savings. In doing so, you get to enjoy tax savings as well. Consider investing your CPF and SRS savings in suitable products.

Aim to fully pay up the housing loan of your residence before you retire. As you plan for retirement, you would also want to think about how you can optimise your home as an asset. For instance, if your children are no longer staying with you, you can consider downgrading to a smaller place to unlock more cash. If you are short on cash, consider monetising your home via renting, downsizing, lease buyback, or a home equity income loan.

A portion of your savings can also be used to buy a retirement income plan to complement the national annuity CPF LIFE payouts during your retirement. In recent years, these retirement income insurance plans have become increasingly popular among Singaporeans.

For instance, RetireSavvy, Singapore’s first flexible digital retirement product allows customers to adjust their plan whenever they want, to help them easily manage any changes later in life. The premium is a manageable $128.74 a month, based on a 30-year-old individual and a 10-year premium payment term. The plan comes with a flexibility to top-up their premium any time after the first year, up until five years before their selected retirement age. They can also set their desired retirement age during the policy term and choose when to start receiving their retirement benefits. For example, they can retire at 70 instead of 55, and receive 20% of their benefits and get the remaining 80% as their monthly retirement income. With these customisable options, saving for retirement can be a priority, whether you’re climbing the corporate ladder or just a little unsure of what the future holds.

You can also consider investing in the Retirement Portfolio via our digiportfolio. It is a single investment solution which employs a ‘glidepath’ strategy.

When you are further out from retirement, the portfolio allocation is geared towards higher risk assets such as equities to help you accumulate and grow your wealth over years to retirement. The longer time horizon to retirement would also allow for your portfolio to ride out ups and downs of markets.

Over the years and as you move closer to retirement, risk is gradually dialled back by reducing allocation in higher risk assets and increasing allocation to fixed income funds, building a more conservative and stable portfolio to ease into your retirement years.

Lastly, many neglect the need to set up a sound estate plan. It is important – whether you are single or married - so that your last wishes will be carried out efficiently such that there is sufficient capital for your dependants to be well take care of even when you are no longer around.

Common Financial Pitfalls for Women

1. Lack of medical insurance coverage

Women are more prone to certain medical conditions like musculoskeletal problems and some critical illnesses such as breast/cervical cancers and/or pregnancy complications.

Be prepared for the unexpected by having adequate insurance cover, especially for hospitalisation and critical illness. For single women, consider sufficient long-term care cover as well. This is because they are far less likely to have a partner to care for them in old age.

2. Potential pitfalls of credit card usage

Owning a credit card can be exciting for those who have just started working. However, in their haste to use their plastic to pay for groceries, online shopping, transport, and that branded handbag to chalk up cash rebates, reward points and air miles, some females are unaware that missing a payment or just forking out the minimum payment each month may snowball into a bigger debt.

All is fine if they can pay their credit card bills in full and on time each month. However, they are on a slippery slope if they allow their bills to go unpaid over time as the credit card interest rates and payments will spike. To repay their credit card loan, some may be forced to take a loan which can derail their retirement plan.

3. Having no “Plan B”

Some women may prefer to be a Stay-At-Home-Mum (SAHM) after they give birth as this is a precious period which they may wish to spend with their child. For many SAHM, they may quit their jobs and rely entirely on their husband’s income. While this is up to personal choice, women should always have a plan B if things do not work out.

For instance, relying on a single income at home puts the entire family at financial risk should the husband get retrenched or meet with a medical crisis. As such, it is best that there is a source of recurring or passive income for the woman to at least sustain her minimum living requirements. There are several ways to earn passive income, including investing or taking up a side hustle.

One should also try to remain relevant in the society by upgrading themselves, should they hope to return to work after a few years. Taking a career break can result in reduced opportunities for career advancement and lower lifetime earnings compared with their male counterparts. Thus, proper financial planning is critical to ensure they do not outlive their nest egg.

While it may be taboo to think about the possibility of divorce happening, the financial consequences are undesirable, on top of the emotional upheaval and changes to your life. Arming yourself with the knowledge of how a divorce can impact you financially can help you make the right decisions to hopefully reduce the emotional and financial pain for everyone.

To sum up, empower yourself by taking charge of your financial wellness with early planning and taking the appropriate actions to safeguard yourself and your loved ones!