Investing in foreign stocks

![]()

If you’ve only got a minute:

- While investors know the importance of diversification, research has often shown that investors tend to skew towards a home-country bias.

- Benefits of investing in foreign stocks include tapping growth opportunities in emerging markets and investing in larger markets.

- As with all things related to investing, you must do your due diligence, including understanding your risk tolerance when investing internationally.

- If stock picking isn’t for you, you can purchase diversified investment products like ETFs and unit trusts with foreign exposure.

![]()

Diversification means not putting “all your eggs in one basket” and instead, placing your capital in different investments to reduce the likelihood of your investments from being wiped out.

While we know this, it doesn’t always translate to practice. In fact, research has often shown that investors, tend to have a home-country bias, and this includes Singaporean investors too.

It is understandable why this happens. Just like how we gravitate to comfort food due to familiarity, retail investors’ investments are heavily skewed towards their own country for the same reason.

However, investors often confuse familiarity with knowledge, and therefore suffer from overconfidence with investments they are more familiar with. Moreover, you may be inadvertently taking on more risk as the source of your employment, investment and properties are all concentrated in a single country.

Now that does not sound very diversified, right?

To mitigate this bias, it is important to consider global investment opportunities like foreign stocks that you would be missing out by being too home-centric.

Read more: Diversify to help manage investment risks

Should you buy foreign stocks?

Diversification is often cited as a main reason for gaining exposure to foreign stocks. Other common reasons include tapping growth opportunities in emerging markets and the access to larger markets.

Buying international stocks is about gaining exposure to the “wealth of the world” or riding on the success of different markets around the globe.

In that search for exposure to the “wealth of the world”, there may be specific companies with unique products, services, business models, or technologies, that you believe would be particularly successful, such as business offerings that you do not find locally.

Geographical diversification

According to the World Bank, the market capitalisation of the Singapore stock market was US$652.6 billion in 2020 while global markets were worth US$93.7 trillion. In other words, the Singapore market represented just 0.7% of the total market capitalisation of stock markets globally.

If your portfolio comprises solely of Singapore-listed stocks, you have a very heavy home-country bias. Not only does this mean that any adverse Singapore-specific economic, geopolitical or market event can put a significant dent in the value of your portfolio, it is going to be difficult to capture global growth and income opportunities, adequately too.

In contrast, a US-based investor with a heavy home-country bias will still be able to capture more opportunities than a Singapore-based investor due to the sheer size of the US stock market. In 2020, the market capitalisation of the 2 largest US stock exchanges – The New York Stock Exchange and Nasdaq – alone was US$40.7 trillion or around 43% of the market capitalisation of all stock markets.

Furthermore, many of the largest non-US companies often have listings on these 2 exchanges. So, even though these 2 investors may suffer from a lack of geographical diversification, the Singapore-based investor has far more to lose by not being as global.

Going back to the example of not putting all your eggs into one basket, it is imperative to note that each economy has its own specific risks, which can be reduced by geographical diversification.

In general, countries go through each stage of an economic cycle at different times. By having geographical diversification, it is probable to have more consistent investment returns while reducing overall portfolio risk.

Sector diversification

Investing in a single market isn’t advisable as many major stock markets have a bias to particular economic sectors like technology or commodities.

This can leave investors with a lack of sector diversification. For example, if you are only investing in a country with a tourism-dependent economy, you might have been more affected than others during the Covid-19 outbreak, where there were travel restrictions.

What you should consider when buying foreign stocks

Many of us might have heard of cautionary tales of how investing in foreign stocks, especially those in emerging markets, can be very risky business.

While this concern isn’t unfounded, as with all things related to investing, you must do your due diligence, including understanding your risk tolerance.

Below, you’ll find other points to take note of when investing in international stocks.

Understand the maturity of each market

Riding on the wealth of the world is about investing in productive and well-governed economies and markets. As each market carries different risks, you should understand some general differences between mature, emerging and frontier markets.

Mature or developed markets include the US, Western Europe and Japan. As a whole, investing in these markets often means access to the largest and most famous companies in the world. These markets also tend to exhibit comparatively stable growth and are viewed as lower risk.

Emerging markets are countries that do not yet have the economic strength of their developed counterparts. Such economies include our South-east Asian neighbours like Malaysia and Thailand. Compared to developed markets, investing in emerging markets tends to carry with it larger growth opportunities but this comes at the expense of more risk and volatility.

Investing in stocks from frontier markets are riskier and more volatile than mature and emerging markets. Furthermore, liquidity in these new markets can often be poor, there might be political instability, they tend to be less well-regulated and there is less information available on the company’s business.

Despite the risks, they are still considered viable investments, which offer great growth potential provided you are willing to stomach the risk and have a long investment horizon.

Know the companies you’re buying

A reason behind home-country bias is due to an investor’s familiarity with local corporate names, the nature of their business, and the local economic conditions.

That said, it is important to overcome this bias. It is increasingly easy to do so as many foreign companies have an international customer base and revenue stream, which means information is readily available for many of them.

Do spend some time to understand the nature of the economy of its major markets. As you would with local stocks, make sure you have a reasonable level of knowledge and comfort in the foreign companies you’re buying into, whether they are in the US, Germany, or China.

One way to go about this is to start with foreign-headquartered companies that you are already familiar with (e.g. you know or use their products).

Read more: How to analyse a company’s financials

Understand the currency risks

With local stocks, it’s easy to see the performance of your investments as they are often purchased and denominated in Singapore dollars.

However, when it comes to buying foreign stocks, measuring performance is less straightforward as stocks are often bought and denominated in their local currencies (e.g. Thai Baht, Japanese Yen).

All investors who hold foreign stocks face currency risk, which is the possibility that the value of your investment is eroded due to unfavourable changes in exchange rates.

When deciding whether to sell foreign stocks, it goes beyond looking at the value of the investment (i.e. whether the share price will go up or down) in their local currencies. You also have to look into the value of the investment when converted back to the base currency, which for most Singapore-based investors is the Singapore dollar and US dollar.

It is commonplace for investors to perform a currency exchange when rates are favourable in order to minimise currency risk.

This is where a DBS multi-currency account (MCA) like DBS My Account and DBS Multiplier comes in handy.

All DBS MCAs offer 12 currency pockets within a single account, allowing you to conveniently perform a currency exchange whenever the exchange rates are favourable.

Read more: The basics of foreign exchange

| Find out more about: | DBS My Account DBS Multiplier Account |

Find out more about:

DBS My Account

DBS Multiplier Account

Foreign transaction and custody costs

Apart from the usual brokerage commissions, there are additional costs in transacting in foreign stocks, which vary according to the country/market.

Ask your broker to confirm the fees for each of the overseas markets you plan to trade in. Some examples are:

i. Custody fees

When you buy Singapore stocks, your shares can be held through the Central Depository (CDP). Your foreign stocks will likely then be held in a broker’s custody account. That will incur a fee of typically a few dollars a month or quarter.

ii. Charges

These fees are for notifying you of corporate actions such as rights issues and dividend re-investment.

iii. Transaction fees peculiar to each market

For example, in the US, a fee equivalent to a very small percentage of the trade is paid to the Securities & Exchange Commission.

Taxes

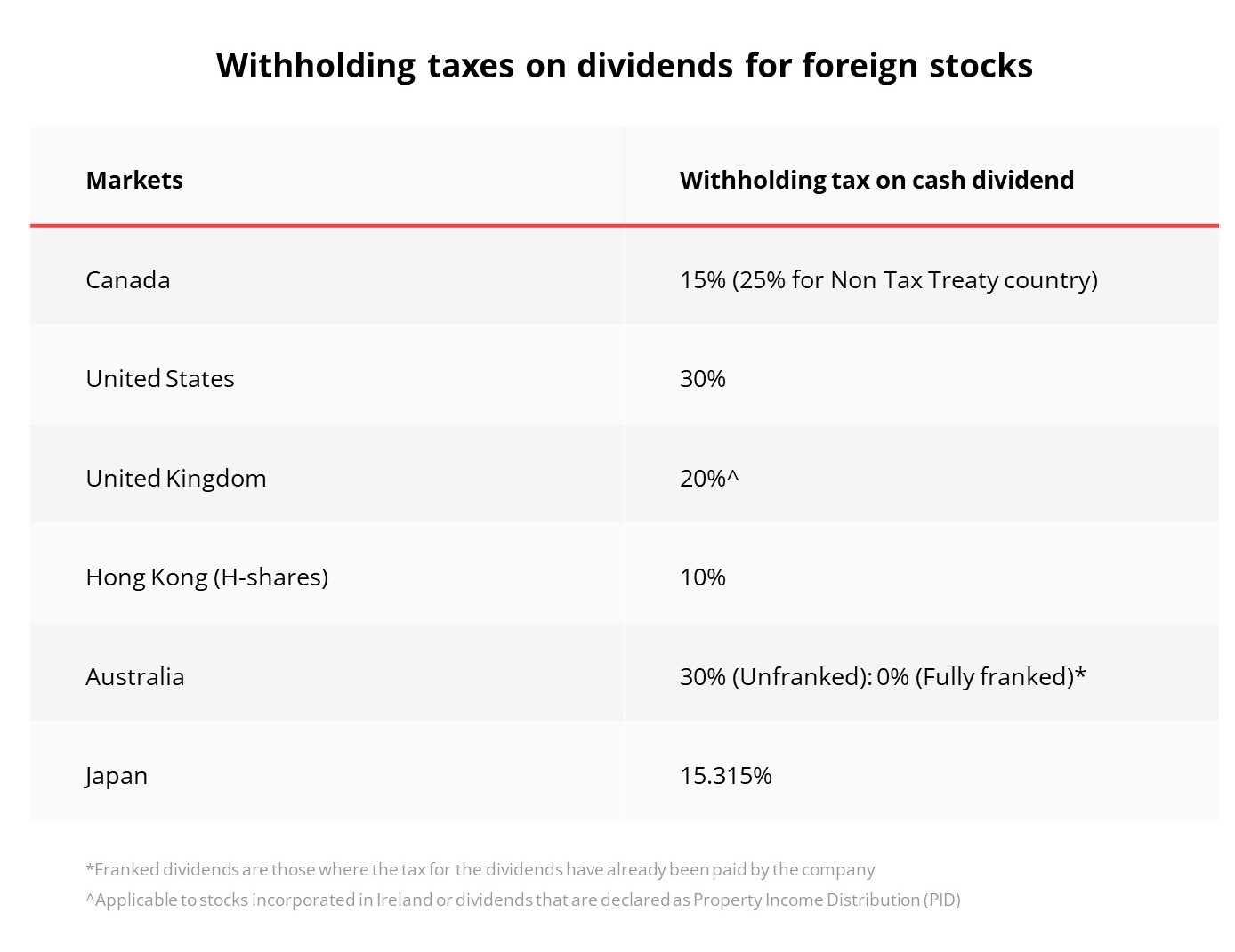

Do take note of the tax obligations of each of the markets that you are investing in.

One of the most common of these is the withholding tax on cash dividends received from stock holdings. In most cases, this tax is deducted directly from the dividend received for non-residents in the country where the stock is listed.

Taking US-listed stocks as an example, you will have to fill in a declaration (in a form called W8BEN) to the US tax authority that you are a foreign beneficiary of income from those stocks. This is usually done through your broker. Then a standard “treaty withholding tax” will be applied to your income derived from US stocks.

Also, be aware of goods and services taxes that may apply in some countries.

Read more: Costs of investing in equities

Find out more about: DBS Vickers Online Account

How do you go about investing in foreign stocks?

The process of investing in foreign stocks is similar to that of Singapore-listed stocks as they are both done through a brokerage.

That said, a key difference is that stocks listed on the Singapore Exchange (SGX) can either be held in a Central Depository (CDP) account or a custodian account. The availability of these options is dependent on your broker.

With a CDP account, your stocks are held in the centralised depository after buying and it will be stored there until you decide to sell. A benefit of this is that you can use one brokerage to buy and another to sell. Moreover, the stocks are registered in your name, so you receive annual reports and other forms of communication, directly.

With a custodian account, the brokerage not only facilitates the buying and selling of your stocks but holds them on your behalf too. This means you can only buy and sell stocks bought with the same brokerage and your stocks are not directly held in your name. You will have to liaise with your brokerage to receive communications from the companies you have invested in.

With foreign stocks, you can only trade with a custodian account.

What if you do not want to buy foreign stocks individually?

There is a sizeable segment of investors who prefers to buy stocks through diversified investment products like exchange-traded funds (ETFs) and unit trusts as opposed to individual stocks.

Many ETFs and unit trusts offer geographic and stock diversification. This means you can be invested in a large portfolio of foreign stocks for a relatively small amount.

If you invest in ETFs of foreign markets that are listed on the SGX, your investments are held in your CDP account (for most brokers) while those listed in foreign markets are held in custodian accounts.

For unit trusts, they are often purchased through financial institutions like banks. There are several options like the currency you can purchase the unit trusts with as well as whether you can receive dividends in cash, through new units or have them reinvested.

There are other charges unique to ETFs and unit trusts that you should take note of too.

| Read more: | Costs of investing in ETFs Costs of investing in unit trusts |

Read more:

Costs of investing in ETFs

Costs of investing in unit trusts

In Summary

Gaining exposure to foreign stocks is key to effective diversification. It allows investors to tap growth opportunities in other markets and sectors that they are not able to in their home country.

As you would with local stocks, you must do your due diligence, including understanding your risk tolerance, before investing in foreign stocks.

Also make sure you are familiar with the charges and the tax obligations of each of the markets you trade in.

Happy investing!

Ready to start?

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on digibank to receive specific investment picks based on your objectives, risk profile and preferences.

Invest with DBS Invest with POSB

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)