5 tips to retire well

By Lorna Tan

If you’ve only got a minute:

- As part of our retirement planning, it is prudent to do a realistic projection of our income flows and expenses so that we can identify and close any gaps early.

- To maximise CPF savings, consider performing top-ups to your CPF accounts to leverage the risk-free interest and power of compounding.

- Have a comprehensive view of your finances so that you can make informed and better financial decisions.

![]()

For most of us, retirement is a life stage where we would have built sufficient passive income flows to fund our desired lifestyle and our dependants, without having to work if we choose not to.

When we retire, the focus shifts from accumulating wealth to that of decumulation which is the drawing down from our assets to fund our expenses. We want to do so optimally so that we do not risk outliving our financial resources.

At the same time, we want to be able to enjoy a reasonable standard of living after working so hard and planning for a secure financial future. And some of us may desire to leave some assets as a legacy for our loved ones.

Here are 5 tips for a sustainable retirement.

Tip #1: Project our retirement income flows and expenses

As part of our retirement planning, it is prudent to do a realistic projection of our income flows and expenses so that we can identify and close any gaps early. Divide our projected expenses into needs and wants and review them regularly together with our assets and liabilities. By doing so, we will have more clarity and confidence on when we can achieve financial freedom.

During retirement, it is likely that the first decade or so will see us incurring more travelling expenses as we would want to see the world while we are still physically mobile and healthy. Some of us may want to start a business and will need capital to do that.

Furthermore, ensure that you have adequate health coverage to mitigate the risks of hospitalisation, illnesses, disability and long-term care in retirement.

Here are some questions you can ask yourself:

What will be the projected income flows that fund these needs and wants? When will they begin and the duration?

For example, if you have been contributing to the Supplementary Retirement Scheme (SRS), the penalty-free withdrawals from your SRS account age 62 or 63, depending on the statutory retirement age that was prevailing when you made your first SRS contribution. And they can be spread out over 10 years.

If you own endowment insurance plans and annuity, find out when the payouts will start and for how long.

Tip #2: Building guaranteed and non-guaranteed income

One decumulation strategy is to build your passive income flows ahead of your retirement. Understand what proportion will be guaranteed and non-guaranteed. If you are very risk averse, you may want a higher portion of your passive income flows to be guaranteed and/or reliable to be able to fund all your needs and perhaps some of your wants.

Examples of guaranteed income would be our Central Provident Fund (CPF) payouts, withdrawals from our CPF accounts, SRS savings, annuity or retirement income insurance, cash and near cash assets like Singapore Savings Bonds, some bonds, annuity and/or retirement income, money market funds, index funds, and so on.

Some people may consider rental income as a guaranteed/reliable income flow but do bear in mind that it is dependent on the availability of tenants.

Non-guaranteed income can come from relatively riskier tools that are usually subject to more volatility but can potentially offer higher yields like equities, some bonds, investment-linked insurance plans, as well as alternative assets like commodities, private equity funds and so on.

Read more: Insurance plans to boost your retirement income

Find out more about: Retirement digiPortfolio

Tip #3: Maximise our CPF savings

For me, my CPF savings will form the foundation of my retirement plan and is what I consider the fixed income component of my investment portfolio. CPF savings enjoy attractive and risk-free interest rates which makes it a low-hanging fruit in my financial plan and is most suitable for building a sustainable nest egg.

If you are age 55 and above, you enjoy up to 6% per annum (pa) on the first S$30,000 of combined CPF balances (up to S$20,000 from Ordinary Account), and up to 5% on the next S$30,000 (up to S$20,000 from Ordinary Account). The balance in the Special Account (SA) and Medisave Account (MA) attracts 4% while Ordinary Account (OA) savings earn 2.5% pa.

For those who are under age 55, the first S$60,000 of combined CPF balances (up to S$20,000 from Ordinary Account) earn an additional 1% interest or up to 5%. The monthly CPF interest on our OA, SA, MA and RA is credited into our accounts on 1 January each year.

CPF members are encouraged to top up their CPF SA or RA each year in January rather than in December to start earning interest earlier and reap the benefits of compounding. By doing so, you could earn 20% more interest on your savings in 10 years.

Do note that if you are eligible for the Matched Retirement Savings Scheme, you will enjoy dollar-for-dollar matching from the government for cash top-ups made to your RA, for up to S$2,000 per year, with a S$20,000 cap over an eligible member’s lifetime.

To maximise my CPF savings and increase the monthly CPF LIFE payouts, I have performed some top-ups to my CPF accounts in January to leverage the risk-free interest.

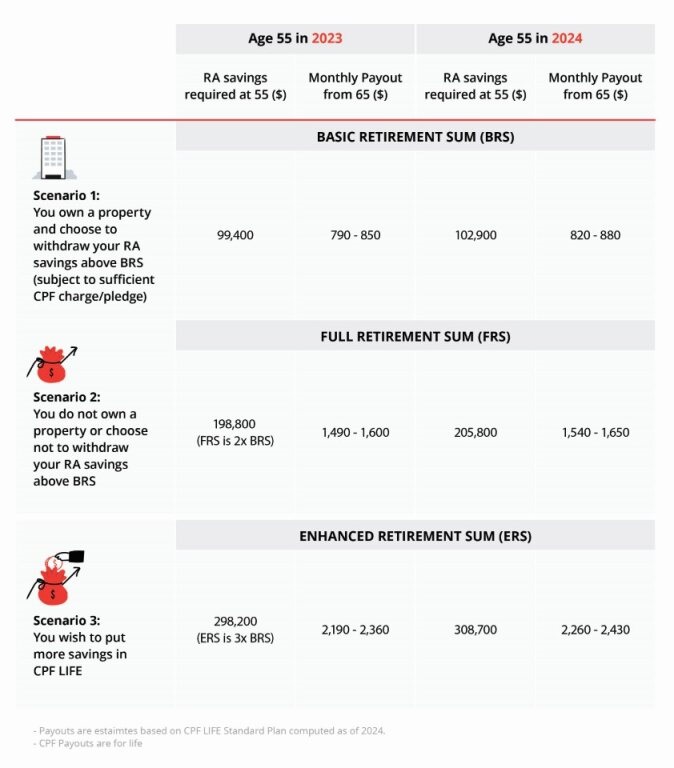

Comparing CPF retirement sums

Here are the 3 CPF Top-Ups that I have done in January:

a) Top up to the prevailing Enhanced Retirement Sum (ERS) in my RA: The ERS is S$308,700 in 2024, which is S$10,500 higher than last years’ ERS of S$298,200 (which is the RA amount I had in 2023 excluding interest).

I did a cash top-up of S$10,500 to my RA under the CPF Retirement Sum Topping-Up (RSTU) Scheme. I plan to do this each year till my payout eligibility age of 65 which is when I can pick a CPF LIFE plan and start receiving monthly payouts for life.

With my annual top-ups to my RA to each year’s prevailing ERS, I expect to receive about S$2,400 each month in CPF LIFE payouts for life. You do not take into account the interest component when calculating the maximum amount you can top up to your RA each year.

b) Top up my dad’s RA: I did a cash top-up of S$8,000 to my dad’s RA under the RSTU scheme. By doing so, I will enjoy personal income tax relief of S$8,000 in the following year.

c) Top up to the prevailing Basic Healthcare Sum (BHS) in my MA: This year’s BHS cap is S$71,500, an increase of S$3,000 from 2023. I did a S$3,000 top-up to my MA (as a Voluntary Contribution) and this cash top-up will result in a personal income tax relief of S$3,000 in the following year.

Read more:

Low-risk ways to grow money with CPF

Boosting personal income tax savings

Tip #4: Contribute to Supplementary Retirement Scheme (SRS) and invest

I’ve been contributing to my SRS account for the past decade. Parking your savings in SRS not only makes you eligible for some tax relief but you can also stretch your dollar by investing your money. After all, leaving it idle only earns you a paltry 0.05% per annum.

Use SRS to defer taxes that would be paid in higher-income tax brackets in your peak earning years. By doing so, you can pay taxes in lower tax brackets during your retirement years when income is lower or nil.

The prevailing SRS contribution cap is S$15,300 a year for Singaporeans and permanent residents, and S$35,700 for foreigners. You can use SRS funds to buy a wide range of investments, including insurance plans such as single-premium endowment policies, unit trusts or shares.

Read more: A guide to how SRS accounts can work for you

Find out more about: Supplementary Retirement Scheme (SRS) Investment

Tip #5: Have a complete view of your finances

The best way to review your financial health is to have a comprehensive view of your finances so that you can make informed and better financial decisions.

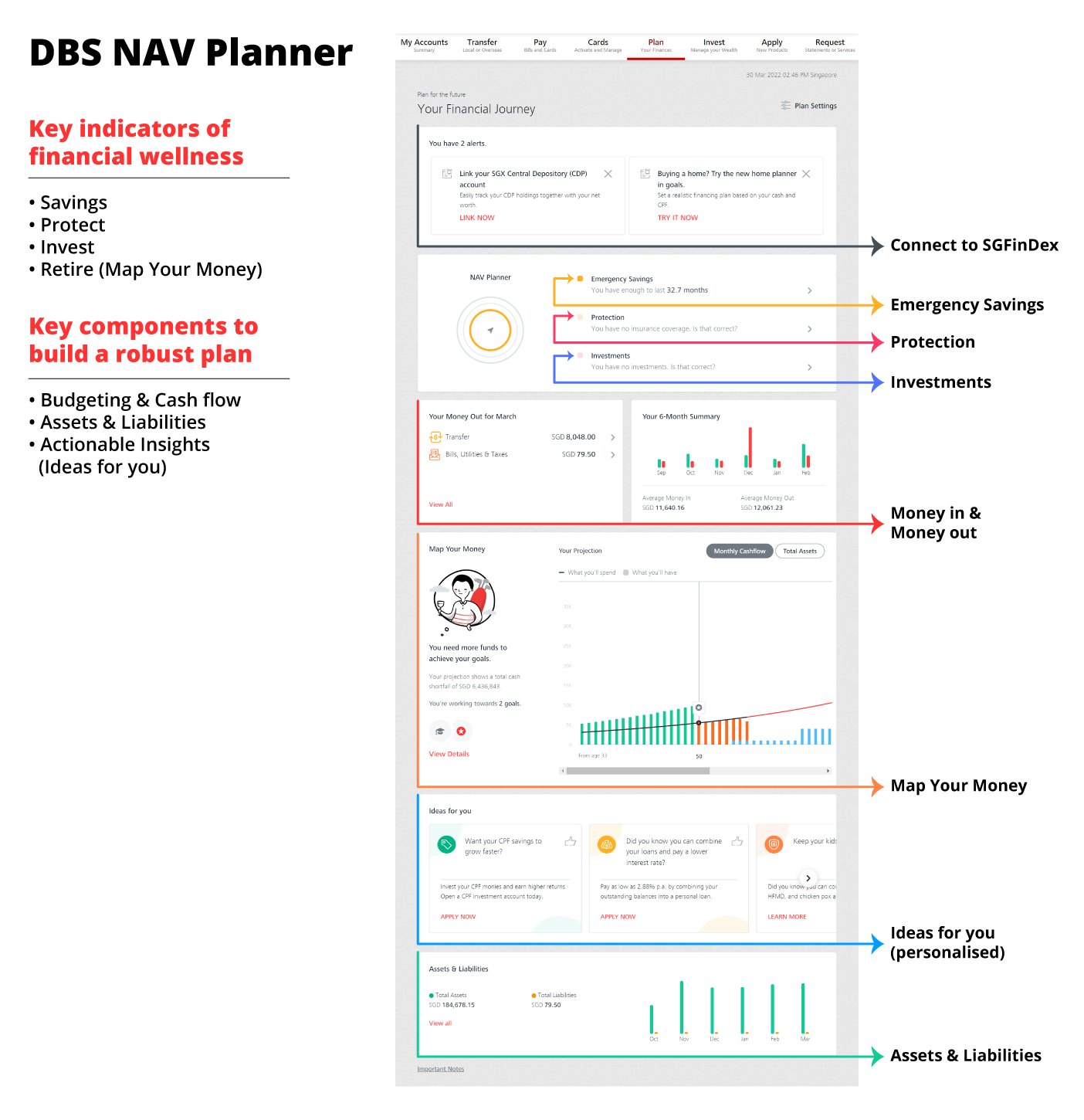

With the introduction of the Singapore Financial Data Exchange (SGFinDex) in 2020, consumers can easily consolidate their different bank accounts and financial information from CPF, HDB and Inland Revenue Authority of Singapore in one place, for greater clarity of their financial situation.

DBS Plan & Invest - a digital financial and retirement advisory tool – enables you to connect to SGFinDex, so your financial information will be pulled onto the DBS NAV Planner platform, with your consent.

Plan and Invest tab in digibank will then make use of your data and offer comprehensive insights on your finances, and help you identify and close insurance and investment gaps, as well as map your future. It has an investment simulator as well as cashflow projection capabilities so you can visualise how your savings can grow with investments into the future.

So far, 2.2 million customers have used the Plan and Invest tab in digibank and we have helped more than 400,000 customers turn their finances around with it.

Read more: Plan on digibank - Supercharged by SGFinDex

Ready to start?

Start planning for retirement by viewing your cashflow projection on Plan tab in digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)