Your one-stop click to financial freedom

Start your financial education

| Financial tips for the new year: Wondering how you can plan for a more secure financial future? Get these financial tips from Lorna Tan, Head of Financial Planning Literacy at DBS Bank. |

| How to grow your money and make it work for you: Financial planning sounds scary, but really, it doesn’t have to be that intimidating. Here’s your quick guide to financial planning. |

| Budgeting discipline: To master your own life, start by honing your budgeting skills. It can help you stretch your hard-earned dollars so you can achieve your financial goals sooner. |

| Understanding debt - types of loans, calculating interest spend: Thinking of taking up a loan? Educate yourself on the different types of loans to find the right one for your needs. |

| Getting out of the debt trap: Snowballing interest can cause debt to spiral out of control, leaving you in a debt trap. Read more to find out how you can get a leg up on debt. |

| How to use debt wisely as a financial tool: Debt can be a friend but it can also be a foe if you don’t use it wisely. Here’s a quick guide to keep that friendship with debt. |

| What is credit rating and how it impacts me: Did you know that your credit score determines the loan rates financial institutions provide you? Know how they grade you so that you can improve your credit score! |

Save

| Savings – Lifeline in emergencies, door to lifestyle choices: The general rule of thumb is to set aside 3 to 6 months of emergency funds. However, we all have different needs and lifestyles. Find out how you can apply this to your own unique situation. |

| Earning interest vs pressure of inflation: You probably know how inflation works. What used to cost S$1 ten years ago will cost you S$1.33 today. The question is, are you doing enough to grow your money while you save? |

Protect

| Why is insurance important in financial planning? Insurance plays an important role in financial planning, yet many of us tend to neglect it. Find out how you can plan for it. |

| Insurance needs for different life stages: The tricky thing about insurance is that it is never one-size-fits-all. If you are not sure about what type of insurance to purchase, it might be helpful to look at it from a life-stage perspective. |

| Guide to health insurance in Singapore: How can you tell the difference between the many types of health insurance available? This article will help you understand. |

Growing Wealth

| Taking the emotions out of investing: Are your decisions guided by facts, or are there psychological traps that you could be blind to? Here are eight traps and tips to counter this. |

| How to start investing: No matter your life stage, investing is an effective way to put your savings to work so that you can build or preserve your wealth. Here’s a simple introduction to get you started. |

| 5 investment ideas for 2023: Take a look at some themes for retail investors to consider this year. |

Home

| Buying a home in Singapore: Buying your first home is a milestone of adulthood in Singapore. How do you go about doing this? Here’s what you need to know to make your home-owning journey as smooth as possible. |

| The real costs of buying a house: The last thing you want in this exciting new chapter of your life is to be blindsided by unexpected costs. This article tallies up the potential costs of buying your first home so you can be prepared for what it’ll take. |

| Home loan matters: Should you opt for an HDB or bank loan? How much is the down payment? And what on earth are LTV, MSR and TDSR?! This article helps you tackle the home loan issue in a systematic manner. |

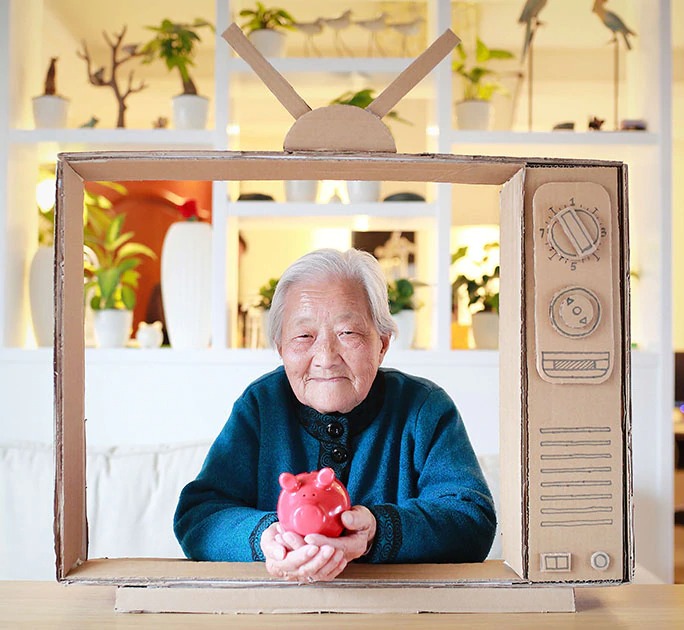

Retirement

| Why still save for retirement during tough times: It’s likely that many of us have put this on the backburner in favour of the current pressing needs. If planning for your retirement is not yet on your to-do list, or you’re starting to lose steam, here’s why we should still save for retirement despite tough times. |

| Think about your retirement in phases: One way to see how much you need to retire, is to look at it in terms of the lifestyle you have become accustomed to. Here’s how a time-segmented bucket strategy can help you retire well. |

| Give your retirement a head start: Retirement may seem far off when you are in your 20s and 30s. Still, it is prudent to start early. Find out how you can build a comprehensive plan for retirement to achieve your desired lifestyle. |

| DBS NAV Planner:

|

| DBS NAV University:

|

| FLY:

|

| DBS Multiplier Account:

|

| DBS Invest-Saver:

|

| digiPortfolio:

|

Useful Links

- DBS Investment Disclaimer

- Types of Investments by MoneySense

- Investing in Specified Investment Products by MoneySense

- Investment Solution Partners / Product Providers

- Terms & Conditions Governing Accounts

- Terms & Conditions Governing Electronic Services

- Terms & Conditions Governing Investment in Funds

- Best Execution Policy