DBS Cashline

Promotions

Frequently Asked Questions

Transact like a regular bank account.

- No minimum loan amount. No transaction fees.

- 0.07%1 daily interest on the outstanding balance only (minimum interest S$10 on your statement date).

- Flexible repayment. Repay any amount or minimum payment of 2.5% of the outstanding balance or S$50, whichever is higher on your statement date.

- Flexible tenure from 1 day onwards.

- No early repayment fee.

|

|

|---|---|

Withdraw cash using funds transfer or FAST via digibank. | Transfer money directly from your Cashline via digibank

Anyone, anywhere, anytime. |

Online bill payment | Pay your bills via digibank with your Cashline. |

Withdraw cash at any DBS/POSB ATM | Simply select the DBS/POSB Cashline account number to withdraw cash with your ATM card. |

Perform NETS transaction | Pay for purchases with your ATM card - with DBS/POSB Cashline as your primary account. |

Interest is calculated daily by multiplying the outstanding balance by the applicable prevailing interest rate and then dividing by 365 (or 366 in a leap year). A minimum interest charge of S$10 applies.

For example, you do a fund transfer of S$1,000 from your Cashline for 30 days.

Interest: (30/365) X 22.90% p.a. X S$1000 = S$18.82

Simply log in to your digibank -> select Pay Cashline -> select the account to pay from.

Alternatively, you may also make repayment via AXS or DBS/POSB ATMs.

Required Documents:

| Salaried Employees | Variable Commission-based Employees / Self Employed |

|---|---|---|

NRIC (Front & Back) | ✓ | ✓ |

Latest 1 Year Income Tax Notice of Assessment (NOA) | Any one of the two documents (NOA must be submitted with latest payslip) | ✓ |

Latest Computerised Payslip or Salary Crediting into DBS/POSB account | N.A |

Skip income documents: Apply via Myinfo (Singpass) or salary crediting to DBS/POSB.

After your Cashline is approved,

- Step 1: Log in to your digibank (Go to “More” -> “Apply” -> “Personal Loan” or “Balance Transfer”)

- Step 2: Choose from Cashline and/ or Credit Card and select your preferred amount and tenure

- Step 3: Submit

To find out more:

Click here to apply for Balance Transfer

Click here to apply for Personal Loan

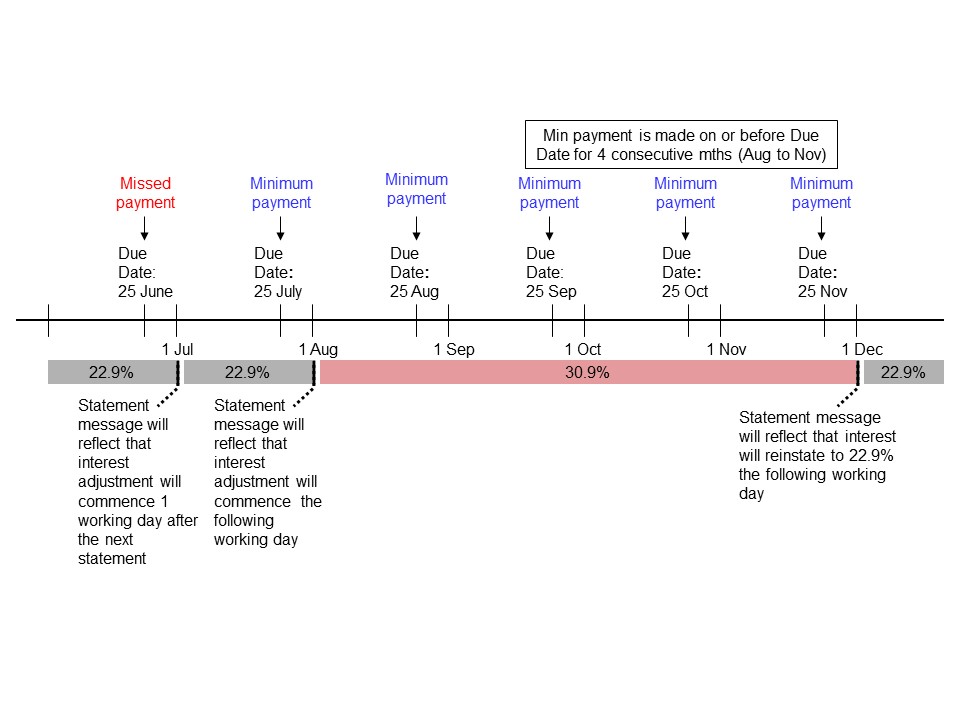

If the Bank does not receive the required minimum payment by its due date (for example, due date on 25 Jun as illustrated in the example below), the interest rate applicable to your DBS/POSB Cashline account will be increased by 8% p.a. on top of the Prevailing Interest Rate (“Increased Interest Rate”). This Increased Interest Rate shall be applied to the outstanding balance in your DBS/POSB Cashline account from the first working day after the date of the subsequent DBS/POSB Cashline account statement following your DBS/POSB Cashline account statement (i.e. August’s statement) and used to compute the finance charges applicable to your DBS/POSB Cashline account.

This additional interest rate shall be applied even if minimum payment is received by the Bank on or before the due date of the following month (i.e. in July).

In the event that the minimum payments are made in full on or before their respective due dates for 4 consecutive months (i.e. for August, September, October and November statements), the Increased Interest Rate shall be reinstated to the Prevailing Interest Rate on the first working day after your next Statement Date (i.e. December’s statement).

CashCare Protector is an optional credit life protection insurance underwritten by Manulife (Singapore) Pte Ltd. It pays off the outstanding balance on your DBS/POSB Cashline account up to S$100,000 in the event of diagnosis of critical or early cancer5, terminal illness, death or total permanent disability. For death due to accident, the amount doubles to a maximum of S$200,000.

5 This plan does not cover pre-existing medical conditions. A waiting period of 90 days applies for claim of critical or early cancer benefit.