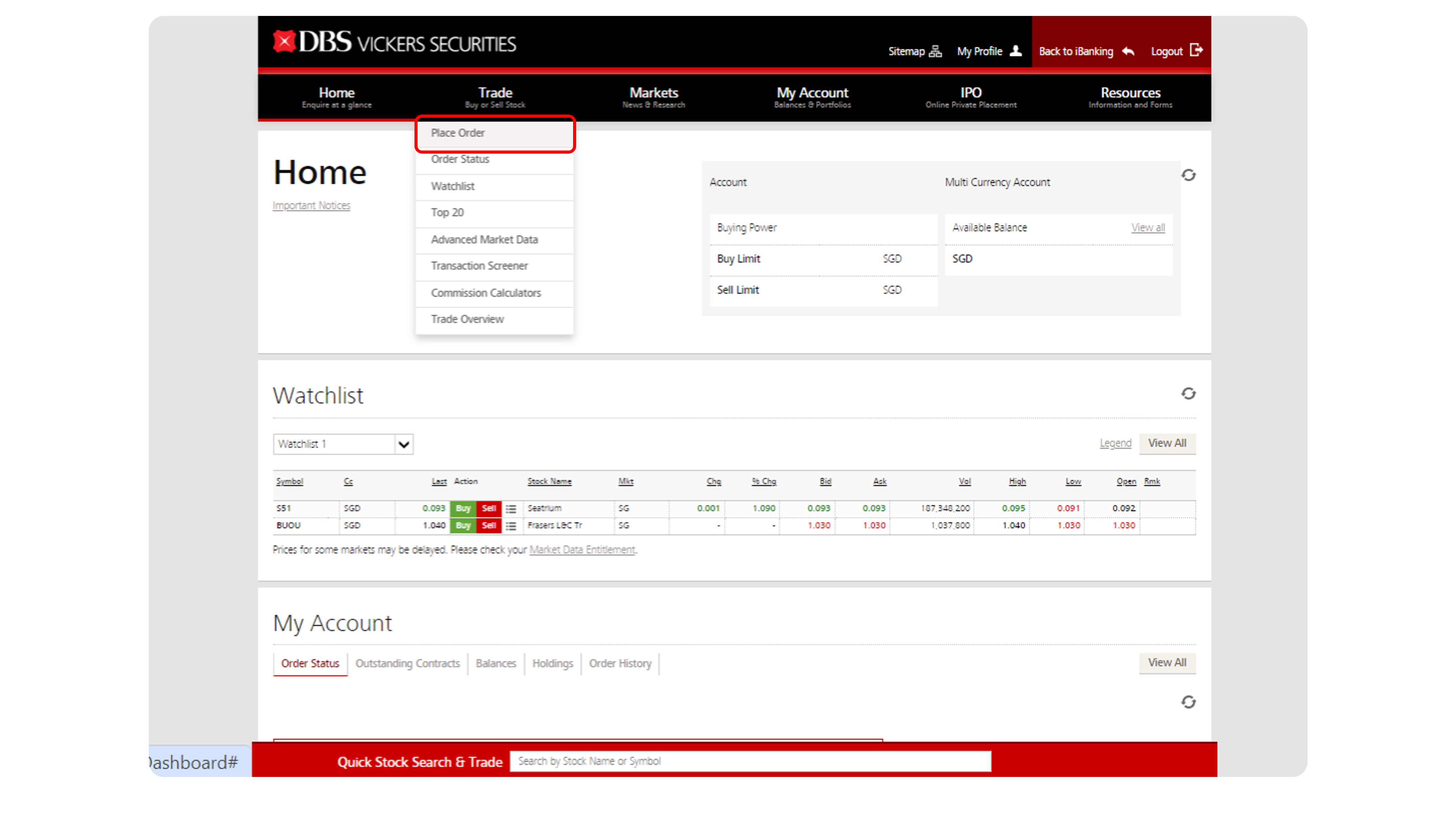

Placing a trade on DBS Vickers Online

Placing an online trade order on the DBS Vickers Online Trading platform is simple, intuitive and fast.

Part of: Guides > Your Guide to DBS Vickers Online Trading Account

Types of Settlement Mode

Buy

- Your trading limits determine how much you can buy. Learn more on how to Increase DBS Vickers Cash Trading Account Limits.

- Learn more about the Charges for making a buy trade.

- Once you have successfully made a buy trade, your shareholdings will be credited to your CDP account (for Singapore Market Shares) or will be held in the DBS Custodian account(for Foreign Market Shares) after the settlement date.

- The payment of shares is only after the settlement date. Learn more about the Delivery and Settlement of Your Shares.

Sell

- Your trading limits determine how much you can sell. Learn more on how to Increase DBS Vickers Cash Trading Account Limits.

- Learn more about the Charges for making a sell trade.

- Ensure you have sufficient shareholdings. For Singapore market shares, check your CDP account. Learn more about the Penalties imposed if you sell without sufficient holdings. For foreign market shares, click My Account and select Holdings to check your shareholdings.

- Learn more about the Delivery and Settlement of Your Shares.

Benefits

- A single account for transactions in different markets.

- Option to link your DBS / POSB account for convenient trade settlements (choose between GIRO and EPS settlement modes).

- Convenient FX conversion service to facilitate trade settlement in foreign currencies.

If you see a DBS Multi-Currency Account (MCA) on the right panel, it indicates that your account is linked.

Buy

- For Cash Upfront buy order, please ensure that there are sufficient funds (contract value of the trade plus charges) in the traded currency in your MCA before placing a trade. You can view your MCA balances from the right panel.

- Learn more about the Charges for making a buy trade.

- Once you have successfully made a buy trade, your shareholdings will be credited to your CDP account (for Singapore Market Shares) or will be held in the DBS Custodian account (for Foreign Market Shares) after the settlement date.

- Once an order is placed, the funds in your MCA account will be earmarked and the amount will be used to pay for the contract on settlement date.

- Cash upfront option is only available when you log in to digibank online, it is not available on digibank mobile or the mtrading app.

Sell

- Sell trades are not available for cash upfront.

Buy

- To start trading online using funds or shares in your CPF Investment/SRS account, please ensure you have linked your CPF Investment/SRS Account to your DBS Vickers Online Trading Account.

- Please check your available trading limits (for CPF Investment Account) and funds in your CPF Investment/SRS accounts before placing a trade. If there is insufficient funds/ trading limits, the trade might be rejected. Learn more on the Rejected CPF/SRS Trades procedure.

- Your DBS Vickers trading limits will determine how much you can buy. Learn more on how to Increase DBS Vickers Cash Trading Account Limits.

- Learn more about the Charges for making a buy trade. Do note there may be additional fees imposed by your agent bank.

- When the contract has been accepted by the CPF Investment/SRS agent bank, funds will be debited from your CPF Investment/SRS account and the shares will be deposited into your CPF Investment/SRS account on the settlement date. Learn more on the Settlement of CPF/SRS Trades.

Sell

- To start trading online using funds or shares in your CPF Investment/SRS account, please ensure you have linked your CPF Investment/SRS Account to your DBS Vickers Online Trading Account.

- Please check your available shareholdings in your CPF Investment/SRS accounts before placing a trade. If there is insufficient funds/ trading limits, the trade might be rejected. Learn more on the Rejected CPF/SRS Trades procedure.

- Your DBS Vickers trading limits will determine how much you can sell. Learn more on how to Increase DBS Vickers Cash Trading Account Limits.

- Learn more about the Charges for making a sell trade. Do note there may be additional fees imposed by your agent bank.

- When the contract has been accepted by the CPF/SRS agent bank, the sales proceeds will be credited into your CPFIS/SRS account and the shares will be debited from your CPFIS/SRS account on the settlement date. Learn more on the Settlement of CPF/SRS Trades.

More information

- Settlement currency for CPF/SRS trades must be in Singapore Dollars.

- Your agent bank will settle your trade with us using your cash or shares in your CPFIS/SRS account. Find out more on Settlement of CPF/SRS Trades.

- Your CPF/SRS trade will be changed to an ordinary cash trade if it fails to settle with your agent bank. Find out more on Rejected CPF/SRS Trades.

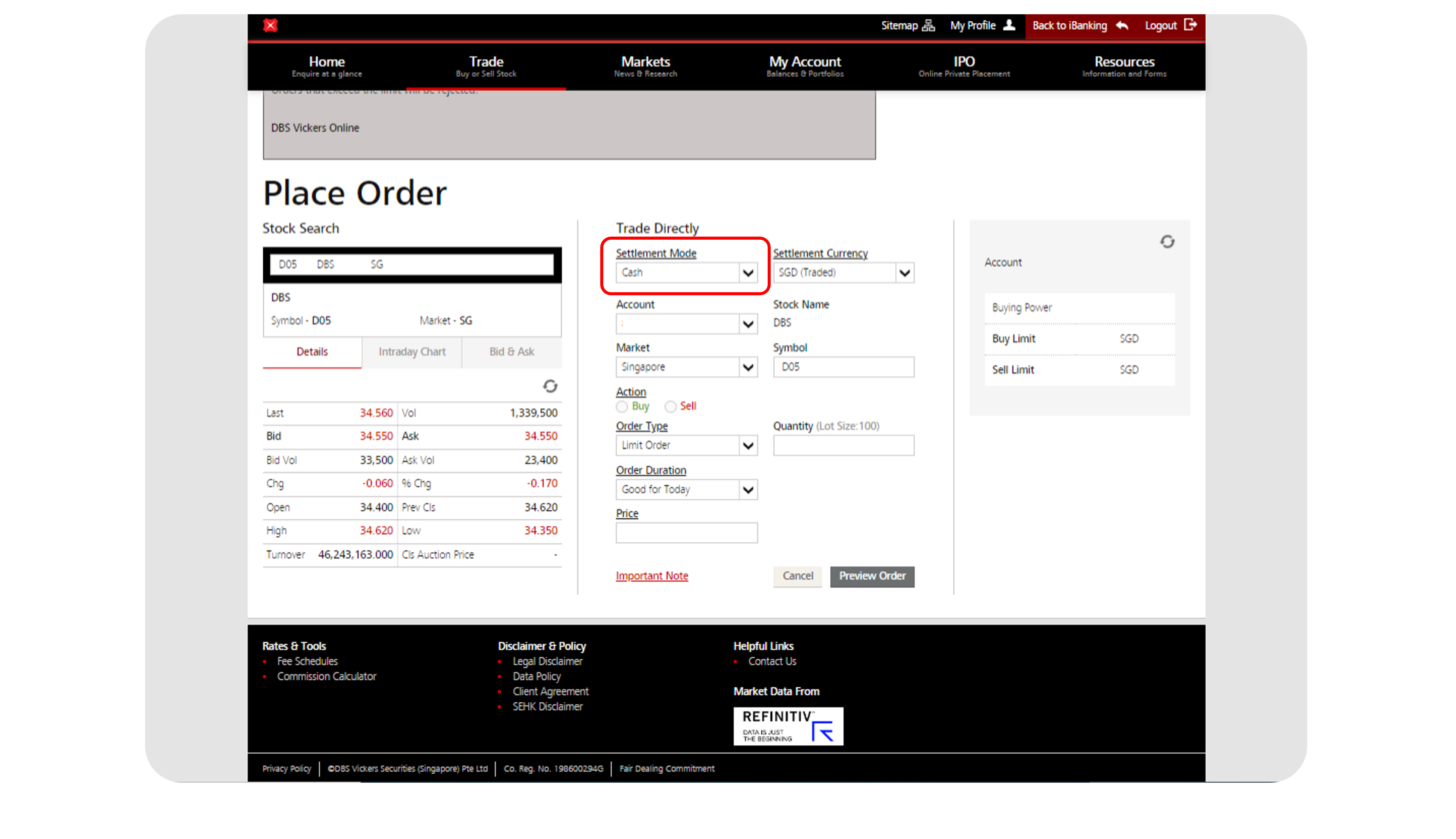

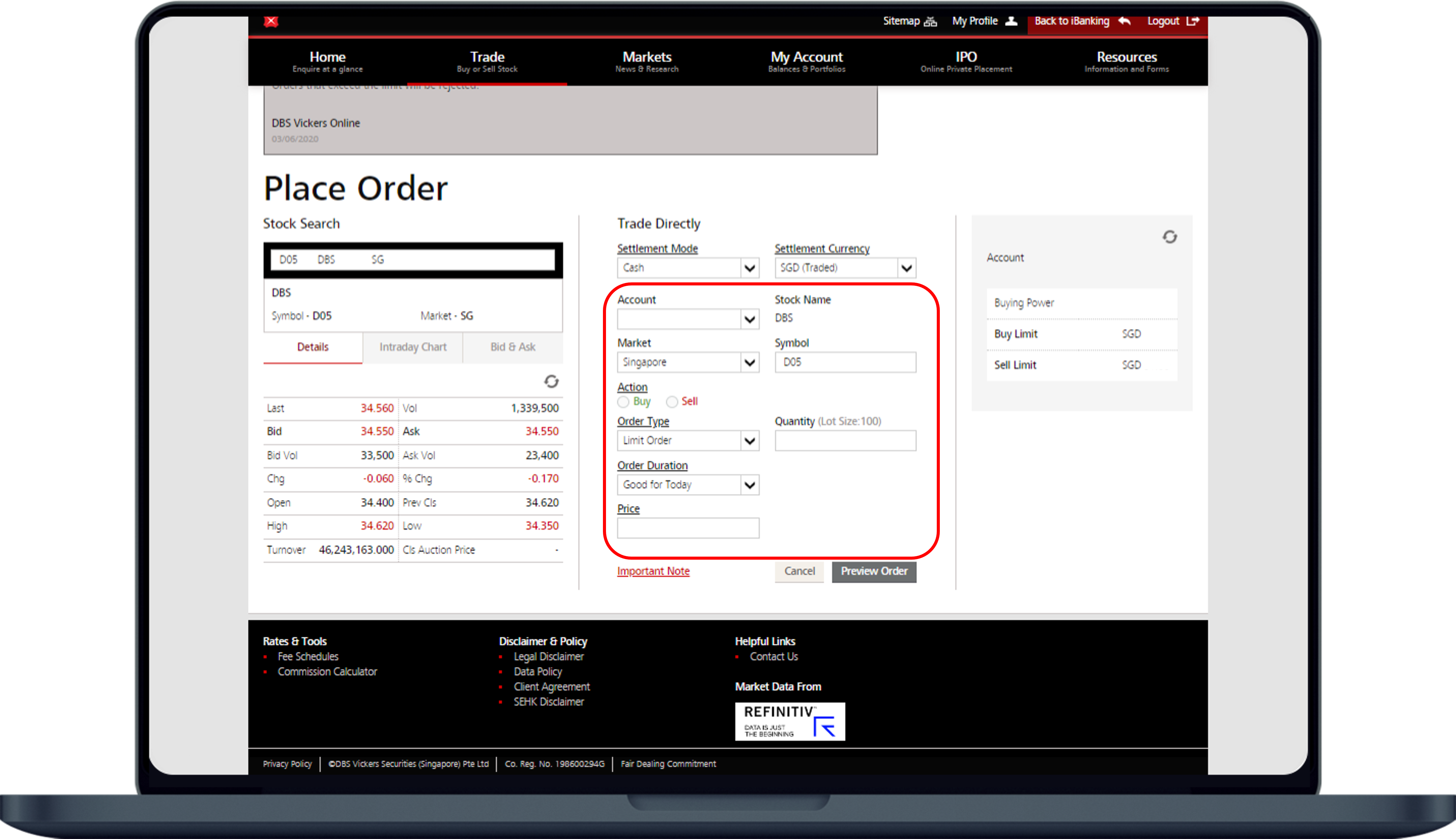

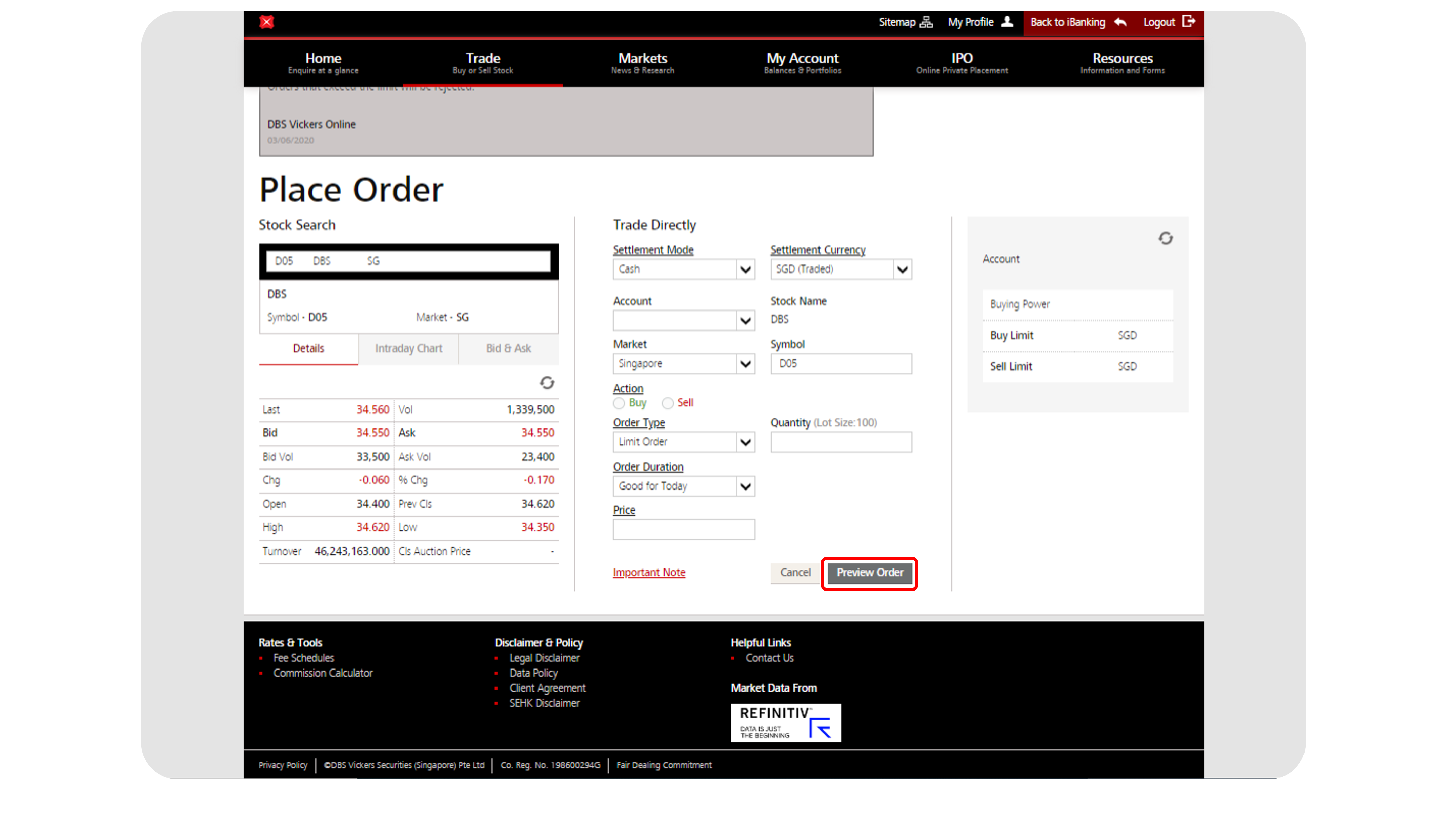

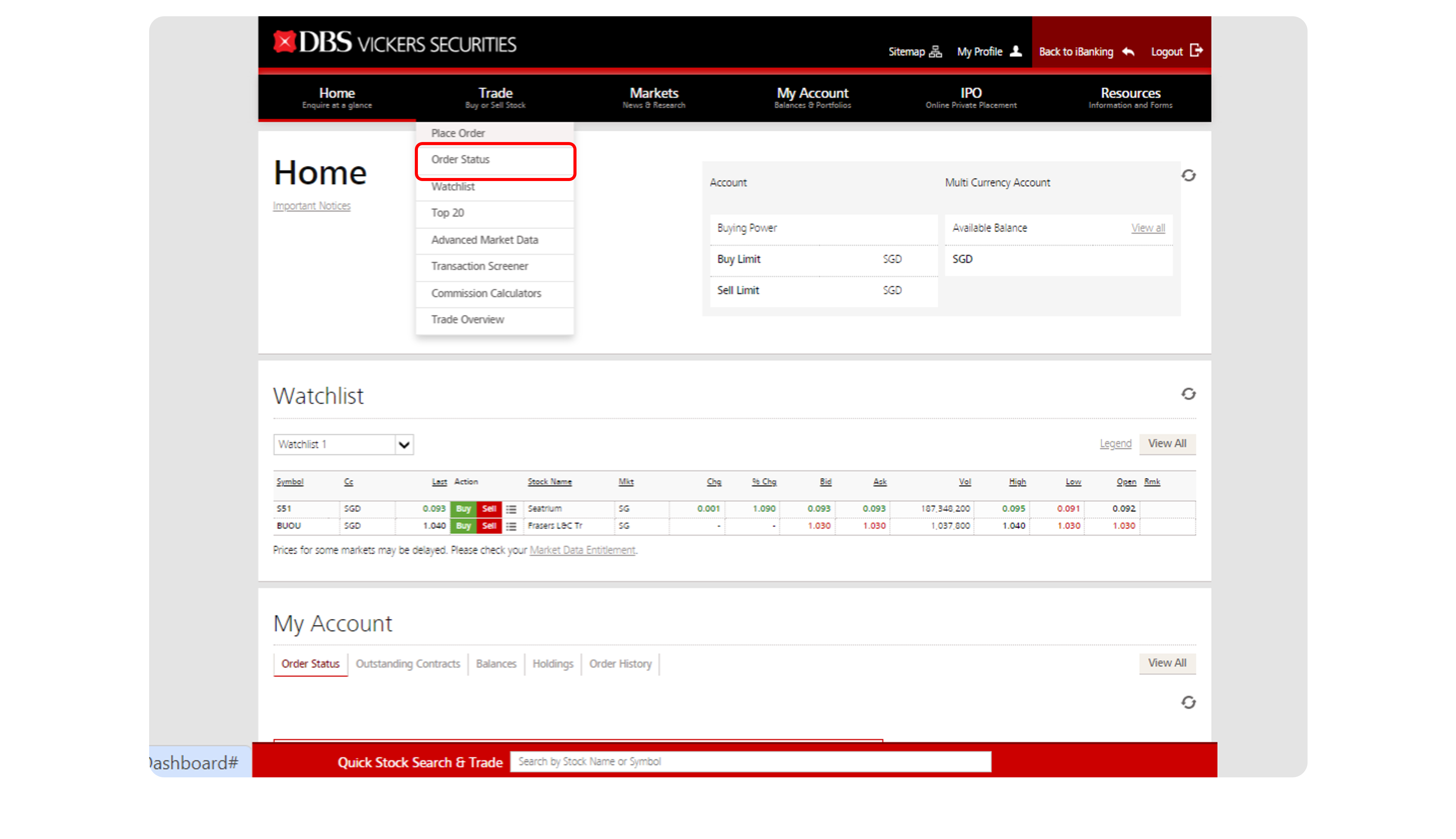

How to place a trade on DBS Vickers Online

Was this information useful?