- Loans

- Working Capital

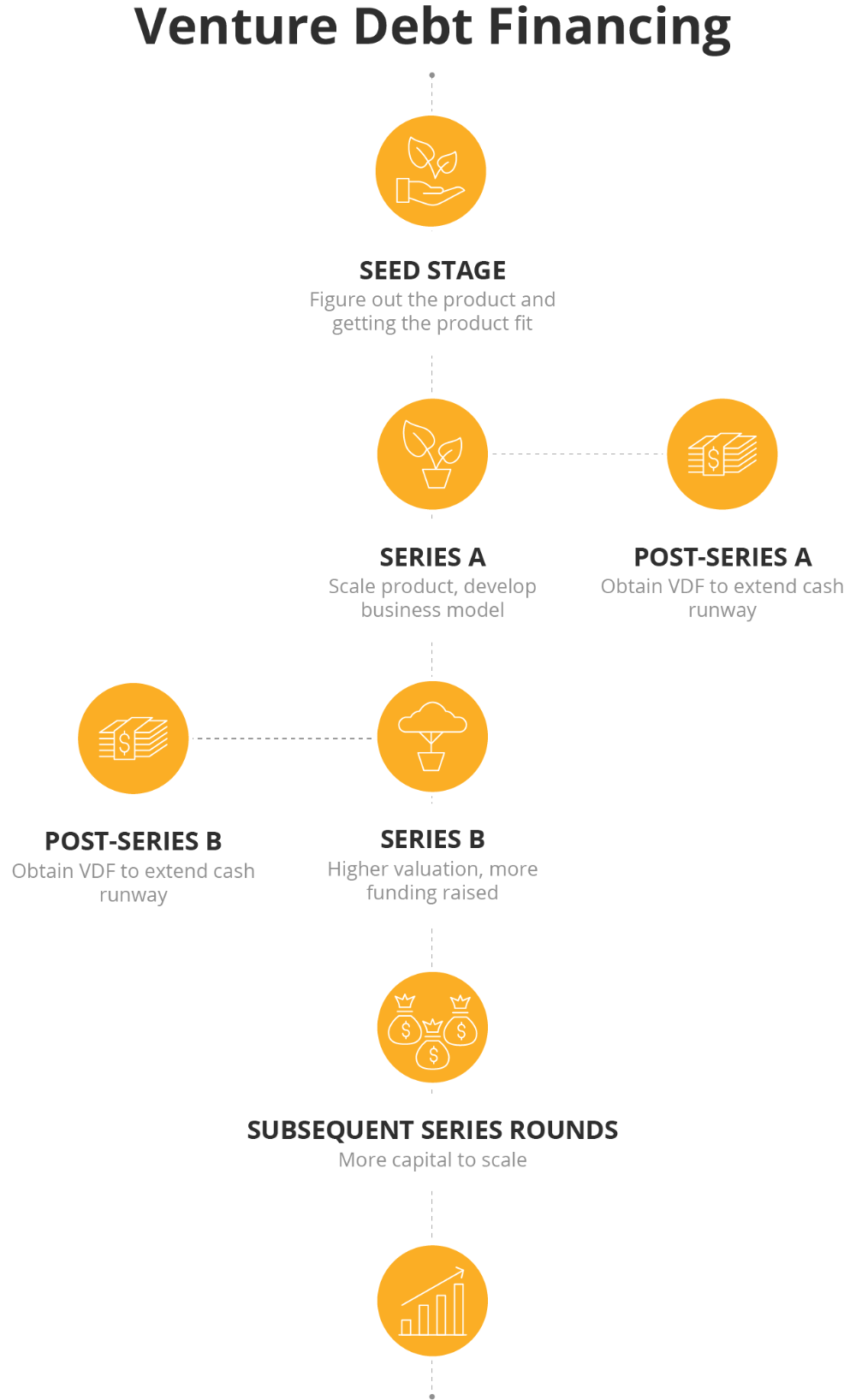

- Venture Debt Financing

Venture Debt Financing

Complement venture capital raised for tech start-ups

- Loans

- Working Capital

- Venture Debt Financing

Venture Debt Financing

Complement venture capital raised for tech start-ups

Minimise shareholding dilution

Lower the overall cost of financing

Speed up growth initiatives

Access DBS cross-border network

Work with seasoned venture professionals

Achieve balance between dilution and flexibility

Extend cash runway

Enhance equity returns

Tech start-ups must:

- be strongly backed by a DBS partner venture capitalist

- have raised at least S$3 million of equity funding from institutional investors

- demonstrate that their business model is commercially viable

| What is a tech start-up? | |

| Tech start-ups are defined as innovation-driven enterprises with cutting-edge technology and a disruptive business model targeting a high-growth market segment. |

| What is the typical debt-to-equity ratio for start-ups? | |

| Venture debt is usually 10% to 30% of the total venture capital raised in the latest equity round. |

| Is this financing available to foreign entities? | |

| Venture Debt financing is only open to registered entities in Singapore or within our DBS markets. |

| Are there products without venture capital investment? | |

| Yes, we offer various types of financing products including government-assisted loan schemes such as SME Working Capital Loan. |

"aCommerce has a great working relationship with the DBS Venture Debt team and we are very pleased to have them as a supporter of the aCommerce growth story. The team invested time to understand our complex business, including visiting our local operations and have used the DBS network to make introductions to expand our customer base and meet other businesses to assist our platform development."

Piers Bennett, Group Chief Financial Officer

"The team at DBS has been very start-up friendly and unlike conventional lenders, the team understands the business and challenges for new age companies such as Circles. The DBS team has time and again responded swiftly and provided timely capital which has helped Circles in its international expansion. DBS has supported us not just on financing solutions but also on treasury and the latest digital banking solutions. We will continue to deepen our relationship with DBS and partner with them in our mission to give back power to the customers."

Eduardo Sarian, Head of Business Finance

“Love, Bonito has a strong and collaborative relationship with DBS, that has further tightened over the last year. We received DBS’ Venture Debt financing through our growth stage and as a client today, what we really appreciate is the holistic and integrated support and advisory the team provides as a strategic financial partner. This coupled with the DBS team’s initiative, ownership and work ethic, make them a partner we look forward to working even more closely in the years to come as we further expand our footprint globally.”

Dione Song, Chief Commercial Officer

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?