- Trade

- Export Services

- Outward Bill Collection (DA/DP)

Outward Bill Collection (DA/DP)

Collect your payments efficiently

- Trade

- Export Services

- Outward Bill Collection (DA/DP)

Outward Bill Collection (DA/DP)

Collect your payments efficiently

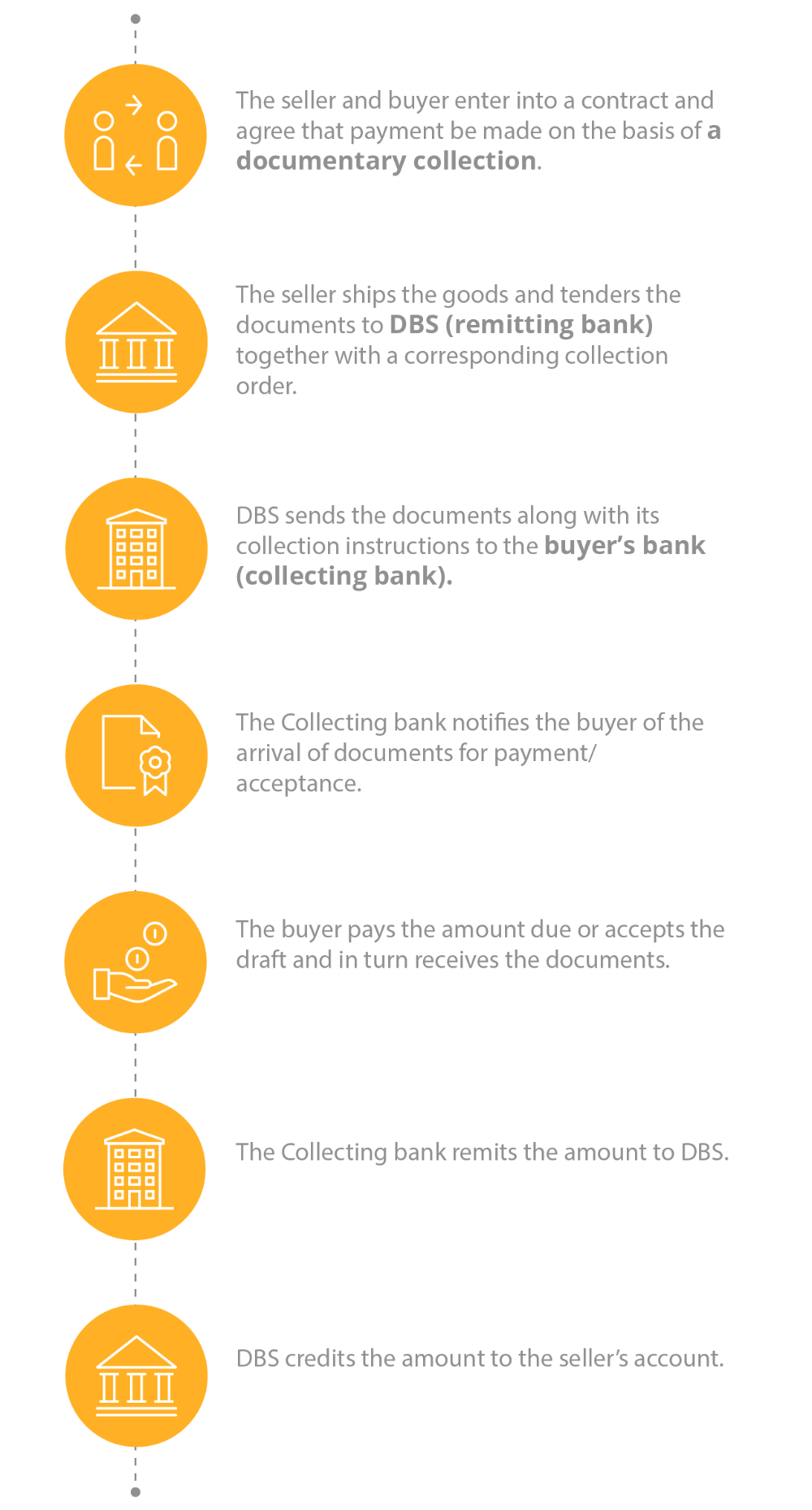

Facilitate the flow of payment and documents with our Outward Bill Collection. We can help you process the following documents on your behalf:

Documents against Acceptance (DA)

We will send your export documents to the buyer's bank. Once the buyer has accepted the bills of exchange/drafts and promised to pay on a later date, buyer’s bank will release the documents. We will credit the money to your account when the buyer (buyer’s bank) remits the payment to us

Documents against Payment (DP)

We will send your export documents to the buyer’s bank. Once the buyer has paid, buyer’s bank will release the documents. We’ll credit the money to your account when buyer’s bank remits the payment to us

Convenient collection

Submit and collect your documents at Trade Document Counters island-wide

Real-time notification

Subscribe to DBS IDEAL to be informed of status

Facility-free service

Apply for Outward Bill Collection without the need for a credit facility

Improve your cash flow

Shorten your cash collection cycle by asking DBS to discount accepetd bills

Please refer to the Trade Pricing Guide.

Get your documents processed on the same day. Submit your application form and trade documents to any of our Trade Documents Counters.

| How do I complete the application form? | |

| Please contact DBS Business Care at 1800 222 2200 (in Singapore) or +65 6222 2200 (outside Singapore) for help in completing the application form. |

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?