Networked Trade Platform

Save costs by digitalising and simplifying your trade processes

Networked Trade Platform

Save costs by digitalising and simplifying your trade processes

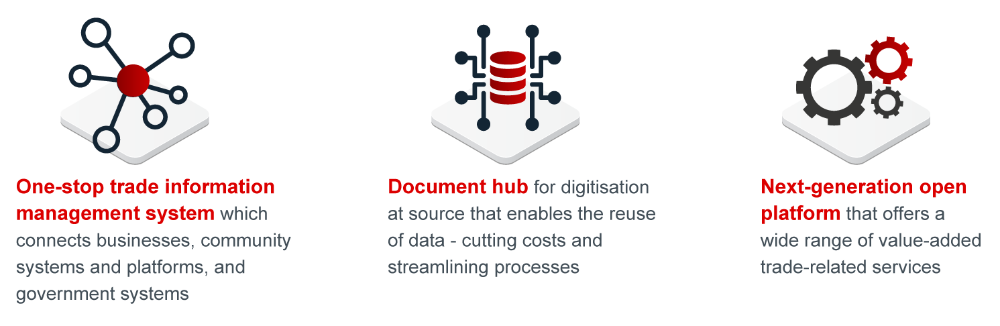

With increasing importance on digitisation today, DBS would like to help businesses like yours to digitise and simplify your trade processes through Singapore’s Networked Trade Platform (NTP), providing you with a seamless end-to-end trade financing experience.

For more information on how NTP and DBS can help digitise your trade processes, click below.

Note: CamelOne™ Trade Finance portal is a value-added service on the NTP.

From 8 March 2021 to 30 September 2021, apply for selected DBS’ trade financing solutions through CamelONETM Trade Finance portal on NTP to enjoy a rebate of S$25 for every successful application.

List of DBS products:

- Import Letter of Credit Issuance

- Import Bill Collection*

- Banker’s Guarantee / Standby Letter of Credit

- Shipping Guarantee

- Purchase Invoice Financing

- Sales Invoice Financing

- Export Letter of Credit Negotiation/Handling*^

*Not eligible for S$25 rebate.

^Not available on CamelONETM Trade Finance. Apply through DBS directly.

Terms and Conditions Apply.

Please contact the NTP Helpdesk:

Call 65703053

Step 2: Create your free CamelONE™ Trade Finance account

Refer to this step-by-step guide on how to create a free account and select DBS as your banking partner.

For further queries, please email: [email protected]

Step 3: New to DBS? Sign up for a DBS business account instantly

Complete instant account opening here

A DBS customer but don't have the relevant DBS trade facility?

To set up the relevant trade facility or for further queries, please contact:

- Your DBS Relationship Manager, or

- DBS BusinessCare at 1800 222 2200

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?