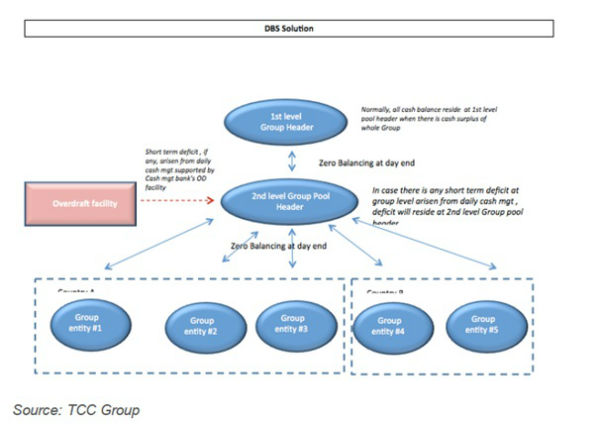

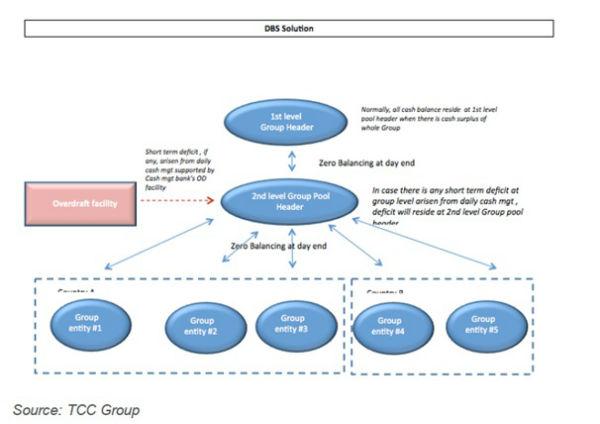

TCC Group selects DBS’s multi-tier bank account pooling structure

TCC Group, a ship-owning company, is working with DBS to establish a cross-border cash pool solution to cater for its growing cash requirements.

In February, TCC Group signed an agreement with DBS to implement a multi-tier account pooling structure. The structure is designed so centralised funds can be pushed to parts of the business that requires cash most. The project will begin in June and will cover the ship-owner’s operations in both Hong Kong and Singapore.

TCC Group has played a part in Asia’s shipping and logistic industry for around one hundred years. The group is headquartered in Hong Kong and it engages in ship owning and fleet management of dry bulkers and oil tankers with operations in Singapore, Japan and China. The firm currently has ten bulkers, three tankers, and customers include BP, Shell, Chevron, and Cargill.

CT spoke to Tony Lam, group treasurer of TCC Group, about the challenges he faced managing cash and why he opted to work with DBS on the company’s first ever cash pooling solution.

Challenges

Lam, who recently joined the company, faced two key challenges: the pace of regulatory change, and reducing dependency on cheques and centralising his view of cash.

- Regulation:

In the past, many shipping groups would use a separate legal entity playing the role of fund manager to receive charter hire incomes from customers. Due to more stringent antimony laundering laws, more customers now tend to pay ship-owner companies directly. This has meant that cash is now more widely dispersed within the company hence a need for a cash pooling structure. - Improve efficiencies:

Approximately 80% of the local payments made in Singapore are completed via bank cheques, and the majority of payments made in Hong Kong are the same. Lam said that if he digitised his payments, he could save cost, cut down on payment and reconciliation workload and generally improve efficiencies.

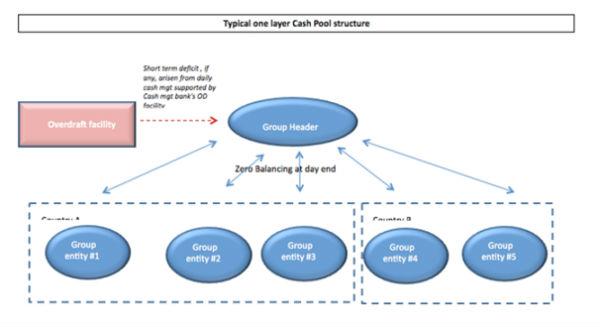

Choosing DBS

To solve its challenges, TCC Group selected DBS to implement a cash management solution called a multi-tier net group structure. The solution is able to pool funds from Hong Kong and Singapore and centralise them at the end of the day. It can also accommodate local payments via DBS's electronic banking platform.

“Although we have operations in China and Japan which become more and more important, there is no imperative to cover them in the short-term until their surplus cash rolls up to a certain size. This also makes the project scalable and moves on faster,” Lam added.

Lam said he selected DBS for the following reasons:

- It has a flexible e-banking reporting function that allows each user to schedule reports to banks via an email.

- It can process intercompany transfers under a simpler matrix. This is part of DBS IDEAL platform, which is an online platform that is used to manage working capital, including monitoring for incoming funds, view remittance advice and statement for reconciliation purposes, or simply paying your employees and suppliers.

- It can perform same-day wire transfers of most currencies that the group needs, including renminbi, Singapore and Hong Kong dollars.

- It offers intelligent bank documentation and implementation support. This includes pre-filling bank documentation based on provided company information, and it allows documentation to be signed off at a group level instead of company-by-company level.

Lam said, “When it came to evaluating the effectiveness of a cross-border pooling solution, the cut-off time is also important. While our pool header accounts are located in country ‘A’, what is the daily cut-off time of bank incoming and outgoing transactions for other cash participants located at other countries is an important factor to practical daily operation.”

Lam added that some banks do not guarantee late incoming and late outgoing transactions to be covered at day-end sweeping to the header accounts. “I am glad that DBS can offer the standard of guaranteeing all daily transactions covered in the sweeping. This is one of the credits in comparing various banks’ solutions,” Lam said.

Lessons learned

Lam offered CT one piece of advice during the bank selection process: A treasurer should always speak to his/her banking partners to select the best solution. “Always shop around the major partner banks to find out the best and value-added solution,” he said. Also go to the very details for product comparison. Of course, this could need a treasury team that has rich experience in similar solutions.”

Lam also mentioned that its important to “fine-tune” the solution with the bank to ensure it fits the needs of internal stakeholders, business and operation needs.

(This article was first published in Corporate Treasurer: TCC Group selects DBS’s multitier bank account pooling structure.)

Subscribe to DBS BusinessClass

Stay updated with the latest market trends and industry insights, connect with a network of entrepreneurs, and gain access to exclusive event invitations. Join Asia's fastest growing business community – get your complimentary membership here.