What to do when in heavy debt

If you’ve only got a minute:

- Big spenders aren’t the only ones who end up with large debts.

- It is essential to keep a close watch on your spending before it spirals out of control.

- Once you build your debt plan, remember to adopt the right budgeting and spending habits.

![]()

Contrary to popular belief, it does not take much to rack up huge debts.

A few months of reckless spending is enough to leave you knee-deep in debt, finding yourself a painfully long way away from financial freedom.

Big spenders aren’t the only ones who end up with large debts. Leaving smaller debts to roll over can land you in the same unenviable situation due to the effect of interest on it. In other words, a lot of small purchases on credit can add up to being quite the headache.

While the reasons why people may find themselves in debt do vary, the one underlying commonality is their inability to keep their spending from spiralling out of control.

If you are trapped in a debt spiral, here are 6 considerations.

1. Seek support from your loved ones

There is little dispute that the family is an important pillar of support in our lives. They are often our first “port of call” when we have grievances we wish to air or when we are seeking a second opinion on a variety of matters.

Likewise, it is important to seek the understanding and support of your family members when in heavy debt.

The burden of a major debt can take a toll on your mental health as it can result in depression, a sense of helplessness, and a lack of self-worth. If these feelings are not addressed early, they may spiral deeper and the healing journey will be tougher.

It will be good to gather your loved ones to work out the family’s expenditure and seek everyone’s cooperation.

You may be surprised at how supportive your family members can be.

2. Have a plan

When facing a heavy debt, setting up a plan that will require you to adjust your spending will certainly help. One way is to list your debts and focus on paying off those with the highest interest rates first. While these might not be the largest debts you have, the effect of compounding at a higher interest rate over time means you will likely pay more in interest payments than covering the principal payment.

Another way is to focus on clearing your smaller outstanding debts first. Once you settle these, you are likely to gain confidence in your ability to manage debt, putting you in a position of greater control.

3. Keep your income records up to date

You are advised to update your latest income records with the relevant financial institutions. This will help to avoid any inadvertent suspension of their credit cards and unsecured loans accounts as a result of outdated income information.

DBS/POSB credit card and unsecured loan customers can update their income here.

4. Know your debt repayment timeline

If you are unable to pay your credit card bills or unsecured loans in full, keep an eye out for an information disclosure statement that you will get from your bank.

This statement shows the total amount and time needed to fully pay off your debts if you only make the minimum payment each month. It also shows the amount of debt that will accumulate at the end of 6 months if no payments are made during this period.

Each table will be customised to a borrower’s circumstances. This information aims to help borrowers understand the cost of being in debt so they can better manage spending and cash flow.

If you have outstanding balances on your credit cards or unsecured loans, it is prudent to pay more than the minimum sum each month if you can manage it and stop spending on the credit cards or using the unsecured loans.

Read more: Rolling over credit card debt is no game

5. Use a debt repayment programme

There are several avenues open for those in heavy debt to seek help in Singapore. One of these is to consider taking up a debt repayment programme.

The Debt Consolidation Plan (DCP) is offered by financial institutions like DBS. The Debt Management Programme (DMP) is a similar programme offered by non-profit organisation Credit Counselling Singapore.

There are different conditions for each programme. For instance, the DCP and DMP have different criteria and requirements.

With the DCP, you can still own 1 credit card with a credit limit of 1 month’s salary to cater to your daily needs. This is not permitted under the DMP.

The DCP offers the convenience of consolidating all unsecured outstanding balances from multiple accounts with all banks into 1 monthly instalment repayment plan at an affordable interest rate. In most scenarios, the DCP customers will have a lower monthly instalment to repay than if the debtor were to manage the different accounts individually.

If you are considering filing for bankruptcy, it is important to take note that there are long-term implications for doing it. You will not be permitted to apply for mortgage loans and the bankruptcy status will impact your employment opportunities.

Bankruptcy should only be considered as a last option.

Read more: Debt repayment programmes in Singapore

Find out more about: DBS Debt Consolidation Plan

6. Start afresh with good habits

When you build your debt management plan and work toward repaying, it is equally important to use this moment to start over and adopt the right budgeting and spending habits.

Here are some tips for you to take note of:

- Save before you spend

- List your monthly expenses

- Be conscious of your fixed and variable expenses

- Make your credit card work smarter for you

- Have a contingency plan

These tips, though simple, go a long way to helping you to manage your hard-earned money better.

Read more: Habits to embrace in your financial journey

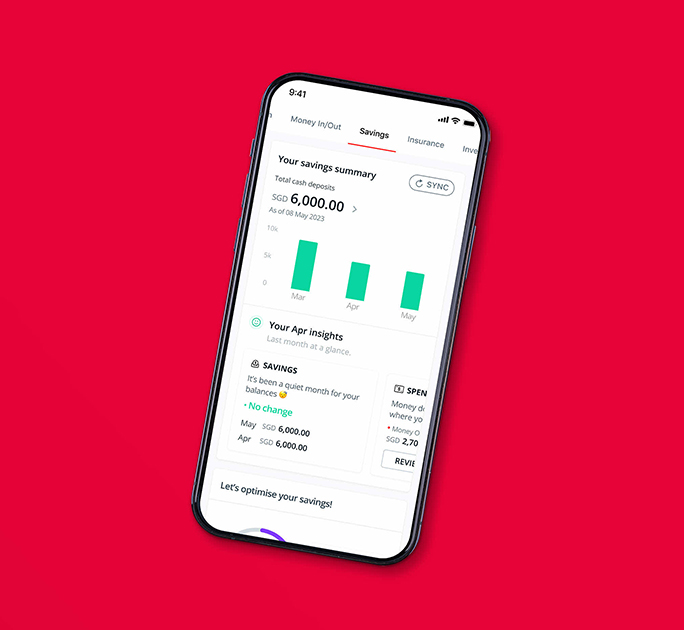

Find out more about: Plan with digibank

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)