Are you losing the race against inflation?

By Lorna Tan

![]()

If you’ve only got a minute:

- The lowest income group and baby boomers are more vulnerable to high inflation.

- Gen X customers who saw their investments grow at a slower rate than their expenses, are encouraged to invest more to boost financial resilience.

- Focus on the things that are within our control to better manage our finances and rise above the ugly head of inflation.

![]()

With inflation hitting record highs coupled with ballooning expenses and sluggish income growth, consumers are caught in a bind. But all is not lost as we can focus on the things that are within our control to better manage our finances and rise above the ugly head of inflation.

In 2022, DBS published “Are you losing the race against inflation?” an in-depth report that examined the impact of inflation on different consumer segments, analysed income growth, and offered tips on how to combat inflation. It highlighted that the lowest income group and baby boomers (ages 58 to 76) are among the most vulnerable to inflation. As such, these consumers could have less bandwidth to stomach higher inflation rates in the future.

On a positive note, millennials (ages 26 to 41) and boomers are in a better financial position to beat inflation. This is because their investments grew faster than expenses over the past year. On the other hand, Gen X customers (ages 42 to 57), who are near retirement age but saw investment growth lagging that of expenses, could invest more to boost financial resilience and safeguard their nest egg.

The report also indicated that the incomes of nearly half a million DBS customers lagged the surging inflation rate, with some customers even experiencing a decline in real income. This is exacerbated by expenses, which have grown 2 times faster than income over the past year.

Impact of inflation on financial wellness

This research paper is the 4th instalment in the DBS NAV Financial Health Series that analysed publicly available data as well as aggregated and anonymised data insights from 1.2 million DBS retail customers.

Here are 12 key highlights.

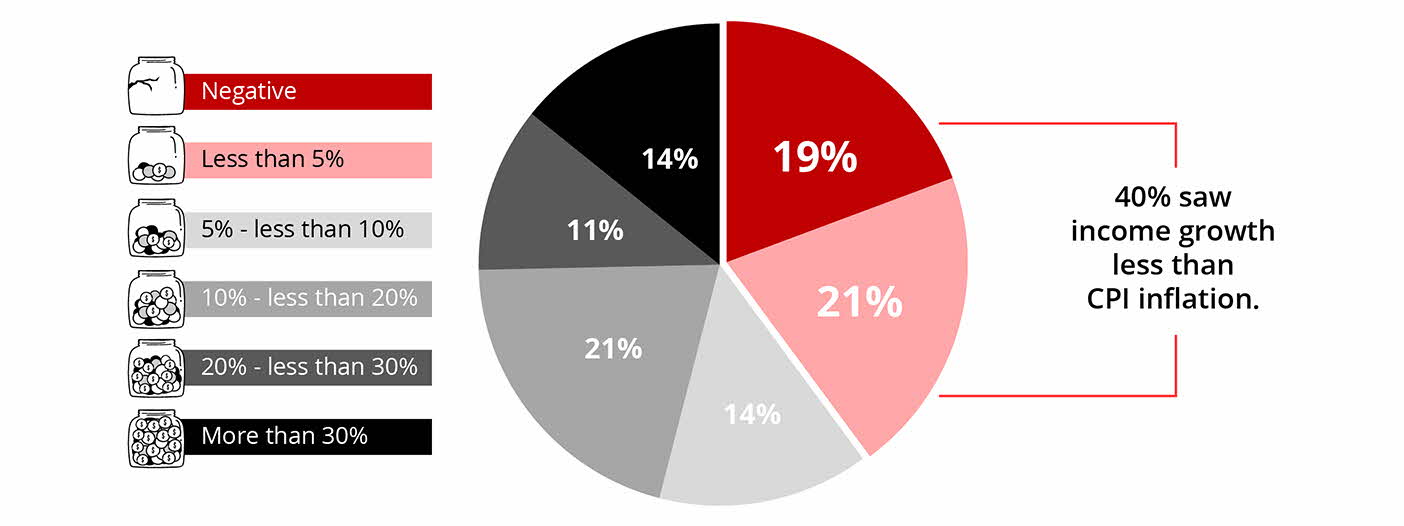

1. Income is not keeping up with inflation

Among the sampled customers, 40% saw their income grow by less than 5% in 2021, which is lower than Singapore’s average CPI inflation of 5.2% in first half of 2022, and DBS’ 2022 CPI forecast of 5.1%. Below is the customer split by income growth over the past year.

2. Lowest income group witnessed the greatest lag in income growth

Customers within the income group earning below $2,500 registered just a 2.5% increase in income between May 2021 and May 2022. Simply put, vulnerable segments of the society are struggling most with high inflation.

3. Upward income mobility amid challenging times

About 23% of the customers who were earning below $2,500 in May 2021 managed to move up to higher income bands over the past year amid the economic recovery, along with the improvement in job prospects and wages.

If we consider income mobility effects, then the income growth situation of this income group would appear more encouraging.

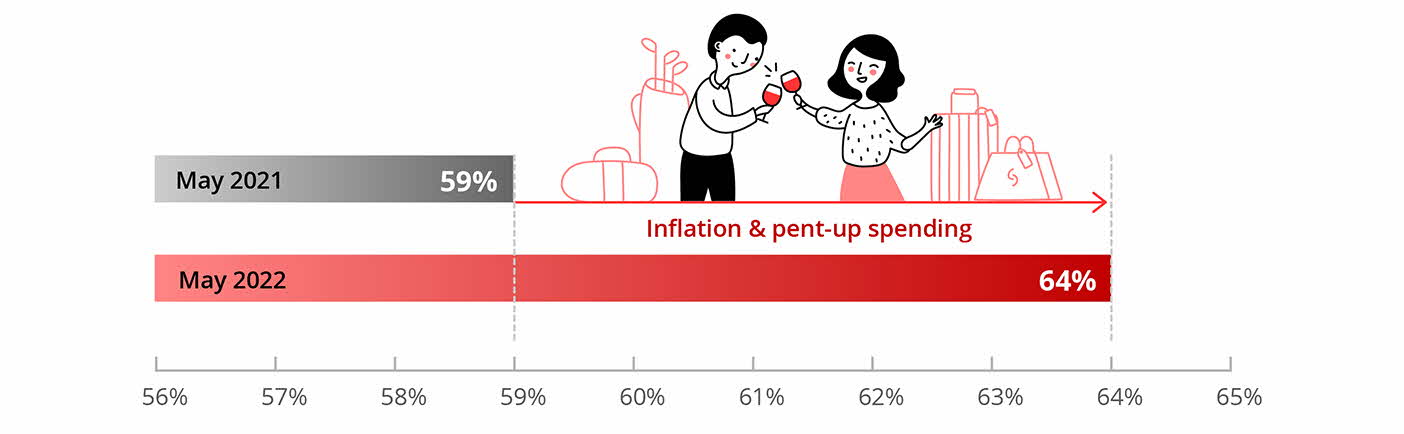

4. Rise in expenses

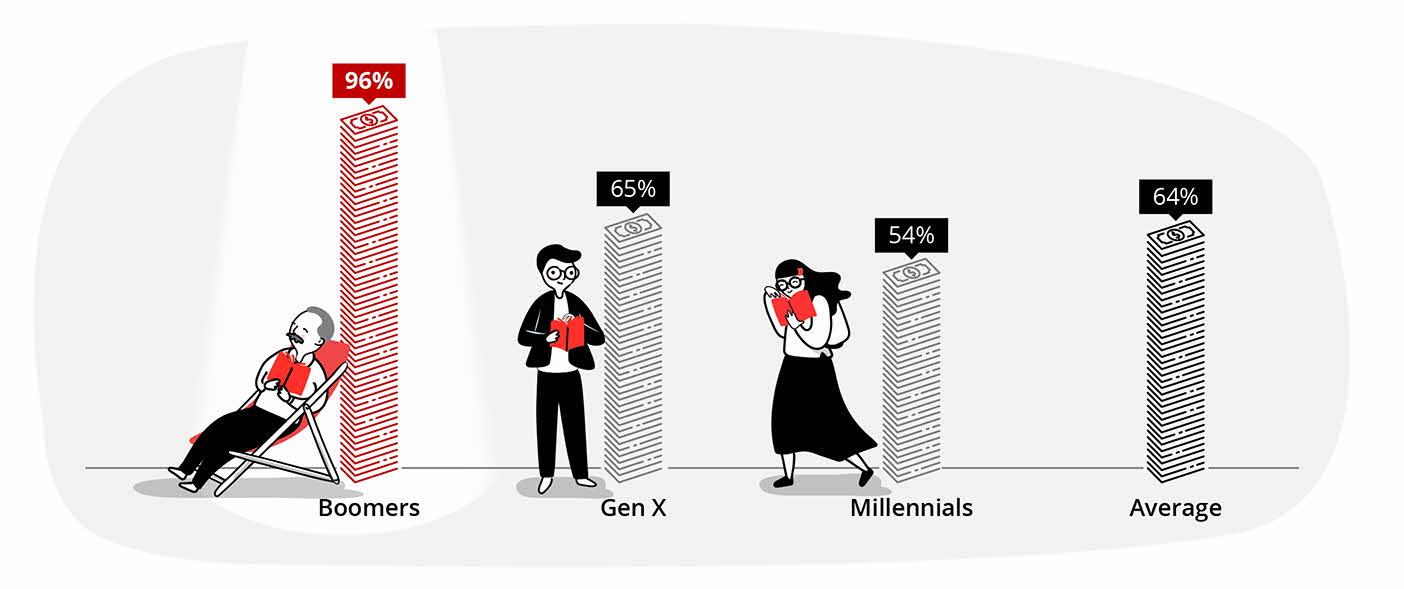

Customers are now spending 64% of their income, versus 59% a year ago. The rising proportion of expenses to income in May 2022 suggests that the growth rate of expenses has outpaced that of income.

Customers are still spending within their means, although rising expense-to-income ratios suggest inflationary effects and pent-up spending over the past year.

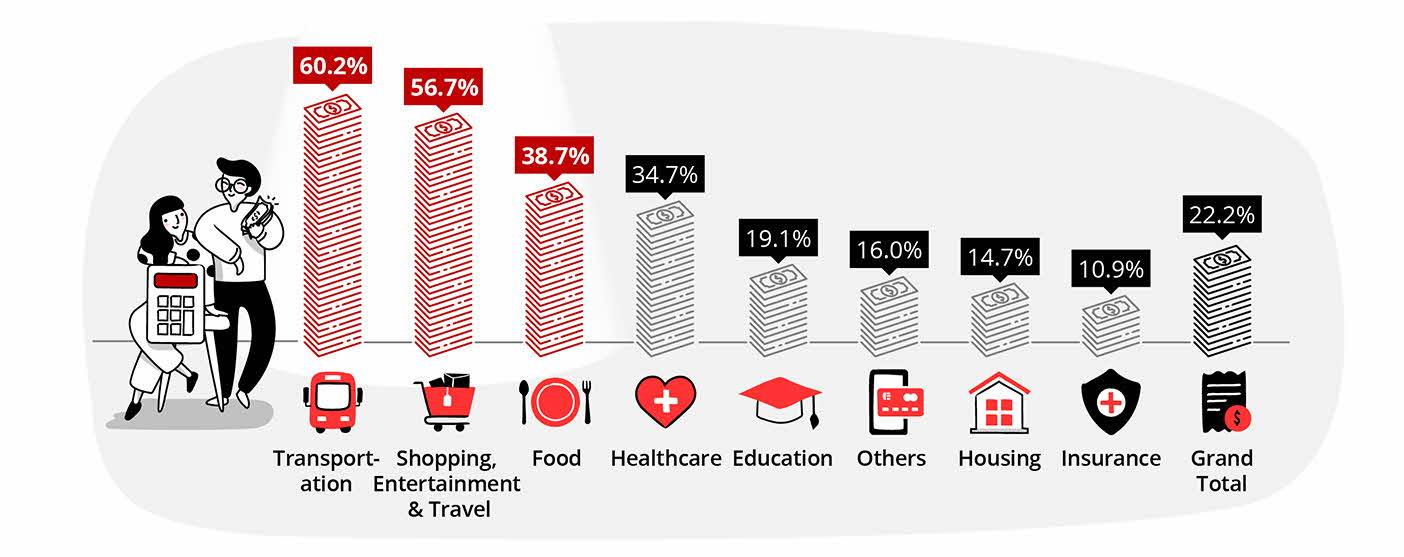

5. Increase in expenditure has outpaced income growth by 2x

Overall monthly expenses for sampled customers grew 22.2% in May 2022, compared to their income growth of 11.1%. This is even more so for the lowest income group, who saw their expenses grow 13.8%, which is 5.6x faster than their income growth of 2.5%.

6. Keep discretionary spending in check amid high inflation

All expense categories saw double-digit growth over the past year. Apart from transportation (+60.2%), spending on shopping, entertainment, and travel, which are discretionary in nature, witnessed the steepest increase (+56.7%). Below is the expense growth rate by categories for an average customer.

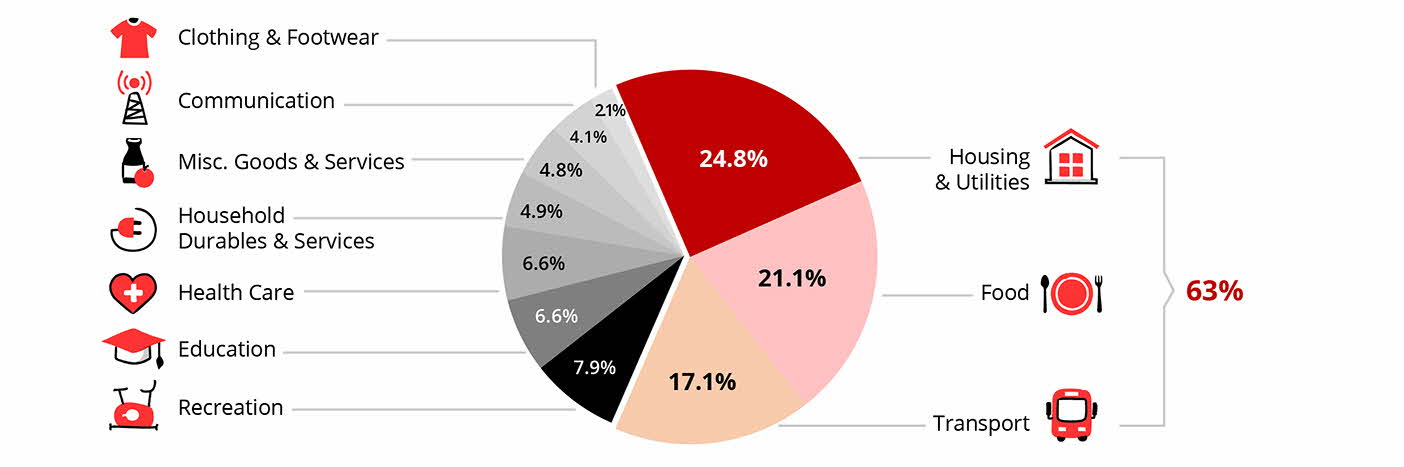

7. 3 key drivers of inflation in Singapore

Inflation affects everyone differently, depending on individual’s expenditure pattern. The 3 key drivers of inflation in Singapore have been food, transportation, and housing & utilities, which together account for around 63% of the overall CPI basket.

8. Lowest income group and Boomers at a disadvantage

We observe that the lowest income group (those earning less than $2,500) spends almost the entirety of their income, with a significantly higher expense-to-income ratio of 94% in May 2022 (versus average of 64%). They are more vulnerable to high inflation, based on their lower wallet bandwidth.

Among the different generations, the expense-to-income ratio (96%) for Boomers is the highest, thus suggesting a lower bandwidth to stomach higher inflation.

9. Investments experienced positive growth

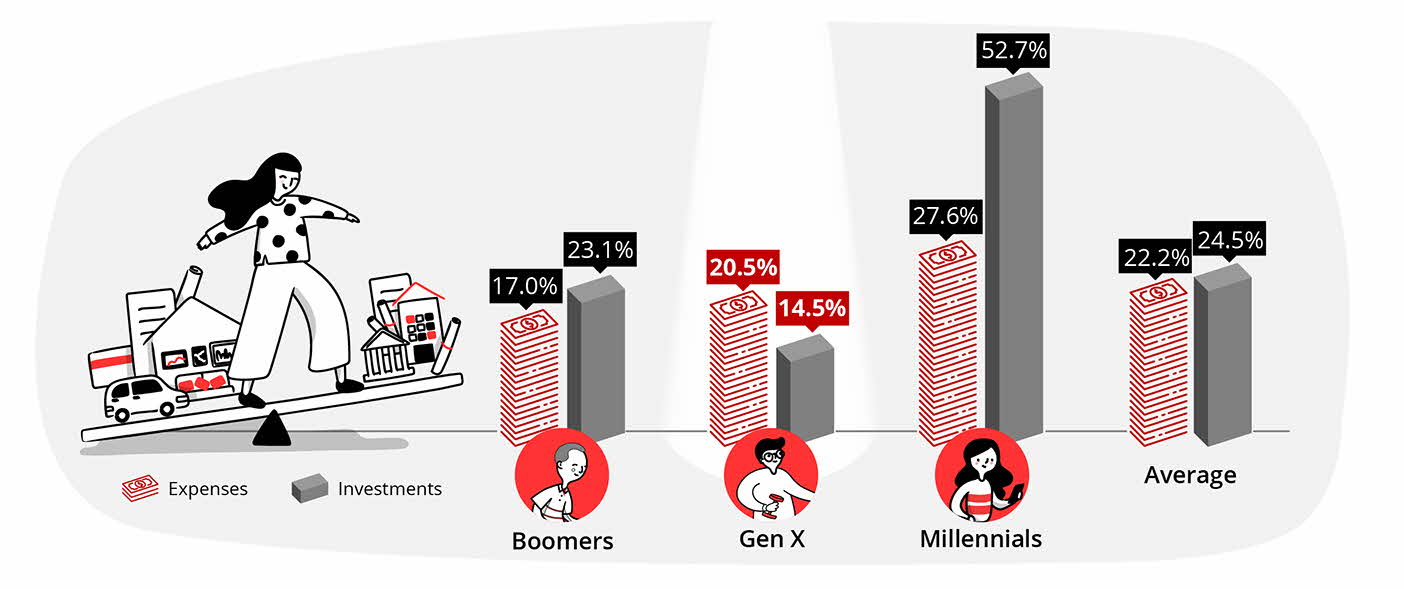

On an aggregate basis, total investments of customers grew 24.5%, outpacing the growth in expenses of 22.2%. However, the main laggards are Gen X customers who saw their investments grow at a slower rate than their expenses, while Millennials and Boomers generally saw their investment growth outpace that of their expenses.

There could be more room for growth in investments among Gen Xers given they are near retirement age, which makes investing and financial planning a more pressing priority.

10. Shift in investments toward bonds across all generations and income groups

There are also signs of “flight to safety” amid recent market volatility. In May 2022 compared to a year ago, bonds make up 37% of total investments, up from 2% in the previous year.

11. Digibank “Plan” tab users are more likely to invest

Across all generations and income groups, 10% of customers, on average, who use the “Plan” tab within digibank app invest, versus only 3% of non-digibank “Plan” tab users that do. Furthermore, digibank “Plan” tab users were found to have more monies invested (based on asset under management or AUM), close to 3x the amount of a non-digibank “Plan” tab user.

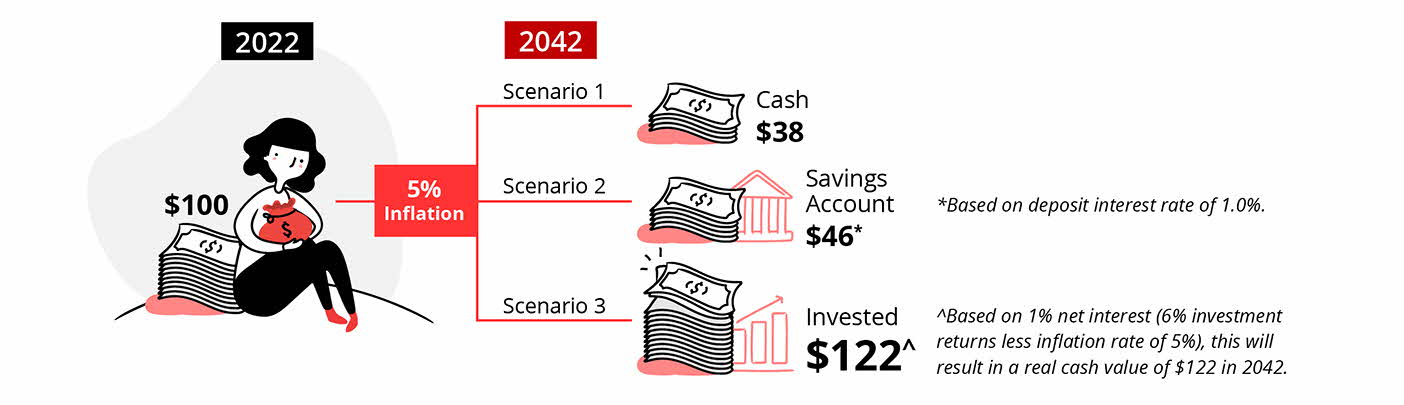

12. Don’t lose your cash to inflation by investing

The value of money declines more rapidly during periods of high inflation. The rate of inflation outpaces that of the returns earned on bank deposits, translating into negative real returns on cash. Excess cash, if uninvested, is at risk of seeing its value erode during periods of high inflation. Here’s an example of real value of money under 3 scenarios.

Here is a summary of the 12 key highlights from the report.

What can you do in this environment?

Here are 6 tips to guard against inflation and make your finances more resilient.

1. Review your expenses regularly

In today’s environment of rising prices, we are facing the reality of tightening our belts. The report has indicated that transportation, food, housing and utilities are the 3 key components hitting our wallets. So, it really helps to understand our individual spend habits. By doing so, we know which areas we can work on to reduce discretionary spend and enhance our financial situation to manage the uncertainties ahead.

Consider using the digital financial advisory tool such as the “Plan” tab within digibank app to help you keep track of your expenses and set up a budget that includes saving and spending targets. More importantly, make it a habit to review your expenses and make necessary adjustments.

With interest rates heading north, those who are servicing their home loan may consider refinancing or repricing to a more suitable mortgage, if they are out of the lock-in period. Do a cost-benefit analysis first and consult a home loans specialist. Home loan options include fixed-rate, floating-rate, or a combination of both.

For new home buyers, do refrain from over-leveraging and maintain adequate funds to tide through at least a year.

For homeowners experiencing tight cashflows during this period, consider paying off housing loans through your CPF OA account and maintain liquidity. You can always do a voluntary housing refund to your CPF OA in the future when your situation improves.

2. Shop wisely

Shopping wisely does not just mean shopping less, but instead making the most out of your necessary spending. 4 ways to do this include:

- Buying house brand products at supermarkets

- Bulk buying non-perishables if there is significant discount

- Purchasing second-hand items

- Looking out for sales and promos

This can also be done in indirect ways like using the appropriate payment cards to maximise your benefits. However, be sure to pay your bills in full and on time and to monitor your spending to avoid racking up huge debts from overspending or snowballing interest from late payments.

3. Inflation-proof your savings

While emergency cash should be kept liquid, keeping all of your savings in a simple savings account will not preserve your purchasing power, especially in a high inflationary environment.

Some possible instruments to consider for the more liquid and low-risk portion of a portfolio, include higher interest-yielding savings account like DBS Multiplier Account, Singapore Savings Bonds, money market funds or endowment insurance plans.

Beyond savings, you’d need to start investing your money for a better chance at beating inflation and achieving your life goals.

4. Start investing and adopt a long-term horizon

When it comes to investing, it is crucial to take a long-term approach and allocate a portion of your net worth towards investments. As a rule of thumb, at least 50% of your net worth (assets minus liabilities) should be invested.

An example of an investment product that can help you get started is DBS Invest-Saver, a regular savings plan (RSP). DBS Invest-Saver adopts a dollar-cost averaging (DCA) strategy by setting aside a pre-determined amount of savings for investing, each month. This allows you to accumulate your investments steadily instead of timing the market. It also reduces the impact of short-term market fluctuations on your portfolio.

You can also consider ready-made investment solutions like DBS digiPortfolio, which is powered by human expertise (team of portfolio managers) and robo-technology. The range of portfolios available through DBS digiPortfolio are meticulously screened and selected by the DBS Investment team. The team also monitors the market regularly to ensure alignment with DBS Chief Investment Officer’s (CIO) views.

Alternatively, get investment ideas on DBS’ research platform Insights Direct, where you can access award-winning and in-depth analysis of more than 500 stocks across Singapore, Hong Kong, China, Indonesia, and Thailand.

Tip: Follow Singapore Equity Picks, accessible through Insights Direct and one of DBS Group Research’s most-read products. It has generated a time-weighted rate of return of 14.51% in 2021 and has consistently outperform STI since its inception in July 2016.

5. Stress-test your financial plan

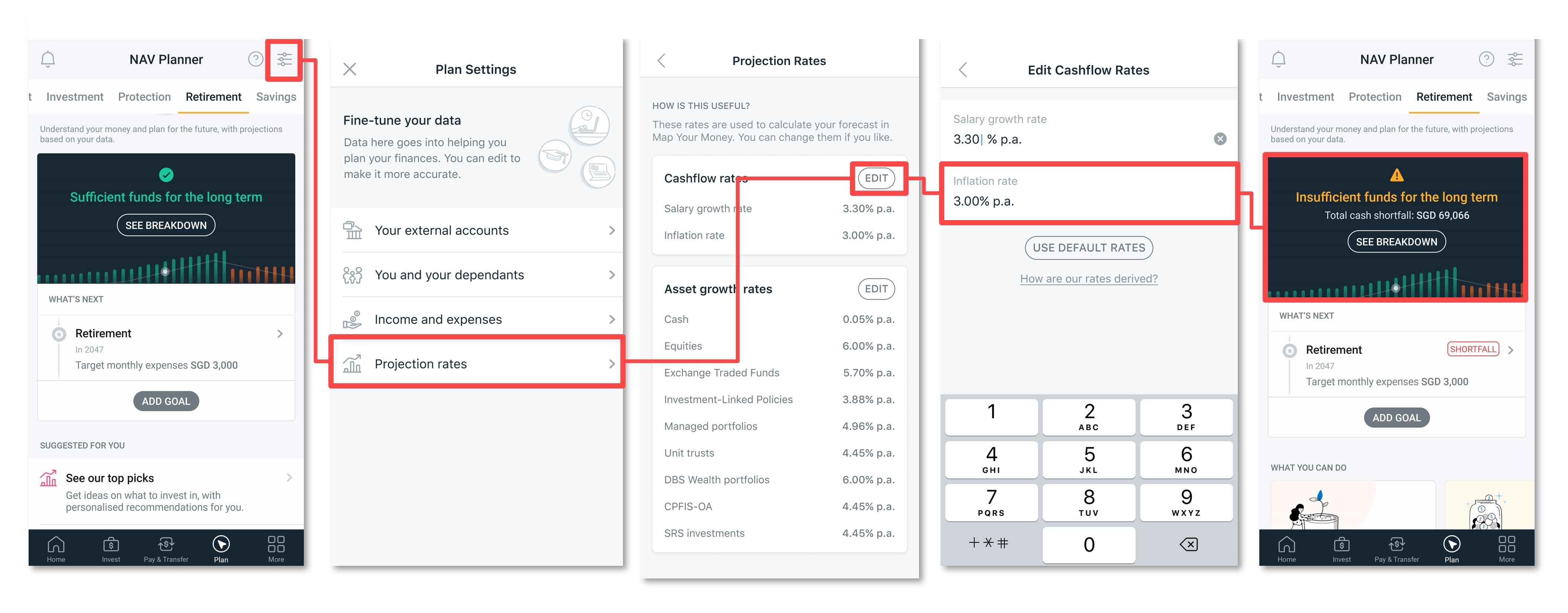

Most financial plans assume an inflation rate of 2% - 3% when projecting future income flows to determine retirement adequacy. Plan for higher costs of living by assuming different inflation scenarios of 3%, 4% or 5% and work out how these different rates impact your future cash flows and retirement planning. The Map Your Money feature under the” Plan” tab in the digibank app allows for different projections of inflation rates and investment yields, which is great for stress-testing your finances and identifying your gaps early for clarity.

6. Don’t forget about insurance!

The Covid-19 pandemic has increased awareness that taking care of ourselves and attending to our health is more important than ever. It may be tempting to cancel or reduce your insurance coverage to lower monthly expenses, but the last thing you want to worry about in a health crisis/accident is how you can pay for your medical expenses.

Going forward, healthcare and insurance spending will likely play a bigger role in our financial planning since inflation will increase healthcare costs as well.

As a guideline, we recommend our customers to have a suitable hospitalisation plan, a basic life cover of about 9 to 10 times your annual income, as well as about 5x your annual income in critical illness cover.

Note: On 1 April 2023, changes were implemented to the cancer coverage of Integrated Shield Plans (IPs). This change follows the adjustments for MediSave and MediShield Life since 1 September 2022 where only treatments that are listed on the Cancer Drug List (CDL) are covered.

Here is a summary of our 6 financial planning tips.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)