Manage your finances conveniently as a foreigner in Singapore – whether you are looking to send money home, cope with Singapore’s cost of living, or grow your wealth, we have a solution for you.

Before you begin

Are you looking to: |

||

|---|---|---|

|

|

Make payments within Singapore |

|

|

|

Withdraw money in Singapore |

|

|

|

Transfer money within Singapore |

|

|

|

Transfer money in and out of Singapore |

International Money Transfer |

|

|

Save money in Singapore |

|

|

|

Insure and Invest in Singapore |

|

|

|

Plan with DBS in Singapore |

|

Get your DBS Visa Debit Card

Why get a DBS Visa Debit card?

Shop in stores and online easily with your Debit card. Plus, you can also use it like an ATM card.

Find out where your nearest DBS/POSB ATM is.

Quick peek at the benefits |

||

|---|---|---|

|

|

Up to 4% cashback when you spend on online food delivery, local transport and in foreign currency. |

|

|

No foreign exchange fees for up to 11 popular foreign currencies. Simply primary-link your DBS Visa Debit Card with My Account. |

||

Smart ways you can use DBS Visa Debit Card |

|---|

|

Lock in best rates early by exchanging SGD to foreign currency before an overseas trip to hedge against rate fluctuations. |

|

Convert unused currency back to SGD effortlessly after your travels, no need to spend it all. |

Check out other benefits of having a DBS Visa Debit Card.

Apply with digibank |

||

|---|---|---|

|

To apply through your digibank mobile app: |

|

Want more deals with your debit card?

In Singapore, we say “Lobang” when describing a good deal or opportunity.

Fancy a good lobang? Check out our DBS Cards promotions here!

Find the perfect Credit Card for seamless shopping experiences |

|

|---|---|

DBS Altitude Card |

|

POSB Everyday Card |

|

DBS Vantage Card |

|

New DBS/POSB Credit Cardmembers (Foreigners) | |

|---|---|

To qualify for POSB Everyday Card or DBS Altitude Card, you’ll need to earn a minimum annual income of S$45,000. To qualify for DBS Vantage Card, you’ll need to earn a minimum annual income of S$120,000.

| |

| 1 Required Documents | 2 Salaried Employee (length of employment more than 3 months | 3 Salaried Employee (length of employment less than 3 months) | 4 Variable/ Commission-based Employees/ Self-Employed |

|---|---|---|---|

| a) Valid Passport (with at least 6 months validity) | ✔ | ✔ | ✔ |

| b) Employment Pass (with at least 6 months validity) | ✔ | ✔ | ✔ |

| c) Latest Income Tax Notice of Assessment | ✔ 1 year | ✔ 2 year | |

| d) Latest computerised payslips | ✔ | ✔ d) or e) | |

| e) Company letter certifying employment and salary in SGD (dated within last 3 months from date of card application) + Copy of Staff Pass | |||

| f) A copy of your Telecommunication or Utility Bill (For new DBS/POSB Bank customers only) | ✔ | ✔ | ✔ |

Want more deals with your card?

In Singapore, we say “Lobang” when describing a good deal or opportunity. Fancy a good lobang? Check out our DBS Cards promotions here!

Shop like a local with DBS PayLah! App

Whether you’re getting tickets for the latest movie, booking a ride, or ordering meals, you’re guaranteed to enjoy exclusive offers and be rewarded in many ways with PayLah!

Get your PayLah! App today and shop like a local.

Get S$5 when you download and register with promo code ‘FIVELAH’ from now till 31 December 2025. For full terms and conditions, click here.

Download and register today.

You will need to have DBS/POSB digibank account and deposit account in order to sign up for PayLah!

Instant transfers with PayNow |

|

|---|---|

|

With PayNow, you can:

All you need to do is to register for PayNow and check if the other party has registered with PayNow. |

Transfer money in and out of Singapore with ease

Find out more about how DBS Remit can help you with your overseas transfer needs.

|

Quick peek at the benefits:

|

To mark Singapore’s 60th birthday this year, we’re rewarding you with up to S$60 cashback1 on your first overseas transfer with DBS Remit using promo code NEWREMIT:

- Transfer at least S$300 to enjoy S$12 cashback!

- Transfer at least S$1,500 to enjoy S$60 cashback!

Follow 3 easy steps to send with zero fuss.

Save time anytime with hassle-free sending:

Tap Overseas Transfer

Enter amount and recipient

Review and Send

Bank Name

Account Number

Recipient’s Full Name

- For transfers to individuals: Do not use nicknames or short form names for Individuals.

- For transfers to individuals with long names or corporations: If there is insufficient space, you may use the Full Address field under Recipient Details to continue filling in the recipient’s full name.

Recipient’s Address

- Located in

- Full address

- In the city of

To receive funds from an overseas party, provide the sender with the following details:

- Your name that you used to open your DBS/POSB Account

- Your DBS/POSB Bank Account number

- Name of Beneficiary Bank: DBS Bank

- Address of Beneficiary Bank: 12 Marina Boulevard, DBS Asia Central, Marina Bay Financial Centre Tower 3, Singapore 018982

- Country: Singapore

- SWIFT Address/Code: DBSSSGSG

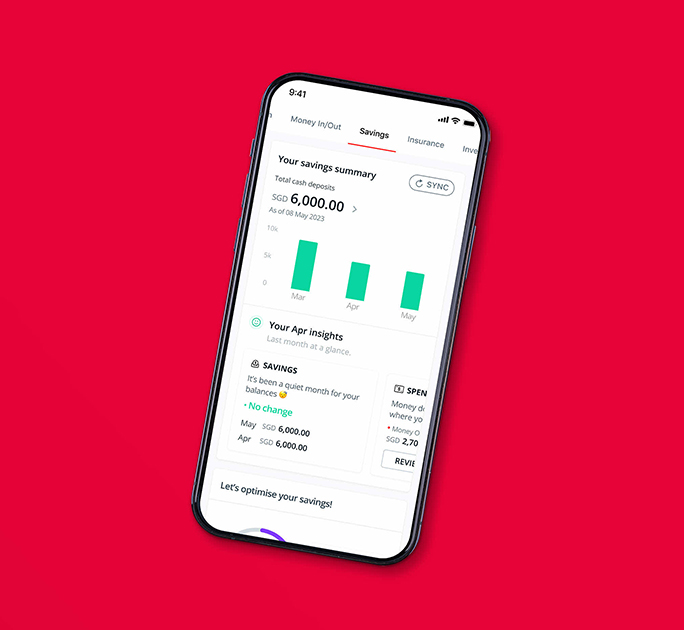

Use DBS Multiplier to level up your savings game |

|

|---|---|

|

|

Why it's great:

To apply through your digibank mobile app: |

Looking to wealth accumulate & diversify? |

|

|---|---|

|

Manulife InvestReady (III)Consider Manulife InvestReady (III), an investment-linked insurance plan offering access to a diverse range of curated funds to build and diversify your portfolio. Make your money work harder with welcome bonus, annual premium bonus2 and loyalty bonus3 in the form of additional units. |

Looking for a regular stream of income? |

|

|---|---|

|

Manulife IncomeSecureConsider Manulife IncomeSecure that provides yearly income that last for generations, starting from as early as end of policy year 3.

|

|

Manulife IncomeGenConsider Manulife IncomeGen, a whole life insurance plan that gives you monthly payouts.

|

Apply now

Chat with our friendly Wealth Planning Managers now. (This chat service is available from 9am to 6pm on Mon to Fri, excluding Public Holidays.)

Alternatively, you may leave your contact details and we will get in touch soon.

Don't let travel worries hold you back, get TravellerShield Plus today

TravellerShield Plus just got enhanced! The miles and hotel loyalty points that you have painstakingly collected are now covered under Premier and Platinum plans, in the event of journey cancellation. Also, add on our FlySmart Flight Delay Cover and be automatically compensated for flight delays from 30 minutes.

Find out the latest promotion now.

Investing your money - Key points to consider

- ✓ Determine your risk appetite & work out your investment outlay.

- ✓ Understand the pros and cons of each investing approach - Do-It-Yourself (DIY) or Leave it to the Experts.

- ✓ Tap on available research and analysis.

Ready to kickstart your investment? |

|

|---|---|

|

Unit TrustsConsider Unit Trusts, which are professionally managed funds to help you grow your wealth. Invest with ease by tapping on the rigorous research and expert analysis done by the DBS Funds Selection team. |

|

DBS VickersConsider DBS Vickers to trade in 7 key markets.

|

|

|

digiPortfolioConsider digiPortfolio, the simple way for you to invest from a variety of ready-made portfolios, wherever you go.

|

Apply now

Chat with our friendly Wealth Planning Managers now. (This chat service is available from 9am to 6pm on Mon to Fri, excluding Public Holidays.)

Alternatively, you may leave your contact details and we will get in touch soon.

Starter guide to Simple Banking

Download our bilingual (English and Chinese 中文) guide on how to enjoy 24/7 convenience with the digibank app! We have it in mobile and desktop versions.

Need more help?

Check out our Help & Support page which you may find useful guides.

Terms and Conditions

1 To be eligible for the promotion, the customer must use promo code “NEWREMIT” when making a DBS Remit service via digibank online or digibank mobile and has not performed any DBS Remit service or online outward overseas funds transfer (“DBS Remit”) via digibank online or digibank mobile within the last 12-months.

2 A one-time Annual Premium Bonus will be given for selected MIP options if the first basic premium is paid via annual premium payment mode. If there is any change in mode of premium payment from annual to non-annual during the premium shortfall charge period, the Annual Premium Bonus will be deducted from the account value.

3 Loyalty Bonuses vary in accordance with the MIP selected and is not applicable to MIP 5 Years Flexi 4.

4 Yearly income consists of guaranteed and non-guaranteed yearly income.

5 Lifetime monthly income consists of guaranteed and non-guaranteed monthly income. Guaranteed monthly income is equal to 0.81% of the sum insured divided by 12. Based on the illustrated investment rate of return of 4.25% p.a., non-guaranteed monthly income is equal to 2.43% of the sum insured divided by 12. Based on the illustrated investment rate of return of 3.00% p.a., non-guaranteed monthly income is equal to 1.17% of the sum insured divided by 12.

Please visit the official DBS Website for full Terms and Conditions.

Disclaimers – TravellerShield Plus

TravellerShield Plus is underwritten by Chubb Insurance Singapore Limited (“Chubb”) and distributed by DBS Bank Ltd (“DBS”). It is not an obligation of, deposit in or guaranteed by DBS. This is not a contract of insurance. Full details of the terms, conditions and exclusions of the insurance are provided in the policy wordings and will be sent to you upon acceptance of your application by Chubb.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation ("SDIC"). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Chubb or visit the General Insurance Association or SDIC websites.

Information on this page is correct as of 25 Mar 2025.