DBS Balance Transfer

Promotions

Frequently Asked Questions

Two easy ways to relax your finances with DBS Balance Transfer

1. Tap into your unused credit limit for cash

Cash out unused credit limit from your DBS/POSB Credit Card or Cashline into your DBS/POSB Savings Account.

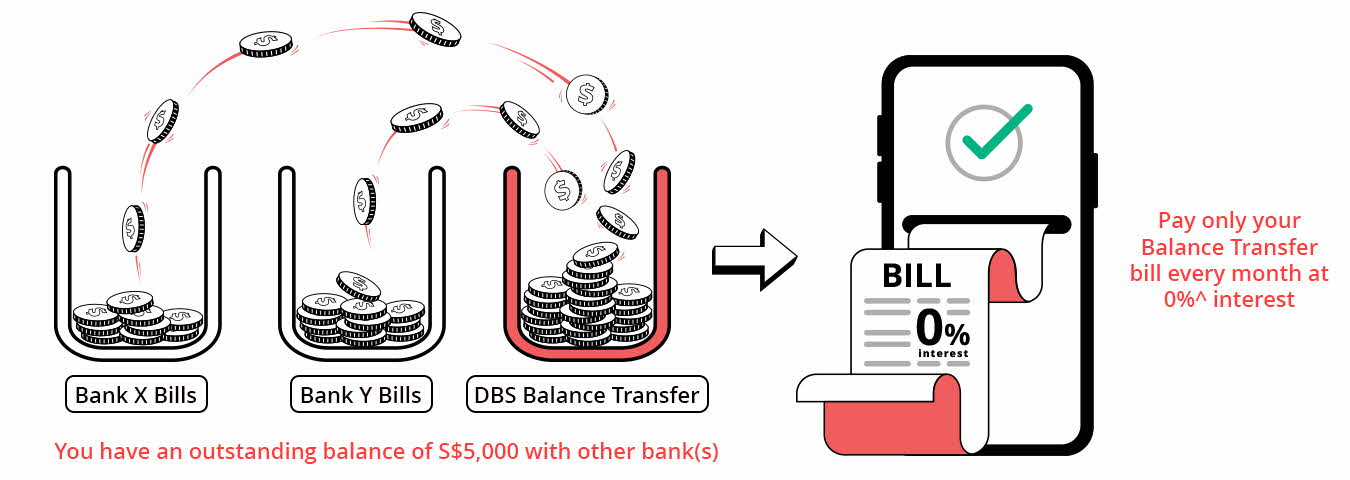

2. Consolidate outstanding balances

Use the funds to pay off balances from other banks to avoid rolling interest.

Here’s an illustration of how much you could save with Balance Transfer

| Bank XYZ | DBS | |

|---|---|---|

| Outstanding amount: | S$10,000 | |

| Tenure | 12 months | |

| Interest | 24% | 0% |

| One-time administration fee1 | - | 4.5% |

| One-time administration fee amount | - | S$450 |

| Interest | S$2,400 | $0 |

| You could save S$1,950! | ||

This is an example based on a 24% p.a. interest rate charged by other banks on credit card balances over 12 months.

You will receive an SMS and the approval letter to your mailing address registered with the bank.

You can apply up to 93% of your available credit limit. You may apply for multiple Balance Transfer as long as there is available credit limit.

There must not be any credit balance (excess payment – i.e. your available credit limit is more than your assigned credit limit) or GIRO arrangement in all your Credit Card or Cashline account for Balance Transfer application.

Learn how to transfer your credit balance from Cashline to your own DBS/POSB Savings account here.

You may refer to your Cashline or Credit Card monthly statements or log in to Mobile banking (applicable for Cashline only).

Yes, you can repay your Balance Transfer early with no early repayment fee. There will be no rebate of the one-time administration fee.

Minimum Payment:

- For Credit Card(s) - 3% of your total outstanding balance, or S$50, whichever is higher

- For Cashline account - 2.5% of your total outstanding balance, or S$50, whichever is higher.

The outstanding amount on your Balance Transfer is included in your total outstanding amount.

It is recommended to apply for a Balance Transfer on your Cashline or a Credit Card (with the least usage), to keep your repayment separate from your regular spending.

Tips: Trying to understand your statements? Here’s the guide for Credit Card and Cashline.