Which type of investor are you?

![]()

If you’ve only got a minute:

- Investors must understand their financial goals, risk tolerance, time horizon as well as the investments they plan to undertake by doing their due diligence.

- Investments that carry higher risks often offer higher potential returns as compensation for the higher risk undertaken.

- Knowing your investor profile helps you in your investment decision making process.

![]()

We live in a world with such a myriad of options that we can end up facing choice paralysis in our day-to-day decision making. From something as trivial as choosing what to have for lunch, to weightier decisions like what jobs to apply for, choice paralysis is often experienced in many areas of our lives.

This paradox of choice not only causes some level of anxiety but takes up excess time in decision making and can hinder us from taking necessary action.

We already know the importance of investing our savings so that it can keep pace with inflation and help us achieve financial goals. Yet many are held back by the sheer number of choices available to us.

The first step to overcoming this is to learn about your own financial goals, risk tolerance and what type of investor you are. You can then narrow your options accordingly and be in a better position to make the right decisions.

Understand your financial goals, time horizon and risk appetite

Your financial goals and when you want to reach them determine your investment time horizon. These goals, which can be loosely categorised into short-term, medium-term, and long-term aims, will affect how you approach your investment choices.

Short-term goals

These are priorities that need to be achieved within 2 years, such as repaying a personal loan.

For short-term goals, it is vital to set aside a fixed amount of savings regularly and focus on capital preservation. You can make use of principal protected products like fixed deposits or Singapore Savings Bonds (SSBs) to give your savings a leg-up.

If your risk-tolerance allows for it, you can invest through unit trusts or exchange-traded funds (ETFs) to potentially help you meet your short-term goals sooner.

Medium-term goals

Such goals are priorities that you want to achieve within 2 to 10 years, such as saving for the down payment on a home or family planning.

To achieve these goals, you can invest in products that adopt a mid- to long-term focus when selecting underlying assets.

Keep an eye out for market opportunities that may arise from time to time, while avoiding knee-jerk reactions to market events. If you want to invest individual stocks, remember to do your due diligence and also conduct fundamental analysis to help you determine if the investment has growth potential in the mid- to long-term horizon.

Long-term goals

These are priorities that you want to accomplish further in the future (10 years or more) like planning for your ideal retirement. Consider what your desired retirement lifestyle will be like and put on a long-term lens when you make investment decisions.

Regardless of whether your goals are short-, medium-, or long-term, it is important to conduct regular reviews to ensure that you are on track to meet your goals. If you aren’t, do recalibrate your approaches as necessary.

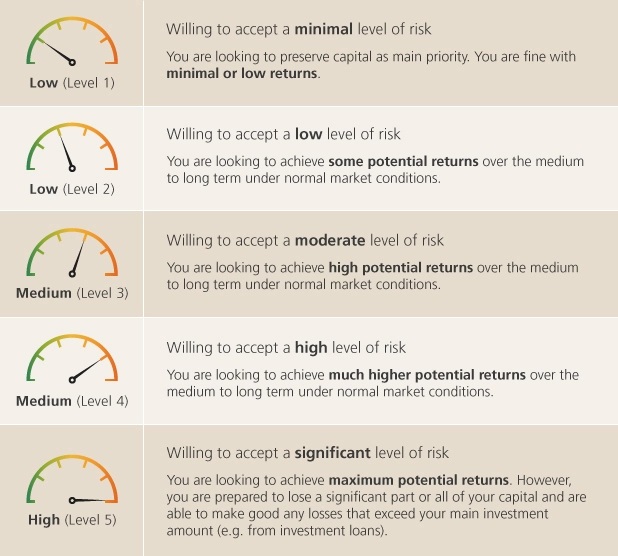

Risk appetite levels

Being aware of your risk appetite is essential as it helps you decide whether the projected returns of an investment is sufficient to make up for the risk you are taking. With higher risk investments, you get higher potential returns but this is accompanied with higher volatility.

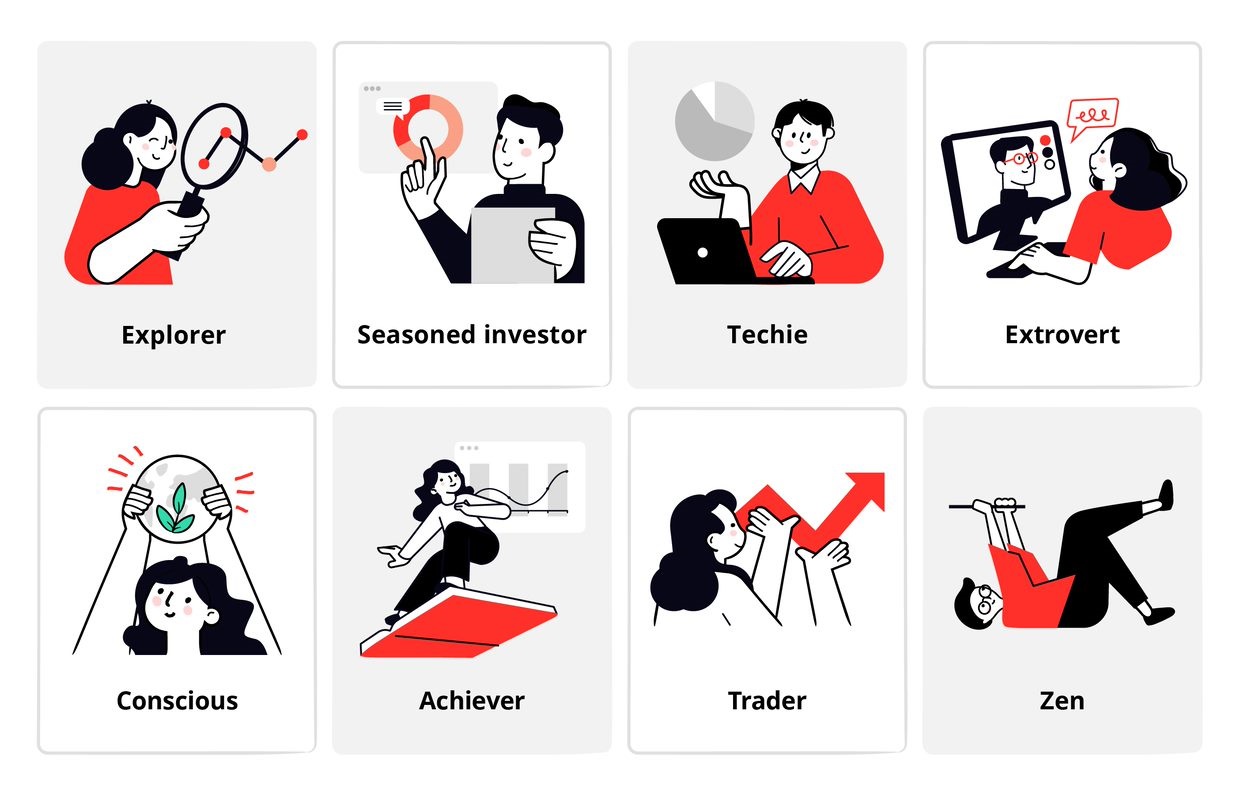

Understanding what kind of investor you are

Identifying your investing traits can aid in your decision as to what type of investment solutions best suit you.

While it is hard to pigeonhole each investor into specific categories, here are 8 general profiles. Which ones do you relate most to?

1. The explorer

You may be new to investing for a variety of reasons. Whatever they may be, the key is to do your research, understand your investment objectives, risk tolerance, time horizon, and most importantly, to begin!

There are a vast number of investment solutions available in the market and you should only implement those you understand, avoiding overly complex strategies or products.

A common way to ease yourself into investing is to start with pooled investment products like unit trusts or exchange-traded funds. These offer diversification which helps to stabilise your portfolio. When you have more experience with choosing investments, you can then consider adding individual stocks to your portfolio.

| Read more: | I’m ready to invest, how can I start? Taking the emotions out of investing |

2. The seasoned investor

As an investor who has “been there and done that”, you’re likely to have been through a few market cycles. You may have even grown a sizeable investment portfolio to meet your financial goals during this period!

Remember to rebalance your portfolio regularly to ensure your investments are performing in line with your goals. If you already have a core portfolio in place, one strategy you can consider employing is the core-satellite approach. Another alternative is the barbell strategy, which has been advocated by DBS Chief Investment Office (CIO) since August 2019

| Read more: | Understanding and riding market cycles What is a core-satellite portfolio? An introduction to the Barbell Strategy |

3. The techie

You are comfortable with technology and digital platforms, and feel right at home when it comes to researching, analysing, executing, and managing your investments.

Investing can be a breeze when you use a digital platform that provides a one-stop experience. Look for one that can facilitate seamless funds transfers, trade placements, and even generate research information and solutions tailored to your investment goals.

An example is the DBS digibank app which offers a comprehensive solution, allowing you to save, plan and invest your money on the go.

When used in conjunction with the Singapore Financial Data Exchange (SGFinDex), it consolidates your financial information across different participating financial institutions, insurers, CDP, CPF Board, HDB and IRAS to give you greater clarity on your financial position.

It also includes a “Make Your Money Work Harder” feature which is backed by DBS investment experts. After you answer a few simple questions, it then helps to recommend investment options based on your personal goals, risk tolerance and financial position.

Read more: Plan your finances entirely online with digibank

Find out more about: Connect all your finances with open eyes

4. The extrovert

You want to be heard and understood, and prefer a personal touch from an insightful financial advisor. Someone trustworthy who listens and takes time to understand your goals and preferences before offering investment advice or product recommendations is greatly appreciated.

It is important that you are comfortable with the credibility and track record of your advisor, and that he or she gives you confidence by doing the necessary financial needs analysis while conducting regular reviews of your portfolio.

If this resonates with you, you can speak to a Wealth Planning Manager to explore your financial health and investment objectives.

Read more: What to look for in a financial advisor

Find out more about: Let us help you plan your finances in the comfort of home

5. The conscious

Environmental, social and governance (ESG) factors of an investment is a big thing for you. While financial return is imperative to you as an investor, you also consider a company's values and its ability to benefit the society and environment.

When choosing what to invest in, look for businesses or funds that have a socially responsible mandate or a specific focus in impact investing.

Examples include companies that contribute to sustainable decarbonisation, renewable energy, food and waste management, among others.

One simple way to play your part in sustainability initiatives is through DBS LiveBetter, available on the DBS digibank app. It allows you to track and offset your carbon footprint, invest and give to sustainable causes, and gain access to tips on eco-friendly living – all in one convenient place.

Read more: Understanding ESG investing

Find out more about: DBS LiveBetter

6. The achiever

While all investors aim to grow their funds, the achiever’s top priority is on making the highest profits from investments. It is possible to do this while still choosing socially responsible causes to invest in.

Since achieving high returns is the aim, it is likely that your investment portfolio will have a good mixture of growth stocks and under-valued stocks. This can also mean that your overall portfolio risk leans toward the higher end of the spectrum.

Thus, it is important to ensure sufficient diversification to protect it against potential market fluctuations.

You must also have an awareness of the fees incurred in managing your portfolio as these may take away from your potential returns.

| Read more: | Diversify to help manage investment risks Understanding investment fees |

7. The trader

Investing is a fun and hands-on activity to you. You enjoy devoting your time to watching the markets, analysing companies, and trading actively to take advantage of market opportunities.

Even for highly experienced professionals, it is not easy to pick the most opportune time to enter the market. As such, you should be aware of the high risks (and potential losses) that come with trading and be diligent in staying attuned to what is going on in the financial markets.

It is also beneficial to balance out your short-term trading portfolio with some longer-term and well diversified investments.

Read more: Understanding and riding market cycles

Find out more about: DBS Vickers Online Account

8. The zen

‘Chill’ is your favourite word. You prefer to sit back and leave it to the experts. It gives you peace of mind to let someone more experienced take the wheel in portfolio building.

Thankfully, there is a wide range of pooled investment instruments like unit trusts, exchange-traded funds (ETFs) and even robo-advisors available these days.

While you do not have to worry about which underlying investments to pick, you still need to have discipline, time, and patience in your overall investment approach.

Read more: Discipline, time, and patience in investing

Find out more about: DBS digiPortfolio

Time to begin

Having a clear understanding of yourself and your affinities can help you better choose investment products that are suited to your needs and beliefs.

The 8 profiles explored are just a guide to help you think about where you stand in your investment preferences. Most of us will identify with more than one of them.

As Albert Einstein said: “Nothing happens until something moves.”

Is it time to start your investment journey, or explore ways to rebalance your portfolio?

Make your move today.

Ready to start?

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on digibank to receive specific investment picks based on your objectives, risk profile and preferences.

Invest with DBS Invest with POSB

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)