Trade Finance - Tricks of the Trade

Small and medium enterprises (SMEs) like yours now face incredible opportunities for growth, with increasing global trade lowering more barriers.

According to the 2021/2022 trade outlook by ESCAP[1], the increase in Asia-Pacific exports and imports are estimated at 23.1% and 22.8% respectively, outperforming the rest of the world. That said, international trade still comes with its own set of risks. To trade beyond your borders, you need a cushion against the unpredictable; this is where trade finance and trade financing instruments can help.

Trade finance solutions are different from your run-of-the-mill business loans and are better at guarding against the inherent risks associated with international trade, while addressing the differing needs of importers and exporters. Compared to business loans, trade finance solutions offer a more SME-friendly way of optimising cashflow for your business —a win-win scenario.

However, given the complexities and the number of solutions available in the market, how can SMEs like yours know the first place to start? In three minutes, you can learn all you need to know about the basics of trade finance in the following section.

What is trade financing?

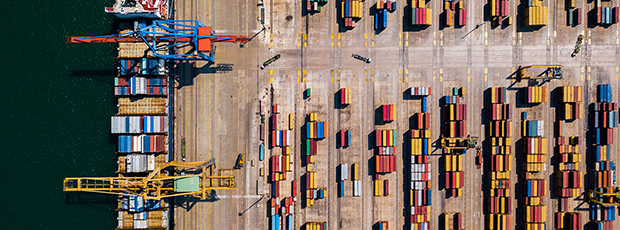

To put it simply, trade finance refers to financial instruments offered by banks, FinTech companies, and other financial intermediaries to help facilitate international trade and commerce for companies[2]. Trade finance is particularly useful for businesses that experience a time lag between providing goods and services and actually receiving the final payment from the buyer – typically businesses that rely on global shipments, such as manufacturers, and traders engaged in cross border trade by way of exports or imports.

Benefits of trade financing for SMEs

SMEs that take up trade financing can tap a number of benefits that simply aren’t available to other businesses that only rely on business loans, or don’t pursue any financing solutions at all. These perks include:

1. More growth opportunities. International trade opens new opportunities that previously might not have been available to SMEs. For example, it can accelerate expansion into new and existing markets to drive revenue and market share. Effective cash flow management can also free up capital to reinvest into the business. These opportunities can be locked in by mitigating risk through trade financing instruments and increased working capital offered by trade finance. Business owners can exert greater control over their day-to-day running costs, while growing and fulfilling larger orders that would normally be too risky.

2. Increased trust between importers and exporters. Trade finance allows SMEs to strengthen relationships with one another, because tapping a bank’s financing solutions and risk mitigating instruments offers a safe and secure space for them to conduct imports and exports.

3. Greater efficiency and productivity. Working with international players allows SMEs to diversify their supplier network, which makes them more competitive and drive efficiencies in markets and supply chains. Trade Financing ensures better management of cashflow through early receipt of payment or extension of repayment period.

Types of trade financing

There are many types of trade finance solutions in the market; which one you end up choosing depends on your business need. These are some of the popular trade financing solutions you can leverage.

| Letters of Credit | |

| A letter of credit is issued by the buyer’s bank to the seller through the seller’s bank, to guarantee the buyer's payment, upon presentation of complying documents evidencing shipment of goods or services provided as per agreed terms. While undertaking business with buyers in countries and/or Banks that are perceived to be carrying a higher risk, the seller may request for additional risk mitigation by requesting his own or any other Bank (usually in his own country) to add confirmation to the letter of credit issued by the buyer’s Bank. The confirming Bank then assumes and underwrites the payment and country risk of the issuing Bank so as to protect the seller from these elements. Having a letter of credit can alleviate any concern either party might have relating to the risk of non-payment or its creditworthiness. It is therefore widely used as a trade financing instrument in international trade. |

| Import Financing | |

| Import financing solutions provide immediate funding for importers to purchase goods. In a general trade life cycle, it may take some time to complete the cycle from purchase, production, sale to delivery and conversion to cash thereafter. Import financing helps importers bridge this gap and enhance their cash flow. An example of an import financing solution is purchase invoice financing, where importers can seek funding to pay the supplier on time while at the same time enjoy an extended credit term from the bank. They can also choose to get funding in local currency if their sales proceeds are in local currency. |

| Banker’s guarantee/ Standby letter of credit | |

| A banker’s guarantee is exactly what it says: a guarantee from a bank, on behalf of a company, to make payment to the beneficiary upon receipt of their claim stating that the company is in breach of their obligations. A guarantee provides peace of mind to the beneficiary and provides assurance of the contractual obligations of the parties. Banker’s guarantee and Standby Letters of Credit are used in a variety of situations e.g., securing rental obligations, providing performance assurance for projects etc. |

| Export financing | |

| The financial pressures on export trade businesses are very specialised—and call for export financing solutions that cater to their specific needs. Businesses can use export financing to free up working capital from overseas transactions, increase trust between trading partners, and gain leverage for further growth. For instance, businesses selling to overseas markets can ask potential overseas buyers to provide an Export Letters of Credit (LCs) issued by their local bank. Export LCs can reassure trading partners that any risks of non-payment will be covered by a trusted bank. To free up capital that might otherwise be locked up in invoices or accounts receivables, businesses can either secure sales invoice financing that provides a quick cash advance by submitting unpaid invoices to the bank; or Accounts Receivable Purchase (ARP) services that purchase a business’ receivables to help unlock fast access to working capital of up to 90% of the receivables’ value. For more on export financing, read our article about trade finance services that can help SMEs grow. |

Get the most out of your business with trade finance

Trade finance might seem like a complex subject given the intricacies of international trade. In reality, trade finance solutions make trade simpler and more accessible, thanks to its ability to reduce or mitigate risk. You can now digitally submit trade finance documents and other supporting materials for your applications using the new Document Upload feature on DBS IDEAL.

The right guidance from banking partners like DBS can help SMEs adopt suitable trade finance solutions to minimise risk and grow their business beyond borders.