Skip the Hassle - Open a DBS Corporate Account Online Now!

A customer’s first-hand experience opening a DBS account online

Credits: Vulcan Post © Permission required for reproduction.

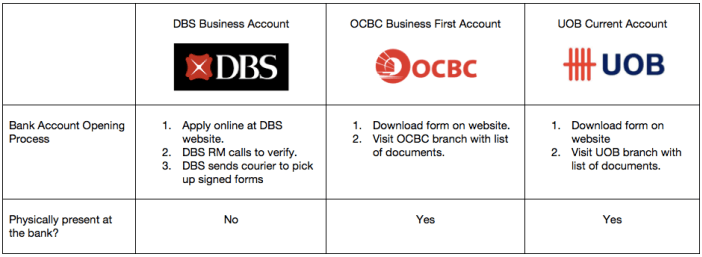

It is intuitive for new business owners to head down physically to the branch to set up their corporate account. However, most don’t realize that you can actually skip the queue and apply for your corporate account online with DBS. In fact, DBS is waiving off the set-up and monthly subscription fees of their corporate Internet banking platform and mobile app for those who apply online. The DBS website also states that this amounts to up to $390 per year in savings.

Those that benefitted from this will tell you that all you need is 5 minutes and your laptop and you can cross out “setting up your business account” from your to-do list. Based on our previous analysis on which is the most value-for-money corporate account to get, we decided to give DBS a shot. And this is our experience. Here is the 4-step process that we went through to set up our business account:

Step 1: Apply Online At DBS Website

Visit the DBS SME Banking website. Make sure you know your business registration number (BRN), which can be obtained from your ACRA report, the currency you want to operate in, the number of cheque books required, your business details as well as the authorised signatories.

Once we submitted the form, we then received an email with a copy of the completed form so we could double check and make sure that the information we provided was accurate.

Time Spent: About 5 minutes.

Step 2: DBS RM Calls To Verify

A DBS relationship manager then called the next day to verify the account details, again, to ensure that all the details are accurate to save us from any future hassle that may arise because of wrong information. During the call too, the relationship manager ran through the list of documents they needed from us, including the bank opening application forms, certified true copies of proof of residential addresses, as well as certified true copies of IC for all authorized signatories.

DBS then arranged for a courier to pick them up from our office.

Time Spent On Call: 10 minutes

From their website, it looks like they also do FaceTime calls for account verification. And that’s pretty neat. Image source: DBS SME Banking website

Step 3: DBS Courier Pick Up

At the time slot which we set up with DBS, the courier came to collect the documents from us.

Step 4: Bank Account Set Up And Corporate Internet banking Security Tokens.

After two days, we received a confirmation email from the DBS relationship manager informing us of our account number. The IDEAL corporate Internet banking security tokens along with the passwords arrived via mail and we were officially in business! We also received our Visa Business Advance Plus Debit Card along with all the documents.

Concluding Remarks

All in all, our corporate banking application with DBS was a simple and hassle-free process, and we didn’t need to be physically present at the bank to join the long queues. The phone call verification was also a great way to save time.

So for fellow business owners who are thinking of setting up a business account, DBS offers a much more convenient way of account set up, at least in our opinion. If you would like a comparison of the various corporate banking accounts, check out our earlier article to learn more.

The post Our Corporate Bank Account Application And Opening Only Took 5 Minutes. Here’s How We Did It. appeared first on Dollars And Sense.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?