An SME's Experience on Business Loan Application on Top 3 SME Banks in Singapore

Vulcan Post Is Expanding! Here’s Our Experience Applying For A Loan At Singapore’s Top 3 SME Banks

Credits: Vulcan Post © Reproduced with permission.

With our team of sister publications (and ourselves) having grown significantly, we vacated our old premises in the heart of Tanjong Pagar, and have officially moved into a larger space in the east side of Singapore!

And as with any expanding business, we are definitely on the lookout for SME loans to help us in our time of transition, as we deal with a larger team, as well as the upkeep of a larger office and studio.

Having written much about the startup scene in Singapore, we know more or less who to turn to when getting a loan.

Here's what we experienced when approaching 3 of them.

DBS vs. OCBC vs. UOB

We had 3 choices of banks to get our loans from - DBS, OCBC, and UOB, all reputable banks in Singapore that you would have undoubtedly used for personal banking.

But how do they stack up when it comes to business banking?

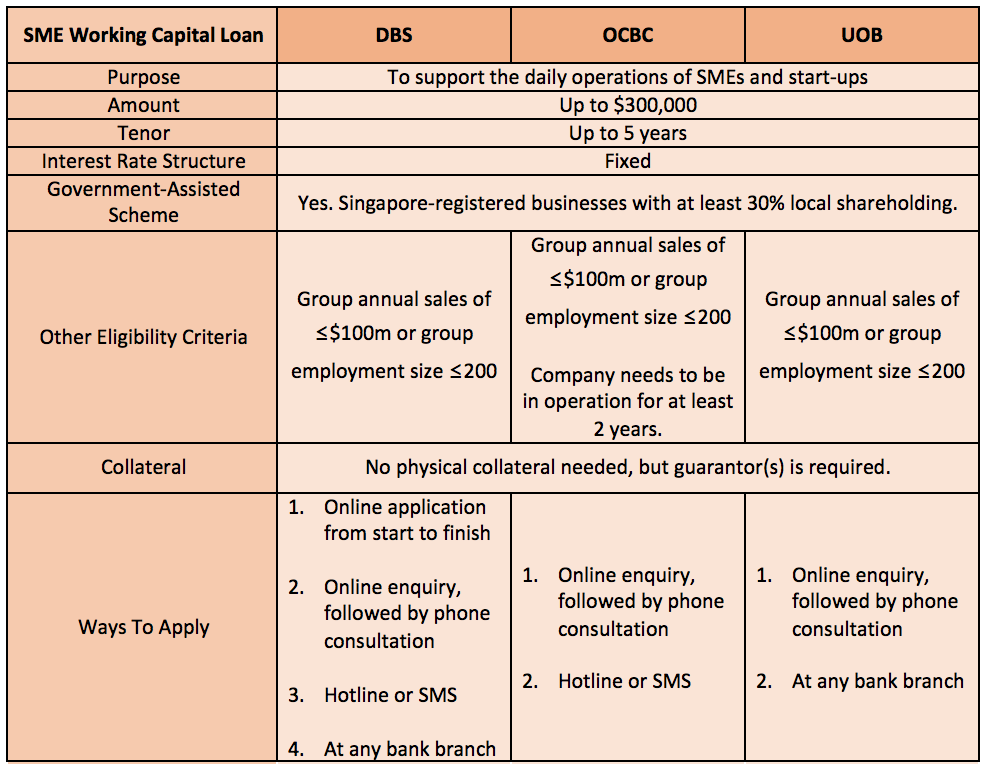

The table below is a summary of the information that we could find about the SME Working Capital Loans that the 3 banks offer.

Comparison of their SME loans

As you know, the SMEs and startups of today are very tech-dependent - we're no different, and we expect banks to be the same.

Unfortunately, it seemed like only one bank was able to offer a fully online application process, but for the sake of a fair comparison, we decided to try our luck at the other 2 banks as well.

But given that OCBC and UOB were pretty similar in terms of their application process, we figured that we'd just go with the former, since we meet their minimum operational requirement of 2 years.

Our other choice was DBS.

Here's how they fared.

The Application Process

Since we had already narrowed the choices down to DBS and OCBC, we checked out the actual online application process for both, starting with the former.

DBS

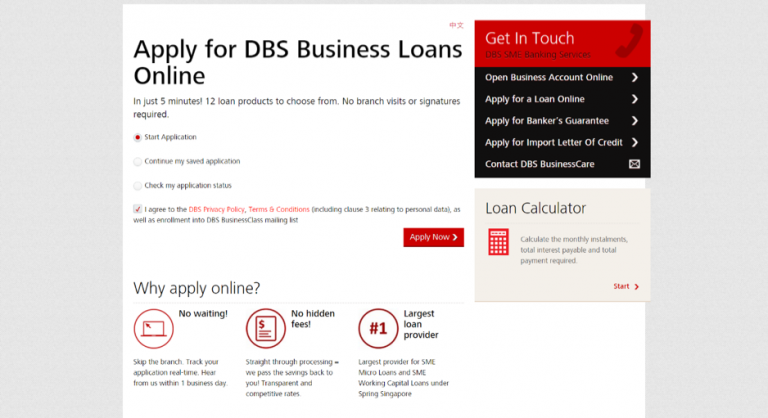

When we accessed the website, 3 things immediately hit us:

- DBS is Singapore's largest provider for SPRING's SME Micro Loan and SME Working Capital Loan

- They offer attractive rates online due to less manual processing

- Apply online and get in-principle loan approval within the next business day

The path to getting a loan started by clicking on the big red Apply Online Now button.

At the first step, we encountered three options - starting a new application, continuing from a previously saved one, or checking on an application's progress.

Getting started on DBS' loan page

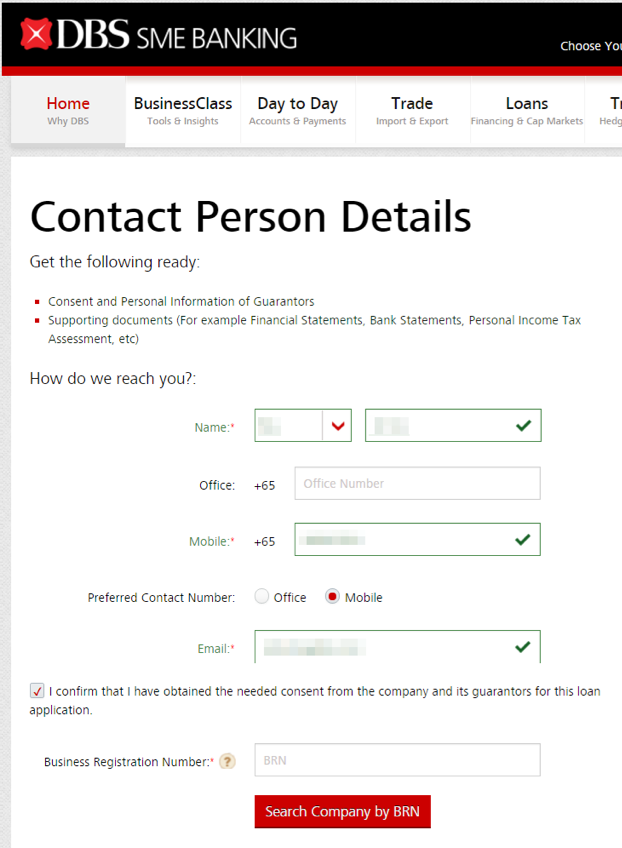

The next screen was where we filled in our personal details, as well as the company's Business Registration Number.

Filling in our contact details

After entering all the contact details, we received a confirmation email and an SMS acknowledging that the loan application was being initiated.

The confirmation page

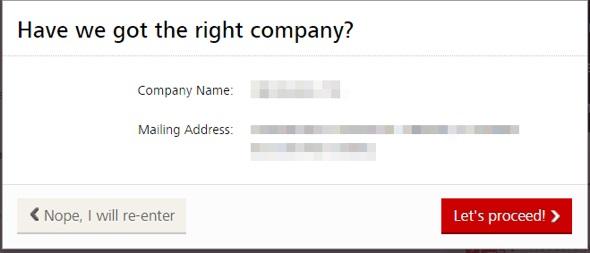

When we keyed in our Business Registration Number (BRN), one feature that stood out was that the form automatically became populated with our company's information, saving the time taken to key in additional information.

Past that, and various loan options are presented, allowing us to choose the loan product we were applying for.

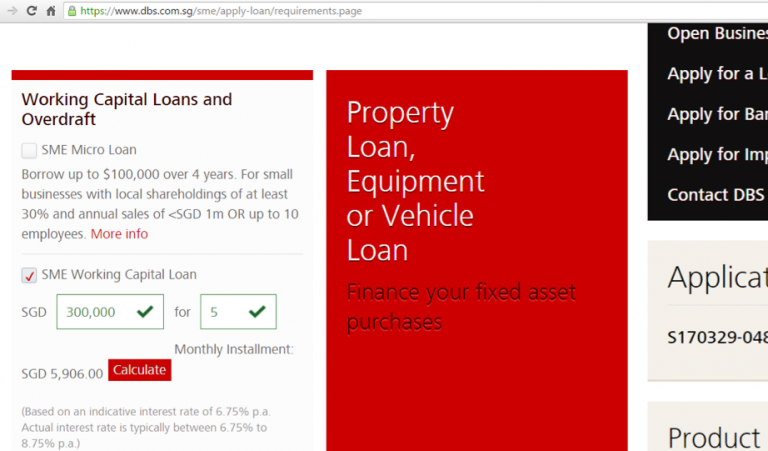

When selecting the loan type, we were able to calculate the monthly instalments based on how much we wanted to borrow, and for how long using the free business loan calculator.

We tried maxing out the SME Working Capital Loan at $300,000 for 5 years, and it worked out to be a monthly repayment of $5,906.

Checking out our monthly repayment

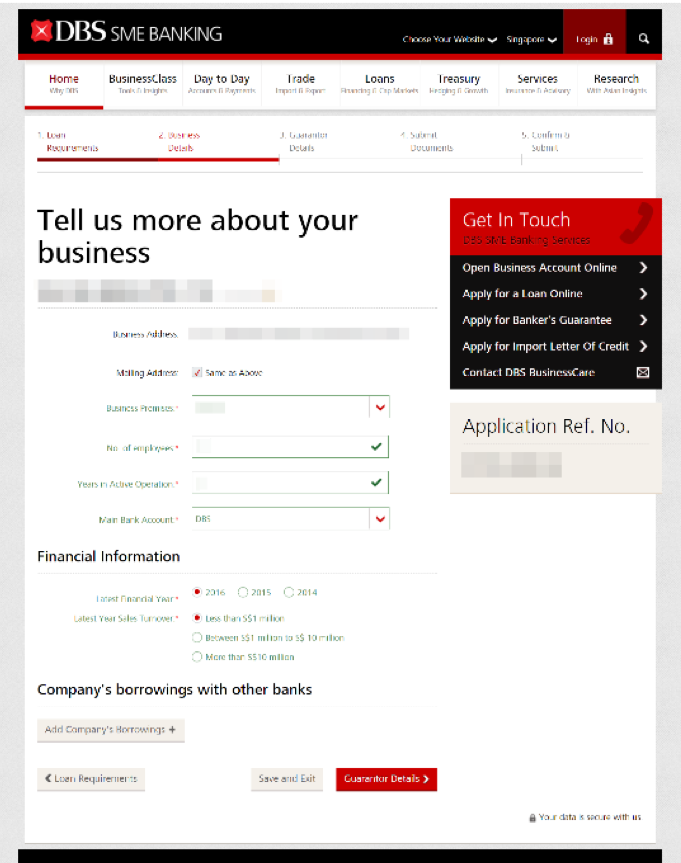

Moving along, more specific financial details like the company's sales volume and current borrowings with other banks also need to be keyed in.

Then, loan guarantors would need to be appointed, and the names could easily be selected from ACRA-listed partners/directors and/or major shareholders of the company.

Keying in our company details

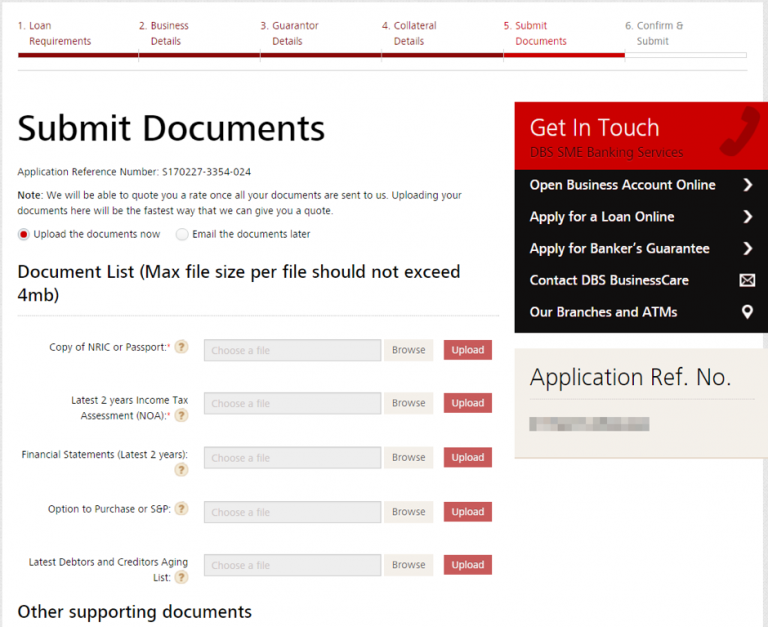

Finally, supporting documents for the loan application needed to be uploaded - including scanned copies of the company's financial statements, the guarantor's Notice of Assessment from IRAS, and his/her NRIC.

Personally, we prefer to upload private and confidential documents via a secured website such as this one on DBS, instead of the less secure route of emailing to RMs.

Submitting our relevant documents

Finally, we got to preview and confirm that every detail is accurate before we hit that Submit button.

Our final confirmation

After the entire process was done, I immediately received an email confirmation stating that my application was received and was being processed.

By the next business day, we actually got a loan offer from an RM. He called to inform us that our credit limit had been approved, and we were given a specific rate for our loan.

We then had the option to either accept it, or withdraw ourselves from the application.

To be getting a corporate loan offer in just 24 hours after submitting our application with full documentations is certainly new to us, and is definitely something that is very much welcomed in today's fast-paced world.

OCBC

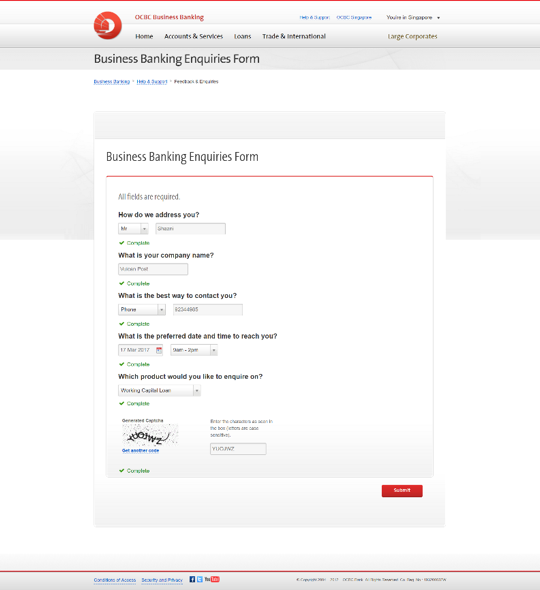

Here's what happened when I tried to apply for a loan from OCBC.

OCBC loan page

It started similarly enough - filling in our company name, contact details, and the preferred time slot for someone to contact us.

Filling in our contact details

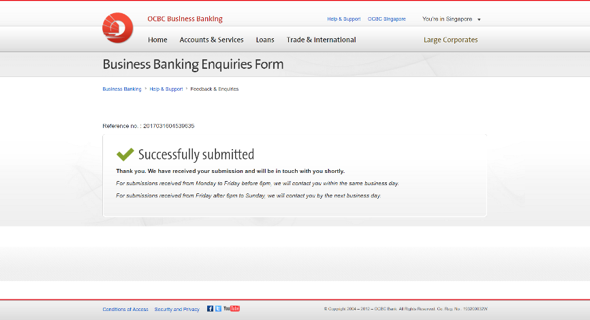

However, after hitting the submit button, that was where the 'application' ended.

The end of our OCBC online application process

Here we were expecting to move onto completing the entire application process, but the buck had stopped there.

We tried heading to one of the branches close to our office to find out more, but were told that there's no loan servicing at branches, and only account opening services were available.

So, we were back to square one.

In all fairness though, we did get a call from an RM one business day later, who then requested for us to email the supporting documents to him.

Conclusion?

It's clear as day which bank offers a truly end-to-end online application that we could get to without delay.

At the end of the day, what SMEs want is a bank that is easily accessible, and one that can process loan applications quickly and efficiently.

The process for OCBC has been somewhat anticlimactic. The excitement and eagerness to apply for a loan immediately fizzled away when I had to wait for a call back.

For DBS, it was a convenient process from start to finish.

The thing about DBS is also that the website that is up 24/7, and it requires no branch visits or signatures. What also amazes us is the ability to get a loan offer the next business day after completing the application online.

This level of efficiency from banks is almost unheard of, and we are certainly glad that it exists, as it saved us a substantial amount of time.

We guess we now know who to look for when financing our plans to take over the world.

Disclosure: This post is sponsored by DBS, who asked that we share our own experiences in getting a business loan.

Was this information useful?

Thanks for your feedback

Subscribe to DBS BusinessClass

Stay updated with the latest market trends and industry insights, connect with a network of entrepreneurs, and gain access to exclusive event invitations. Join Asia's fastest growing business community – get your complimentary membership here.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?