Questions to Ask Before Applying for a Corporate Loan

Our fast-changing world has resulted in many unique ways to do business.

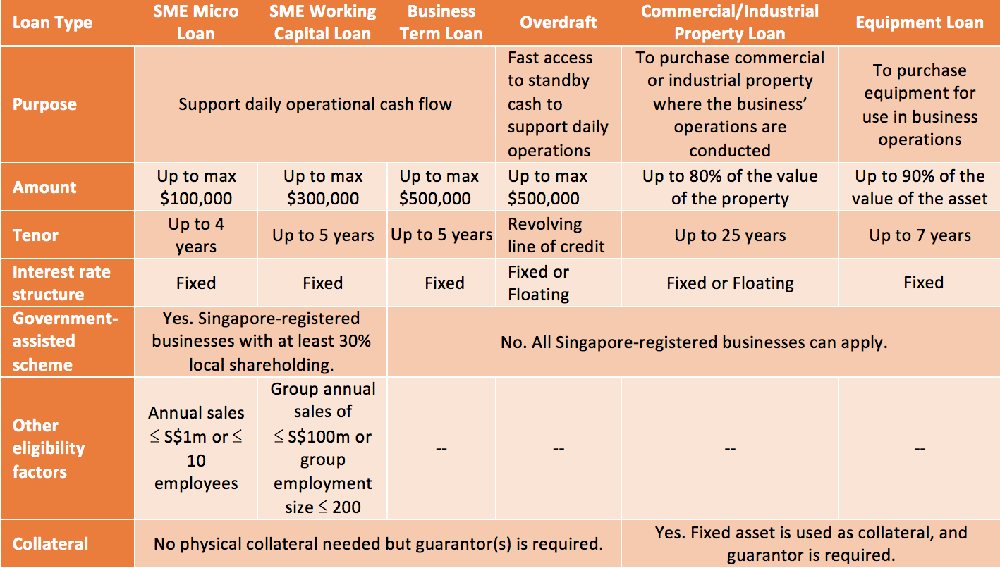

Credits: Moneysmart © Reproduced with permission.

Our fast-changing world has resulted in many unique ways to do business. The advance of globalisation and the connectedness that the Internet brings means that companies now change people’s lives in more ways compared to a few decades ago. For example, I now can key my ulu destination into an app and a driver can use GPS to find it. And then, after getting lost for 15 minutes, they still end up asking me how to get there. I guess some things don’t change then.

What also doesn’t change is that businesses need an injection of capital to run. These capital injections can come from various sources. Some may have a wealthy director bankrolling them, others do fundraising from venture capitalists. However, most companies will have to rely on a loan from a bank. Here are 4 questions you should ask before applying for a corporate loan.

1. What am I going to use this corporate loan for?

What helps early in the application process is knowing exactly how you’re going to be using the money and then getting the right product to meet your needs.

For example, there are working capital loans. These supplement your cash flow for daily operations so that you don’t find yourself in a situation where your workers leave you because they aren’t being paid. These loans have a fixed interest rate structure, a pre-determined loan tenor and there’s no need for physical collateral. All you need is to nominate a guarantor to secure the loan.

Another type of corporate loan is a fixed asset loan. These are used to purchase things like commercial property and equipment. Because they’re fixed assets, they’re used as collateral for the loan. Some banks allow you to borrow up to 80%-90% of the value of the

2. So which type of loan should you apply for and what are the eligibility criteria?

Here’s a summary the various loans that are commonly offered by the local banks.

Notably DBS also offers the DBS Business Capabilities Loan. If you have successfully applied for government grants, this unique solution is a bridging loan to cover expenses incurred prior to grant reimbursement from the respective schemes.

3. How will my personal financial standings affect my chances of getting a corporate loan?

Remember what we said about nominating a guarantor? Although no physical collateral needs to be pledged, most local banks require the ‘Joint and Several Personal Guarantee’ of directors/partners and major shareholders to be the guarantors of corporate loans, which means that the bank may recover all the payment due from any of the guarantors of a loan regardless of their individual share of the company.

And in the case of SME loans, at least one guarantor needs to be a Singaporean or PR. So like it or not, if you’re running your own business then you will need to stand guarantor for such bank loans.

Naturally, the success of your loan is going to be based on your financial standing as guarantor. This is why banks will typically request for all guarantors’ past 2 years’ tax statements or Notice of Assessment (NOA) from IRAS to assess their ability to repay in the event that the company defaults on the loan.

4. Which bank should you go with for your corporate loan?

This question is perhaps the most important. Admittedly, rates are important. At the same time, you’ll want a bank that is easily accessible and one that can process your loan application quickly and efficiently.

And in the case of SME loans, at least one guarantor needs to be a Singaporean or PR. So like it or not, if you’re running your own business then you will need to stand guarantor for such bank loans.

DBS offers one of the most convenient services for applying for a business loan in Singapore. With their online platform available 24/7, no branch visits or signatures are required to apply. Best of all, you will hear from them within 1 business day from sending in your applications with all the required documents.

Another practical reasons to apply is that they offer attractive rates through this channel due to the straight-through processing of online applications allowing for cost savings on their end.

Being the largest provider of SME Business Loan and SME Working Capital Loan schemes also speaks volumes about DBS’ strong heritage as being a strong supporter of local enterprises.

To find out more, visit go.dbs.com/smeloan

Was this information useful?

Thanks for your feedback

Subscribe to DBS BusinessClass

Stay updated with the latest market trends and industry insights, connect with a network of entrepreneurs, and gain access to exclusive event invitations. Join Asia's fastest growing business community – get your complimentary membership here.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?