Powering Your Business with the DBS Working Capital Solutions

Boost cash flow, manage expenses, and seize growth opportunities with our flexible working capital solutions—tailored for short-term financing, trade support, and business expansion.

Promotion

Unlock Festive Rewards with Business Loans!

Up to S$888 Cashback on your Corporate Credit Card with your Next Business Loan!

Learn more-

Unlock Festive Rewards with Business Loans!

Up to S$888 Cashback on your Corporate Credit Card with your Next Business Loan!

Learn more

Loan

Get the funds you need (1 to 5 years) to manage daily operations, expand your business, or cover unexpected expenses, with attractive interest rates.

Business Loan

Financing to support business growth and operational needs. Borrow up to $500k and enjoy up $888 cashback this festive season!

Learn moreWorking Capital Loan

Get access to funds to manage day-to-day business expenses. Borrow up to $500k and enjoy up $888 cashback this festive season!

Learn more-

Business Loan

Financing to support business growth and operational needs. Borrow up to $500k and enjoy up $888 cashback this festive season!

Learn more -

Working Capital Loan

Get access to funds to manage day-to-day business expenses. Borrow up to $500k and enjoy up $888 cashback this festive season!

Learn more

Trade

Keep your business running smoothly with low-interest financing (30 days to 1 year) for imports, exports, and trade transactions, ensuring steady cash flow.

Purchase Invoice Financing

Free up your working capital from your payables and advance your business today.

Learn moreSales Invoice Financing

Free up your working capital from your receivables and advance your business today.

Learn moreBanker’s Guarantee / Standby Letter of Credit

Provide assurance and peace of mind to your beneficiaries

Learn more-

Purchase Invoice Financing

Free up your working capital from your payables and advance your business today.

Learn more -

Sales Invoice Financing

Free up your working capital from your receivables and advance your business today.

Learn more -

Banker’s Guarantee / Standby Letter of Credit

Provide assurance and peace of mind to your beneficiaries

Learn more

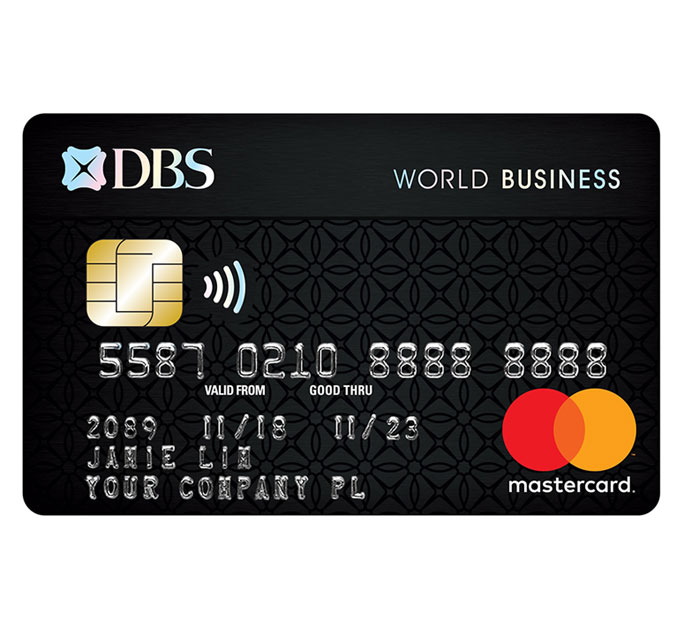

Credit Card

A revolving credit facility with flexible repayment to help manage daily business expenses and vendor payments effortlessly, with up to 55 days of interest-free credit.

DBS Platinum Business Card

A business credit card that lets you do business on your own terms

Learn more-

DBS Platinum Business Card

A business credit card that lets you do business on your own terms

Learn more