Which is the best account for Startups?

We Break Down The 3 Top Choices Of Startup Banking Partners, To Help You Decide On One

Credits: Vulcan Post © Reproduced with permission.

The time is ripe to be an entrepreneur in Singapore.

While the startup culture gains significant traction with plenty of government support, one of the key foundation of any business is still to choose a good banking partner.

This is probably a fundamental factor in the early days of your new company, and can set a precedence to ensure the proper management of your finances as your business grows.

The Competition

The three most sought-after banking partners by small and medium enterprises (SMEs) are DBS, OCBC and Maybank.

All three banks have, on hand, corporate accounts that have been positioned to take aim at start-ups and SMEs.

DBS has their Business Starter Bundle account that is positioned to make banking on-the-go for young businesses as seamless and fuss-free as possible.

OCBC has just launched a new corporate account specifically for start-ups and SMEs.

Called the Business Growth Account, OCBC wants small businesses to not have to wrestle with the complications of banking when starting out.

And then we have the ever-present Maybank with their FlexiBiz Account.

How They Stack Up

So, you are now the proud founder of a start-up, and are looking for the perfect banking partner to manage incoming funding and the company’s finances in general.

The three banks that we have shortlisted offer some interesting perks for corporate customers who use their services. Even though they are all pitching at young businesses, the terms on which they are doing it can be quite different.

To help you better understand the differences, here’s an analysis of how much bang you can get for your buck.

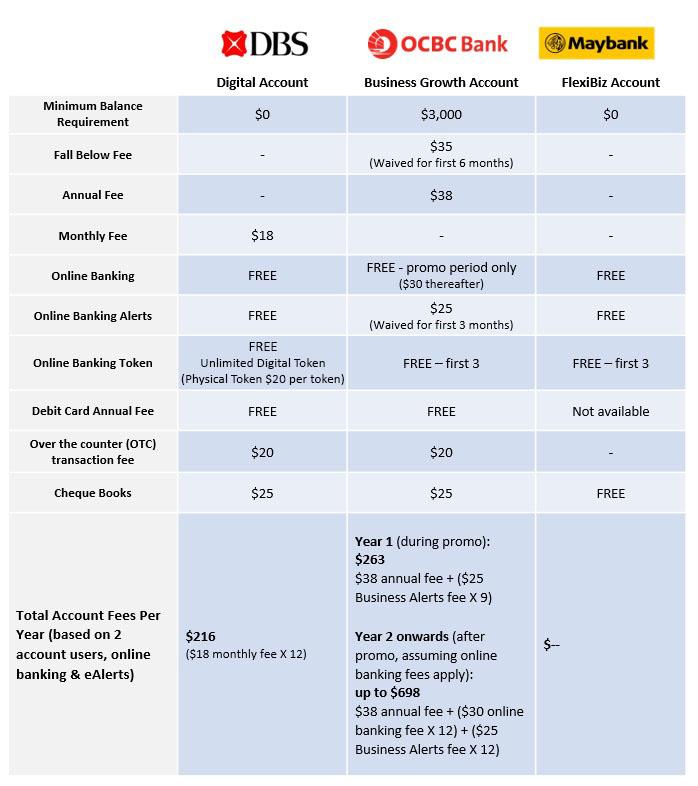

Pricing

Top of everyone’s minds – the dollars and cents. We break it down for you:

For DBS, for fixed monthly fee of $18 you get additional features such as a corporate debit card, internet banking convenience and a full-fledged mobile banking app – all without additional charge, ever. But as this is a digital account, note that there is a deterrent surcharge for performing OTC txns and issuing old school hard copy cheques.

For OCBC, note that their min. balance requirement is waived for 6 months only, and thereafter you have to maintain $3,000 every month to avoid the fall-below fee of $35. In terms on online banking, their Standard Service Package is free for now. Should they announce otherwise though, that will be an additional $30 per month to view your account balance and to perform transactions online.

So, if you don’t want to fork out extra cash, be prepared to make trips to the bank just to get things done.

Then there’s their SMS eAlerts. It’s free for 3 months, after which you will need to fork out $25 per month if you want to continue receiving it.

At this point, it seems that Maybank offers the most value. But let’s look at how it measures up against the rest for account capabilities – an important point of consideration if you need banking services to properly support your day-to-day operations.

Account Capabilities

Here’s our take on account capabilities –

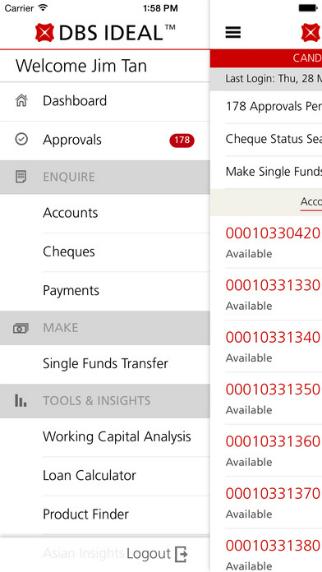

DBS’ IDEAL offers full functionality and control over your account, regardless of whether you are on your computer, or your smartphone – to view the account, transact, approve transactions, and much more.

Why is this important? It means that you will never have to set foot in a DBS branch ever. From the time that you create the account, to actually using it.

Also, DBS is the only one so far to have evolved to a digital token on your smartphone. This lets you get your access codes from your phone anytime, without the need to carry physical tokens. There is no catch, this service comes free for all IDEAL mobile app users.

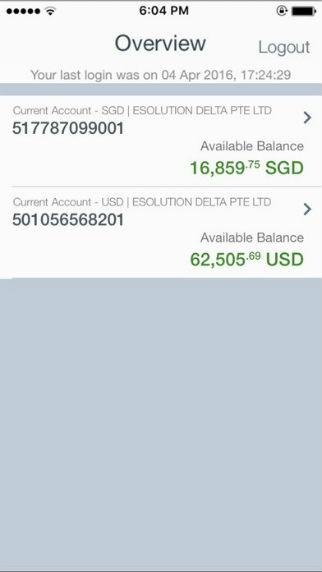

Here’s OCBC’s Business Mobile Banking app.

Their app doesn’t really allow you to interact with your account – with the ability to only view the bank balance, and your past 10 transactions.

Unless you have access to a computer (and assuming you coughed up that additional $30) you can pretty much do nothing else on the app.

As for Maybank, their mobile app features for their Business Internet Banking (BIB) are pretty self-explanatory at this point. All you can do here is just view how much money you have left, which hopefully isn’t in the red.

And if you do have to go to their branches for any service matters, consider their limited number of branches and accessibility versus the local banks.

Conclusion

Know What You Are Paying For – Transparency in pricing is something that should not be taken for granted, and with Digital Account’s single fixed monthly fee, it is as transparent as they come.

Anyone can be drawn to a long list of initial sweeteners thrown in to lure you into using their service. The problem with starter promotions like OCBC’s Business Growth Account is that they run out eventually, and you find yourself in the lurch if you are not willing to pay for more.

So look at the bigger picture, and choose a bank that gives you the features outright, without the use of ‘promotions’ for that amount that you will be paying.

Free Isn’t Always The Best – While Maybank FlexiBiz may seem like the perfect banking solution for any new businesses, the massive lack of features and value-added services will disadvantage your business in the long term in today’s digital economy.

Choose your Banking Partner For The Long Term – Having a banking partner that not only gives you a peace of mind with your finances, but also lets you learn how to grow and sustain your business will go a long way in ensuring the longevity of the company.

DBS BusinessClass is a mobile app that serves as a community platform to a network of almost 17,000 entrepreneurs and business leaders in the region; with informative articles you can read, an advisor messenger service, and a community where you can seek advice from.

In August 2016, DBS launched DBS TechMatch in partnership with government entities Infocomm Investments and IPI Singapore. This programme provides an opportunity for SMEs to firstly articulate their business challenges, and then be matched with the viable tech solution providers after consultation and deep dives to understand their issues. This gives SMEs very customised and tangible solutions to improve and build capabilities in their business.

At the end of the day, DBS looks to be offering the better deal for businesses when considering all the features and functions you are getting, with an overall lower annual fee.

Was this information useful?

Thanks for your feedback

Subscribe to DBS BusinessClass

Stay updated with the latest market trends and industry insights, connect with a network of entrepreneurs, and gain access to exclusive event invitations. Join Asia's fastest growing business community – get your complimentary membership here.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?