Treasury leading the charge to unlock cash: Part 1

Asia’s growth story will move into a new phase over the next 10 years, and CFOs will increasingly leverage on data analytics to optimize working capital management to free up incremental cash flow and drive value creation. In part one of this series, we take a look at the changing dynamics of Asia.

The changing dynamics of Asia

As shareholders and investors look beyond the bottom line into the quality of earnings, internal efficiencies, and sustainability of a company’s business model, the quality of cash flow and management of working capital is highly correlated to enterprise value. Particularly in Asia, the multi-country supply and distribution chains carry a high degree of complexity and also the opportunity for well-managed companies to build a competitive advantage.

To navigate this new paradigm, CFOs and treasurers need to develop a deep understanding of the countries and regions within Asia. Growth in Asia has and will continue to be heterogeneous; this multi-faceted neighbourhood includes the world’s largest democracy (India), the world’s most populous Muslim country (Indonesia), and the world’s second largest economy and the biggest population globally (China). While Hong Kong and Singapore are the smallest by size, these markets are the most popular regional treasury centres for corporates.

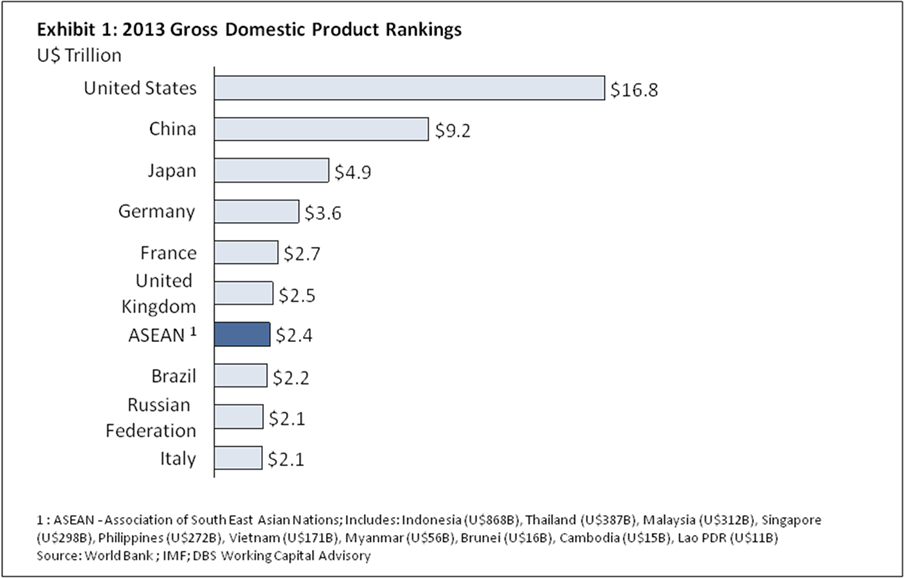

Within the region, there is a wide mix of emerging and advanced economies, with GDP per capita ranging from US$2,500 in India to US$64,500 in Singapore, based on data from the International Monetary Fund. Beyond the dynamics of each individual country, there are intra-regional dynamics to consider. For example, the Asean (Association of Southeast Asian Nations) has set itself a target of forming the AEC (Asean Economic Community) by 2015. The AEC aims to form a single regional market and production base and have this fully integrated into the global economy. If Asean were a single entity, it would be the 7th largest economy in the world (See Exhibit 1).

Subscribe to DBS BusinessClass

Stay updated with the latest market trends and industry insights, connect with a network of entrepreneurs, and gain access to exclusive event invitations. Join Asia's fastest growing business community – get your complimentary membership here.