The building blocks of future-ready liquidity solutions

Atul Bhuchar, Group Product Head - Liquidity Management, Account Services and Liabilities at DBS Bank, Singapore

In 1980, US telecom firm AT&T decided to exit the cellular market due to a poor forecast provided by a reputed consultancy firm. The estimate provided was less than a million subscribers by 2000 - based on the heavy devices, poor battery capacity, high cost and limited coverage of cellular networks, slow historical adoption rates etc. However the actual number of mobile phones in 2000 was around 109 million and the number of active mobile connections in Oct14 crossed 7.22 billion, exceeding the number of people in the world! [Source: GSMA Intelligence] The mobile phone is now ubiquitous, allowing connectivity via voice and data, across borders in a jiffy.

This analogy is relevant for liquidity management, which was traditionally used only by few multinational corporations, esp. those with regional/global treasury centres and/or in-house bank structures. As businesses expand across geography and in complexity, mobility and effective use of corporate cash has become a focus area for corporate treasurers. Regulatory, tax and accounting issues as well as sometimes banks currently constrain the optimal use of liquidity, but the evolution and adoption of liquidity management solutions is accelerating and the pace of this change is likely to surprise many.

The collapse of Bear Stearns, Northern Rock and Lehman Brothers magnified the importance of dealing with liquidity risk. Improved risk governance structures, cost reduction, cash visibility and the ever-increasing focus on treasury centralisation are the key drivers to future-proofing corporate treasuries using liquidity management. Liquidity management structures are a key factor in selection of the cash management bank for most corporate RFPs received today. Based on corporate treasurers’ experience in structuring and implementing cross-border liquidity management, the key building blocks for these solutions are:

Cash Concentration a.k.a. physical pooling

This is also known as cash sweeping or zero-balancing. Balances in accounts of participating companies are swept to/from a centralised header account. This automated sweeping is done at end-of-business-day on a predetermined frequency, i.e. daily, weekly, monthly, but it may be done on an intra-day basis too. Cash concentration supports treasury centralisation treasury function by automating intercompany lending and results in more efficient investment of surplus balances in the header account.

Sweeping can be one-way (down or up), two-way, or reverse, with defined target balances for participant accounts. Most banks support multiple tiers of sweeping.

Value-added services:

- To facilitate payments for subsidiaries participating in cash concentration structures, one of two sub-optimal solutions have been traditionally used: target balances left in the subsidiaries’ accounts or setting up overdraft facilities for each of these accounts.

- Nowadays balance-sharing between participating accounts in the liquidity structure is provided by select banks. Sophisticated solutions are available with flexibility for either parent and child account to share balances (bilateral) or for all participating accounts to share balances (multilateral).

- Balance-sharing between parent and child account can be controlled with fixed-amount caps or based on net contribution (or accumulator). Net contribution is the accumulated, net funds-flow from child to parent account. This is a powerful tool for cash flow control, as it enables child accounts to drawdown on available balances in the parent account, based on their respective funds-contribution to the parent. It also allows clients to set limits on the sweeping (i.e. lending) between group companies. Pooling of balances across all participating accounts can also be controlled with specified limits. While this sounds simple in theory, managing such real-time controls cannot be accomplished by a number of banks.

- Intercompany loans are subject to scrutiny over transfer pricing principles. Hence interest allocation with flexible interest rate rules and comprehensive reporting capabilities are essential requirements. Automated settlement of interest payments and computation of withholding/business-tax/stamp-duties on inter-company interest and/ or borrowings are provided. Intelligent logic has been embedded into cash concentration solutions to optimise tax positions. Accordingly sweeping variants such as tax-efficient sweeping, horizontal sweeping and hybrid sweeping (a combination of tax-efficient and horizontal) have been developed by agile banks in markets like China.

- Online capabilities for liquidity maintenances (viz. to change parameters like target-balance amounts or sweeping frequency, to trigger on-demand sweeping, to configure user-defined events to generate alerts), simulation and analytics are also increasingly available.

- Follow-the-sun sweeping is a cross-border technique to centralise cash on a global basis. This involves movement of funds from Asia to Europe, and thereafter to the US within a 24 hour cycle. It leverages on the time zone differences between the key financial centres in these three continents. Against-the-sun sweeping works on the opposite principle, whereby the movement of funds is from US to Europe or from Europe to Asia for an Asian multinational.

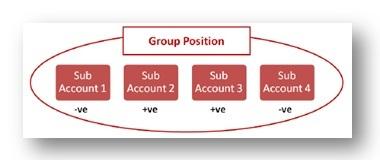

Notional Pooling

Balances in accounts of participating companies are notionally offset (with partial or full offset of debit and credit balances) for interest-computation; interest is calculated on the net position of the group. Hence there is no physical movement or co-mingling of funds.

Notional pooling is popular among companies operating on a decentralised basis, as subsidiaries maintain control and ownership of cash. This results in account autonomy. It has the benefit of not creating inter-company loans, and associated withholding taxes. The client - documentation for notional pooling is stringent as it requires cross-guarantees, right of setoff etc.

Pooling is typically on a single-currency basis and may be offered with or without allocation of interest to subsidiary accounts. Where multiple currencies are involved in the notional pool, the notional conversions to a base currency (before pooling and interest offset is done) will be undertaken at close of business with the risk covered through the adjustment of currency-wise credit or debit interest rates, or using short-dated swaps.

Physical versus notional pooling

In the real world, physical pooling is often preferred over notional pooling by businesses. This is largely due to the transparency of intercompany lending associated with cash concentration, alleviating regulatory concerns.

Client documentation for physical pooling is relatively simpler to execute vis-a-vis for notional pooling, as the latter involves requirements such as cross-guarantees for establishing joint- and several liability. These may conflict with covenants for the company’s credit facilities. Further notional pooling often has more complex regulatory environment, and has relatively more complications due to enforceability issues as well as differences in capital reporting for banks.

That said, physical pooling also has implications, such as thin capitalisation (wherein deductibility of interest expense is limited when applicable debt/equity ratios are exceeded), withholding tax (applicable to inter-company loans), transfer pricing etc. Some other issues for cross-border physical pooling are higher transaction-costs for funds-transfers and cut-off times. Co-mingling of funds in physical pooling does not appeal to joint ventures. Moreover, the account autonomy resulting from notional pooling supports decentralized treasuries.

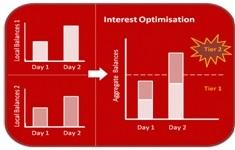

Interest Optimisation

Corporations may find their liquidity trapped in regulated environments. Interest optimisation or notional aggregation is a multi-country, multi-currency liquidity solution which enables companies to enjoy preferential rates on account balances based on their aggregate regional or global balances with the bank. Certain banks can only offer preferential rates on credit balances, while other banks have the capability to provide preferential rates for both credit and debit balances. The total global balance is notionally computed in a base currency by factoring in the in-country regulations, viz., certain countries do not allow companies to earn better rates on domestic aggregate balances, but allow these to contribute to the global pool; while some other countries restrict contribution of country balances to the pool.

This solution is relatively much simpler than cash concentration or notional pooling, as it neither creates any inter-company loans nor creates any cross-guarantee obligations. Moreover, administration is easier as it does not create any need for interest reallocation required for transfer pricing purposes. Companies can continue to maintain decentralized account ownerships. However, this is also a limitation of this solution as it does not provide effective control on the group’s liquidity.

With the focus on liquidity and risk management, treasurers are increasingly using interest optimisation for their “trapped cash” in domestic accounts, which cannot be incorporated into cash pools - physical or notional. This solution effectively leverages trapped surplus cash to optimize earnings from balances in non-regulated jurisdictions.

Hybrid Liquidity solutions

In practice, a combination of physical pooling, notional pooling and/or interest optimisation enables a company to achieve a complete cross-border liquidity management solution, which allows centralisation of funds and notional pooling or interest optimisation of the resulting balances. Because local operating companies will often have accounts with domestic banks, the network bank offers an overlay solution, which funds/ defunds these local bank accounts from an overlay account in each country at the network bank. Thereafter funds are concentrated into a central notional pool with the network bank, with the funds typically continuing in the companies’ names. This significantly reduces or eliminates fragmented cash positions existing in multiple countries.

In cases where the network bank does not have a geographic presence in the particular market(s), bilateral arrangements are put in place with the local banks via SWIFT MT101 (Request for Transfer).

Value-added services: Cross-border liquidity solutions can integrate with payments files from clients’ payments factories, using “just-in-time” funding concepts, to provide funding to subsidiaries for domestic payments on the required date. Sophisticated liquidity solutions have in-built algorithms and mathematical models to determine the preferred path for a participating account which is overdrawn, to automatically draw funding from another participant, based on rule-based algorithms to minimize cost or tax impact etc; or to empower the treasurer with real-time flexibility to alter structures.

Taxation Matters

While an evaluation of the tax impact of pooling will require another article, depending on the corporate structure and the selected liquidity management solution, the typical taxation issues which may arise are:

Internal transfer pricing (based on arm’s length principles), Withholding tax, thin capitalisation, stamp or capital duties, permanent establishment, and value-added tax.

Clients are generally recommended to have a transfer pricing policy prepared for intra-group transactions. Companies need to seek their own tax and legal advice before implementing cash management structures. Banks may provide general information on country regulations and products.

Regulations

Wide variances in country regulations increase the complexity of a regional or global approach to liquidity management. Countries can typically be segregated into Unregulated (viz., Singapore and Hong Kong), Regulated (viz., China and Taiwan) and Restricted (viz., India) for cross-border liquidity solutions. In countries such as Malaysia and Indonesia, where local currency is more restricted than foreign currency, the former is managed using domestic liquidity solutions, while the latter can be concentrated offshore. In-country regulations also define the types of participating entities (same/ multiple entities, resident/ non-resident entities etc) allowed to participate in liquidity structures.

Regulatory changes within individual markets enable new liquidity structures to be implemented. With Renminbi being gradually liberalised by the regulators in China, automated sweeping options are now available enabling previously trapped cash in China to participate in company’s cross-border liquidity structures.

The Organisation for Economic Co-operation and Development (OECD) project on Base Erosion and Profit Shifting (BEPS) is progressing rapidly and this could impact some existing global liquidity management structures. OECD’s 15 action points focus on multinationals’ treasury activities and in particular, BEPS will be a significant catalyst for shift in tax considerations. Hence it is likely to result in changes to most tax-driven treasury structures, changes in preferred jurisdictions of the entities wherein global cash is concentrated etc.

Capital requirements from Basel III, European Union’s Capital Requirements Directive IV are resulting in changes to how banks value liabilities, esp. for operating account balances and for institutional investors. Banks have reviewed the impact of these regulations on notional pooling and a number of them continue to offer this product, subject to requisite client-documentation and of course, client-profitability. Moreover, the International Financial Reporting Standards (IFRS) requirement of periodic net settlement of balances is typically addressed by banks with an on-demand two-way sweep.

Anticipating and responding to regulatory and market changes is a critical success factor for liquidity management banks.

The 5 Cs of Liquidity management execution

The 5 C factors for successful execution of liquidity management solutions are:

Customizability: Effective liquidity management requires the right liquidity, delivered at the right time and with the right reporting. Responsiveness of the bank to offer bespoke solutions, based on an understanding of the customer’s business model, specific markets in which the customer is in, regulations, tax considerations, unique operational and reporting requirements are critical attributes.

Collaboration: First-time implementation of liquidity management by a company is akin to a business process reengineering/corporate transformation project. Experienced banks facilitate this journey for the client by detailed planning and communication, along with different training-programs for subsidiaries, for regional/ global offices and for different levels of staff.

Convenience: Treasurers are increasingly seeking an expanded range of capabilities that can be conducted using bank’s liquidity advisors or online, whether for clients with multi-country presence, regional treasury service centres or decentralized finance functions. Accessibility and functionality both need to be supported, along with best-in-class customer service.

Consultation: The quality of advisory services and thought leadership in the complex liquidity management and working capital space is a key differentiator. Cost-benefit analysis as well as insights into pros and cons of different liquidity structures facilitates selection of the right solution by the client, followed by a comprehensive implementation-plan, based on their timeline and priorities.

Connectivity: Treasurers need access to liquidity across geographies. Multi-bank solutions are an integral part of the liquidity management solution, whether domestic or cross-border. Though large, global banks have the advantage of a wider footprint, but sometimes adopt a cookie-cutter approach. This enables agile regional banks to gain a competitive advantage by offering seamless connectivity with cross-border, multi-bank liquidity solutions, along with balance sheet commitment and expertise to navigate safely across the choppy operational and regulatory waters of liquidity management.

The liquidity management landscape is dynamic, with new regulations opening up new opportunities and sometimes reducing the viability of certain products. The liquidity profile of businesses is also fluid and evolves over time. Hence clients should periodically review whether they are using the most optimum liquidity strategy and products.

In today’s VUCA (volatile, uncertain, complex and ambiguous) world, cross-border liquidity management is an idea whose time has come and the pace of its acceptance by businesses is changing from linear to exponential growth. Soon this will be the new normal for both banks and treasurers.

(This article was first published in GTNews: The building blocks of liquidity solutions.)

Subscribe to DBS BusinessClass

Stay updated with the latest market trends and industry insights, connect with a network of entrepreneurs, and gain access to exclusive event invitations. Join Asia's fastest growing business community – get your complimentary membership here.