Digital solutions boost efficiency and security in trade finance

DBS Bank provides an overview of its initiatives and value propositions in the digital trade space, including its experimentation with distributed ledger technology.

Trade finance processes and risk management controls have long been challenging tasks for many companies, because manual processes and limited information have made these tasks timeconsuming and relatively inefficient. The current paper-driven processes have also made it difficult for companies and banks alike to track goods and establish ownership throughout the trade flow, from shipping companies issuing bills of lading to logistics companies documenting goods in the warehouse when they are delivered.

"Current practices require corporates to use paper-intensive processes that reduce their efficiency," says John Laurens, Head of Global Transaction Services at DBS, "and as a result, risk management becomes a tedious and costly investment."

The increasing pace of digitisation and emerging technologies today are rapidly improving trade practices. Recent examples include cloud-based solutions that enable electronic presentation and financing of trade finance instruments, blockchain technology for process digitisation and transaction validation, data analytics for business intelligence, and artificial intelligence to increase efficiency and better manage risk; and these have already begun to benefit corporates.

Online applications for bankers' guarantees provided by DBS, for instance, have eliminated the need for corporate customers to visit the branch, and reduced the approval time for applications by 70%.

Blockchain technology and a distributed ledger will soon make it far easier for the ecosystem, which includes the importer, exporter, bank, logistics company and customs, to have realtime information to track and verify the authenticity of the transaction. Using real-time data and proactive practices to identify fraud can also reduce risks for both corporates and banks.

"We are working on a number of digital initiatives, including the use of technology that exploits blockchainbased data to confirm the uniqueness of trade transactions and prevent duplicate financing,” explains Laurens. “We have also employed data analytics and rule-based algorithm on a platform to predict potential trade anomalies, delivering significant enhancements to risk management for the bank and for our clients."

Two initiatives from DBS demonstrate the benefits of digitisation and how it is happening faster than many might expect.

Using a distributed ledger

One of the most innovative initiatives underway to digitise and improve trade finance is a project that demonstrates how a distributed ledger can improve current trade finance processes.

For centuries, banks have used traditional manual and paper-based approaches to verify genuine trades before providing financing. Corporates have had to take the time to compile the paper documentation, deliver it to the bank and wait for the bank to assess the information. Such methods have still not been able to eliminate risks entirely, however, as duplicate financing and fraudulent invoices can still occur.

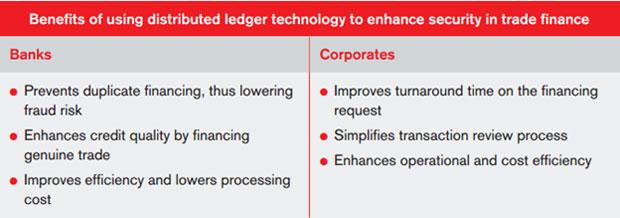

DBS, together with Standard Chartered Bank (SCB) and Infocomm Development Authority of Singapore (IDA), has successfully completed the first proof-of-concept in the world to demonstrate how blockchain can use a distributed ledger and enhance the overall security of trade financing.

Blockchain can be described as an independent, decentralised distributed ledger for validating or recording transactions. With a distributed ledger system, everyone is connected to a common platform. A transaction is cryptographically signed and put through an algorithm that generates a unique hash value. Other nodes and computers authenticate the unique cryptographic hash of the block, add another hash value and ensure that the ledger provides irrefutable proof of ownership. With this technology, duplicated addition of invoices is prevented.

The proof of concept was a success, validating that the blockchain technology can be used to reduce risk. This opens up possibilities as the same ledger technology can also be used in other areas of trade finance beyond just settlement or authenticating invoices, such as crossborder payments and securities trading. The three core strengths of blockchain technology - no duplicate transactions, irrevocable secured transactions and decentralised control - will change how banks and clients interact.

To make this innovation an industrywide success and hasten commercial adoption will, however, require broader participation from more banks, governments and bank associations. Once participation grows, this distributed ledger technology will bring a lowcost and low-risk sustenance model to corporates, and have deep ramifications across the entire banking industry.

Using data analytics

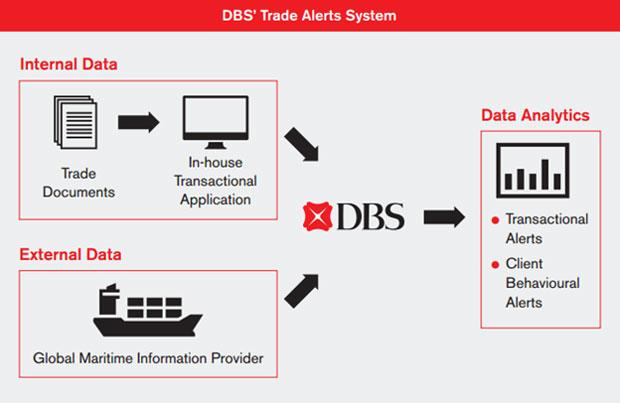

Another game-changing initiative by DBS is the cutting-edge proactive risk management programme that leverages big data analytics and rulebased algorithm to proactively identify suspicious transactional behaviours in trade finance.

While trade finance is burgeoning, it has long remained a paper-intensive industry with highly manual processes. Trade finance risk controls have traditionally centred on a bank’s understanding of its clients, transactions, documentary financing and credit monitoring. It has been challenging for individuals in trade finance operations that process hundreds of transactions a day to identify transactions that deviate from historic norms.

Corporates have also faced risks and potential losses in the event of unusual counterparty behaviour or possible fraud. In recent years, regulators have also increased requirements for banks and even for corporates to develop more robust controls for anti-money-laundering (AML) and for countering the financing of terrorism (CFT) in trade finance.

In line with its strategic priority of embracing the digital world, DBS Bank established a ground-breaking programme, Trade Alerts, which utilises big data technology to enhance existing controls, screen broader-based transactions, and identify potential deviations in transactional behaviours in trade finance activities. Launched in April 2016, this programme uses transaction trends as well as external data on global maritime information to manage risk proactively, instead of solely relying on manual checks on individual transactions.

Choong Yang Ping, Regional Head of Institutional Banking Group Operations at DBS, says: "We believe in taking a proactive approach in enhancing our current risk management processes. The Trade Alerts programme has helped the bank create a more robust platform to detect trade anomalies."

This programme uses recommendations on trade finance fraud prevention and AML from global financial regulators (including the Monetary Authority of Singapore, Hong Kong Monetary Authority and UK Financial Conduct Authority) to create a set of systematic rules with assigned severity ratings.

This project enhances fraud prevention by using data analytics and artificial intelligence to escalate abnormal transactional behaviours or specific potentially fraudulent transactions based on pre-defined criteria. When abnormal transactions are flagged and verified as suspicious, additional controls such as requiring supporting documentation can be applied. “At DBS, we believe in harnessing technology to move trade finance into the digital world,” says Lim Him Chuan, Group Head of Product Management, Global Transaction Services at DBS. “For a start, this programme can help DBS reduce the risk in documentary trade finance. Over time, it can also be extended to our customers, enabling them to detect unusual counterparty behaviour and mitigate possible losses.” This programme is a major breakthrough in maintaining DBS’ integrity and protecting clients against dubious counterparties. Corporates will benefit tremendously from the reduction in the risk of transactions and from DBS being able to alert them when a transaction entails heightened risk. More importantly, this development facilitates a shift from reactive solutions that put mitigating controls in after an event occurs towards proactive prevention that anticipates an event and puts preventive controls in place before it even happens.

Leading with digitisation

Emerging technologies and changing regulations have resulted in complexities for trade finance. In such an environment, corporates and banks need to work together to harness the digital revolution and keep ahead."The future will be digital, and this is why we are investing in product development that brings new and innovative solutions to our customers. It's our focus on the customer that will keep DBS at the forefront of shaping transaction banking in Asia," says Laurens. DBS, with a strong commitment to listening to our clients’ needs, is constantly innovating to deliver cuttingedge solutions, help its clients reduce risk, and increase efficiency.

"They want to see practical, value-adding solutions that they can apply to their financial and commercial business processes. They expect banks to be close to and drive innovation in financial technology, and in the process deal with the complexities inherent therein, so they don't need to spend an undue amount of resources beyond necessary due diligence," Laurens adds.

Along with implementing these initiatives, DBS is also investing and experimenting with new technologies which have the potential to transform the industry, as well as the way banks and corporates interact.

(This article was first published in Global Trade Review, Aug/Sep 2016)

Subscribe to DBS BusinessClass

Stay updated with the latest market trends and industry insights, connect with a network of entrepreneurs, and gain access to exclusive event invitations. Join Asia's fastest growing business community – get your complimentary membership here.