LiveBetter

LiveBetter is a sustainability initiative by DBS that is empowering our customers to Live more, Carbon less. Residing in your digibank app, LiveBetter makes it easier, more affordable, and more rewarding for our customers to take sustainable actions that count. Customers can explore different ways of making a real impact towards building a sustainable future.

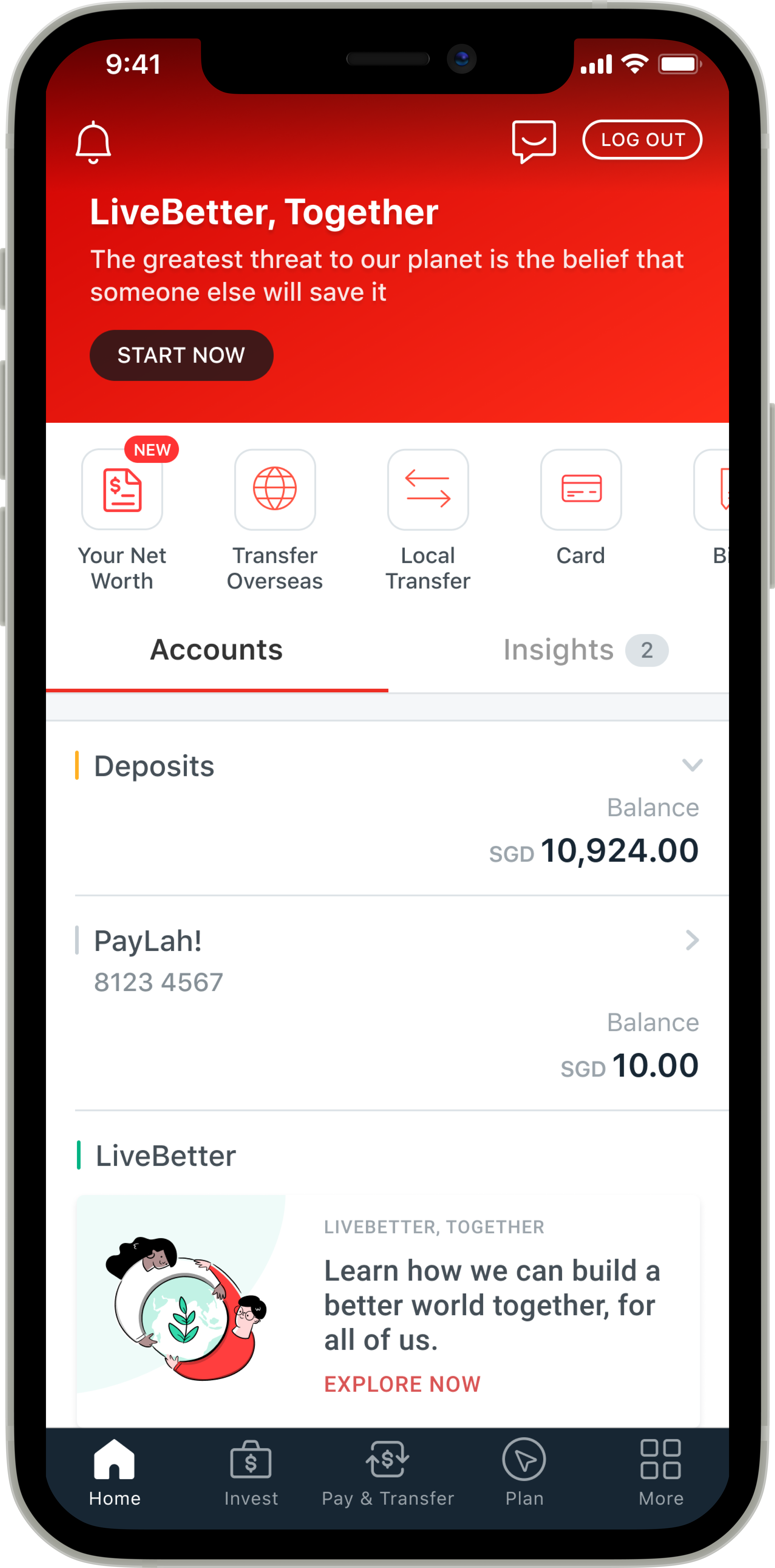

LiveBetter is accessible through the Singapore DBS digibank application. There are several entry points to LiveBetter:

a: Post-log-in under the ‘Home’ tab:

LiveBetter product card below banking and credit card accounts

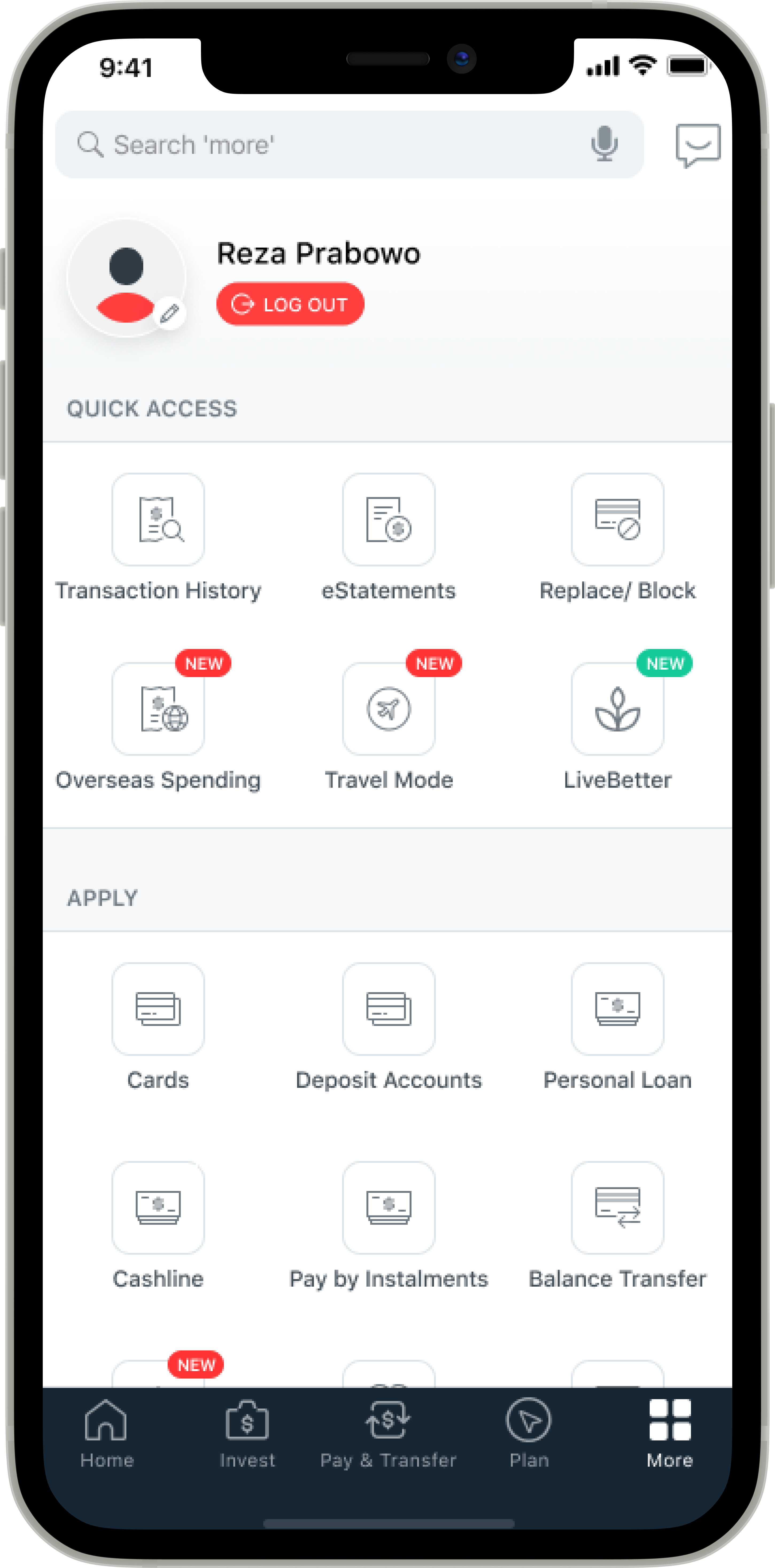

b: Post-log-in under the ‘More’ tab:

LiveBetter product icon under ‘Quick Access’

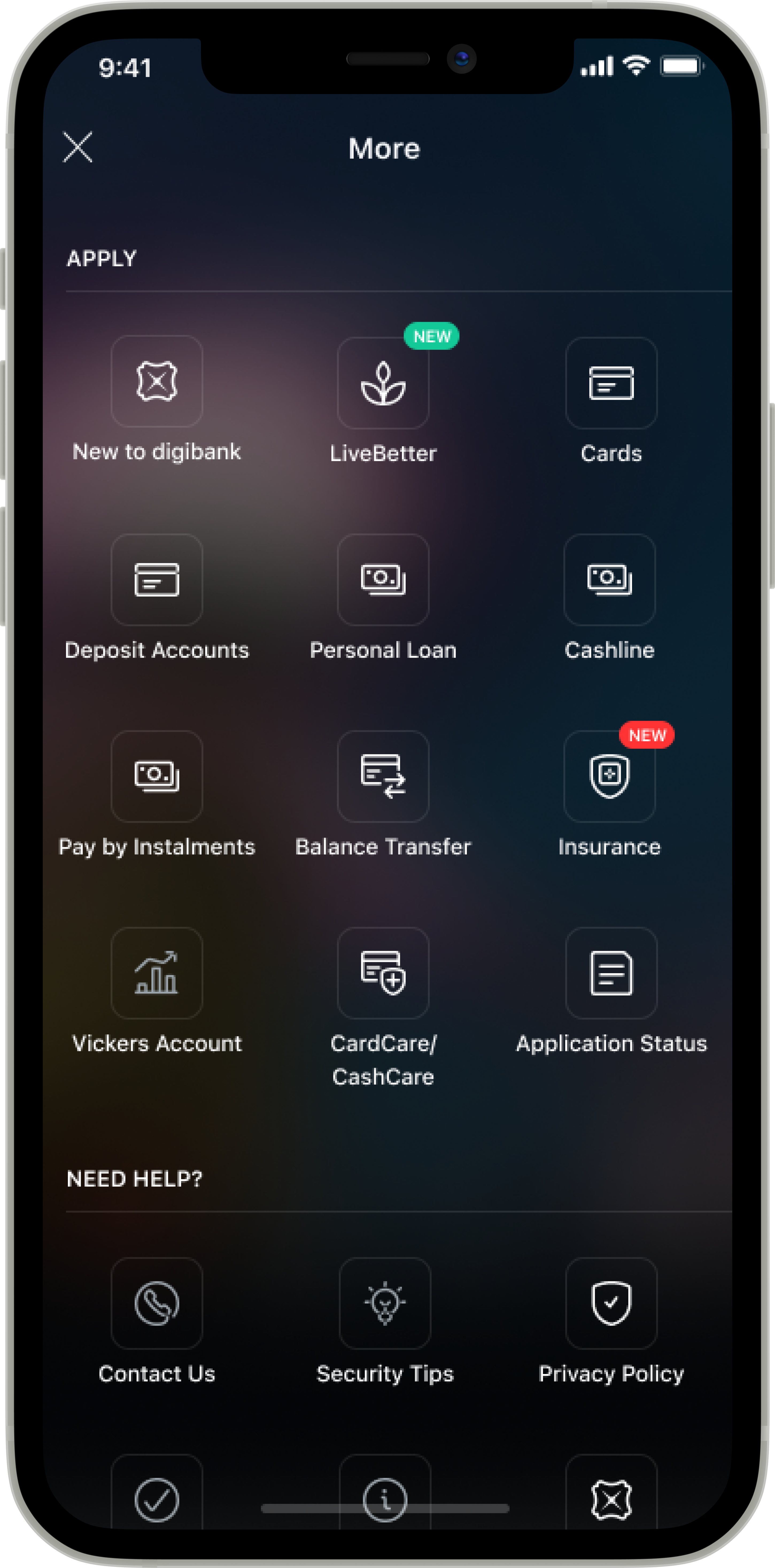

c: Pre-log-in under the ‘More’ tab:

LiveBetter product icon

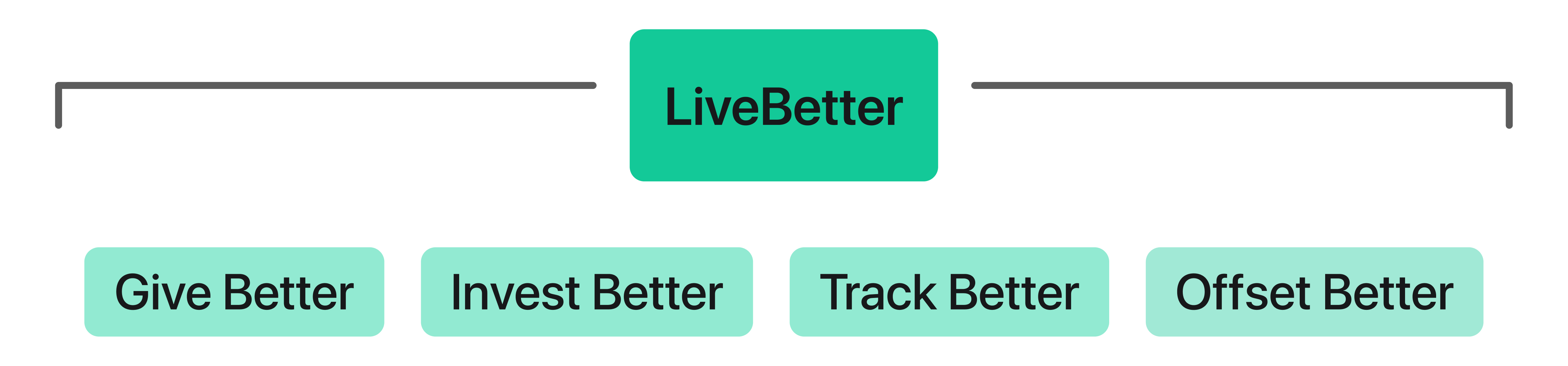

LiveBetter is home to Give Better, Invest Better, Track Better, and Offset Better, digital platforms on your digibank app.

Give Better

Give Better is a part of the LiveBetter initiative enabling our customers to support local charitable causes that they are passionate about. Customers can contribute to an ongoing campaign, fund the work of local charities, or pay it forward sustainably through social enterprises.

Charities on Give Better are non-profit organisations and your contributions will be used to fund any of the environmental work that the charity deems necessary to further their cause. Contributions may be available for tax deduction as these charities are Institutions of Public Character (IPC).

Social enterprises on Give Better are businesses that seek to be financially self-sustaining while addressing critical social issues in sustainable ways. As social enterprises are businesses, you will not be able to donate to them. Instead, you can buy products from social enterprises to be given to various beneficiaries.

When donating to a charity, funds contributed will be used to generally support a wide range of efforts that the organisation are focusing on.

Campaigns are time-based initiatives where funds contributed will only be used for the specific campaign and its goals.

Yes, all charities have gone through DBS’ internal due diligence process. The charities on the platform are governed by the Charities Act in Singapore and have an Institutions of Public Character (IPC) status. You may check the charities’ status here.

No, a separate account is not required. You may can continue using your existing internet banking credentials.

No, only your DBS banking account(s) can be used to make a contribution.

All contributions are made in Singapore Dollars (SGD).

No. You will need to set up a new payment request each time you would like to contribute.

Yes. The minimum Give Better contribution amount is $1.00 per transaction. The maximum contribution amount is $100,000 per transaction. However, the maximum contribution amount is subject to customers’ pre-set transaction limits, including your daily transaction limit and available balance.

No, DBS does not charge any fees for Give Better transactions. 100% of the funds contributed by customers go directly to the organisations and campaigns that customers have opted to contribute.

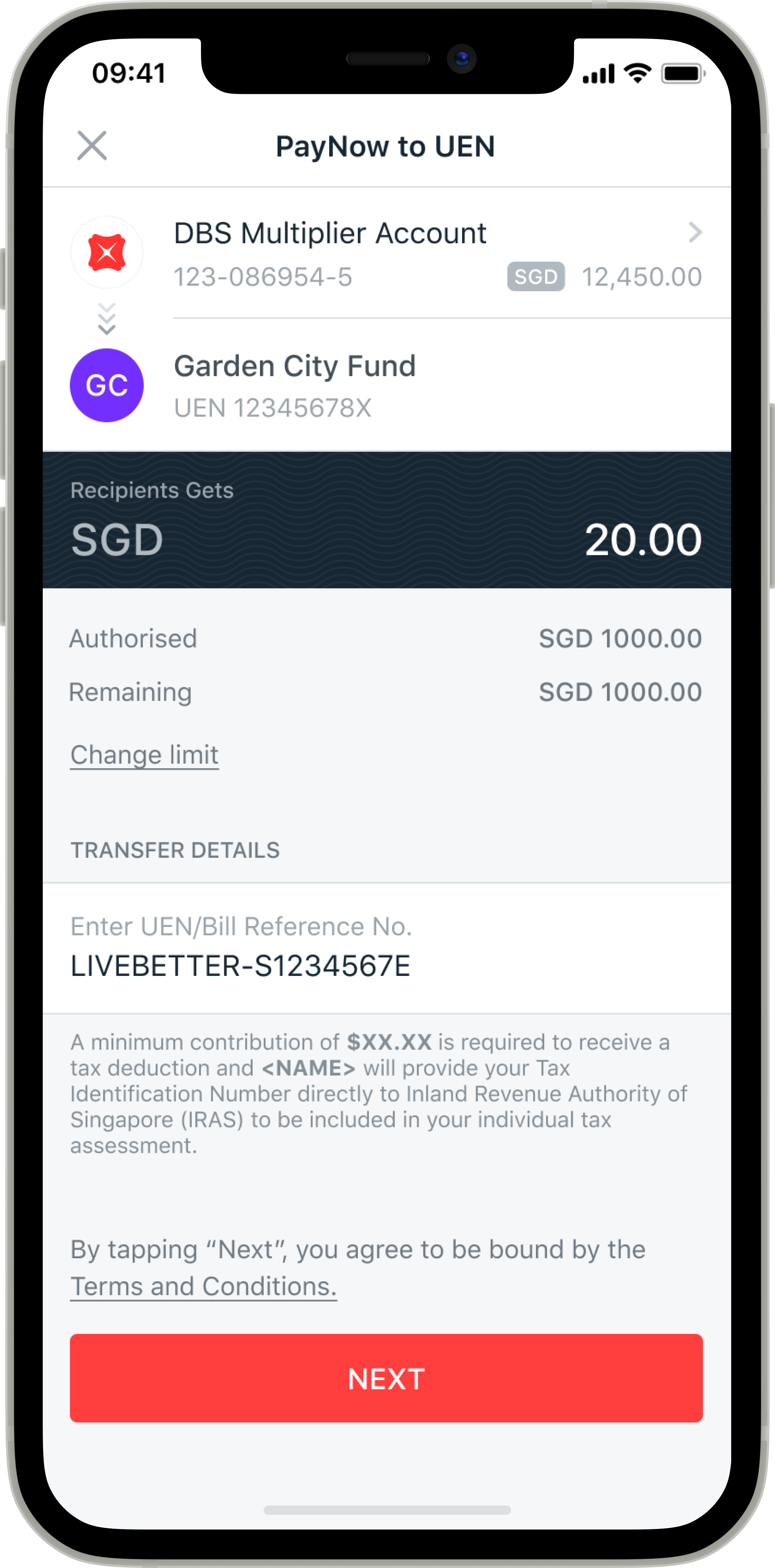

All funds are transferred using the ‘PayNow to UEN’ payment framework. You may view the full terms and conditions on the use of PayNow here.

All funds contributed are transferred to the organisation’s bank account immediately upon successful completion of the transaction via PayNow to UEN. All funds that you contribute to an organisation via LiveBetter go straight to that organisation’s bank account.

If you have opted to receive a tax rebate, DBS will send your Unique Identification Number such as NRIC or FIN to the charity organisation as required by the Income Tax Act (Cap. 134).

You will receive an email confirmation once the payment has been completed. For any further enquiries, please contact the DBS Customer Support hotline at 1800-111-111.

No. All funds transferred are non-refundable. For more information, please refer here.

For enquiries related to your contribution to a charity organisation and/or charity campaign, please get in touch with the relevant organisation(s) directly.

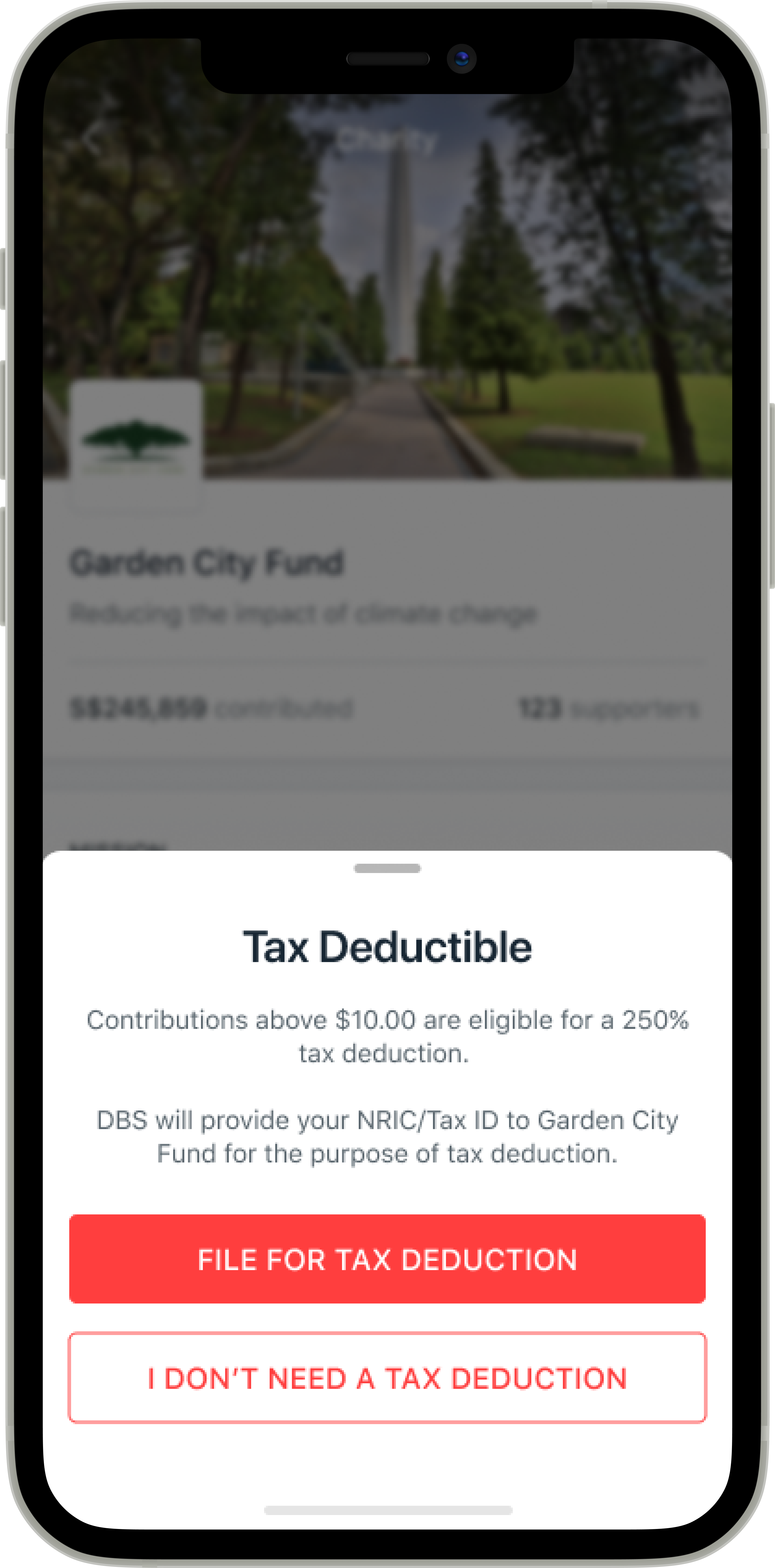

Charities and campaigns that have a ‘Tax Deductible’ label are available for a tax deduction. To file for a tax deduction, select the ‘File for Tax Deduction’ option when completing the contribution transaction. The charity will then file for a tax deduction on your behalf.

However, please note that selecting ‘File for Tax deduction’ does not automatically make your tax deduction request eligible or successful. Tax deduction requests are subjected to the following terms and conditions:

- All requests are to meet the prevailing eligibility criteria set out by Inland Revenue Authority of Singapore (IRAS) for the requests to be successful. Please click here for more details.

- The charity will file a tax deduction on your behalf only if your contribution meets the minimum contribution amount set by the charity.

You may refer to IRAS’ website for the latest information on eligibility for tax deductions for donations in Singapore, here.

Yes. The charity will file for a tax deduction on your behalf only if your contribution meets the minimum contribution amount set by the charity. You will be able to access and view this information before you make the contribution:

- Upon clicking on the ‘Contribute Now’ button to contribute to a charity.

- Upon clicking the ‘Contribute to The Campaign’ button to contribute to a specific campaign.

Other than selecting ‘File for Tax Deduction’ button while completing the contribution transaction, there is no further action required on your end. DBS will provide your personal details to the charity for the purpose of tax deduction filing. The charity will then file for the tax deduction on your behalf to IRAS, if you have met the minimum contribution amounts set by the charity.

For every dollar that you contribute to an eligible charity or campaign, $2.50 will be deducted off your taxable income. For example, if you have contributed $150 in the year 2021, $375 will be deducted off your taxable income for 2021.

There will be no physical receipt provided by the organisation or IRAS. You may keep the email receipt from DBS upon payment completion as reference for your contribution.

- Please update your personal information by following the steps highlighted here.

Once completed, please contact the DBS Customer Support hotline at 1800-111-111 for us to send your updated information to the charity.

OR

- You may contact the organisation directly to update your new identification details.

For future transactions, you may manually check and make changes to the NRIC/FIN in the ‘Enter UEN/Bill Reference No.’ before confirming your contribution transaction. The number in the description box should reflect your NRIC/FIN.

By default, each transaction will be tagged to the customer’s name and NRIC/FIN. However, if you wish to change the NRIC/FIN for your transaction, you may do the following:

- Contact the charity organisation directly to request for the update upon contribution.

OR

- Manually make the changes to the NRIC/FIN before making the contribution. You may do so by changing the NRIC/FIN in the ‘Enter UEN/Bill Reference No.’ before confirming your contribution transaction. The number in the description box should reflect your NRIC/FIN.

Invest Better

Invest Better is a part of the LiveBetter initiative enabling our customers to discover ESG-thematic investment vehicles that aims to generate returns and at the same time do better for the world. Invest Better provides a range of investments across different asset classes, so that customers can make informed choices based on their portfolio and financial goals.

Invest Better ETFs are only available to DBS Wealth customers. If you are a DBS Wealth customer, you will need to open an OET account to begin investing in Invest Better ETFs. For more information, please click here.

Invest Better funds and ETFs are updated regularly. For the most up-to-date and accurate list of investments available, please visit the Invest Better page on your digibank app.

Track Better

Track Better is a part of the LiveBetter initiative enabling our customers to visualise their monthly carbon footprint across 5 main categories – food, travel, transport, shopping, and energy and utilities – estimated based on their DBS credit and/or debit card transactions.

A carbon footprint is the total amount of greenhouse gases produced and emitted into the atmosphere by something or someone.

| Metrics | Equivalent CO2e Emission |

|---|---|

| 1 homes' electricity use for one year | 2022.26 KG |

| 1 Taxi Trips | 1.2 KG |

| 1 tree for CO2 sequestration | 12.25 KG |

| 1 KM via MRT | 0.01 KG |

| 1 meal consumed | 1.85 KG |

| 1 plastic bottle used | 0.06 KG |

| 1 Taxi Trips across Singapore | 5.8 KG |

| 1 Smartphone charges | 0.007 KG |

Currently, only DBS Mastercard/Visa debit/credit cards are taken into account during the carbon footprint calculation process.

The general modelling approach taken by the Track Better carbon footprint calculator is shown below:

Track Better carbon footprint model

For more information on the carbon footprint calculation methodology, please refer to the Appendix below.

The DBS Track Better carbon footprint model was developed by DBS. DBS and the Singapore Institute of Manufacturing Technology (SIMTech), a unit of the Agency for Science, Technology and Research (A*STAR), jointly verified the model technically, in accordance with ISO 14040/44/67 principles for life cycle assessment.

Track Better provides a close estimate of your carbon footprint, based on how much you spend using your DBS credit and/or debit card(s).

Knowing your carbon footprint and monthly trends can help you to visualise how your day-to-day habits impact our environment and help you to take active steps towards reducing your individual carbon footprint.

You can start by identifying the categories that contribute the most greatly to your carbon footprint and discover LiveBetter’s stories and articles to see how you can reduce your carbon footprint in fuss-free ways, suited to your current lifestyle. You may also choose to offset your carbon footprint via Offset Better.

Visit LiveBetter for more information and a full list on what LiveBetter can offer in helping you to reduce your carbon emissions.

Your carbon footprint will be calculated and displayed if you have used your DBS/POSB debit/credit card in the past 3 months with at least 10% of those transactions are deemed to add to greenhouse gas emissions (e.g. travel or food transactions). For more information, please refer to our Terms & Conditions here.

Offset Better

Offset Better, also known as carbon offset, is a part of the LiveBetter initiative enabling our customers to offset their carbon footprint right from their mobile phones. With Offset Better, DBS buys and retires carbon credits on behalf of customers from carbon projects that seek to preserve vital carbon sinks, by protecting forests and the wildlife living in them.

Firstly, select the amount of carbon that you want to offset using a slider bar, to the nearest Kg. Then, select one of your bank accounts as the source of your transaction funds. Finally, confirm your transfer. DBS will then proceed to use these transacted funds to purchase equivalent amounts of carbon credits on your behalf.

By offsetting your carbon footprint, you are helping to put dollars towards climate change solutions such as tree planting and renewable energy. These projects help to mitigate climate change, while the world develop technological solutions in the longer term.

DBS selects carbon offset projects that have been accredited by Verra under the Verified Carbon Standards (VCS) program. For more information, visit the Verra website here.

DBS is continuously working on future features that will allow you to better visualise the impact of carbon offsets on the environment. Currently, you will be able to view certificates of carbon offset retirement published by DBS. For more information, please refer to our Terms and Conditions here.

All Offset Better transactions will appear under your transaction history tabs, where you will be able to view the quantity, amount, and portfolio purchased.

Currently, there are no additional fees charged by DBS for carbon offsets transactions made via Offset Better. Customers will be informed if there are any changes.

Appendix

The general modelling approach taken by the Track Better carbon footprint calculator is shown below:

Track Better carbon footprint model

A purchase refers to customers’ individual expenses using DBS credit and/or debit card(s). An Economic Emission Factor (EF) is a fixed quantity which converts activity data into GHG emissions. These values reference national data and are annually reviewed and updated.

Multiplying the dollar amount of the purchase (in SGD) by its associated EF provides customers with a carbon emission value in Kg CO2e. This is done across all valid expenses across the 5 categories, providing customers with their overall estimated carbon footprint, rounded to the nearest Kg CO2e. DBS continuously reviews the model and may expand to include more categories in future.

Accuracy of the Model

All expenses and transactions fall into specific carbon categories, whereby each category has its own associated Merchant Category Code (MCC). MCC Codes are 4-digit numbers listed in ISO 18245 for retail financial services and are used to classify businesses by the types of goods or services they provide. The calculated carbon footprint value shown is a sum of customers’ carbon footprint across multiple carbon categories, sorted into 5 main display categories:

- Food

- Eating (Restaurants and Bars)

- Eating (Fast Food Eateries and Coffee Joints)

- Travel

- Travel (Airline Tickets)

- Travel (Hotels)

- Transport

- Driving (Fuel)

- Commuting (Public Transport)

- Commuting (Taxi)

- Shopping

- Clothing

- Footwear

- Energy and utilities

- Monthly Bill (Gas, Water, Electricity)

EF Values

Instead of using global carbon EF values which have a higher uncertainty, the model references national (Singapore) statistics to determine EF values and improve its accuracy. These EF values are annually reviewed and updated.

Additionally, as the expenses in a typical bill contain a mixture of different items, the model takes the weighted average approach (where applicable) to improve its accuracy. Hence, different carbon categories will have different uncertainties. The accuracy of the EFs is dependent on 2 main factors:

- The amount of data available for calculation.

As the model references national data to determine EF values, greater availability of quality data allows for outputs of higher accuracy. For example, a customer living in a 4-room HDB flat may have a higher certainty of their utilities carbon calculation compared to a customer living in a bungalow. This is because there may be a greater number of customers living in HDB 4-room flats than in bungalows, providing a larger number of available data points. The carbon calculator will thus provide customers with estimates for their utilities carbon footprint, by taking the weighted average of the number of people living in different types of housing in Singapore. - The number of components charged to a particular MCC code.

MCC codes may consist of multiple components. For example, a typical utilities bill is made up of a varying ratio of water to gas to electricity use, that each have different EF values. However, these details are not made available to the carbon calculator. As such, the overall EF used in the carbon calculator is determined using the weighted average of the EFs (at the national level) of the individual components that make up the bill.