Treasury leading the charge to unlock cash: Part 2

Asia’s growth story will move into a new phase over the next 10 years, and CFOs will increasingly leverage data analytics to optimise working capital management to free up incremental cash flow and drive value creation. In this concluding section, we discuss active management of working capital and the importance of Big Data.

Active management of working capital is critical

Today, CFOs and treasurers are focusing on a broader set of decisions which are emerging around the convergence of their physical and financial supply chains. Active management of a company’s cash conversion cycle, and its underlying drivers – accounts receivable days, inventory days, accounts payable days – have proven to be a key source of competitive advantage when approached correctly. Leveraging tools such as accounts receivable financing can further optimize this process, which is often at the top of the CFO and treasurer’s agenda as it generates tremendous upside.

CFOs/treasurers who are able to generate incremental free cash flow can lower funding cost to support further expansion and business development. They will also be well prepared ahead of the anticipated slowdown in quantitative easing and expected rise of interest rates over the next few years. As credit tightens, internally-generated free cash flow will become increasingly critical.

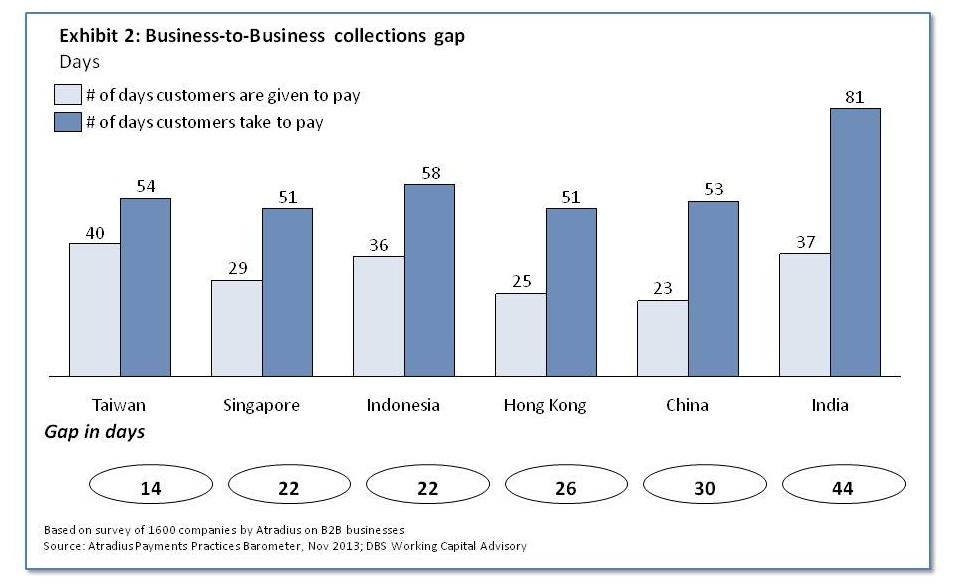

Recent studies around working capital have indicated that there is over US$1 trillion of cash “trapped” in existing sub-optimal working capital practices in Asia. There is a wide range of working capital performance across Asian countries. An average late payment gap can range from 14 days in Taiwan to 44 days in India (See Exhibit 2). Hence, there exists a large opportunity for companies to optimise working capital and improve its internal efficiency, regardless of industry and size.

Leveraging the era of Big Data

We are in the era of data-driven analytics and insights. CFOs and treasurers are the natural guardians of large amounts of data and can leverage data to identify opportunities to build holistic insights across the business. Finance teams that are the most efficient in creating value-added insights will also create a competitive advantage for their entire company.

CFOs and treasurers can also scrutinise their existing cash conversion cycle to pick out areas to look for cash trapped in sub-optimal working capital practices. With effective utilisation of big data, companies can also benefit from mitigation of counter party risk, foreign exchange risk and drive effective customer and vendor relationships.

Given the complexity and variance across Asia, CFOs and treasurers require an in-depth level of analysis, a suite of sophisticated tools, as well as rigorous risk mitigation and data-management policies to identify and capture the opportunity from cash trapped in sub-optimal working capital practices.

Subscribe to DBS BusinessClass

Stay updated with the latest market trends and industry insights, connect with a network of entrepreneurs, and gain access to exclusive event invitations. Join Asia's fastest growing business community – get your complimentary membership here.