- Services

- Business Insurance

- Life Insurance

- Universal Life Insurance

Universal Life

Be assured of business continuity regardless of unexpected events

- Services

- Business Insurance

- Life Insurance

- Universal Life Insurance

Universal Life

Be assured of business continuity regardless of unexpected events

Key person protection

Insure against the loss of key talent in your company with Key Man Insurance

Talent retention

Promote employee retention with Executive Bonus

Risk management

Protect your financial assets with Asset Diversification

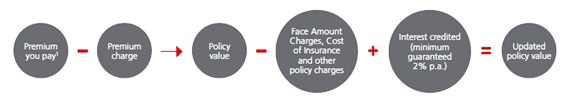

- Delivers strong cash value accumulation

- Transparent insurance charges

- Offers flexible premium payments1

- Offers guaranteed minimum interest crediting rate

- Allows for change of life insured2

- Offers a quit-smoking incentive

Value Propositions

1The actual amount and frequency of premium payments will affect the policy value and potentially the death benefit, as well as how long the policy is kept in force.

2Policy owner may request to change the life insured after 2 years from the policy issue date. A maximum of 2 changes is allowed per policy. Acceptance of the new life insured is at our and Manulife’s absolute discretion and will depend upon the insurability of this new life insured as well as other terms and conditions as Manulife (Singapore) Pte. Ltd. shall determine from time to time. Cost of insurance will be based on the new life insured’s age, sex, country of residence, underwriting class and any additional ratings. For more details, please refer to the product contract.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?